In the early afternoon of April 28, 2025, a cascading voltage surge plunged much of the Iberian Peninsula into darkness, marking one of Europe’s most severe power outages in recent history.

The blackout affected mainland Spain, Portugal, and even parts of southern France, leaving millions without electricity for hours and disrupting critical services.

While power was largely restored by evening, the incident exposed vulnerabilities in Spain’s increasingly renewable-heavy grid. In its wake, natural gas consumption for electricity generation has surged, highlighting the fuel’s critical role in maintaining stability amid high shares of variable wind and solar power.

Spain’s Evolving Energy Mix

Spain’s electricity generation in 2025 reflects a strong push toward decarbonization, with renewables and nuclear dominating the landscape. According to recent data, the country’s power mix includes approximately 21% from wind, 20% from nuclear, and 19% from solar, making low-carbon sources the backbone of its energy system.

This represents a continuation of trends from 2024, when renewables and nuclear accounted for 82% of electricity generation on the Iberian Peninsula.

Fossil fuels, including natural gas, fill the gaps at around 17-21%, with coal reduced to a minimal 2.2% share.

Demand patterns vary seasonally. In July 2025, electricity demand rose 1.5% year-over-year, driven by hotter weather, while August saw a 1.7% decline.

Wind and solar have been particularly prominent; in January 2025, wind contributed nearly 31% of generation, underscoring its importance during winter months.

Overall, Spain’s grid is among Europe’s cleanest, with milestones like achieving 100% renewable-powered hours on April 16, 2025.

|

Energy Source

|

Share in 2025 Mix (%)

|

Notes

|

|---|---|---|

|

Wind

|

21

|

Dominant renewable, peaks in winter

|

|

Nuclear

|

20

|

Stable baseload, 12.5% of total energy supply

|

|

Solar

|

19

|

Rapid growth, leading in installed capacity

|

|

Natural Gas

|

~17-21

|

Flexible backup, increased post-blackout

|

|

Hydro

|

~3-5

|

Variable based on water levels

|

|

Coal & Others

|

~2-5

|

Phasing out

|

The Rise of Wind and SolarSpain has aggressively expanded its renewable capacity, positioning itself as a European leader. Solar photovoltaic (PV) now leads in installed power, with over 35 GW operational as of mid-2025, and an additional 3 GW commissioned in the first seven months alone.

Projections indicate solar could reach 152.8 GW by 2035, driving total renewables to 218 GW.

Wind power complements this, with around 30-36% of renewable capacity, contributing significantly to the mix.

Production highlights include solar generating 2,292 GWh in January 2025 (9.5% of total), up 18.6% from the prior year.

However, the intermittency of these sources became evident during the blackout. Initial generation losses in the first 80 seconds were entirely from solar and wind, totaling 2.5 GW or 10% of demand at the time.

While official reports attribute the root cause to a voltage surge and poor voltage control rather than excess renewables, the event underscored challenges in integrating variable sources without sufficient flexible backup.

Misinformation campaigns quickly blamed renewables, but experts emphasize grid infrastructure lags as the primary issue.

Natural Gas: The Grid’s Stabilizer

Post-blackout, Spain’s reliance on natural gas has intensified to ensure grid reliability. Gas demand for electricity production jumped nearly 37% in the first nine months of 2025 compared to 2024, reaching equivalent to 267.6 terawatt-hours overall—a 6.6% national increase.

This surge is directly tied to operating the grid in a “strengthened mode,” where gas-fired plants provide spinning reserves and voltage support that renewables alone cannot consistently deliver.

Gas plants, which accounted for 17.7% of generation in August 2025, are now running harder to compensate for renewable variability and prevent cascading failures.

Costs for grid services have doubled since the outage, with gas covering 57% of these expenses.

Additionally, Spain has boosted gas exports, further driving demand.

This “reinforcement” role has added over $1 billion in costs to consumers, as the grid operator curtails solar and wind at times to maintain balance.

