Josh Young, founder and CEO of Bison Interests, joins David Blackmon and Stu Turley to unpack the major developments shaping today’s energy markets. From new sanctions and shifting trade policies to rare earth supply issues and OPEC capacity, the conversation explores how political and geopolitical factors continue to influence oil, gas, and investment trends.

Josh Young from Bison Interests stops by, and we discuss with David Blackmon and Stu Turley. Numerous changes are currently occurring in the energy markets, and we sit down to discuss the political, geopolitical, and other significant developments that the investment community needs to be aware of.

Josh and David were on target, and we will see higher natural gas prices as colder weather is predicted. I think that once we get the world calmed down and wars end, we will see new trading blocs emerge. Those countries that follow Net Zero and deindustrialization, and then onward to fiscal collapse, will see huge financial growth and stability, while those that pursue solid energy policies and fiscal responsibility will see the opposite.

This podcast went out on the Energy News Beat Channel and the Energy Impacts with David Blackmon.

On Monday, we have an interview with Doomberg , and it will be live on our YouTube, X, and David’s LinkedIn. You can bookmark and watch on YouTube here:

Highlights of the Podcast

00:01 – Introduction

00:44 – Josh introduces Bison Interests and Bison Insights

06:00 – Discussion on new oil sanctions and market effects

11:30 – Trade and tariffs – U.S., Canada, Japan relations

19:00 – Rare earths and China’s leverage

25:30 – Economic deregulation and energy demand

31:54 – OPEC, Saudi production, and spare capacity

37:00 – Russia, Venezuela, and Middle East relations

46:30 – U.S. defense, alliances, and America First debate

52:00 – Europe’s natural gas dilemma and net zero failure

59:30 – Japan’s JERA gas deal and corporate strategy

1:04:30 – Energy companies shifting away from renewables

1:07:00 – Canada, UK, and future of Western trade

1:15:30 – Tech firms buying into gas assets and energy security

1:35:33 – Episode wrap-up

The world needs trillions of dollars of investment to meet current demand. Not many see or talk about that.

Full Transcript:

David Blackmon [00:00:10] Hey, everybody. Welcome to Energy Impact podcast. I’m here today. I’m David Blackmon, your host or co-host along with Stuart G Turley. Actually, I don’t know what Stu’s middle name is, but who is the host of the Energy News Beat podcast and the guy who sets all this up for us. We are here today with our special guest, Return Engagement from Josh Young, the head of Bison Interest. One of the great gurus of oil and gas. How you doing today, Josh?

Josh Young [00:00:44] I’m good.

David Blackmon [00:00:45] Just wonderful. We’re just wonderful. It’s a beautiful day in Texas. Stu has things in Oklahoma, man.

Stuart Turley [00:00:51] I’ll tell you, it’s all wet, nasty and everything. I’ve got every, I’m just all sitting here looking at it. And I saw some beautiful eagles this morning. So between the eagles, coyotes and bears, I am all.

David Blackmon [00:01:02] Wet and nasty, nothing wrong with that. It’s often wet and nasty in the oil patch too. So we’re good to go here. Josh, first, just give everybody your elevator speech about bias and interest before we get into the Q&A.

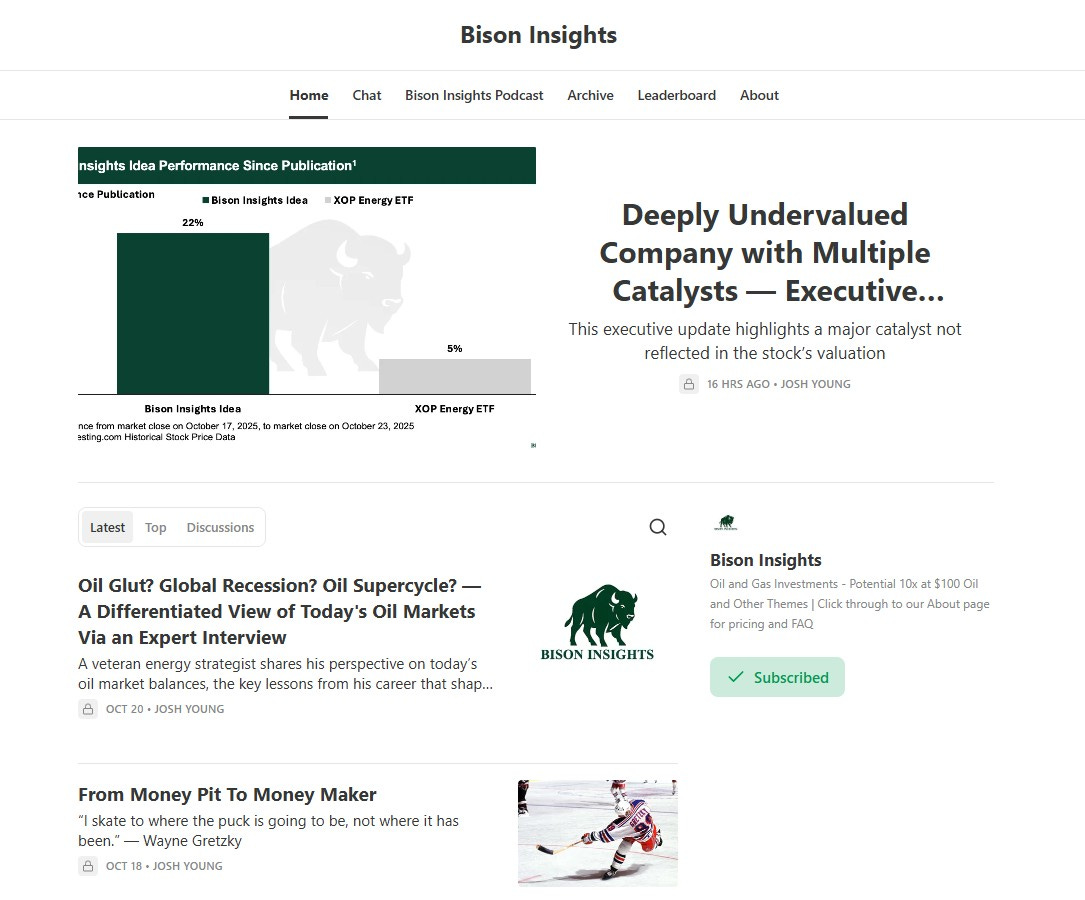

Josh Young [00:01:20] Sure. Yeah. So so I have two hats. And actually, we’re about to launch a merch store for one of those. So I’ll actually literally have a hat for it in a bit. So, I run a small investment firm that invests in publicly traded oil and gas companies. And we launched that a little more than a decade ago. So great timing. And if anyone doesn’t know that was sarcasm, the last decade or so has been quite rough with a few, few bright spots. And then, in… In actually earlier this year we decided to launch somehow got this big social media following, which is wonderful. I love getting to interact with so many different interesting people. Launched a newsletter called Bison Insights where I share various stock ideas and interview various folks and just honestly a lot of it was to keep myself out of trouble by Here, I just shared this on social media. I get asked probably five times a day what my favorite oil and gas stocks are, and if I can give someone a stock idea. And from a compliance perspective, it’s catastrophic. And so having all that in one spot with a disclosure where someone is paying something, but they also understand I’m not recommending them anything, I’m just sort of sharing educational, informational stuff is fantastic because it’s there and I can update stuff where relevant there and they can look at it and I don’t have to try to remember which stock I told which person to whatever and also there’s very, very clear disclaimers that, you know, if I own something I say it, if my don’t, I say if my funds I advise own something, I see it or not and you know so that’s perfect. And then, and then she’s saying he wants me to talk about the oil market. Did you want to join do that now? Or do you guys want to do just just

David Blackmon [00:03:21] Wait, just just one little thing before we do that is just to be sure everyone knows bison interest is your substacks type So they can that’s where they can find you

Josh Young [00:03:31] Bison Insights is my is my sub stack and that’s the sort of the thing for general consumption. And again, there’s all these rules around qualified investors, accredited investors, and whatever for my investment advisory business. And so for this sort of thing, it’s wonderful to have this because now I have something I can actually appeal to and say, hey, go here and I can recommend that they come and subscribe to it. And it’s a nominal amount of money and it’s not whatever. It’s not like, hey give me a million bucks to go, you know, and I’m still I’m doing that, but it’s just it’s so much simpler to be able to just have from a public perspective this this one thing and the performance on it has been it’s been on it so I thought over time the ideas I would share would do well and would outperform but I didn’t think it would do this well this quickly so it’s great you know I actually I don’t think I’ve sold a single share of anything I’ve talked about so far. Wow. I will at some point for sure, especially if things get out of whack in terms of position sizing or whatever, but it’s sort of fun. And then I’ve no.

Stuart Turley [00:04:40] You a long time. Josh, this is Nancy Pelosi kind of numbers. This is absolutely within the realm. This is not Kramer numbers. I got Kramer numbers. So anything Kramer says, I do the exact opposite. Now this is Nancy Pelosi kinda numbers.

Josh Young [00:04:57] Yeah, and also just that second one that was a crazy high risk, you know, there’s a real chance of a zero there. There’s still a chance of zero there, so that’s not, you know, these other things were stocks. This was a, you know, post-bankruptcy warrants. So very complicated, high risk. But that’s the other excuse for setting up a newsletter is, hey, I can write about whatever I want. I don’t have to worry about, hey is this going to go to, you know, a huge distribution? There’s a modest and growing number of subscribers, but not the 117 or whatever thousand Twitter followers or whatever that I have. And so, you know, it’s nice to have that sort of defined space where I can disclaim. Uh you know my my interest and my um involvement and where people can understand that these things are if it’s i think it’s higher risk i say i think its higher risk and so on so anyway so that’s not that one probably i don’t know how to like take it out to be fair but like you know these other things where it’s you know up 20 versus up five i think is maybe more indicative than up 412% versus, you know, oil stocks up four or whatever.

Stuart Turley [00:06:04] Hey Josh, we’ve got some new oil sanctions that just absolutely dropped on us and we want to kind of bring these on up and say, hey, what do you think is going to happen? I’ve got an opinion of sanctions and I think that President Trump is doing a phenomenal job with his domestic policies and I that he’s listening to the warmongers trying to end the war in Ukraine. And I think that President Putin showed up in Alaska ready to do a business deal and end the war, but President Trump, he wants to do business because he is tapped out. I think President Putin is tapped-out on his oil reserves. Then we have the new sanctions that just kicked in. And I think by President Putin, by President Trump, excuse me, putting sanctions on India. And then the EU additional sanctions, all of a sudden yesterday, Josh, we saw a huge price just go, boom, here we go. We’re starting off to the races again. You know, my oil bowl in the backyard is kind of happy. He goes, hey, Stu, they’re raising prices here. So what do you think’s going on with all that?

Josh Young [00:07:20] Um, I don’t know. I think, uh, it’s been very weird and disappointing how we’ve dealt with sanctions on Iran. Um, here one second, I’m just sharing this on social media just so people can see. And then, um, and we’ll close this up so it doesn’t affect the connection. Um so, I I don’t know. I’m not sure I really understand what’s going on in Russia. I’m sure I don’t really understand Trump’s foreign policy. I like the idea of America First. I worry about some of the connections that we’re making in the Middle East and sort of what they want and are trying to do and how different that could be from our general this America First framework. So I liked that and I’m not sure. I would like us to adhere to that matter. Sanctions are so complicated, but the worst thing you can possibly do is threaten something, say you’re doing something not do it. It’s credibility destroying. And so, hopefully we enforce these sanctions we imposed. I don’t exactly understand why now we’re sanctioning Russia. The whole thing is strange and disconcerting. And what I’d like, if it was up to me, was real strict sanctions on Iranian oil that’s enforced because it’s smaller, it’s actually doable. These guys fund terrorism. They fund all kinds of terrible stuff. They were involved with a lot of American soldiers, deaths and so on. And so, you know, that that to me seems like real simple, real America first, and, and we’re not even doing that. And here we are saying we’re going to go sanction millions of barrels a day of Russian oil and try to prevent India and China from buying it. I just don’t I don’t know. I don’t get it. I don’t know that I believe that it’s actually going to get cut off. And then actually, David, it was exciting. I think this is the first time I was written about it or quoted in Forbes and it wasn’t you where I said that, where it’s like, hey, this would be a big if true sort of in terms of oil market. I think oil should be higher, but not necessarily because of this. But I’m real interested in your guys’ perspectives on that.

David Blackmon [00:09:36] Well, you know, I think so much of it is tied up in the president’s obsession with keeping oil prices down, right? I mean, he’s, he doing all these things. I think the reason why he, he doesn’t strictly enforce the sanctions on around it’s because he doesn’ want to take 2 million barrels a day off the market and cause prices go up 10, $15 because that costs people at the gas pump. And we’ve got the lowest gasoline prices right now in four years. And so he’s got this. You know, he’s just his whole energy policy is a self-conflicting thing between the talk about drill, baby drill that isn’t going to happen at $60 oil, you know, as opposed to low gas prices that isn’t going to happen at 80 dollars. So he’s, he just keeps going back and forth on that. We did see the oil price go up a few dollars. I guess this morning, it’s still over 61, which is Kind of nice, given that it was down below 57 the other day, and that that all most of that appears to be a reaction to two things. One, the sanctions on Russia with the market kind of anticipating some of Russia’s barrels going off the market and optimism about Trump’s upcoming meeting with Xi Jinping, you know, and the progress that could be made there on rare earth minerals and other issues between our two countries. I wonder if you have a view on what happens if that meeting doesn’t come off to oil markets? What might happen in oil markets if, because the Chinese have not yet confirmed the meeting with President Trump next week. I mean, everybody’s sitting around waiting to hear some announcement out of the Chinese government that that meeting is actually going to happen. If it doesn’t happen… What do you think might be the impact on crude markets? Because it’s all interrelated, obviously.

Josh Young [00:11:38] You know, I’m actually more worried about what Trump tweeted yesterday, late last night, actually, apparently he became aware or whomever runs his Twitter account, I think he’s only doing that sometimes it appears sometimes maybe Baron has it to go promote random crypto scams or various other things. But I’m really worried about his post about Canada and how he was complaining. He claimed that some Canadian funded nonprofit posted or some Canadian group posted a quote from Reagan and he claimed that it was AI and fake. But it appears to be actually just a quote from Reagan who is a free market. Um you know fair but open trade advocate um and so i i just worry um you i worried about this with the last administration um as well i think when you have someone who appears to be sort of slipping away from reality um you get sort of very weird sort of divergent policies and so this idea like trying to co-opt reagan’s legacy and literally a video of reagan saying i don’t like tariffs, let’s have free markets and fair trade, and then claiming it’s fake and then punishing our ally that’s, you know, we have a great trade relationship with Canada. I mean, there’s lots of problems with Canada and lots of problem in America, but like trade is not one of those problems. Trade, I think we’re actually a net beneficiary. I shouldn’t say that too loud, but when you ask that beneficiary of trade, like that should be the framework, the relationship we have with Canada from a trade perspective is net beneficial. So let’s do that with everyone. Don’t punish them. And then also, you know, it does, I think Reagan was one of the best presidents that we’ve had in America measured on a number of different perspectives. And so taking his legacy and trying to re-appropriate it and saying that he, it doesn’t take much. You just literally click on the link of the, the, and even the Reagan Institute where they claimed that Trump was right, but you just click on their video that they say, and you listen for one minute and Reagan says that he is pro-free trade, um, and pro-fair trade and, and doesn’t like tariffs.

David Blackmon [00:14:01] Yeah, but if you listen to the whole speech, I think the Reagan Institute’s problem was twofold. Number one, Ontario didn’t pre-clear the use of that video, which they have the full copyright to in advance. And number two, they believe that if you watch the whole speech, it is taken out of context. It’s somewhat misleading as to what Reagan was saying related to the specific issue that was at hand in that speech, which was Reagan putting a new tariff on Japan for its discriminatory trade practices. Back in the late eighties, people need to remember that Japan was pretty dominant in the US automotive market and engaged in a lot of very aggressive trade practices vis-a-vis the United States to protect that market share. And so Reagan responded with, which compared to what Trump’s doing, a pretty small tariff. On Japan’s imports into the US. But anyway, yeah, it’s all, you know, and control that bow and Trump’s going to reverse that here within a few days. Those talks will be back on.

Stuart Turley [00:15:09] And compare that to the new prime minister for Japan, who is a conservative female. I think that he had, it’s going to change from Reagan putting the sanctions on Japan back then to Japan helping the new trading blocks. And I think, that is her conservative leadership. She’s got a huge Japan bond market issue to take care of. And I think that if she gets the trade with us going, I think it’s gonna make a huge difference and a very good thing for us.

David Blackmon [00:15:45] Well, I hope so. It’d be good to have a better relationship with Japan than we’ve had the last few years in terms of trade. But, you know, yeah, I’ve read just a few things about her. I don’t know if I was actually planning on this weekend taking kind of a deep dive into her because I’m not familiar with her other than the headlines we’ve seen this week.

Josh Young [00:16:07] You know, I will say on trade and related to Japan, that part of sort of growing up is accepting that good things can happen from people you dislike and supporting things that came from those people. And so I went through that recently with sharing my latest idea, where it’s like, hey, holding my nose and buying this thing, I’m not so thrilled with some of the aspects of it. But there’s a lot of upside here. And I view my role as trying to find upside that’s asymmetric, regardless of whether I like or dislike if I find it distasteful. But I can say I find a distaste and then find the thing to be compelling. And so I can’t help but think of Obama’s TPP, and there’s very little that Obama did, and it’s possible that this was over like begrudgingly and whatever, you know, similar to like Clinton balancing the budget where he was very opposed to that, but he gets credit for it because it happened under his administration. So TPP this idea of having a free trade zone with no tariffs and no trade barriers across. It was like 14 countries or something. What a great idea. Protection of private property, protection of IP, no trade barriers with countries that have enormous trade barriers, and the ability to counter China’s growing influence, which even then, I mean, now it’s way bigger. And to counter their dumping of various manufactured goods again, now, it’s we bigger. I do think it’s a little unfortunate that we’re going the stick and bigger stick route instead of the carrot route with our with our allies. So I really, I really wish that we would and again, it sounds to me, but I think we’d all be better off including, you know, the average American worker would be much better off with low trade barriers, and essentially a free trade zone across these different countries that buy tons of our stuff. And Canada made me think of this, where it looked like what we want in America is a strong, prosperous Canada because they buy tons and our stuff, so let’s get them. Before not like, oh, let’s endorse Mark Carney, this sort of socialist wacko who does even apparently, like he helps facilitate this entity he was chairman of, avoiding billions of dollars of taxes in Canada. He’s now promoting sustainability, but really it’s just shifting emissions to China away from Canada. Of course. I think we’re so much better off and it’s not me and the portfolio manager role here in Houston, Texas. It’s the welder in the middle of Ohio and the farmer in Iowa and just so many different people who are such big beneficiaries of expanding markets. So I did, I did re-listen actually to the whole speech that Reagan gave. And then I went down a little bit of a rabbit hole last night re-listening to some of the Milton Friedman stuff on trade and tariffs and so on. And I just think we have such a wonderful opportunity, especially now that we’ve imposed tariffs, where there’s this opportunity to roll that back and get into this great mutual free trade policy, where we could end up with significant gains. And will it be good for oil? Yes, in the long run. In the short run, I’m not sure. Good, bad, hard to tell. But I don’t know that this meeting with Chi matters so much. I think that what matters more is how we navigate our trade agreements and economic policies with our allies who we’re in healthy bilateral economic relationships with already.

David Blackmon [00:19:49] Well, but don’t you think, I mean, if we have made these ongoing disruptions and we’re already seeing pretty big fallout in the car industry right now, because the chips that they need aren’t, aren’t coming in because of rare earth minerals have been restricted by China and the products manufactured from them. If that continues for a long term, don’t you think that that is going to have a pretty significant disruption in the U S economy? Because you’re not going to be able to build cars. You’re not going to be able to fill the… Military’s needs, because we don’t make those magnets here in the United States, and we don’t mine enough of the minerals that we have underground to supply our own needs. So, I mean, it seems to me that getting this resolved with China one way or another, freeing up those imports, is a pretty significant thing for the U.S. Economy.

Josh Young [00:20:43] So I think the problem is the volatility of this and the uncertainty of it and the high probability of inconsistent policy where something is imposed and then withdrawn. And so I think that volatility is far more damaging than any specific policy. And the information problem around it is extremely damaging. It’s sort of the known thing. So the basic problem with conventional economics is that there’s a value to information. So this idea that you maximize utility under certain constraints, the sort of basic, sort of classic Adam Smith economics is, that there is a cost to information, you don’t always you that your information is correct. And so the volatility and inconsistency of American policy, first under Biden with all these regulations and taxes and now under Trump with the sort of back and forth on tariffs and other sorts of similar issues, is that you can’t invest to address the problem. And what we should have is a consistent policy of lowering trade barriers and free trade to the extent possible and high barriers with sort of unfair trade partners that would allow it doesn’t we don’t need the government to go put money and frankly I think we should not have the government putting money into some of these things where very clearly there’s some politicians and other folks buying ahead of the announcements and I mean just terrible crazy stuff of looting essentially by our leaders and their affiliates Um, but. I think what we need isn’t government money. What we just need is policy certainty with some significant guarantee of continuity on that policy certainty. So the rarer thing, as I understand, isn’t actually even a time lag so much because you could go get these mines. So there’s some mines that just need to get restarted. You could get some of this manufacturing or refining done to the environmental standards, which are basically almost none of China. The problem isn’t that manufacturing and refining, the problem is that it’s immensely polluting. And so the Greta Thunbergs of the world who have one standard for the world and the other standard for, you know, the US and the West and whatever would freak out. And there’s all these environmental laws and regulations we put And I’m not even sure that those laws are so bad. The problem is that we don’t enforce those rules on the things that we import. And so we have this sort of weird thing where China is destroying our oceans and our water and our air. And in exchange, we get these rare earths where we pretend like there isn’t all this pollution from China. So that’s a real problem.

David Blackmon [00:23:26] You said it earlier, what we’ve done over the past 45 years is export our emissions and our pollution to China, right? I mean, that’s exactly what we have done. And now we’re surprised that China is using the dominance of the market that they’ve established as leverage in a negotiation. It’s hilarious, really, when you think about it. People in China, the Chinese government, must thank Americans are the stupidest people on earth. I mean they really must. I mean, given the way we’re reacting to what they’re doing today, I mean we begged them to do this for half a century now. And now they’re using it as leverage and all of a sudden, they’re the bad guy.

Stuart Turley [00:24:08] Isn’t net zero, I mean, it is a net zero is basically offloading everything to China. China has been supporting net zero. Germany is now since 2017, they have made 2 million less cars since 2017 because of industrialization in net zero. So if you’re trying to go after net zero, it is absolutely, you know, the EU has pushed Germany off the edge. They are no longer a manufacturing hub. Um, and can we get it back? I’m excited about the Australian, um, minerals deal that we just signed in that I’m kind of curious. I’m trying to find out. More about the specific contracts and how that is going to play out and good investments could be joint made between the companies, the mining companies and the ore being processed in Australia. I’m very excited about the potential of that. Gallium is one that I know that we are now able to produce in the U S 50% for our military this year. That is a home run one down. 37 more to go.

David Blackmon [00:25:27] There’s a lot more to go, yeah.

Josh Young [00:25:31] But again, just getting back to the problem. So the problem is that we… We have a solution, which is to build this stuff. And we have choices in terms of how polluting we’re going to allow this stuff to be. But we also have a problem, which is that very likely, the next time there is a Democrat-run executive branch, we’re going to end up with a lot of these things shut down or ominously punished and regulated. And so this sort of decision, hey, let’s build this thing because it’s important for national security for our economy could lead to, hey, well, you did it. Thanks. Now, we’ll take that and you’ll get no return on your investment. And so again, that regulatory and tax uncertainty is what I think is the real problem here. And the volatility of the Trump administration itself, I think, contributes to the higher, the elevated risk that there’s going to be a policy shift after the Trump administration. And frankly, there may even be one where in a year, we end up with a trade agreement with China, and we’re getting rare earths again. I mean, that’s what happened. No one wants to talk about this. But Mali Corp went bankrupt because they were built out for this when China was restricting rare earth exports and then China unrestricted rare earth exports and this this thing collapsed and then you know here you are sort of round two but we saw how that ended and you have the combination of the onerous regulations under the Obama administration and then the Biden administration along with China sort of flooding the market again so I think without real clarity long-term clarity on this policy it’s impossible for the market and private enterprise to do what they need to do. And instead, we’ve sort of supplanted that with almost like fascist style. Hey, we’re gonna do this thing where the central government puts in money, chooses winners and losers. There are all these weird trades that happen right before it with undisclosed parties who seem to have information about which companies are getting these rewards or whatever. And then they get them and then their stocks go a lot, but we don’t even know the weirdest part is, hey, these things, when are the insiders going to go dump them and then short them? And then we find out, oh, hey there’s a free trade agreement with China or some sort of trade agreement and then everything collapses again. So again, I think those are real issues. I will throw in, there’s one benefit of the Trump administration, which is I’ve been really negative on them so far this morning, that they are reducing taxes and regulations broadly. And there’s an enormous stimulus effect from that. And I think people can’t see it. It takes a while for it to show up in the economic data, but it’s great to see deregulation. It’s great to see this trajectory towards lower taxes. And then it’s actually sort of I probably shouldn’t say this, but it’s great to see the government shut down. And yet here we are living and breathing and things are fine. And so, you know.

