A triple whammy of BTFDiness hit just after 1300ET as the S&P hit crucial support at 3600.00, German officials denied supporting joint-debt to pay for energy crisis, and The Fed’s Lael Brainard offered a very modestly dovish comment.

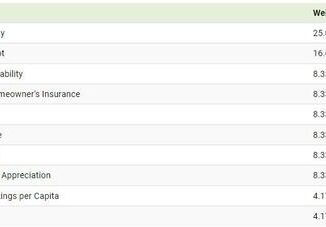

As SpotGamma noted before the open, 3600 is the level of the Put Wall for the S&P 500 – a key support level.

As we detailed here, German officials denied supporting the joint-debt issuance (which had weighed on Bunds during the EU day) and prompted a bid to bund futures.

And Fed vice chair Brainard said “Fed is attentive to risks of further adverse shocks, aware that [market] moves could interact with financial vulnerabilities”…

However, she also noted that the “1970s taught [policymakers] that there are risks to easing prematurely.”

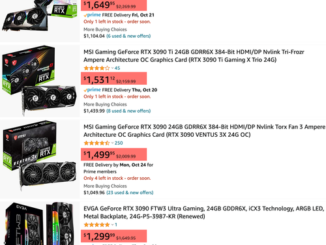

This sent US equity prices soaring (with the Dow back in the green)…

Perfect bottom-tick in S&P Futs at 3600.00…

And push Treasury futures prices higher (cash market closed)…

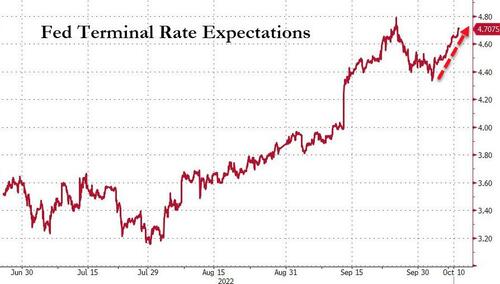

We do note that market expectations for The Fed terminal rate did not shift dovishly at all and in fact are at their highs of the day…

With the cash market closed, liquidity is thin across the entire US market so don’t hold your breath on this equity bounce.