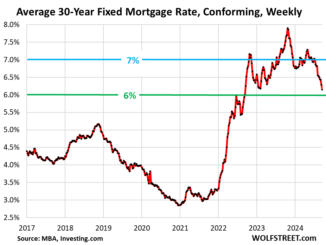

Optimism about dropping mortgage rates drove up its Home Purchase Sentiment Index, but the poll occurred just before mortgage rates exploded.

By Wolf Richter for WOLF STREET.

Fannie Mae said today that its Home Purchase Sentiment Index (HPSI), which has several components, increased in September to 73.9, a 30-month high “as consumers reported survey-high optimism that mortgage rates will decline over the next 12 months.”

A record 42% said they expect mortgage rates to decline, up from 39% a month earlier and up from 24% two months earlier.

Most of the polling occurred in the first two weeks of September with some data collection through September 19, thus largely when mortgage rates were falling into the low 6% range ahead of the intensely anticipated rate cut by the Fed on September 18.

But mortgage rates have exploded since the rate cut, along with the 10-year Treasury yield, on renewed inflation fears, and on the complication that a whole bunch of rate cuts and 2% inflation had already been priced in to even get to the low 6% range. Today the daily measure of the 30-year fixed mortgage rate by Mortgage News Daily jumped to 6.62%, up by 51 basis points since the day before the rate cut (6.11%).

This iffy hope for further declining mortgage rates from the low 6% range where they had been in the first half of September was largely responsible for the increase in the HPSI to a still-low level but a 30-month high (73.9), when it was at 91.5 in September 2019.

Great time to sell, terrible time to buy: that doesn’t work.

Two of the other components of the HPSI look very funny in combination: Consumers think it’s a great time to sell a home and a terrible time to buy a home. And that is a prescription for more inventory, lower sales, and lower prices.

65% said it’s a “good time” to sell a home, and so there has been this surge in inventory for sale because sellers feel emboldened by lower mortgage rates, and so they’ve started to put their vacant homes on the market that they could have sold some time ago but didn’t because they wanted to ride the price spike up all the way.

The “good time” to sell a home sentiment had hit survey highs of up to 77% in 2021 and early 2022 when mortgage rates were still ultra-low, but people didn’t put their moved-out homes on the market because they wanted to ride the price spike up all the way, and so inventories dried up at the time. This time, they’re putting their homes on the market.

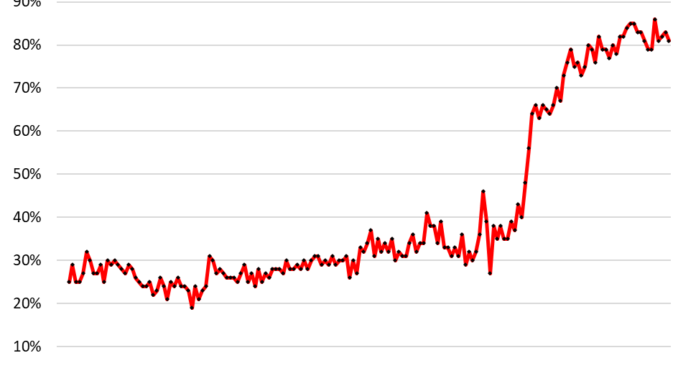

But a near-record 81% said it’s a “bad time” to buy a home. That’s the buyers’ strike, and they are still on strike because prices are too high, and so demand for existing homes has collapsed.

Buyers’ strike because prices are too high: Fannie Mae

“Although most consumers continue to think it’s a ‘bad time’ to buy a home, the recent shift in attitude toward mortgage rates” – if only mortgage rates would play along – “is pushing overall housing sentiment higher, and a growing share are now pointing to high home prices rather than high mortgage rates as the primary sticking point for affordability,” the report said.

“We’ve yet to see consumers’ newfound rate optimism translate into a meaningful increase in home sales activity,” the report said.

“Existing home sales are on pace to record their lowest annual total since 1995. This signals to us that consumers are paying attention to the easing interest rate environment but still feel stymied by the considerable run-up in home prices over the last four years,” the report said.

But mortgage rates have re-spiked. So that’s going to put the onus on prices to jar loose the people on buyers’ strike.

And yet, we knew it, consumers have it drilled into them endlessly that home prices can only go up:

“A plurality of consumers also indicated that they expect home prices to increase over the next 12 months, which would offset some of the expected rate-driven improvement to affordability,” the report said.

But rates have spiked since the survey. So where should the improvement in affordability come from? Prices? No way Jose…

In September, at the time of the rate cut, Fannie Mae’s economists got even gloomier about home sales, though at the time, mortgage rates had dropped into the low 6% range: They noted that buyers were waiting for even lower mortgage rates, lower home prices, and higher wages.

Here is Austin demonstrating how home prices can start to become more affordable when buyers go on strike, regardless of mortgage rates:

We give you energy news and help invest in energy projects too, click here to learn more