By Peter Tchir of Academy Securities

This morning, I can’t help but wonder about Tesla cutting prices on some models (first in China and then domestically) and the off-the-charts cancellations builders are facing. But that could wait until this weekend’s report.

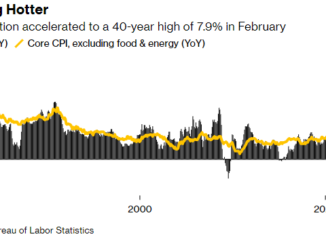

What can’t wait until this weekend is the messaging, I’m seeing related to inflation.

On the “political” front:

Senator Warren (@SenWarren) tweeted: “Inflation has slowed for six months, providing families more breathing room. The Fed needs to take this data into account and not drive the economy off a cliff with more extreme interest rate hikes.”

Let’s remember that this was all “transitory” until amongst other things, President Biden and Chair Powell sat down in November 2021 to discuss his renomination.

On the “media” front:

There is a “victory lap” sort of reporting. It is almost as though mainstream media got fed the talking points that “7.1% is bad! But 6.5% is good”. We are “winning” the war. It is headed in right direction, etc. Do NOT underestimate how much mainstream media is influenced via talking points to influence the public. Almost feels to me like we are setting up for a shift in how inflation is treated.

Nick Timiraos (@NickTimiraos) is writing about and tweeting about annualizing the Q4 data! (Where have we seen that before? From 2 + 2 =5 on December 15th) Whether true or not, many view him as the person in the press closest to this Fed, so it is interesting to see what narrative he is helping shape for the more specialized audience (financial media as opposed to mainstream media).

I am still neutral, but this shift in political and media talking points could pave the way for a series of Fed speakers to come out downplaying the inflation risk.

That would make me want to get on the bull one more time as that would fuel, likely erroneously, but fuel nonetheless, another big “soft landing” surge in stock prices (with a good rally in the front/belly of the yield curve).

Loading…