Authored by Simon White, Bloomberg macro strategist,

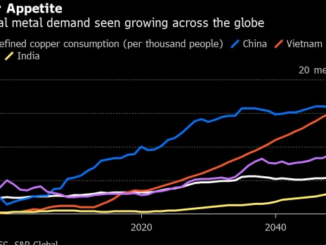

Heightened inflation risks and more profligate governments are pushing developed-market bond yields higher, closing the gap with their emerging-market counterparts.

It couldn’t last forever. After more than a decade of ultra-low DM rates driven by forward guidance and central-bank balance-sheet expansion, the higher-rates genie is out of the bottle.

The repressed risks from years of QE, which allowed debt, leverage and other financial risks to build, as well as the “government put” – a sea change to the fiscal backdrop where DM governments run persistently large fiscal deficits – have conspired to make developed-market bonds look increasingly EM-like.

The average yield of DM government bonds is as high at it’s been relative to the average EM bond yield since the early 2000s, the time of China’s accession to the WTO, the rise of the BRICs and the general improvement in financial prudence shown by EMs after the Asian crisis in the late 1990s.

In median terms, DM yields are now just a hair’s breadth below those of EMs. Again it was the 2000s since the two were so close together. The difference this time around, however, is not a marking down of EM risks, but a notable marking up of DM ones.

Ten-year bond yields are up almost everywhere. But there is a notable bifurcation, with most of the largest yield moves over the last two years in DM countries.

There are clear reasons why.

First, inflation has generally been a worse problem for DMs than EMs.

The median year-on-year CPI for DM countries rose by almost 9 percentage points between 2020 and 2022 versus only six points for EM.

Second, fiscal deficits have risen globally since the pandemic.

But even though the median deficit of EM and DM countries currently sits at about the same level, DM fiscal deficits have risen by more since 2020. Countries across the globe had to increase borrowing to cope with lockdowns, but DMs – with their more generous government support – borrowed more.

Furthermore, the emergent change of attitude in DM countries after the pandemic – that governments are now there to backstop a litany of downside risks, from job loss to ill health to higher energy prices – has led to the government put, where elevated fiscal deficits are becoming a feature rather than a bug.

The rise in fiscal deficits has driven a marked increase in government debt-to-GDP levels of DM countries. While they have generally had a higher debt-to-GDP level (often EMs’ problems manifest first on the private sector’s balance sheet), DMs’ debt ratios have recently risen to new highs while those of EMs have remained steady.

These official debt ratios do not take account of the huge unfunded liabilities in medical care and pensions carried mainly by DM countries – a fact that will not be lost on bond investors.

The increased debt load, along with a greater proportion of debt at ultra-low rates, means that DM countries’ interest expense is poised to rise faster than EM countries. For the US we can see the outcome clearly, with the rise in bond yields leading the annual interest expense of the US government by six months.

Governments have two main sources of income: borrowing, and taxation. Given fiscal deficits are already large – especially when you factor in that most DM countries are not (yet) in recession – taxing more would normally be an option. But here DM countries are already hitting against limits.

The chart below shows the tax-to-GDP ratio of EM and DM countries in the OECD (EM OECD countries include Mexico, Turkey, Colombia and Hungary). The ratio has risen in both EM and DM countries, but the DM’s ratio is greater, and is close to all-time-highs going back to the 1960s.

It’s possible DM countries in the aggregate are unable to tax much more in a net productive manner.

It has been speculated that the recent rise in global yields, led by the US, is due to an increase in the neutral rate’s estimate (Federal Reserve Governor Powell may address this at Jackson Hole this week). Even if that is the case, it means the economy needs higher real yields to prevent inflation from accelerating – an implicit acknowledgment fiscal risks have risen in the US (and likewise in other DM countries).

For international investors there is less to like about developed-market bonds. Yields, and their volatility, are beginning to reflect that. EMs are no bed of roses either, but their longstanding additional risks associated with borrowing in a non-hard currency, a history of more recent defaults, more volatile growth, and the possibility of capital becoming trapped have not significantly worsened in recent years.

What has got worse is the developed-world’s attitude to debt. Starting out in the 1980s with the great bond bull market, and reaching its apotheosis in the post-GFC QE years, a dalliance with MMT-like policies, and finally the pandemic, DMs’ fiscal situation has become increasingly precarious – leaving the line between EMs and DMs ever more blurred.

Loading…