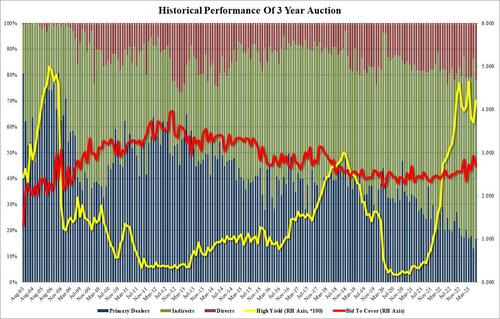

Ahead of Wednesday’s FOMC meeting, we have a truncated treasury auction schedule with two auctions – the 3Y and 10Y – taking place today, and a sale of 30Y paper tomorrow. The first of these just priced, and was generally in line with expectations.

Stopping at a high yield of 4.202%, the sale of $40BN in 3Y paper say the highest yield since March, and up more than 50bps from the 3.695% last month; it also tailed the When Issued 4.200% by 0.2bps, the first tail since February.

The bid to cover of 2.696 was below last month’s stellar 2.929 but was above the six-auction average of 2.662.

The internals were a tad more soggy with Indirects taking down 61.5%, down from 73.3% and below the recent average of 64.6%. And with Directs awarded 21.74% or the highest since Sept ’22, Dealers were left with 16.7% of the auction, just below the recent average of 17.1%.

Overall, this was a solid auction which came in line with expectations, and sets up the market well ahead of today’s benchmark sale of 10Y paper at 1pm.

Loading…