The natural gas market has undergone profound changes in the last year, with prices rising from under $2.00 to over $5.00. Inventories have been drawn down due to demand, weather events, and the export of LNG to Europe and Asia. In the U.S., gas storage is about 30% below year-ago levels, and about the same in European storage caverns. Consumers are just now starting to feel the effects of this change in their monthly energy bills. Most pundits now say that it is up to the winter weather if we are to see curtailments. A cold winter in Europe or the U.S. could generate discomfort in the homes of millions, and cause the shutdown of energy-intensive industries.

There is an old saying that “one man’s poison is another man’s meat.” In the case of the two Canadian gas drillers we are going to discuss today, this scarcity could lead to outsized gains in their share prices as they capitalize on the need for this currently scarce commodity. Tourmaline Oil Corp, (OTCPK: TRMLF) and ARC Resources, (OTCPK: AETUF) are two of Canada’s leading gas drillers and are the subject of this month’s comparison article.

Both of these key Canadian gas drillers hold key acreage and infrastructure positions in the “Permian” of Alberta and British Columbia Province’s, the Montney basin. It has some similarities to its more famous play in West Texas. The size is comparable and the nature of sedimentary accumulation is somewhat similar, yielding “stackable” reservoirs that enable multi-horizon completions. This promotes capital efficiency which ultimately lowers the cost per foot and ultimately improves investor returns.

Source

What’s the story with gas?

Supplies of gas are tight as we noted in the introduction. Inventory levels are below the 5-year moving average, and there are only a couple of months left in the injection season. It isn’t looking good, unless… you are an investor in TRMLF or AETUF.

When you include –

- Record and increasing shipments to Gulf Coast liquefaction plants for conversion to LNG.

- Prolonged summer cooling draining supplies that could go toward injection.

It makes for an incredibly bullish winter heating season, which by the way is almost upon us. If we get a cold winter… you can write your own ending to this sentence. An article in the RBN Energy blog fairly well summarizes the thesis for gas, and by extension gas-related companies.

”The incredible bull run for global gas prices has been underpinned by high demand for LNG and the cascading effect of a supply squeeze in Europe, brought on by the triple threat of low domestic production, decreased imports from Russia, and a scarcity of incremental LNG cargoes. Not only is this driving record-high gas prices and increased volatility now, but the low inventory means sustained high prices for the heating season ahead.”

In short, there hasn’t been a setup like this for gas in ages. The question is, are you too late to take advantage of it? I don’t think so.

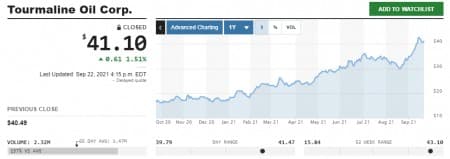

Tourmaline Oil Corp

This company came to my attention in September of last year. Since that time the price has risen from the low $12’s to over $40. That should say quite a lot to you about how the market views this stock. Tourmaline is a great company with an outstanding asset base that is seeing demand like never before.

As noted, I’ve been bullish on the company for a while now on its own merits. What’s coming into focus is, there is a structural move higher in its core asset, Natural Gas.

We think there is more to come in the next year as tight gas supplies and increasing exports in the form of LNG push prices higher still. A final word on this Canadian Energy producer on a growth comparison with a well-known U.S. producer – dollar put into TRMLF last September has returned $2.38 dollars since. By comparison, a dollar put into EQT Corp, (NYSE:EQT) a year ago has returned only $1.40 – still a nice gain, but numbers tell the tale of real value.

The thesis for Tourmaline

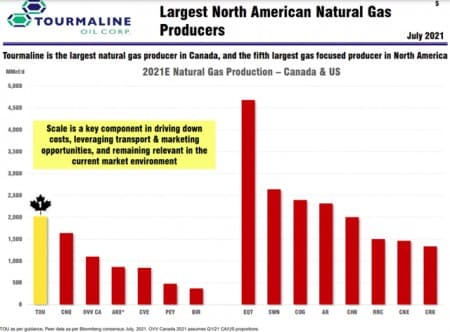

TRMLF produces more gas than any other company in Canada and is on par with some large Marcellus players. It has export connections via pipeline to the Gulf Coast, Western Canada, and California in addition to domestic use in the Alberta area.

