The ongoing war in Ukraine, continued high inflation and recession concerns will play a pivotal role in the gold, silver and platinum metals markets in 2023, according to Heraeus, the world’s biggest precious metals trader.

While the war in Ukraine served as a catalyst for the rally in Q1 2022, the prices of gold, silver and platinum group metals still spent the rest of the year returning to lower levels as the conflict rumbles on.

This year, slower economic growth is predicted in many regions, and both Europe and the US may be facing recessions, which would likely weigh on demand for precious metals, according to Heraeus’ 2023 outlook report, produced in collaboration with UK consultancy SFA (Oxford) Ltd.

Although covid-19 has become a diminishing concern in most countries, top consumer China remains on high alert and is still enforcing restrictions, which could further constrain its economic growth and metal demand, Heraeus adds.

2023 outlook

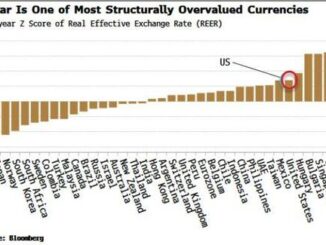

Prices of gold (and, by extension, silver) have not made gains over the past year despite a multi-decade-high inflation, thanks to persistent strength in the US dollar as the Federal Reserve aggressively hikes interest rates.

With interest rate hikes likely to continue, the dollar strength could persist through 2023, potentially drawing more investors away from these metals. However, a weakening economy may lead the Fed to change course, resulting in a weaker dollar and potential upside for gold and silver, Heraeus says.

Should the US central bank keep interest rates stable or even lower them, a record high for gold in euro terms is quite possible, Heraeus predicts.

Depending on the direction for the dollar resulting from the Fed’s actions, gold is likely to fall in range between $1,620/oz $1,920/oz, while silver is forecast to trade between $17/oz and $25/oz in 2023, according to Heraeus estimates.

Platinum has also been depressed by the strength of the dollar against the South African rand, and would benefit as the dollar weakens, even though the platinum market is predicted to remain oversupplied (by over 400,000 oz) in 2023. The price forecast for platinum is between $800/oz and $1,150/oz, with upside driven by a potentially weaker dollar.

Likewise, the palladium market is forecast to swing into surplus in 2023, providing downside price risk for the metal. Supply is picking up, partly owing to a lacklustre demand from the automotive sector. Given the oversupply, palladium is predicted to trade between $1,300/oz and $2,250/oz for the year.

Read the full report here.