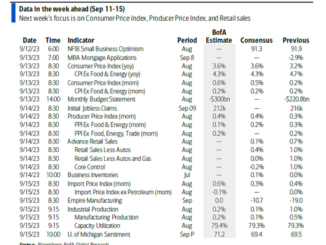

Following big misses in CPI and PPI data, tomorrow’s retail sales should come in line to slightly stronger than expected by consensus. That’s because real-time card spending data, as measured by BAC aggregated credit and debit cards, was a solid +3.1% year-over-year on a per household (HH) basis in October, and rose 0.5% month-over-month.

As a result, BofA’s economists forecast a solid 0.6% m/m increase in the Census Bureau’s ex-auto retail sales figure in October, just above the consensus estimate.

Alas, as has been the case in recent months, much of this retail sales strength will be driven by inflation, namely a pickup in gas spending (due to higher gasoline prices)…

… and restaurant spending.

Therefore, BofA expects a smaller 0.3% m/m pickup in core control sales (retail sales ex autos, gas, building materials and restaurants) in October

As BofA further notes, two special factors appear to have boosted spending in October.

First, there was another round of Prime Day and related promotions last month, in addition to the usual annual July event. This likely contributed to the strong increase in online retail spending in October (+1.5% m/m).Second, and as we observed above, California (CA) distributed one-off (anti-inflation) stimulus payments last month. Ex-auto retail spending in CA significantly outpaced the rest of the country in October, after lagging in four of the previous five months. CA accounts for about one-seventh of the national economy, so the stimulus checks could move the needle on national spending aggregates.

As an aside, the Census Bureau’s retail sales report for September did not mention any impact from Hurricane Ian, whereas the BofA card data showed a 0.2-0.3% headwind to ex-auto retail sales. Therefore it is likely that the Census Bureau will enact downward revisions to the September data. Such revisions could support stronger m/m retail sales growth in October by creating favorable base effects.

Finally, we shift away from BofA, and present a summary of what JPMorgan economist Michael Feroli expects tomorrow:

We believe that nominal retail sales jumped 1.3% in October. Unit auto sales surged between September and October and we think this suggests that related retail sales picked up noticeably as well–we forecast that sales at motor vehicle and parts dealers jumped 6.0% in October. We also think that price increases boosted sales at gasoline stations in October and we estimate that related nominal sales rose 1.2% that month. Our Chase card data signal a strong gain for food services sales in October along with a decline in sales of the important control group, although we are fading these signals somewhat given recent noticeable deviations between the signals from the card data and the official figures reported by the Census Bureau. We estimate that food services sales increased 1.1% in October while control retail sales–the total excluding food services, autos, gasoline, and building materials–were basically unchanged that month relative to September.

More in the full note available to pro subs.