David Blackmon [00:28:39] You know, for three weeks now and hardly anybody’s notices, except the folks who aren’t getting paychecks, right? Which some of that I want.

Josh Young [00:28:48] Them to get paid. I want our military to get paid. But a lot of this, why don’t we just shut it all down and then restart the central services and that’s it.

David Blackmon [00:29:00] I mean, didn’t we think that, uh, Russ Vaught and OMB were going to do some of that during the shutdown and they have hardly done anything, which is a shame because this is a great opportunity to unilaterally do some of that stuff because I mean the reality is, like you say, half of what the government does, we don’t need, doesn’t affect anybody, doesn’ help anybody in our society and is just a complete waste of money. Uh, and the Democrats are holding out for $1.5 trillion in additional spending. On stuff that doesn’t help any American citizen in reality. That’s what’s going on in the damn shutdown. But I totally agree with you on that. Today, the Dow and some of these policies I think you’re talking about must be working because the Dow is at another all time record high as we speak today. Gold and silver prices are falling. And I guess the S&P is actually at another old time high as well. Maybe the NASDAQ too, I’m not sure about. Um, so stocks are doing well. We had a good inflation report. I wonder how much of that is attributable to low gasoline prices. Probably a significant part of that. But, uh, but anyway, I, you know, the, the economy does seem to be generally healthy, doesn’t it?

Josh Young [00:30:16] One thing that we should talk about related to that is these strong oil consumption numbers and strong gasoline consumption numbers. Yeah, we have some severe narrative violation here where it turns out that the developed world isn’t done growing its oil demand shockingly. So hard to believe. I know, right? Who’d have thought that as we can regulate… As you deregulate lower taxes, that demand would rise. And even this chart, this is a good chart, but really, the last three months, it’s just phenomenal. And again, I think you can point to deregulation as the driver on this. And The other fascinating part of this is that you have these multiple currents because you have illegal immigrants being sent out of the U.S. And there’s less of an increase in immigrants living here. And so that immigration flow was driving incremental oil consumption too, sort of disproportionately. Some of the wealthiest, if you’re living in New York City or whatever, you might be using a lot less oil, but when you move from, you know, wherever, Central America or. Sub-Saharan Africa to Southwest U.S., you end up using a lot more oil per day. And so there was this extra bump in demand from that that we’re getting rid of to some extent, and we’re still seeing demand growth. So it’s really, really powerful how much demand you get from this deregulation.

Stuart Turley [00:31:54] Uh, Josh, uh, you know, OPEC has, has been releasing back their production, walking back, their production quotas and things. And I saw a post yesterday that is unconfirmed. I can’t confirm it, but with these newest sanctions on Russia, uh. Saudi Arabia was putting out, um, from this post that is unconfirm, but they were saying, we want to, um. Start bringing out rigs out of cold storage to start building rigs again. That to me is huge. If it is proven to be true. If Saudi Arabia is bringing rigs at a cold storage, to start drilling more, that means their spare capacity has been proven again, not there.

Josh Young [00:32:46] Yeah, I saw that. I loved it. It’s so funny. These guys, they’re like, there’s these these weird sort of concurrent narratives that go on. There’s this like, oh, the biggest glut ever. Right? And oh, there’s still 7 million or whatever barrels a day of spare capacity to OPEC and it’s probably higher. Right. And at the same time, you see these guys, like they they try. So actually, I interviewed Arjun recently for this newsletter provides an insight. It was so fun. Honestly, It was so great. It’s fun to be on the other side of the camera on occasion. And like, you know, just getting to ask those couple of follow-ups and then just. Stopping talking, which I’m hard at, or it’s hard for me, I’m not good at. But you know, it was so interesting. So yeah, it’s really like, once you try to, like, pull the thread a little on these narratives, it’s like, okay, well, you have these concurrent, conflicting bearish narratives. So pick one, right? Because like, trying to think okay so so the narrative is the Saudis are flooding the oil market because really Saudis have been the majority of this incremental OPEC quota increase and an actual production increase so far this year I think they’re actually the outright majority if not the plurality of those barrels and so because they had cut a lot supposedly but then any time this was Arjun that appointed this out I don’t think it was in my interview with him I think talked about it previously, anytime the Saudis get over 10 million barrels a day, their inventories start falling and they start trying to add more rigs. And so that’s not, you know, I would, this is now my commentary, Occam’s razor. Hey, anytime I say, hey, I need to do more than a certain amount of a thing, and then I need you to like, try to backfill and like get deplete reserves. I mean, that tells you, I think everything you need to know. So I think I actually This was explained to me by a few different folks. I’m not sure I 100% believe it. But one of the theories was that OPEC increasing their quotas was the Saudis getting back at Russia and maybe some of the other Gulf states getting back to Russia for flooding the market in 2020. And they were going to go embarrass Russia because they were gonna show that Russia can’t produce what their quota level is. But the funny part is maybe in the process of doing that, they’re also showing the world that they can’t reduce what their spare capacity numbers are too. And you know, maybe this means they don’t get the invited back to Vienna next February. That’s okay. I like the guys that run OPEC a lot. But you know I’m just still going to say what I think. But I do think the spare capacity numbers are way overstated. And I think they should just be honest with it. And i think the OPEc leadership thinks that but maybe not the countries they have this very sort of weird ego stuff tied to their potential spare capacity. But if everyone knew that you really only had probably a million barrels a day of spare capacity from here. I mean, oil would be $30 a barrel higher, and you’d have 100 rigs more running in the U.S. Right now, and maybe 50 more in Canada. So that’s what I think about that. I’m curious about your guys’ take. How do you interpret the news that they’re starting to order more of these high-spec drillships and jackups to start drilling offshore some more in Saudi Arabia in the context of this market? But what do you think? Thank you.

David Blackmon [00:36:07] Just nailed it. I mean, I don’t have any disagreement with anything you just.

Stuart Turley [00:36:12] I think that they’re absolutely getting ready for Russia is not capable of building out anymore. And that’s why President Putin, when President Putin showed up in Alaska, he was ready to do a deal. And that is the way to end the war. Go and just say flat out, we’re done paying for it. President Putin and that’s why when he showed up, he handed President Trump a declaration on the Sacklin project and was trying to find a couple billion dollars to pay back Exxon because Exxons was out a few billion bucks. Now you have the EU trying to use Russian money out of the EU’s money changing hands system to pay Ukraine and That is going to backfire if they do that. I’m just telling you right now, that ain’t a good idea. So you sit back and take a look at how this could end. I think that Russia needs to have the United States as an export, as a service, get our great oil and gas guys out there. Let’s do business with Russia. Let’s end the war. Let’s quit killing people and call it a day. I agree with President Trump on that. And we need to quit listening to the Lindsey Graham, Lindsey Graham. You need to just retire, please.

David Blackmon [00:37:43] Well, we’ve got so many of those guys in the Senate and ladies in the Senate who are so tied into the defense industry and getting all that money from them that it really influences their, their politics. And I’m afraid I’m like you that Trump has been spending too much time listening to the warmongers in his own cabinet.

Stuart Turley [00:38:06] Yes.

David Blackmon [00:38:06] This question of you guys.

Stuart Turley [00:38:08] This brings us to Venezuela. Venezuela is one of the OPEC members. They have billions of reserves there, but the Monroe Doctrine has been ignored for 30 to 40 years. And I think that that is what is going on right now. I don’t think it’s narco terrorism, because for the last 30 years, China has really focused on South America. And now that we’re seeing B to B one bombers running around Venezuela right now. I think that it is more about getting China out of South America in my opinion than it is narco terrorism blowing up a couple of boats. I think it’s got a bigger thing that the administration is not talking about.

David Blackmon [00:38:58] Well, but narco terrorism is the hook, right? It’s, it’s, it’s the hook for the visuals. And, uh, but yeah, I think obviously like most other things internationally, it all kind of revolves around China and what to do about them.

Stuart Turley [00:39:12] I mean, China still has both ports on each end of the Panama Canal, and that’s still not resolved yet. However, we have a bunch of military sitting out there. So I think President Trump is doing a good thing by trying to focus again on our hemisphere, because if the net zero crowd, the EU fails, and you take a look at the UK failing, and they start doing more business with China. I think the new trading blocks are going to make a difference. And Josh, you were spot on when you mentioned earlier about trading partners with Saudi Arabia and Qatar and the other big deals that President Trump has done, but I would like to do business with Russia, Qatar, Saudi Arabia, India, and do business and not wars. I’m more of a non-war kind of guy.

Josh Young [00:40:09] Yeah, I mean I am too, but why are we building and expanding our military base in Qatar? Why do you have a defense alliance with Qatar? These guys sponsor terrorists and they sponsor some of the groups that used to attack our soldiers when we were in Iraq and they now have part of an air base here. I had posted they’re building their own that they apparently or getting like a building or something on a U.S. Airbase.

Stuart Turley [00:40:39] And

David Blackmon [00:40:44] and improving the hangar there.

Stuart Turley [00:40:47] They’re improving the hanger and it’s a normal thing because they’re going to be buying so many planes that they are going to need their pilots trained. And I’ve got a lot of contacts that I believe me, Josh, I reached out on that one going away. What are they doing? No, it’s, it is simply just because they are buying so many planes, they’re gonna need a place to train. And mountain home Air Force base is where my dad trained. Uh, before he went to Vietnam in the F four.

Josh Young [00:41:20] Yeah, I just think we should, again, just focus on this sort of America first thing. And so I agree. We should be better friends with our friends. And I like the idea of it being Department of War instead of Department of Defense. Right. That sort of like positioning makes sense to me. And maybe we should be better enemies with our enemies, too. And I think this sort of like gray area where we like give hangers to folks that like sponsor killing Americans and sponsor Al Jazeera with their super anti-American, anti-Western, anti-Jewish and Christian, anti whatever propaganda, I mean, these aren’t our friends, even if they give our president a plane and a golf course. And so they might be his friends, but they’re not our friends. And I just liked this idea so much of America first as the leader of America being America first, like, what a cool idea. Like, let’s try to align our policies with what’s best for us. And so why should our enemies have a hanger and why should we have a base in a place where they’re funding these things that are truly antithetical to our values and to us and where they’ve been in our lifetimes with unrepentant. You know

David Blackmon [00:42:42] A big part of the issue there is that we do have these obligations in the Middle East and compelling national security interests and keeping straight of our moves open. And one of the things Trump is doing there, the administration is doing with Qatar, is trying to improve relationships with that country that is situated on the Persian Gulf, just adjacent to Iran, as- a potential check on Iran and any efforts Iran might take to shut down the Strait of Hormuz. And so, it all gets caught up, it’s very complicated, and gets caught in those politics. Plus, for better or worse, America agreed to assume the responsibility as the policeman of the world to keep all of the shipping lanes open as part of the Marshall Plan and other agreements that were signed in the wake of World War II. And we’re still tied to those 80 year old agreements. And, um, you know, I, I agree with you. I think, uh, maybe the time has come where we shouldn’t be tied to agreements that were made in a completely different world 80 years ago, and things have changed a lot since then, and maybe we should let the Middle East defend for itself.

Stuart Turley [00:43:59] Let’s ask the seventeen hundred and eighty people that are live right now with us and say, can we get rid of the Jones Act right now? Because that’s a that is just right. I was only keeping 200 people in employment because they’ve got a fantastic Lobbying group that it just is what?

David Blackmon [00:44:21] The dumbest law ever written in American history.

Josh Young [00:44:25] It is awful.

David Blackmon [00:44:27] It’s just so.

Josh Young [00:44:27] Is it, is that any worse than pardoning a known terror money launderer just now who apparently is like deeply involved with the president’s family’s business on the cryptocurrency side? I don’t know. I feel like there’s this sort of, I feel we just need to have sort of clear delineations and maybe we have these obligations, but I don t believe that we have an obligation to have American soldiers and equipment. In the Middle East. And even if we’re going to travel police shipping lanes, we don’t need to have that base in Qatar. And I think if we were going to have a base somewhere, it should not be in a place where they run 24-7 anti-American propaganda and where they fund… They were funding a lot of these college protests or whatever they were funding. I mean, they’re malignant. If you have a malignant tumor, you don’t say, oh, it’s part of me. You cut it out and get rid of it. And so to me, this is like, and they’re also our biggest competitor in the LNG market. So they’re not our trade partner. They’re our enemy and they are our opponent. Commercially in addition to funding these bad things.

David Blackmon [00:45:37] Well, that brings up another topic actually, uh, well, a related topic. What did you think about the letter that Chris Wright sent jointly with the Qatari minister who’s also the head of the Qatary national oil company to the EU in opposition to the CS three D rules? What would you think? What is it?

Josh Young [00:45:58] A brookie clock is right twice a day? I don’t know.

David Blackmon [00:46:01] I don’t know. No, I mean, but I just thought that was an interesting partnership. And it shows, I think it shows how important the administration views getting rid of that particular bit of EU madness is in terms of the ability for American companies to keep doing business over there. And it’s obviously, obviously a lot of those companies are in the oil and gas business, right? Exile Mobile’s been very active on that.

Josh Young [00:46:31] I just think we should be better friends with our friends. I think if we need Qatar to intervene, to try to affect European trade policy and regulations that are hurting our economy, we’re in deep trouble. And I think that we should deal with that by dealing with it, not by buddying up with folks who, again, are antithetical to our moral and religious values, who have sponsored killing Americans, kidnapping Americans, all kinds of stuff, and who are commercial competitors. Like, I don’t think it’s just not. I feel like we were promised a set of things, and it’s sort of this opposite of those things. And so, yes, like, did they say things that I agree with? Yes. But is it weird to have this? That was to me was almost as weird as Chris Wright going to, I know we disagreed about this, going to the fields that Saudi Arabia bought for one one thousandth the value and giving a big thumbs up. You know, similar idea like this is just not this is what weak, ineffective leaders do. It’s not what strong competent leaders do. Strong competent leaders, if we have a problem with Europe, we go to Europe and say, we have problem with you. And we say, hey, here, we’re gonna solve it. And you do it privately. Well, I mean.

David Blackmon [00:47:44] Well, I mean, but I think we’re doing that too, aren’t we?

Josh Young [00:47:48] Maybe, but I don’t think you’d go that this to me again, it’s just so it’s the opposite of like a TPP style thing. You find your friends and you get into economic relationships with your friends. And you find your natural defense allies like Mexico and Canada, and you you figure out how to sort of coordinate with them and you don’t like tilt the odds in favor of like socialists getting elected in Canada like Carney which Trump did. You don’t buddy up with the communists in Mexico. You try to help promote freedom and democracy and free trade and deregulation and stuff in the countries that are directly relevant to you. You have that impact which you do have some control over and we’ve gone weirdly the other way under Trump even which again is very hard to understand. And so why does all this matter for oil and gas, right? So you have weird policies that are disruptive and… Seem likely to me to backfire. And so that’s the problem. The problem is it’s not good for America, but it’s also not good for the continuation of free open trade or shipping lanes or borders or whatever. And so I think there’s going to be uncertainty of supply of LNG from Qatar and other similar countries. I think even with us, the more we’re involved there, the more we are going to upset that we’re rocking the boat there by being… Like, we have a base there. It doesn’t make any sense. And, you know, we learned this very painfully, sadly, at a huge cost of money and human lives. But what we have bases in Afghanistan for what we occupy Iraq for, for a decade, just terrible. So similar idea. Why does that matter? It increases the volatility of supply. It increases the price, which I guess is good because I own it, but I’d rather have certainty of supply, certainty of growth, and a higher long run price than a higher average price, but average because you end up with crazy price spikes and then crazy crashes.

David Blackmon [00:49:52] But on the question of volatility of supply, I can’t remember personally. I don’t remember a time since I’ve really been paying attention to oil markets, which is 40 years, where we’ve had a lower fear premium built into the crude oil price than we do today. I think it’s at an all time. I don’t think there’s any fear premium in the price of crude oil today. And I think there have been times in my career which. Began in 1980 in the oil business when we had $30, $40 of fair premium in the price of oil. Oh, so I mean, a tanker would get hit in the Red Sea and friends and who isn’t, but, but you look around and in the wake of that peace deal in Gaza, which, you know, is still pretty tenuous, admittedly, I don’t think we have any fair premium in the price of oil

Josh Young [00:50:49] Yeah, one, I agree. I agree and there should be and I mean, maybe there’s now a few dollars because of this, there’s now a fear that Trump for once will enforce sanctions at least for his administration. But yeah, I mean we have like $3 priced in here but yeah, there probably should be 20. And with the current policy set there maybe should be 30 because you point to that peace deal, but the whole concept was there was going to be a release of hostages, a Be safe. Prisoners who in many cases were armed murderers and terrorists, and then a disarming of Hamas. Well, the disarmy didn’t happen and that’s not what happened. And so there’s no peace, right? It’s just a very temporary, I think it’s an Arabic term, hadna or whatever, where it’s like the ceasefire before the resumption of conflict. You know like that’s literally their belief right there’s and there’s apparently this whole framework where you’re like supposed to lie in order to accomplish that better in order to then you know ambush your opponent and i don’t know it’s always been around I followed the Middle East for a long time. I lived in Israel, actually in the West Bank, for a year in my junior year of college. And it was always interesting to me, you could watch the Arabic videos of the Hamas leaders or PLO leaders or whatever, you know, terrorist groups, and what they would say to their people in Arabic, and then you could see what they say in English. And they were the complete opposite mess, and it’s like, listen to what you’re telling your people because you’re probably, if you lie to them, they’re going to hang you. And if you lie to the world, the world will just say, oh, you know, you have no agency. We forgive you. You know, we were colonialists. So I think that’s a good framework for understanding what’s going on there. And unfortunately, that framework tells me war is in the offing. And, you, know, maybe we end up with a much, much, much higher oil risk premium, which, you know, may be the fair price for oil here outside of a risk premium would be 70 or 75. There’s some growth, there’s some concerns. OPEX bringing oil on the market. That seems sort of fair to me. And then maybe you should have a much higher price just because there is this increasing risk of supply disruption.

Stuart Turley [00:52:55] Let me turn this question to both of you on what is possibly going to happen when the EU has announced that they’re going to enforce getting rid of all gas out of Russia and you have the Siberia 2 pipeline. It’s four years, five years away from being even completed before he’s going to be able to replace because the Siberian 2 pipeline will be able to be. Uh, almost the equivalent of the Nord stream one and two combined. And so when you take a look at that amount of volume, that that thing is going to be able to move, he can, it’s basically replacing almost the EU amount, depending on how the contract works out, but let’s ask this question, natural gas, if they have a cold winter and the Vlugen vlog, and I don’t even know the word for it, but when they don’t have any wind and thank you, bless you. They don’t have any wind in Germany, their natural gas supply is low and they’re going to be requiring more and more, Spain had the incredible blackout this year, they are using more natural gas now importing in. Because they’re needing to balance the grid out of there, I see a huge natural gas demand coming for the EU in this mess.

David Blackmon [00:54:28] Yeah, I mean if there’s a cold winter for sure, but it’s been a while since we had one in Europe.

Josh Young [00:54:34] You know, they keep doubling and tripling down on these failing energy policies, and you saw there was this terrible blackout randomly in Spain, right? I don’t know if it was particularly hot or cold. It was just blackout, right? And they couldn’t restart it because too much of their grid is powered by solar and wind. So they couldn, you have to sort of surge power, apparently to sort of like kickstart the grid and they just couldn’t do it. And they just keep doing it. And now it’s, it reminds me. So one of the things that got me to be way more vocal was probably bad for my business, but I don’t regret it. There’s only so much money you can make. Was after the winter storm here, really, I’m a capitalist, but also I will trade off pushing for rational economic and energy policy in exchange for being a little less wealthy. That’s fine. So the winterstorm, it happened because Aircott and the system was managed by people who were increasingly wacko, almost like environmental terrorists. And so we get this winter storm and it’s cold and there’s insufficient power. And it’s going to be a real problem for the alternative energy narrative because the sun’s not shining and the wind’s not blowing. So what do they do? They cut the power to the gas processing facilities and to the gas pipelines. And then they say, oh, well, gas was down. I said, no kidding. You guys cut it. It’s not a gas problem. It’s a people problem. So similar in Spain, right? Where it’s a people problem and now the, oh well, we need more batteries and we need more solar. No, you need rational economic policy. And I’m not averse to a portion of the power mix being solar and wind, especially in places where there’s a high cost of fuel, where there are other challenges, it makes sense. Look, you wanna make 10% of your contribution solar? Great, probably good, probably better for the planet. 10, 15, 5, I don’t know, you go 50. You’re just you’re gonna have blackouts and then you’re gonna get mad and it’s gonna be cut and they’re doing the same sort of nonsense. I’ve been reading the stories as they develop and you even had some of the reporters who normally greenwash everything who were a little critical of Spain at first and now of course it’s all fossil fuels are bad what we need is a grid modernization and more batteries and it just not. It’s just not there. So, you know, I think I think people sort of cause their own problems. So I’m actually I would be much more excited. I sort of I think Europe’s sort of making their own sort of weird bad choices. Will they stop buying Russian gas? I don’t know. But why on earth were they sending Ukraine money for weapons and sending Ukraine weapons while buying Russian gas. But pick one that the concept there and and it’s economic, right? So I don’t like that they were buying Russian gas, because you know, I invest in companies that supply gas that they could have been buying. But the humanitarian aspect is way worse. Just think about that, right? They’re funding both sides of a war in which young people and civilians are dying. That’s just human. It’s just a humanitarian catastrophe. And then they lecture us and lecture the world about climate and all of other nonsense there while they’re essentially funding a war on both sides of the war and supplying both sides of the War. I mean, really, truly, morally challenged. But when you talk about winter, it does look like the forecasts are starting to ramp up that there might be a cold winter in the US. And I don’t want to bet on weather. But if there is a cold weather in the U.S., if there is, again, there’s a chance, right, you just deal with it like a normal distribution and probably occurred whatever. In that scenario, that there’s a cold winter in the US, we could see natural gas prices at levels we last saw in 2022. We could see we’re going to do this merch door thing. I think we’re doing $7 Henry Hub shirts and hats. I don’t know that it’s not sustainable at all. I think five maybe is sustainable. But seven seems like it could be in the off thing if we have a cold winter.

David Blackmon [00:58:37] I’m gonna go get me one of those caps

Stuart Turley [00:58:40] I think you’re, you’re spot on. In fact, that’s where I was going with that question was because I think that that is a real endeavor there. I think I like your assessment of Europe’s, uh, funding both sides of the war. I don’t get that. I absolutely kind of have some pain on that one, but as, as we sit here and we’re, we’re rolling down here to the time we still have 2076 people watching this show here. I want to make sure that everybody knows to go check out, um, uh, bison insights. It is a great, uh publication there, Josh. You’re doing great things. I loved your interview with, um uh, Murtry. Uh, he is a cool cat. Uh, I’ve, I have interviewed him before as well, too. He is, uh what need the CEO of conical Phillips are on the board.

Josh Young [00:59:37] He is on the board there and he’s also, he’s the head of energy consulting for Veritan, which is an energy sort of strategy consulting firm and media and other stuff. So it’s a very cool job. He’s out there talking to some of the most senior people running the largest and sort of most complex energy companies in the world, from what I can tell. He didn’t say that, but he sort of that’s what that rule means. And then, yeah, he used to run, he ran energy research for Goldman Sachs for a little while. So, you know, he was the oil permeable on the last cycle. I’m sort of stepping into his shoes, I’m not working for Goldman, but, you, know, everyone was bearish and he was just bullish all that way through. And, and I think he really is able to look through it. Yeah, it’s been, the returns again, past performance may not be indicative, but this has been a really fun ride so far sharing some of these ideas. And while it may not indicative, I can certainly say that I hope. While I do not expect, I hope that this continues. And it’s been really fun sharing these different ideas, even the ones where I’ll hold my nose and buy it or hold my knows and talk about it. They’re still fun to talk about. And I had no expectation that these things would do as well as they’ve done as quickly as they’d done. And hopefully, the next ones are well-received or we’re close to releasing the next idea I’ve been working on early November. And you know just super fun and yeah thank you for for highlighting this it’s really you know bisoninsights.info check it out um you know it’s It’s really so cool to be able to share these ideas in this way. I think we’ve put out an update on every idea I’ve written about so far, whether it’s a CEO interview or a CFO interview, whether it is me doing it or a conference presentation, or some new transaction. Actually, there was a transaction yesterday, we should talk about generally, but it’s relevant for this portfolio too. Jera, I think I might be pronouncing that right, a Japanese energy consortium. They just bought this small Hanesville asset for a not small amount of money. They paid $1.5 billion for 500 million cubic feet a day, which is just. Extraordinary. I mean, so much money, so little production. One of the companies we talked about is a Haynesville producer. In Haynesville for a long time. They have almost that production in the Haynesvilles, and they, I think, have way better wells. I look at the single-well economics, far superior, much bigger in terms of just total volumes, and more land, and they trade for a fraction of that $1.5 billion value. And they have all this other stuff too, so it’s pretty cool. I’m interested in your guys’ take on that transaction, and then we should spend a little talking about your guys. David and Stu, you both have your own things. David, you have this substack that we should spend some time talking about. Let’s do this. Let’s talk about it. But first, let’s talk. If you guys want to talk about this Hainesville transaction, what it means for Japan to be buying gas. I’m excited because of this comp for my investment, but what do you guys think it means for them to be coming in and paying this kind of price for this kind asset.

David Blackmon [01:03:03] Well, Stu probably has more insight than I do because I was not aware of that transaction until you talked about it. Seems like a very high price. So apparently they’re expecting high gas prices in the near future.

Stuart Turley [01:03:16] And I also was kind of J E R A also, yeah. And I was also looking at them and I’m BP halting the development of beacon wind project off the East coast. So, you know, I think it was a smart, I got tickled because on Energy News Beat I was, I had the, the other one that we were just talking about, but I also noticed that they were working with, they’re divesting themselves of, of wind. But then they were sitting there going around and buying and getting their own supply lines all fixed in. So, and I was kind of scratching what little hair I have left on that one as well too. Cause I was sitting there kind of going, I’m with you Josh. I was like. That did not make much.

David Blackmon [01:04:02] BP, BP also backed out recently of the world. What was going to be the world’s biggest biofuels project, uh, near Stockholm, that was a over 50% already completed and they canceled further investment in that as well.

Stuart Turley [01:04:18] So you mean investors want returns? What’s up with that?

David Blackmon [01:04:23] I just don’t understand anything.

Stuart Turley [01:04:24] And, and I’ve, I’ve had so much fun. I actually had a bunch of folks on LinkedIn that I put out that you, you have three to eight years, you have catastrophic failures in wind farms. And man, that you should see the heads exploding. When I put that one out there, that one was absolutely, you need to go buy a wind farm. I said, I drive by one every day and they’re hideous.

David Blackmon [01:04:49] Incidentally, I need to add one thing. This is my sub stack, David Blackmon’s energy additions, but I was advised by a friend that I probably ought to let everyone know that on X, which is really the only social media I use to any great extent, my handle is not David Blackmon. It’s actually at energy absurdity because that’s what I write about mainly or used to anyway. It has Come a little more, uh… Serious endeavor here in recent months over at energy additions. So I rebranded it Anyway, just to make it easier for folks to find me on that.

Stuart Turley [01:05:27] And you can also find me on the energynewsbeat.substack.com and energynewsbeat.com or energynewsebeat.co. So, tell you what, this was a lot of fun, guys.

Josh Young [01:05:40] Should we give it, let’s see, let us give it five or ten more minutes, do you guys have the time? Or is this so? Yes, no. This is great.

Stuart Turley [01:05:46] I just want to make sure we got those in there for those folks that had been coming in because I noticed a bunch of people piling in. But when we sit back, we’ve got the EU. We’ve got, the UK and everything else we’re seeing hair starmer just put out and said, digital ID is going to put us in the, in the next generation or it’s going to bring us up to date. What a knucklehead. Then you have the former British leader who’s now saying we need to get away from net zero. You have Norway, which actually went through and they said, we’re getting out of natural gas, invades Russia. Now they’re in full into natural gas. They’re investing several billion dollars in the natural gas so they can go to the North Sea. You have the UK getting out of the North Sea, shutting it all down, taxing it with windfall profits tax. You can’t buy this kind of entertainment and stupid. Holy smokes. And what about Trudeau saying there was never any LNG exports and now there’s been seven, I think seven or eight exports of LNG shipments out of Uh, Canada, go Canada. I would love to see all those that are still listening. I would loved to annex, uh, Alberta. I would like to leave the rest of Canada alone. I don’t really want any of them here, but I’d love Alberta. I love all my Alberta friends.

David Blackmon [01:07:24] And can we buy Greenland while we’re at it? Absolutely. And retake the Panama Canal. I’m all.

Josh Young [01:07:30] So I saw I saw a proposal recently and again, I’m not endorsing any of this But I saw proposal that that was intriguing again with my economist hat on where someone suggested that we trade Minnesota which has been you know, there’s been a lot Questions here That on a on especially when you do it on a currency adjusted basis we trade Minnesota to Canada and we get Alberta and Saskatchewan in in a trade and actually it would be net positive for Canada on a GDP basis, currency adjusted. And there’s probably more sort of political and cultural alignment in those two provinces with the U.S., particularly with Montana and some North Dakota states that are right there than with Eastern Canada.

Stuart Turley [01:08:23] You’ve got Terry Edam up there who’s a great author and I’ve thoroughly enjoyed he and Heidi McCallop and I love my time interviewing them. They’re great Albertans, all the oil companies that I used to drag you around and bore you to tears with. But I mean, they’re great and we could buy all the oil, we might even get a pipeline redone again, but think about how much was hurt by killing the keystone.

David Blackmon [01:08:52] But you know, people keep bringing Keystone back up again. I don’t understand. It’s gonna cost us.

Stuart Turley [01:08:56] It’s going to cost us three billion because we got to pay back what was the companies that had put that money back in very much like, uh, we were talking about earlier, you know, it’s a big ticket to get that started again, just like Putin was going to pull down the ground.

David Blackmon [01:09:14] There’s no pipe left in the ground.

Stuart Turley [01:09:16] That’s what I’m saying. And that’s what, I was trying to say with president Putin was trying to get ex on his money back. Cause he made a commitment that he was going to do that and get the money back to ex on cause he needs help that goes back to our full circle. And that how we end the war. We don’t have president Trump going through a drive-through. We don’t have president Trump working the drive-through. We have president trump doing a deal with Putin to end the cotton picking war because the people it appears to me Zelinsky when he canceled the elections and he was put in power as a plant by the uh, Yeah, the mi6 mi6 and all those guys he was installed you’ve seen that dude dance. Holy smoke

Josh Young [01:10:09] You know, I’ll speak up for him just for a second. Look, I think I was very critical of him. I think there’s a lot of corruption in Ukraine, a lot challenges. I would say that what I’ve seen from him in the last year or so has been really impressive. I think he’s shown real interest in trying to get a resolution of the war. I think she’s shown a real sort of evolution in terms of how he’s navigated things with the US. I think, you know, he was properly called out by U.S. Leaders, and I think he sort of addressed that. And I think at this point, from what I can tell, he’s not the burden to ceasefire peace there. Then why won’t he do elections again? Wartime elections are always hard. I mean, frankly, we had an election in the US in the middle of the Civil War. We had an elections during World War II. The UK had devastating elections right after World War II that led to quasi-socialism implemented, which the UK still is not fully recovered from. I mean that’s a big part of it. I don’t know, I think it’s like a fun talking point, but I actually have a little trouble with that. I’m not sure I think it’s as good as powerful a point as you’re thinking.