Critics argue this highlights the hidden costs of rapid renewable adoption without adequate storage or grid upgrades.

Key Suppliers in 2025

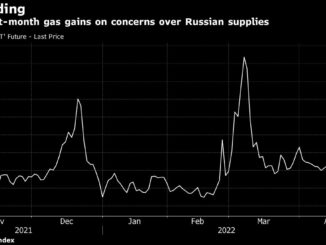

Based on data through mid-2025 (Enagás and CORES reports), Spain’s suppliers reflect a diversification strategy post-Ukraine crisis, with a shift away from Russia toward the U.S. and stable African partners. In the first half of 2025, total imports rose 44% year-over-year, driven by grid stabilization needs.

Here’s a breakdown of major sources, using July 2025 shares as a recent snapshot (percentages of total imports):

|

Country/Region

|

Share (%)

|

Type

|

Notes

|

|---|---|---|---|

|

Algeria

|

32.9

|

Pipeline (Medgaz) & LNG

|

Long-standing top supplier; over 100 TWh imported in 2024 alone. Stable due to proximity and long-term contracts.

|

|

United States

|

~25-30 (up 75% YoY)

|

LNG

|

Emerged as leader in Q1-Q2 2025 (35% in first four months); key to replacing Russian volumes. A U.S.-EU pact may boost this further.

|

|

Russia

|

15.2

|

LNG

|

Down from 22.4% in 2024; limited to ~7-13% overall as Spain phases out amid EU sanctions, but still third-largest.

|

|

Nigeria

|

7.7

|

LNG

|

Growing African supplier; part of diversification efforts.

surinenglish.com

|

|

Angola

|

4.3

|

LNG

|

Emerging source, completing top-five ranking.

surinenglish.com

|

|

Other (e.g., Norway, Qatar, Egypt)

|

~10-15

|

Pipeline & LNG

|

Norway via minor pipeline routes; Qatar and Egypt via spot LNG cargoes. Europe (e.g., France) contributes <1% via interconnections.

|

Long-Term Energy Plans

Spain’s ambitions remain focused on a green transition. The updated National Energy and Climate Plan (NECP) targets 81% renewable electricity by 2030, up from current levels, with a 32% GHG emissions cut from 1990 baselines.

By 2050, the Long-Term Decarbonization Strategy (ELP 2050) aims for carbon neutrality, 90% GHG reductions, and a 100% renewable power system.

Solar is slated to grow to 22% of electricity by 2030, with total renewables at 74%.

Projections include quadrupling renewable capacity by 2050, with solar at 230 GW and wind at 120 GW.

The Iberian Peninsula plans to add ~90 GW of renewables by 2030 in Spain alone.

However, the blackout has prompted scrutiny, with calls for balanced approaches that include flexible gas and nuclear to bridge the gap.

Strategies for Future Grid Stabilization

To prevent repeats, Spain has approved 65 new measures for grid resilience, emphasizing improved voltage control and maintenance.

Royal Decree-Law 7/2025 promotes storage facilities, including battery energy storage systems (BESS), to provide synthetic inertia and revenue streams for alternatives to traditional generators.

Investments in digital monitoring, cross-border interconnections, and infrastructure upgrades are prioritized to handle voltage fluctuations.

Challenges persist: 85% of electrical nodes are saturated, limiting new demand integration, and parliament rejected some anti-blackout reforms.

Grid operator warnings highlight risks of further blackouts without urgent investments.

Experts recommend allowing renewables and batteries to contribute to voltage control, currently limited to synchronous generators.

As data centers and electrification drive demand, balancing renewables with flexible resources will be key to a stable future.

The April blackout serves as a stark reminder: while Spain’s renewable trajectory is admirable, grid stability demands robust backups like natural gas in the interim. As long-term plans unfold, the focus must shift to resilient infrastructure to match ambitious clean energy goals. Matching the clean energy with reality will be the tough balancing act when “Climate Change” is blamed.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack