In the ever-volatile world of global energy markets, the Organization of the Petroleum Exporting Countries (OPEC) continues to navigate a delicate balance between supply management and external pressures. Recent data from December 2025 indicates that OPEC’s overall crude oil production remained largely flat, hovering around 30.07 million barrels per day (mbpd), a slight dip from 30.11 mbpd the previous month.

This stability comes despite ongoing production adjustments within the cartel, but a key factor in this plateau is the notable decline in Venezuela’s output, which has been exacerbated by political turmoil and international interventions.

Venezuela, a founding member of OPEC, saw its production drop to approximately 800,000-956,000 barrels per day in late 2025, down from an average of around 1.1 mbpd earlier in the year. This fall is attributed to a combination of longstanding infrastructure decay, mismanagement under the Maduro regime, and the recent U.S.-imposed naval blockade in December 2025, which disrupted exports primarily to China.

While other OPEC heavyweights like Saudi Arabia, Iraq, the UAE, and Kuwait ramped up output—collectively increasing by over 1.7 mbpd since April 2025—these gains have been offset by Venezuela’s slump and voluntary cuts from other members. OPEC+ (which includes allies like Russia) announced a modest 137 kbpd increase starting December 2025, but overall supply remains constrained amid global demand growth projections of 1.3 mbpd for 2025, unchanged for the eighth consecutive month according to OPEC’s latest Monthly Oil Market Report.

This flat supply trajectory underscores OPEC’s strategy to support oil prices, which have faced downward pressure from non-OPEC producers, including record U.S. output exceeding 13 mbpd. Brent crude prices have fluctuated but settled lower following news of U.S. involvement in Venezuela, highlighting the cartel’s vulnerability to geopolitical shifts.

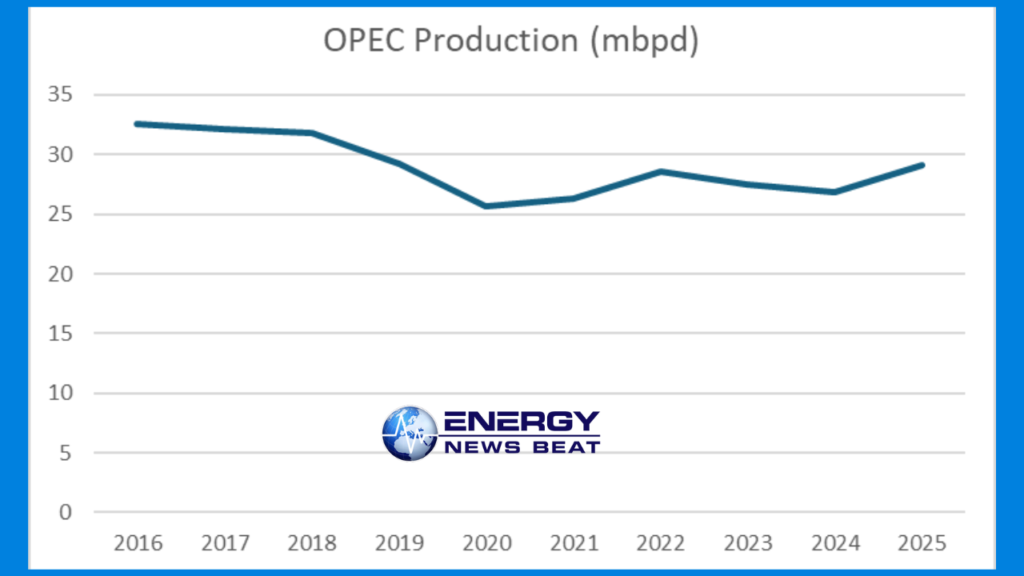

Historical OPEC Production Data (2016-2025)

This data shows a peak in the mid-2010s, followed by declines due to production cuts, the COVID-19 pandemic, and market dynamics, with a rebound in 2025 driven by relaxed quotas.

U.S. Involvement in Venezuelan Oil and Its Impact on Future OPEC Discussions

The United States’ recent military intervention in Venezuela—launching an operation on January 3, 2026, to arrest President Nicolás Maduro and assuming indefinite control over the country’s oil sales—marks a seismic shift in the region’s energy landscape. The U.S. has claimed 30-50 million barrels of sanctioned Venezuelan crude and plans to direct revenues into U.S.-controlled accounts to stabilize Venezuela’s economy and rebuild its oil sector. American companies are being recruited to invest, with lighter U.S. crudes potentially used to upgrade Venezuela’s heavy oil for export.

