Energy News Beat Publishers Note (ENB): There are some interesting diametrically opposing forces at play. We (U.S.) did not take care of the service industry business owners and a record number of businesses had to shut down. Then we increased unemployment so large that people are not wanting to go back to work, and administration changes to all forms of energy have reduced jobs. Industries being shut down by current policies do not include transition training or plans to gain new skills for new jobs. This process even if started would take years to kick start.

U.S. job growth significantly undershot forecasts in April, suggesting that difficulty attracting workers is slowing momentum in the labor market and challenging the economic recovery.

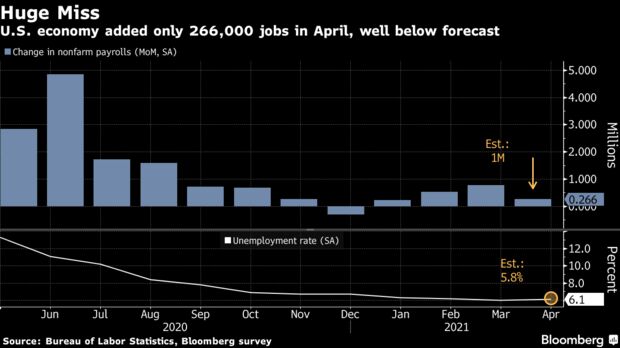

Payrolls rose 266,000 from a month earlier, according to a Labor Department report Friday that represented one of the largest downside misses on record. Economists in a Bloomberg survey projected a 1 million hiring surge in April.

The unemployment rate edged up to 6.1%, though the labor-force participation rate also increased.

The report stunned investors as Treasury yields plunged and the dollar turned sharply lower. U.S. stocks rose on expectations that monetary policy will remain conducive to economic growth for a sustained period. The eurodollar market pushed back its pricing for a Federal Reserve rate increase to mid-2023.

Follow reaction in real-time here on Bloomberg’s TOPLive blog

The disappointing payrolls print leaves overall employment more than 8 million short of its pre-pandemic level and is consistent with recent comments from company officials highlighting challenges in filling open positions.

“It’s a lot faster to lay off workers than it is to hire them back,” said Sarah House, senior economist at Wells Fargo & Co. “While we are seeing some workers come back into the labor force it just isn’t fast enough.”

While job gains accelerated in leisure and hospitality, employment at temporary-help agencies and transportation and warehousing declined sharply.

Fed Chair Jerome Powell said last week the dichotomy between a large number of unfilled positions and millions of unemployed likely reflects a combination of a skills gap, child care obligations and lingering virus fears.

Massive fiscal stimulus including the latest $1.9 trillion package passed by President Joe Biden in March may also be impacting the pace of job growth. Some firms indicate enhanced unemployment benefits and the latest round of pandemic-relief checks are discouraging a return to work even as job openings approach a record.

A sustained period of tepid job gains could support calls for further government spending.

In an interview with Bloomberg Television, Minneapolis Fed President Neel Kashkari said the data justified why the Fed is continuing to deliver its own stimulus. “Today’s jobs report is just an example of we have a long way to go and let’s not prematurely declare victory,” he said.

Another reason for the more moderate employment gain is problems in the nation’s supply chains. For instance, motor vehicle production has been severely hampered by shortages of semiconductors. The jobs report showed manufacturing payrolls declined 18,000 in April, driven by a sharp fall in jobs at automakers.

Average hourly earnings rose 0.7% in April from a month earlier, to $30.17, the jobs report showed. The wage data for April suggest that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages, the Labor Department said in a statement.

A separate measure of compensation that isn’t subjected to shifts in industry employment — the employment cost index — rose 0.9% in the first quarter. That was the largest quarterly gain since 2007, according to the Labor Department’s data last week.

“While the jobs numbers themselves were certainly disappointing, I think there are a few nuggets in here that are positive development,” House said.

Participation Rate

Labor force participation, a measure of the percentage of Americans either working or looking for work, rose to 61.7% in April from 61.5%, likely supported by increased vaccinations that helped fuel the reopenings of many retail establishments, restaurants and leisure-facing businesses.

Average weekly hours increased to match the highest in records dating back to 2006. The gain in the workweek, increased pay and the improvement in hiring helped boost aggregate weekly payrolls 1.2% in April after a 1.3% gain a month earlier.

— With assistance by Chris Middleton, Reade Pickert, Amanda Albright, Sophie Caronello, Liz McCormick, and Daniel Curtis