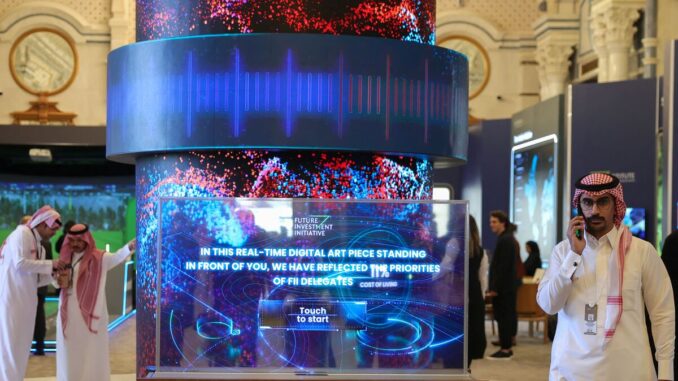

Oil is here to stay as US majors strike blockbuster deals while Saudi policies are helping stabilize global crude markets, the kingdom’s energy minister said at the annual investment forum in Riyadh.

“It’s working,” Energy Minister Prince Abdulaziz bin Salman said of Saudi Arabia’s strategy for managing the oil market. The kingdom has to “ensure that we have a less volatile oil market that will help the global economy to grow and prosper,” he said on the first day of the Future Investment Initiative.

Crude prices rebounded to almost $100 a barrel last month, swelling profits at producers and creating a growing confidence that’s bolstered a flurry of huge deals in the oil patch. Exxon Mobil Corp. agreed to buy shale driller Pioneer Natural Resources Co. and Chevron Corp. is set to acquire storied US producer Hess Corp.

“I don’t think Exxon would merge with Pioneer for charity purposes, or for that matter Chevron would do that with Hess,” Prince Abdulaziz said. “It is a testament by its own virtue that hydrocarbons are here to stay.”

Saudi Arabia hosts the annual FII conference as a showcase for its efforts to develop new jobs and industries alongside technologically advanced and environmentally friendly cities that will guarantee long-term prosperity. The ambitious targets in Saudi Arabia’s Vision 2030 are predicated on preparing for the eventual transition to a post-oil world, all the while bankrolled by shipping barrels around the globe.

Oil will continue to see “significant” demand growth as economies bounce back and major consumers like China return to faster growth, Amin Nasser, chief executive officer of state producer Saudi Aramco, said on a separate panel at the event. Energy consumption is continuing to grow even as economies face headwinds, Nasser said.

Investment in oil is still needed to meet growing demand and avoid a jump in prices, Patrick Pouyanne, CEO of TotalEnergies SE, said on the same panel. It’s wrong to criticize investments in energy supplies, he said.

Earlier at the conference, Wall Street bankers struck a pessimistic tone, saying tight monetary policies, Middle East tensions and the upcoming US elections are clouding the outlook for the global economy.

“The year-ahead will certainly present incredible alpha opportunities, but generally speaking, will have more of a headwind than a tailwind,” Carlyle Group CEO Harvey Schwartz said. “As economies adjust to the rate regime, there are going to be more challenges in the near term.”

Executives including Bridgewater Associates LP founder Ray Dalio and Citigroup Inc. CEO Jane Fraser said it was difficult to be optimistic. “If you take the time horizon, the monetary policies that we are going to see will have greater effects on the world, it’s difficult to be optimistic about that,” Dalio said. The upcoming US elections will be about irreconcilable differences to do with wealth and power, he added.

Meanwhile, BlackRock Inc. CEO Larry Fink said the Federal Reserve “is going to have to raise rates higher,” for longer, which means that by 2025 there may be either a soft or hard landing. In 2024, he doesn’t expect either, he said.

Andurand Says Oil Must Hit $110 Before Saudi Arabia Eases Curbs (5:58 pm)

Oil trader Pierre Andurand said he expects Saudi Arabia to keep its current supply curbs in place until prices reach at least $110 a barrel.

“The Saudis will have to decide when and at what price to bring supply back,” the founder of Andurand Capital Management LLP said. “For me, an adjustment likely will come around $110 a barrel. So there’s room to the upside for prices.”

As inventories decline in the coming months, “the market will have to beg for more supply at some point,” he said.

World Bank Says Mideast Unrest Is ‘Game Changer’ If Uncontained (5:50 pm)

The ongoing war between Israel and Hamas could hurt economies in the entire Middle East region, including oil producers, if not contained, according to the World Bank.

“It used to be that everyone talked about the West and China de-coupling,” Ajay Banga said in a Bloomberg Television interview on Tuesday. “Right now the much bigger issue is the Middle East and what is happening there.”

Saudi Arabia’s Oil Market Strategy Is Working: Energy Minister (5:28 pm)

Saudi Arabia’s strategy for managing the oil market is working, Energy Minister Prince Abdulaziz bin Salman said. The kingdom has to “ensure that we have a less volatile oil market that will help the global economy to grow and prosper.”

The big takeovers in the US petroleum industry show that oil and gas are here to stay, he said. He was refering to Exxon Mobil Corp.’s purchase of shale driller Pioneer Natural Resources Co. and Chevron Corp.’s deal to acquire storied US producer Hess Corp.

Winters Sees Economic Resilience in Times of War (3:10 pm)

Winters also commented on the banking crisis that earlier this year saw the collapse of regional US lenders, including Silicon Valley Bank, saying central banks “did the right thing” when they stepped in and moved to protect depositors.

“A confidence shock with an asset and liability mismatch leads to a challenge and I think the central banks of the world responded to that challenge, in a macro sense, extremely well because they stopped the rot,” he said.

South Korea to Further Collaborate on Saudi Vision 2030 (1:15 pm)

South Korean President Yoon Suk Yeol said his country will continue to increase cooperation with Saudi Arabia, including in areas that expand beyond the economy.

“Korea is one of the key partners and it’s not just for economic cooperation but culture, people to people exchanges and cooperation among SMEs,” Yoon said. He noted that key industries for further partnership include carbon-related energy sectors.

The remarks were the first made publicly by Yoon inside the kingdom and were delivered with Crown Prince Mohammed bin Salman watching in the audience. South Korea and Saudi Arabia were due to sign $15.6 billion in deals this week in conjunction with FII and after a summit between the leaders, Yonhap earlier reported.

Goldman’s Solomon Uncertain About Deals ‘Right Now’ (12:30pm)

Goldman’s top executive said he’s uncertain about mergers and acquisitions in the current period while expressing optimism about a pick-up in dealmaking over the long term. “Long term, I’m certainly optimistic,” David Solomon said. “But I’m uncertain right now.”