Santos managing director Kevin Gallagher says intensifying global concerns over energy shortages have lifted the value of its proposed new oil field in Alaska and prompted the company to begin multibillion-dollar development works before it has been able to sell down its stake.

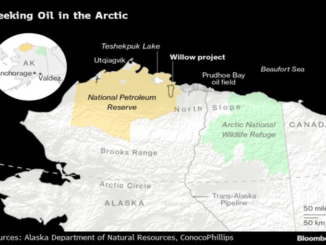

After reporting its half-year profit had quadrupled to a record high on Wednesday, the Australian oil and gas producer announced the go-ahead for the first phase of the $US2.6 billion ($3.7 billion) Pikka oil project, which would produce up to 80,000 barrels of crude oil a day from 2026.

The investment decision was swiftly criticised by climate campaigners, who argued it was out of step with the International Energy Agency’s warnings that the world must not approve any new oil and gas fields to avert catastrophic levels of global warming.

Some analysts, too, voiced concern, pointing out that Santos had never operated in Alaska, and suggesting the failure to complete the planned sell-down of the 51 per cent interest in the project raised doubts about its value.

Gallagher said the world had changed significantly in the past six months amid a deepening global energy crisis, making Pikka the “right project, at the right time, in the right location”. Countries around the world are shunning Russian supplies of oil and gas to starve Moscow of the revenue it needs to fund the war in Ukraine, intensifying competition for spare cargoes and pushing crude oil prices higher.

“Energy security has come to the fore as a major priority, and what that’s done is made Pikka a much more valuable and a more in-demand development,” Gallagher said.

“We think now is the time to develop it … we don’t need to wait, we have a strong balance sheet.”

Santos said it had received substantial interest from companies considering buying some of its 51 per cent share in the project, but this year’s volatile swings in crude oil price, fluctuating by as much as $US30 in just a week, have made it difficult to value.

Source: Smh.com.au