Multifamily lending ballooned 32% from early 2020, powered by low interest rates and soaring rents. Now there’s a price to pay.

By Wolf Richter for WOLF STREET.

The multifamily segment of Commercial Real Estate doesn’t face the structural issues that the retail CRE segment and the office CRE segment face. There is demand for apartments; and even as some areas have been overbuilt particularly with higher-end apartments for “renters of choice” – because that’s where the money is – population growth and the arbitrage with sky-high house prices will see to it that demand for apartments continues to grow.

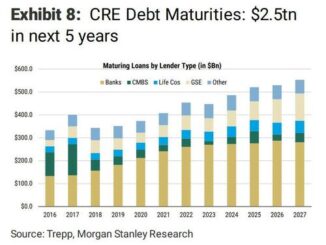

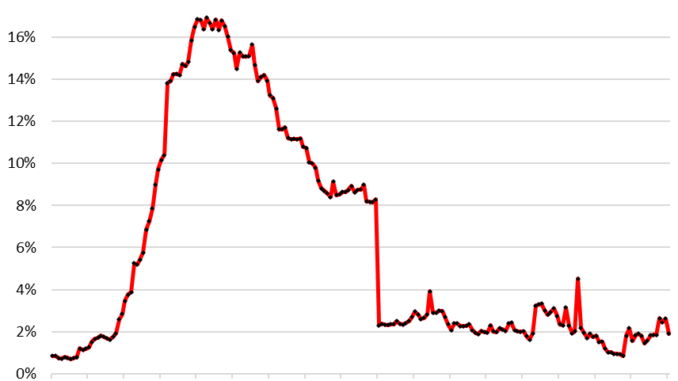

What multifamily properties are struggling with are higher mortgage rates – like all segments of CRE. They are all getting hit by higher interest rates as they have to refinance existing mortgages at much higher rates, or as variable rates adjust to those higher rates. This has caused valuations of CRE properties to plunge and mortgages to go into default. Turns out, 15 years of interest-rate repression by the Fed messed up a lot of things, and there’s a price to pay. But office and retail, on top of facing higher mortgage rates, also have huge structural issues that multifamily doesn’t have.

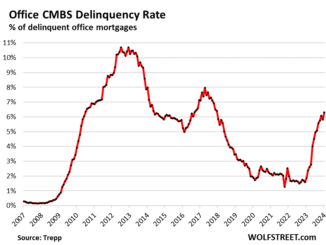

Default rates of mortgages backed by multifamily properties remain relatively low, compared to retail, office, and lodging. The default rate of multifamily mortgages that have been structured into Commercial Mortgage-Backed Securities (CMBS) was 1.9% in January, compared to 6.3% for retail and office (data via Trepp).

Multifamily lending ballooned, powered by low interest rates and soaring rents: Fitch

Fitch Ratings warned about banks’ exposure to multifamily loans – especially small banks that loaded up on multifamily loans that are now going bad.

“Multifamily loans facing pressure include those that are rent stabilized, reliant on overly optimistic rental income increase projections, or in submarkets with elevated rental vacancy rates and/or excess supply, many of which are in Sunbelt states, particularly Texas, Florida, Tennessee, and the Carolinas,” Fitch said in its report.

Multifamily lending has ballooned 32% since early 2020, to $613 billion in loans outstanding as of Q4, “driven by low interest rates, high levels of housing demand, and attractive rents,” Fitch said.

“Attractive rents” would be from the point of view of landlords and lenders; “soaring rents” would be from the renters’ point of view. The combination of ultra-low mortgage rates and soaring rents made all things possible. And it worked until it didn’t.

Some small banks with big concentrations of multifamily may topple, but no big deal.

Nearly 40% of total multifamily loans in the US banking system are held by 10 banks, Fitch said. And these would be larger banks with lots of other assets.

In terms of concentrated exposure to bad multifamily loans, 49 banks had multifamily nonperforming loans (NPLs) that exceeded 5% of their total multifamily loans. At those 49 banks, the multifamily NPL ratio of 5% is far higher than the default rate of multifamily CMBS (1.9%, chart above).

But these banks are small: they average $1.3 billion in total assets, Fitch said. By comparison, failed SVB had $209 billion in assets. JPMorgan, the largest bank, has $3.3 trillion in assets. A bank with $1.3 billion in assets would be the 689th largest bank in the US. So these are small community banks. Those are the banks at risk from bad multifamily loans.

The amounts of multifamily loans at these community banks “is only a modest fraction of the overall industry, thereby limiting the contagion to the broader financial system if one or more of these banks were to fail,” Fitch said.

It’ll take years to play out.

“We expect any deterioration to play out for the banking sector over an extended period,” Fitch said. “During the Global Financial Crisis, losses did not peak until almost two years after a peak in delinquencies, and problem loans have yet to peak for the sector.”

For now, the big CRE problems are office and retail, though multifamily is warming up.

Retail and office CRE, in addition to higher mortgage rates, also face devastating structural issues, some of which will have to be dealt with through demolition and redevelopment of the properties into residential. This is more likely to happen – is more likely economically feasible – after a developer buys the property for cents on the dollar, essentially for land value, such as in a foreclosure sale, hitting lenders with huge losses, and there have been some already.

Retail CRE has gotten bludgeoned by ecommerce years ago, with hundreds of chain-retailer bankruptcies from Sears Holding on down. Recent entries on the bankruptcy and liquidation list included Bed, Bath, & Beyond. Countless malls have failed. Back in 2017, we started calling the phenomenon the Brick and Mortar Meltdown.

Office CRE got hit a couple of years ago by the sudden realization in corporate America that they will never need all this unused office space they’re sitting on, and they or landlords put this space on the market, on top of the vast space already on the market, leading to mindboggling office availability rates.

The astronomical availability rates, combined with much higher mortgage rates, caused transaction prices of office towers to collapse, and delinquency rates to spike: