She nails it with her list of inflation-fueling factors. It parallels what Powell said more softly at the press conference.

The first three months of the year have produced a nasty re-acceleration of inflation in the US. It was across the board: in the Consumer Price Index, in the Fed-favored PCE price index, in the Producer Price Index, in the quarterly Employment Cost Index (for two quarters in a row). The Fed is beginning to adjust to this new scenario, and a rate hike — instead of rate cuts — is now back on the table and keeps getting talked about.

Even – or especially? – after looking at the results of the jobs report on Friday, Fed Governor Michelle Bowman said in a speech that she remains “willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.” This parallels what Powell said more softly at the FOMC post-meeting press conference. No disagreement there.

She would “monitor the incoming data to assess whether monetary policy is sufficiently restrictive to bring inflation down to our target,” she said. Her “baseline outlook” is still that inflation will decline as the Fed keeps its policy rates at 5.25% to 5.5%, but she sees “a number of upside inflation risks that affect my outlook.”

And then she outlined these inflation-fueling factors. And she nailed it.

Why inflation might not decline further:

“Much of the progress on inflation last year was due to supply-side improvements,” she said. We saw that as prices of many goods leveled off or even fell in 2023 – from used vehicles and electronics to gasoline. But “it is unclear whether further supply-side improvements will continue to lower inflation,” she said.

What could put upward pressure on “food, energy, and commodity prices”:

“Geopolitical developments could also pose upside risks to inflation, including the risk that spillovers from regional conflicts could disrupt global supply chains, putting additional upward pressure on food, energy, and commodity prices,” she said.

What could cause “inflation to reaccelerate”:

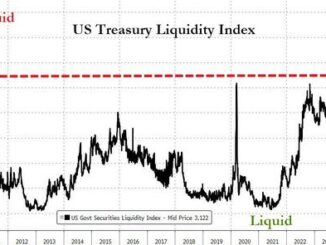

“The loosening in financial conditions since late last year”

“Additional fiscal stimulus” – the gigantic amounts of deficit spending by the federal government.

What could lead “to persistently high core services inflation”:

“Strong consumer demand for services”

“Increased immigration” – specifically: “The inflow of new immigrants … could result in upward pressure on rents, as additional housing supply may take time to materialize.”

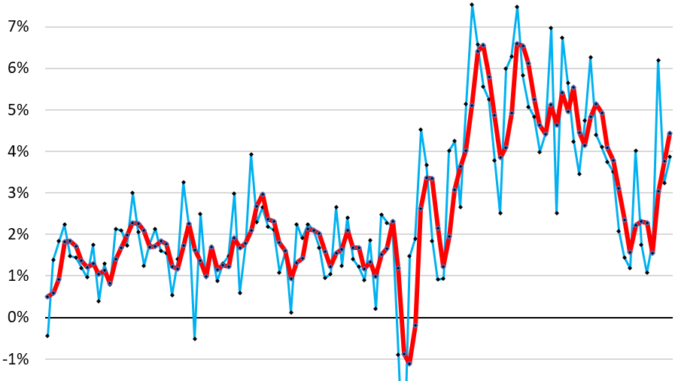

“Continued labor market tightness” – specifically: “Wage growth has remained at an elevated rate of between 4% and 5%, still higher than the pace consistent with our 2% inflation goal given trend productivity growth.”

Data uncertainty makes rate decisions more challenging:

“The frequency and extent of data revisions over the past few years make the task of assessing the current state of the economy as well as predicting how the economy will evolve even more challenging, and I will remain cautious in my approach to considering future changes in the stance of policy,” she said.

Monetary policy “not on a preset course,” rate hike possible to deal with it:

“My colleagues and I will make our decisions at each FOMC meeting based on the incoming data and the implications for and risks to the outlook. While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed,” she said.

“Restoring price stability is essential for achieving maximum employment over the longer run,” she said, something Powell has said at every press conference and in his testimony before Congress.

And they’re trying to get there without plunging the economy into a massive recession, even if it takes a lot longer. That scenario – getting back to 2% inflation without massive recession – may turn out to be a pipedream. It may instead lead to something we’ve facetiously dubbed “higher forever,” higher inflation and higher rates as far as the eye can see, after even Yellen, among others, acknowledged that reality.