David Blackmon [01:11:31] I think how hard it’s going to be for the UK to recover from the full-blown communism is experiencing today under Starmor. This is, you know, we talk about being better friends to our friends. I think one of the things Trump is trying to deal with is figuring out who our friends are going to, be in 10 years, because the UK may not be one of them, depending on how things continue to deteriorate there. Germany is trending in a bad way. And much of the European continent is trending in a very disturbing way. And so I think one of the things they’re trying to grapple with is figuring out where our trading blocks, as Stu likes to talk about, are going to be 10 years from now because they may not be Euro-centric like they have been throughout history. And even Canada could become a bit of a problem on our Northern border as a result of all the. Radical leftism that has invaded those countries. So, you know, it’s, I mean, I understand your criticisms of the Trump administration. He’s all over the place every day and I can’t keep up quite honestly, but he was left behind a real pile of horse dung from the previous president or the fake, his auto pen, whatever it was that we had for the four years prior. And it’s a pretty tough deal to navigate.

Josh Young [01:12:58] I think one of the challenges with a country like the UK, and frankly, I think we’ve had this problem in the US too, is as you get more extreme policies, you end up with, and as you sort of tilt or drift the wrong direction overall, economic, social, all kinds of different energy policies, you sort tilt the wrong way, you ended up with bad leaders on both sides. You end up you know, Boris Johnson was not great, and then his trust was a mess. Actually, I sort of liked her policies, but her stuff got wrecked. Her markets, they crashed right after she came in. And so you end up with a situation where the conservative party is messed up and the liberal party is mess up. And so, you end with like not a lot of hope, I think, for people. And so I think more at risk of it too, is part of why I’m so critical of the Trump administrations, I think that there is this window to, oh, that’s great, I see it now. I didn’t see it before. My oil bowl in the backyard. Oil bowl in my backyard.

Stuart Turley [01:14:05] Is that A.I. Or is that real? Oh, no, that’s I do have two burn barrels in the backyard. Yes, but I don’t have horns on them.

Josh Young [01:14:15] I think there’s a real risk here and there’s even more of a risk in the UK that like you’re saying David, that they don’t fully recover. That being said, I remain optimistic and I actually think if we add a little bit of a different approach, we’re more involved in helping our allies maintain their cohesion as societies and economies and so on. I think that is actually America first for the concerns and the reasons you’re saying, which is these things, we can go shop for new friends or we can help our friends when they’re going through a hard time. And so I think there’s this real opportunity to help. And… You know, I’d like to see that. And I think that is America first to be, you know. I’m not saying we send troops or anything like that. But let’s do let’s you know I think it makes sense to engage with them and to try to encourage. I mean, similar what we’re doing in, let’s say, Colombia, where we’re encouraging free elections and we’re encouraged rational, you know, democratic processes. Unfortunately, it looks like the sort of communist wacko president Columbia may have actually been involved with killing his political opponent who was going to destroy him in elections. That’s really important, I think, to step up for that. In terms of oil and gas, so you guys don’t have a, you didn’t, you hadn’t seen that, Jera.

David Blackmon [01:15:34] I have not seen it, I do probably.

Stuart Turley [01:15:36] I have and I’ve written about it but I really think that you’re going to see more of that and that is an outstanding point that energy security starts at home and you’re gonna see actually that energy-security, you’re seeing AI data centers they’re gonna start, it wouldn’t surprise me to see Amazon starting to buy mineral rights and when you start getting and then you start buying your supply chain. That’s when you really start taking a look at it and saying, wait a minute, you know, you sit back and take a look of the data centers. I talked to a lot of folks that know a heck of a lot more than I do. And that’s why I talked with them about where to put data centers and how to put data center and how you source the equipment, how you stage them out. I don’t know any of that, but I know who to talk to. And that what I’ve been trying to find out is what are the next trends. And you take a look at Japan. Buying into their own supply chain so they can buy into an LNG supply chain. Same thing that Saudi Arabia is doing, same thing that Qatar is doing. And I don’t have a problem with that. And when you take a look at Japan signing up to help buy into Alaska, LNG, I’m okay with that at some point. You have to realize you don’t want them to have controlling shares. You want, I don’t mind the investment to help guarantee them. But it brings up energy security starts at home. And I would like to advocate for any CEOs that are out there. And if you’re sitting there scratching your head, if you’ve not looked at your bottom line and understand your power requirements to keep your door open. When Chris Wright, our great secretary, Chris Wright inherited this energy department, we were facing humongous blackouts based off of the previous administration’s running of the energy department. We still could be there for natural disasters or other disasters. There are still 419 major grid interconnects that China potentially could shut down at any minute. I have not got an answer yet on that one from the administration. It is a potential problem they could remotely shut down a huge chunk with a button.

Josh Young [01:18:10] Stu, you mentioned one thing in there that actually came up. I was just at these two different energy conferences here in Houston. They had them downtown over the last three days. And I think the most interesting thing I heard, and I won’t use the names out of respect to them, but apparently the major tech companies and the hyperscalers are starting to consume. Uh energy research and consulting services and so it wouldn’t surprise me if these guys one or all of them and maybe if one does it then the rest of them will too in the same way as they funded wind farms and solar panels and you know in some cases even like nuclear companies which won’t have anything for 20 years but you know whatever the stocks are up so hey um And in some cases, self-driving vehicles, other things like that, that they would come in and potentially buy the gas reserves and gas production they need in order to backstop their power generation for their data centers. And so I think. When that happens, which seems increasingly likely based on their now consumption of this information that you would want to start figuring this stuff out, whoever moves first probably gets the best deal because the values of these assets go crazy as soon as they go from upstream oil and gas assets that are tarnished for some reason and trade three or four times operating cash flow to, oh, hey, the hyperscalers need them or the mag 7 are buying them. These things should be 20 times or whatever, which is, you know, we’ve seen high prices for upstream assets paid at tops of cycles before, especially considering how low the actual prices of commodities are seeing high multiples on some of these. And again, I’m not saying that they pay 20 times, but you could definitely see. I mean, I think this Jira asset, the best I can tell on a run rate basis, which again is not their underwriting, their under writing, growing yet and then sort of what their operating cash flow based on the press release. But it looks like they bought it for something like 10 times or 12 times run rate cash flow. So they’re going to grow it. So it’ll be six or seven or something next year. It looks like high level numbers could be off by a little. But I think you could see numbers even higher than that if you have a Meta or Google or Amazon or whatever come in and go buy a gas field. And I think, you could even rationalize it. You say, hey, we’re doing this. This is You know, lower emission than the… Three out of the five other options for us, and it also gets us our data center sooner. Look, we’ve planted 500,000 trees or something like that. I think that could be coming. It was my biggest takeaway. Then the other big takeaway was, apparently, the oil majors in West Texas, Southeast of Mexico, and some other shale fields, are starting to ramp their power generation. It sounds like three joint ventures not directly operated themselves, but gigawatts of power coming from the Exons and Chevrons and so on of the world, which, again, I don’t think those are in the announcements in the slate of power projects. And some of them may be in power projects that just they haven’t said where the gas is coming from exactly. But some of my senses, they didn’t say this, my sense is some of that is not yet in everyone’s gas balances for their supply demand numbers. And I would point this, so I get, I see a lot of folks who that try to, they try to model precisely oil supply demand or gas supply demand. And it’s great to have those balances and see them. Part of why I don’t try to. Do that to the nth degree of precision is because when you model something, whether it’s a company or you model supply demand balances, you can end up being precisely wrong. And so I try to do that. I try and track many other sort of modeling attempts and then keep a high level view and then do things like go to industry conferences and keep ears open and post lots of stuff on social media so I can find out that what is it they say that the best way to get a correct answer of something is to post something wrong on social media. And there’s some like internet principle associated with that. So that’s been very helpful. But there’s, there’s stuff that’s not in the balances. It looks like actually both on the oil side, where you see demand growing in the U S which was just not in people’s forecasts at all for this year. And I think isn’t in people. So balances appropriately for what the look forward looks like. And then on the gas side, I think you have that the facilities I think people sort of get. I think there’ll be even more demand from those. But these data centers, there’s more of them. They’re getting built faster. And very big companies are very focused on them in tech and in energy and elsewhere. So I think, I think there’s weirdly… I hate jumping on a train, but we’re getting on a consensus view. But I actually think the consensus might not be bullish enough in the short term, in terms of how much more gas demand we’re gonna get from these data centers. And I guess that’s what I heard. That was my takeaway. What do you guys think about that? Does that make sense?