By Wolf Richter for WOLF STREET.

This may be it, the end of the historic plunge of used-vehicle prices that has unwound 60% of the even more historic price spike during the pandemic. The price plunge, which kicked off at the end of 2021, has been a substantial force in bringing CPI inflation off its highs, and it would be a bummer if that flipped now.

Prices of used cars, SUVs, pickup trucks, and vans that were sold at auctions across the US jumped by 2.8% in July from June, seasonally adjusted, the biggest jump since the surge in early 2023, according to today’s Used Vehicle Value Index by Manheim, the largest auto auction house in the US which runs about 8 million vehicles a year through its auction lanes. The index is adjusted for changes in mix and mileage (red in the chart).

Not seasonally adjusted, wholesale prices rose by 0.6% in July from June, which is very unusual. Prices normally weaken in July after tax-refund season. During the eight years before the pandemic, prices fell on average by 0.8% in July from June. This July, they rose 0.6%.

Manheim notes the unusual price increases in July in several places, including in its index of three-year-old vehicles:

“Over the last four weeks, the Three-Year-Old Index increased an aggregate of 1.1%, including a rise of 0.5% in the last week of the month. Those same four weeks delivered an average decrease of 0.6% between 2014 and 2019, illustrating that the appreciation trend for the month of July contrasted against long-term averages.”

The year-over-year double-digit price drops in the prior months were nearly halved in July: Not-seasonally adjusted, July prices fell 5.9% from a year ago, down from the -10% to -12% range in February through June.

In our report a month ago, we asked: “The question on everyone’s mind: How much further will wholesale prices fall to work off that mindboggling spike that should have never occurred in the first place? When will they bottom out?” And the data today may have provided the answer.

Supply from off-lease vehicles has started to slow. Manheim said lease returns, a key source of supply for the used-vehicle market, are now slowing down, as fewer vehicles were leased starting three years ago, and so fewer leases are now maturing, fewer off-lease vehicles are going through the auctions, and that the slowdown in supply will drag into 2026, and that it expects this to put upward pressure on prices in that segment:

“We are just beginning to see lower lease maturities for the key 3-year-old segment, and that impact will be felt over the rest of this year and into 2025 and 2026. As supply tightens for this key segment for the used vehicle market, we expect to see variances from historical average depreciation rates.”

Inventories of used vehicles at dealers are already getting tighter; they fell to 2.21 million units in June, down roughly by 25% from June 2019, based on the latest data available from Cox Automotive, which owns Manheim. During the entire episode of the vehicle shortages, there were only five months when inventories were even lower.

Dealers buy at these auctions to replenish their used-vehicle inventories. Supply comes from rental fleets that sell some of the vehicles they pull out of service, from finance companies that sell their lease returns and repos, from corporate and government fleets, other dealers, etc.

And there was unusual demand at the auctions in July. Manheim added some detail in terms of the sales conversion rates:

“The average daily sales conversion rate rose to 60.1%, a rise of three-and-a-half points over last month and higher than we normally see at this time of year. For comparison, the daily sales conversion rate averaged 51.9% in July over the last three years.”

Prices of both EVs and ICE vehicles rose in July, not seasonally adjusted, when they should have fallen.

During the pandemic, Tesla-flipping was a phenomenon where people bought new Teslas and resold them as legally used at massive profits because used-vehicle prices in general had shot up and Tesla prices even more. It had contributed to a 145% spike in used EV prices from January 2020 through the peak of the spike in July 2022.

Then Tesla cut its own prices starting in 2022, as production ramped up, and thereby killed Tesla-flipping. And it has tried to discourage Cybertruck-flipping.

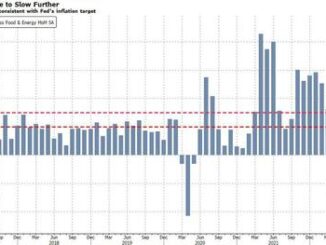

So used EV prices have been coming down off their crazy spike but remain far higher than used ICE vehicle prices and have a lot further to fall to get back into line (prices not seasonally adjusted, red = EVs, blue = ICE vehicles, data via Manheim):

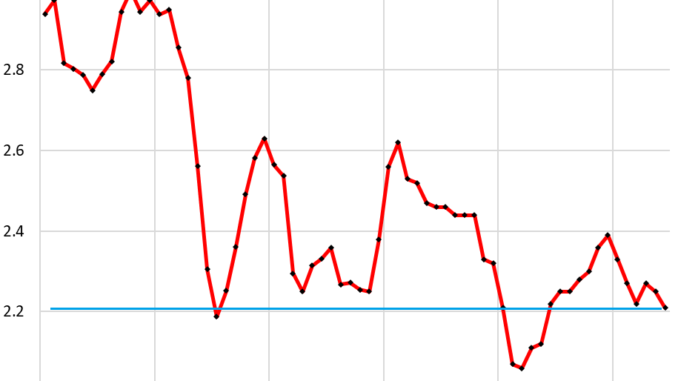

The used vehicle CPI, which represents retail prices, tracks wholesale prices fairly closely but not in lockstep and tends to lag by a month or two. The Bureau of Labor Statistics will release the July CPI next week, and it may not yet show the current price developments at auctions. But if the price increases persist at auctions, they will show up in the used vehicle CPI over the next few months.

This chart is from our last CPI report with data through June. We’re now eagerly waiting for the July data:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/