This year’s slide in oil has been painful to commodity bulls, and none more so than famed oil hedge fund manager Pierre Andurand whose already bad year is getting worse.

Bloomberg reports that after dropping another 9.4% in May, his main Andurand Commodities Discretionary Enhanced Fund has extended this year’s slump to almost 46%, making this the worst-ever phase of losses for the strategy, which has lost money every month this year. Still, the brutal 2023 follow three consecutive years of impressive gains including a record 154% jump in 2020.

While Bloomberg notes that it’s “not clear what led to the drop this month for the fund” that Andurand, who previously predicted that oil prices will hit $140, it is safe to assume that the continuous drop in oil has not helped.

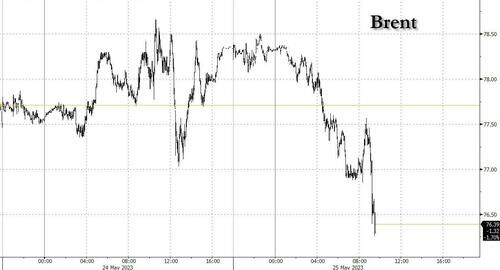

Oil has tumbled 12% since mid-April in London, as initial exuberance in the market following surprise supply cutbacks by the OPEC+ coalition fizzled, replaced by fears over the global economy. Prices stagnated in May, with expectations that rebounding demand will ultimately tighten world crude markets tempered by disappointing economic indicators from China, surprisingly resilient supplies from Russia, and lingering fears over recession in the US.

On Thursday, oil prices tumbled more after Russia played down the likelihood of OPEC+ cutting production further.

As Bloomberg notes, Andurand is among several high-profile hedge fund traders who have seen fortunes turn after a strong gains last year. Said Haidar’s Jupiter macro money pool and billionaire Chris Rokos macro hedge fund suffered double-digit declines after volatile markets in March, while veteran macro trader Adam Levinson shut down his hedge fund after being hit by losses.

Loading…