This involvement could profoundly influence future OPEC discussions in several ways:

Production Boost and Supply Glut Risks: Venezuela holds the world’s largest proven reserves (over 300 billion barrels), but output has plummeted from peaks above 2.5 mbpd in the early 2010s to under 1 mbpd due to sanctions and neglect. U.S.-led revamps could restore production to 1.5-2 mbpd within 2-3 years (with investments potentially reaching $183 billion over a decade, per Rystad Energy estimates), adding significant supply to global markets. This would challenge OPEC’s efforts to maintain price floors through cuts, potentially leading to oversupply and lower prices—especially if combined with high U.S. and Brazilian output.

Quota and Compliance Debates: As an OPEC member, Venezuela’s quotas (currently around 1 mbpd under OPEC+ agreements) could be renegotiated if production surges under U.S. influence. This might spark tensions, with members like Saudi Arabia wary of market share erosion. OPEC discussions could focus on integrating increased Venezuelan volumes without derailing collective targets, possibly prompting calls for stricter compliance or revised baselines.

Geopolitical Tensions: U.S. control introduces an external actor into OPEC’s internal dynamics. Venezuela’s positions in meetings might align more with U.S. interests, such as prioritizing exports to the U.S. Gulf Coast refineries (benefiting Texas operations and potentially lowering domestic gas prices). This could fracture OPEC unity, especially if seen as undermining sovereignty. Allies like Iran or Russia (in OPEC+) might push back, viewing it as U.S. hegemony over global oil. Short-term disruptions from the intervention could spike prices temporarily, but long-term increases in supply might force OPEC to extend cuts beyond current plans.

Market and Price Implications: Analysts from Goldman Sachs and others note that U.S. sanctions policy will dictate Venezuela’s outlook. A rapid revival could reshape crude markets, favoring heavier sour crudes and impacting benchmarks like WTI and Brent. For OPEC, this means future talks might emphasize diversification, non-oil revenue strategies, or even membership reviews if Venezuela’s output becomes “U.S.-proxied.”

A follow-up question will be how the US involvement in Venezuela impacts OPEC+

In the context of OPEC+ dynamics, Russia remains a pivotal non-OPEC participant in the Declaration of Cooperation (DoC), contributing significantly to the group’s efforts to stabilize global oil markets. As of January 2026, OPEC+ has reaffirmed its commitment to maintaining steady production levels through the first quarter, pausing any planned increases for February and March. This decision, involving key players like Saudi Arabia, Russia, Iraq, and the UAE, aims to counter potential oversupply amid geopolitical uncertainties, including the recent U.S. intervention in Venezuela and ongoing sanctions on Russian exports.According to the latest data from OPEC’s Monthly Oil Market Report (published in December 2025) and secondary sources, OPEC+ total crude oil production in November 2025 stood at 43.06 million barrels per day (mb/d), a modest increase of 43,000 b/d from October.

OPEC members accounted for 28.52 mb/d, down 70,000 b/d month-over-month, while non-OPEC DoC countries (including Russia) contributed approximately 14.54 mb/d.

Russia’s crude oil production in November 2025 was 9.367 mb/d, up 10,000 b/d from October, reflecting slight adjustments within the OPEC+ framework.

This figure aligns with Russia’s voluntary cuts and export reduction commitments under OPEC+, where its reference production baseline is around 10.95 mb/d, but current targets for Q1 2026 are set at 9.6 mb/d.

Despite sanctions and a shift in export routes toward Asia (with China receiving a significant share), Russia has maintained compliance, though overproduction by some members like Iraq and Kazakhstan has occasionally strained group unity.

Russia’s involvement in OPEC+ since 2016 has been crucial for coordinating supply cuts during periods of low demand, such as the COVID-19 downturn and recent price pressures. However, ongoing Western sanctions, including the G7 price cap and new measures in early 2026, have forced Russia to rely on shadow fleets and discounted sales, impacting revenues. Forecasts suggest Russia’s output could remain stable around 9.3-9.5 mb/d in 2026, depending on OPEC+ decisions and global demand growth, projected at 1.3 mb/d for the year.

Any surge in Venezuelan supply under U.S. control could prompt OPEC+ discussions on reallocating quotas, potentially pressuring Russia to advocate for extended cuts to protect market share.

In summary, while U.S. involvement promises a Venezuelan oil renaissance, it poses risks to OPEC’s cohesion and price stability. The cartel may need to adapt swiftly at upcoming meetings to counter potential supply floods, ensuring its relevance in a multipolar energy world.

Some things are just funny, and that can be a good or a bad thing. We will just have to see how the story rolls on and how the corruption in the United States and Venezuela is handled.

Stay tuned to Energy News Beat for more updates on this unfolding story.