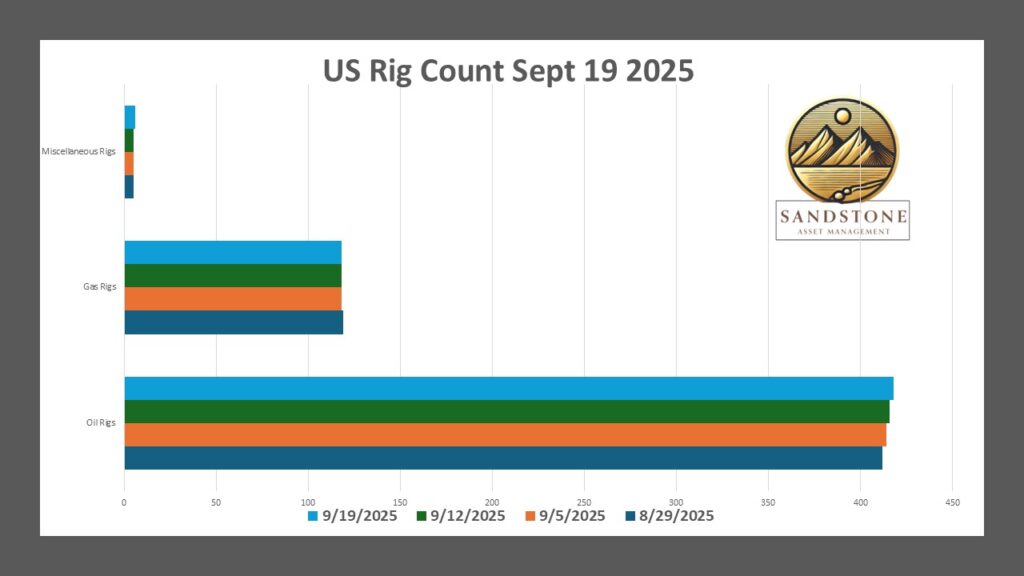

The U.S. oil and gas drilling sector showed continued signs of modest recovery this week, with the total active rig count climbing to its highest level since July. According to the latest data from Baker Hughes, released on September 19, 2025, the total number of active drilling rigs in the United States rose by 3 to 542. This marks the third straight week of gains in the overall rig count, though it remains 46 rigs (or about 8%) below the level from the same time last year.

The increase was driven primarily by oil-directed rigs, which rose by 2 to 418—the highest since July and representing the third consecutive weekly gain for oil rigs. Natural gas rigs, on the other hand, held steady at 118, showing no change from the previous week but up 22 rigs year-over-year. Miscellaneous rigs increased by 1 to 6.

This trend highlights a divergence between oil and gas drilling activity. Oil rigs have been on an upward trajectory over the past three weeks, adding a total of 6 rigs since late August (from 412 on August 29 to 418 currently). Gas rigs, however, have remained flat over the same period after a slight dip earlier in the month, reflecting ongoing caution in the natural gas sector amid fluctuating prices and demand projections. The U.S. Energy Information Administration (EIA) anticipates increases in both crude oil and natural gas output for 2025, which could support further rig additions if market conditions improve.

Are you Paying High Taxes in New Jersey, New York, or California?

Recent Trends in Rig Counts

To illustrate the recent uptick, here’s a summary of the last four weeks’ data:

Oil rigs have consistently increased each week, while gas rigs have stabilized after a minor decline. Year-over-year, oil rigs are down significantly (by about 70), whereas gas rigs have seen a net gain (up 22), indicating a shift in focus toward gas in some regions despite the current plateau.

Breakdown by Key Basins

The rig count changes were concentrated in specific basins, with no major shifts in the largest plays. Here’s a look at activity in key U.S. basins based on the latest data. Note that Baker Hughes classifies rigs primarily by target commodity (oil or gas), but basin-level data often reflects total rigs, with many basins dominated by one type:

Permian Basin (primarily oil-focused, West Texas and New Mexico): Held steady at 254 rigs. This is the largest U.S. basin by far, accounting for nearly half of all active rigs, but it’s down 53 rigs year-over-year amid efficiency gains and consolidation.

Eagle Ford Shale (primarily oil, South Texas): Remained unchanged at 42 rigs, down 6 from last year.

DJ-Niobrara (primarily oil, Colorado/Wyoming): Increased by 2 rigs to 11, the highest since April 2024. This basin saw the most notable gain this week.

Granite Wash (mixed oil/gas, Oklahoma/Texas Panhandle): Added 1 rig (exact total not specified in reports).

Haynesville Shale (primarily gas, Louisiana/East Texas): Recent data from August suggests around 40 rigs, with no changes reported this week, aligning with the steady gas rig count overall.

Appalachia (Marcellus/Utica) (primarily gas, Pennsylvania/Ohio/West Virginia): Saw a +1 change in the prior week, but no update this week; totals are estimated around 40 rigs combined, contributing to the year-over-year gas rig gains.

Oil-dominated basins like the Permian and Eagle Ford continue to drive the majority of U.S. activity, but their rig counts remain subdued compared to last year due to improved drilling efficiencies and lower commodity prices earlier in 2025. Gas-focused basins such as Haynesville and Appalachia have shown more resilience year-over-year, with rig additions reflecting optimism around LNG exports and winter demand. However, the lack of growth in gas rigs this week suggests operators are waiting for stronger price signals.

Outlook and Implications

The three-week rise in oil rigs could signal stabilizing confidence among drillers, particularly as global oil demand projections remain positive. However, the overall rig count is still near multi-year lows, and analysts expect only gradual increases unless oil prices break above $80 per barrel consistently. For natural gas, steady rigs indicate a wait-and-see approach, with potential upside if storage levels tighten heading into winter.

This data underscores the U.S. energy sector’s adaptability, but challenges like infrastructure constraints and regulatory shifts could influence future trends.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack