By Michael Every of Rabobank

A pivot ahead? I’ve got a bridge to sell you!

“Transitory” proved transitory to those confidently walking off a cliff they couldn’t see ahead of them ‘because we don’t have cliffs anymore’. Then, the key fingernail they dug into the cliff-face was “pivot ahead!” to allow them to clamber back up onto solid ground.

Then we got Friday’s strong payrolls report. As one voice put it, perhaps it wasn’t really a surprise given the collapse in JOLTS job openings prior, as they closed because somebody filled them, not because the position suddenly wasn’t needed. Whether you believe that or not, or payrolls or not, the Fed can’t ignore it. Another 75bp hike is locked in, and more after that. Our house view remains the Fed gets to a peak of 5% in early 2023.

This week’s key release will of course be US CPI. Imagine if we were to get another upside surprise for all the same methodological and structural reasons we did last month! Worse, the recent trend in gasoline prices alone suggests we could see a headline m-o-m print of as much as 0.7% for October (not the September print we will see this week).

Anymore thinking the ‘supply side’ re: inflation was all about base effects, energy, and used cars, as so was going to be easily resolved by now, was also hanging on by a cracking fingernail.

Oil prices are marching even higher, Brent sitting at $97.5 at time of writing: we risk the psychological $100 figure again soon. Gasoline prices will surely rise much further, and a spike in heating oil, diesel, and jet fuel prices are all underway that will translate into higher winter fuel, logistics, and transportation costs. Europeans are buying up wood for winter, at extortionate prices; and even in wealthy Denmark there are reports of it being stolen. Coal prices continue to rise. LNG prices will remain high for years as shipping costs soar.

Drought is seeing cargo barges unable to use parts of the key US Mississippi river, as Europe experienced this summer: that could mean higher grain prices in particular. Few looking at a Bloomberg screen will ever have toted a barge or lifted a bale, and I haven’t either; but it still matters for those inflation numbers on said screens.

The latest EU sanctions package against Russian metals is biting in its severity. Not only will it ban their import into EU industrial processes, but it will also not allow the import of any finished product from any country that use Russian metal. That requires a complete re-ordering of some supply chains.

US trade actions against China on high-tech exports introduced Friday are a massive blow to the latter’s ambitions, again with flow-through effect along supply-chains. (The usual optimists claim cutting China off from access to leading semiconductor technology can only be good for its own sector; the same voices also favour free trade because of its ‘spill-over knowledge transfers’; so consistency is only their thing when it comes to optimism.)

The explosion on the Kerch bridge, hugely significant in many respects, underlines that taking any infrastructure or ‘supply side’ for granted is to refuse to see cliff-edges right in front of you. German railways were reportedly sabotaged over the weekend.

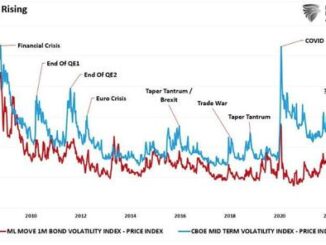

So, no pivot: and current Fed Whisperer Timiraos’s latest Wall Street Journal article notes the Fed are raising rates rapidly despite some optimism that prices are coming off the boil because “they have absolutely zero confidence in their ability to forecast inflation,” according to former Fed economist Nathan Sheets.

So, Mr. Market, why did *you* think you did/do? And why did/do you think it ends up back at 2% again?

Meanwhile, we have US President Biden warning about nuclear “armageddon” – at a fund-raising dinner you had to pay a hefty fee to attend: nice to get inside tips like that.

And for a different kind of mushroom cloud, we have Asiatimes.com –via Spengler/David Goldman of course– writing that as rates rise and pivots don’t happen, what we saw in the UK Gilt market can happen anywhere else at any time: “a portfolio manager at one of Germany’s largest insurance companies said, “It’s a global margin call. I hope we survive.”

If you think a pivot lies ahead, I have a Kerch bridge to sell you. If you think more explosions lie ahead, then you are right.