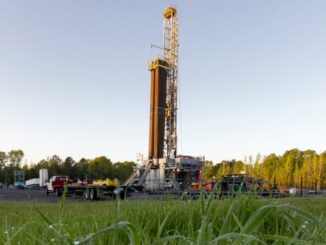

(Bloomberg) — Tokyo Gas Co. said its subsidiary Tokyo Gas America Ltd. will purchase Haynesville shale operator Rockcliff Energy II LLC for about $2.7 billion in a move to expand its U.S. shale gas operations.

Source; World Oil

Tokyo Gas America will acquire all the shares of Rockcliff, a portfolio company of Quantum Energy Partners, through its ownership interest in TG Natural Resources, the Japanese company said in a statement. The deal was signed on Dec. 15 and is scheduled to close on Dec. 29, it said.

The purchase comes amid a wave of multi-billion dollar deals in the global energy industry as oil and gas producers figure out the best way to deploy windfall profits from rising resource prices.

Recent activity includes Occidental Petroleum Corp.’s deal to buy Texas shale driller CrownRock LP, Exxon Mobil Corp.’s $60 billion purchase of Pioneer Natural Resources Co. and Chevron Corp.’s $53 billion agreement to buy Hess Corp. Woodside Energy Group Ltd. is also in preliminary talks with Santos Ltd. on a tie-up that would create a dominant liquefied natural gas exporter.

LNG terminals

The construction of new LNG export terminals in the US is set to boost gas demand, the company said. Tokyo Gas is seeking to expand shale operations and has looked for assets around existing ones in Texas and Louisiana, it said.

After this acquisition, the production volume of gas and natural gas liquid held by TG Natural Resources will increase by about four times to 1,300 million cubic feet per day, the company said. “The outcome from TGNR will become the base of overseas earnings,” it added.

While acknowledging the risks associated with resource prices, Takashi Nakao, senior general manager at Tokyo Gas’s global business development department, said “it is cheap” in an online press conference Saturday.

TG Natural Resources and Rockcliff have mining claims in adjacent areas, and Nakao believes they can survive in changing market conditions because they can improve their competitiveness by lowering production costs.