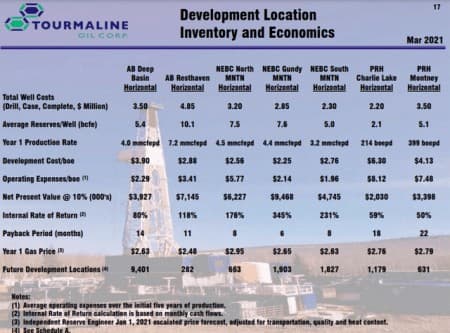

With thousands of locations on existing acreage, and a development rate of ~250 wells a year, the company has a long ramp to maintain and build production.

The only way to reduce costs while meeting production goals is to really, really understand the rock you are producing. This is an area where TRMLF stands out. When it all comes together, you see it in graphs like the one below. Unit costs drop and production targets are met or exceeded. The fact that the company has done this in all three of the key basins where it operates is significant.

Ok, let’s review. Largest producer, got it. Thousands of locations for future drilling, got it. Lower D&C costs than other operators, got it. You’ve heard me say many, many times the following:

Scale – distributes core costs over a larger body of units.

Optimal acreage – easy to drill and produce. Good access to takeoff. Big, blocky acreage blocks.

Low costs – understanding your reservoir to minimize D&C costs, and as shown below strategic acquisitions that enhance your cost position.

Black Swan deal-A Catalyst

Tourmaline closed the acquisition of Black Swan Energy in July. According to company materials, this purchase brings accretive assets that add significantly to the company’s Montney profile.

”Tourmaline acquires existing 2P reserves of 491.9 million boe (GLJ – December 31, 2020), 1,600 Montney horizontal internally estimated drilling locations (237 booked in GLJ 2P Reserve category), and 230,000 net acres of Montney rights. All the acquired reserves are in the Aitken core development area. The acquisition includes material Montney land positions at Laprise, Beg, Jedney, and Sojer that complement extensive existing Tourmaline North Montney acreage positions. Black Swan had not booked material reserves on these additional, highly prospective, acreage positions.”

2P reserves of 491 mm boe for the paltry sum paid – CAN$1.1 bn is an awesome deal. On an acreage basis, it’s CAN$4,700 an acre, also very competitive.

Q-2

The company grew production BOE to 411k BOEPD, a 37% increase year over year. Future growth is targeted in Q-3 to 450-460K in Q-3, with a 2021 exit rate of ~500 BOEPD. If achieved this would be more than 20% growth for the year.

Operating cash flow was CAN$570 mm for Q-2, up over 2X over the same period a year ago. Capex of CAN $215 mm left free cash of $343 mm. After the dividend of $38 mm, which is scheduled to rise in Q-3, there is substantial cash left for share repurchases or debt reduction. CEO Mike Rose comments on capital allocation plans for this year-

“So far in 2021 we’ve used free cash flow for two dividend increases and we now expect to hit that long-term debt target during Q4 of this year. As we look out to 2022 and the full five-year plan, the vast majority of the free cash flow will be returned to shareholders, we’ll provide more detail on the mix of the return opportunities over the upcoming two to three months, including continued sustainable base dividend increases, special dividends and share buybacks where appropriate.”

Sounds good to me.

Long-term debt stands at CAN $1.4 bn and the company expects to exit 2021 at around CAN $1.0 bn, inclusive of the Black Swan deal. The company can pay this down with cash flow and assets sales and has done so in the recent past.

The company is monetizing the bulk of its Topaz shares and expects to realize about $1.0 bn from that sale. Tourmaline will still retain 37% of Topaz.

Now let’s move on to ARC Resources.

ARC Resources

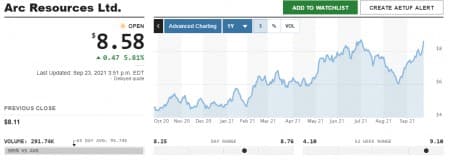

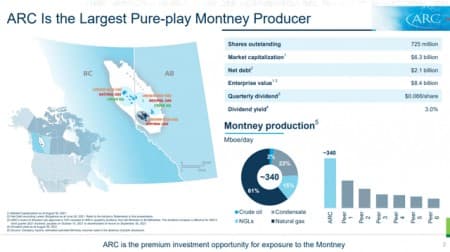

The Montney basin story continues with ARC Resources, (OTCPK: AETUF). It has staged an impressive 30% rally in the past month on the strength of natural gas prices. It’s Canada’s third larger producer of this commodity, and in second position for gas liquids which also are surging strongly.

The analysts are solidly behind ARC. Their second-quarter results seem to have energized the community, with 15 of 18 covering ARC giving it a thumbs up for accumulation. The average estimate is CAN$ 11.55 or about where it is now, and the most optimistic of the bunch is tagging it with a CAN$15.00 tag.

Source

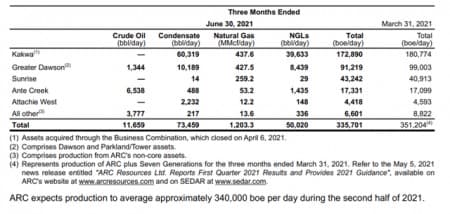

A noteworthy acquisition was accomplished earlier this year with ARC’s acquisition of Seven Generations Oil Corp, earlier this year. In this move ARC nearly doubled its footprint in the Montney. This was done in a share swap that did not create new debt. We will discuss this further in this report.

They also sold some non-core assets in the Pembina/Cardium areas to Ricochet Oil for CAN$100 mm.

So, as per usual we will review Q-2 and other company materials to see if this optimism is justified, or if there is are catalysts that might take it even higher.

The thesis for ARC Resources

We have discussed the Montney on numerous occasions. It is a world-class basin with ample gas, gas liquids, and crude oil assets. There are ample basin exits by pipeline for its production west to toward the nearing-completion gas liquefaction plants at Kitimat, and south to the Gulf Coast refining complex.

Source

One of the critical aspects of the merger with Seven Generations is scale. Petroleum is a business that requires infrastructure and high-priced inputs for E&P costs. Scale permits the more rational and economically advantaged development of these assets. Whether it’s proximity to better utilize field inputs like water handling, or performing simulfracs, or it’s being able to drill longer horizontal legs, scale permits cost reductions, opex efficiency, and ultimately production results that can’t otherwise be obtained.

Source

With thousands of identified new drilling locations on their premiere acreage blocks, ARC has a long runway of internally generated revenue streams. At a development rate of ~150 wells per year, the company can adjust its plans to meet market surges or declines without resorting to the capital markets.

So with a Montney acreage footprint of ~1.1 mm acres, and production in the 340K BOEPD range, with slightly over 60% of it as gas, with the supportive environment surrounding this commodity in place presently, shares of ARC should find additional support to go higher.

Another driver. Lack of new ethane supplies from shale drilling curtailments. We also are seeing tremendous support in key gas liquids, with propane, butane, and ethane being the most sought after for various reasons. In the case of ethane, both Gulf Coast and Overseas buyers are creating demand for this plastics building block. As the linked article notes, the Chinese are scooping up millions of tons in VLEC’s (Very Large Ethane Carriers) of U.S. ethane for delivery to China’s new plastics plant in Zengjiang province. Energy Transfer, (NYSE: ET) has a long-term supply contract for 52.8 mm bbls annually.

Data by Marketwatch , Chart by author

For the rest of the story –Oilprice.com