Here come the “Marketable Borrowing Estimates,” showing by how much the pile of marketable Treasury securities will increase.

By Wolf Richter for WOLF STREET.

The Treasury Department’s Quarterly Refunding announcements, normally cause of a global yawn, have turned into a market-moving circus: Longer-term Treasury yields surged from August through October 2023 after the Treasury Department said in its Quarterly Refunding announcement at the beginning of August that it would issue a tsunami of longer-term Treasury notes and bonds. Then three months later, at the beginning of November, the Treasury Department attempted to undo some of the damage and said that it would shift the huge borrowing needs more to short-term Treasury bills, which caused longer-term yields to fall sharply.

And today, the Treasury Department announced in its “Marketable Borrowing Estimates” that – despite the fiscal deficit that has ballooned in recent months – it would have to borrow less in Q1 than it had forecast in the October announcement, and that it would have to borrow relatively little in Q2. And yields fell again.

Today, in its announcement, the Treasury department said that:

In Q1, it plans to add $760 billion in new debt to outstanding marketable Treasury securities, which is a huge amount, but that’s $55 billion lower that the estimate announced in October for Q1 ($816 billion), assuming a balance in its checking account – the Treasury General Account, or TGA – at the end of Q1 of $750 billion.

It said the $55 billion reduction in borrowing needs was due to higher tax receipts than previously expected and a higher Q1 beginning balance in its TGA – which started Q1 at $766 billion (instead of the projected $750 billion).

In Q2, it plans to add $202 billion to outstanding marketable Treasury securities, assuming an ending balance of the TGA of $750. On April 15, income taxes and estimated quarterly taxes are due, so there are usually huge inflows of tax receipts.

On Wednesday, the Treasury Department will release the Quarterly Refunding details, including projections of the amounts of Treasury bills, notes, and bonds to be issued.

The total Treasury securities outstanding ($34.1 trillion currently) come in two portions: marketable securities ($27.0 trillion currently), which all kinds of investors buy and trade; and non-marketable securities ($7.1 trillion currently), which are held by US government pension funds, the Social Security Trust fund, etc. The Treasury department is talking about issuance of marketable securities.

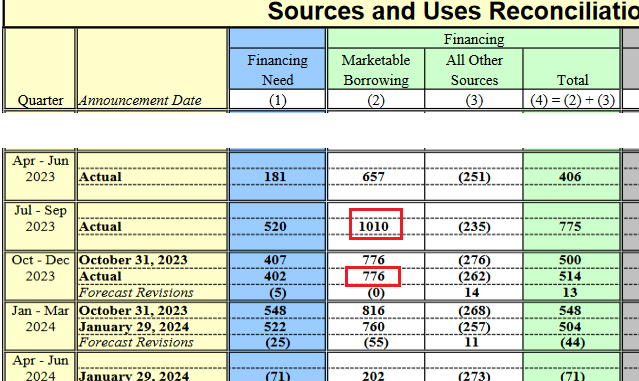

The Treasury department said today that it added $1.01 trillion (“actual”) in Q3 to marketable securities and $776 billion (“actual”) in Q4, or $1.786 trillion combined. We marked these in red on the “Sources and Uses Reconciliation Table” released today (excerpt; total table here):

$2.55 trillion in nine months?

If the estimate of $760 billion for Q1 is on target, and the increase in total marketable securities is actually $760 billion in Q1, marketable securities will have increased in by $2.55 trillion over the nine months from July 1 2023 through March 31 2024.

As of today, marketable Treasury securities are $27.0 trillion, up from $24.7 trillion at the beginning of Q3 2023. And if the “Marketable Borrowing Estimates” estimates today for Q1 are on target, marketable securities will be at $27.8 trillion by March 31.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack