In a groundbreaking assessment that underscores the enduring potential of America’s energy heartland, the U.S. Geological Survey (USGS) has revealed significant undiscovered oil and gas resources in the Woodford and Barnett shales within the Permian Basin. This latest evaluation, released just days ago, estimates technically recoverable reserves that could bolster U.S. energy security and fuel economic growth in Texas and beyond. As host of the Energy News Beat podcast, I’m excited to dive into what this means for the industry—and who stands to gain.

The USGS Assessment: A Deeper Look at Untapped Potential

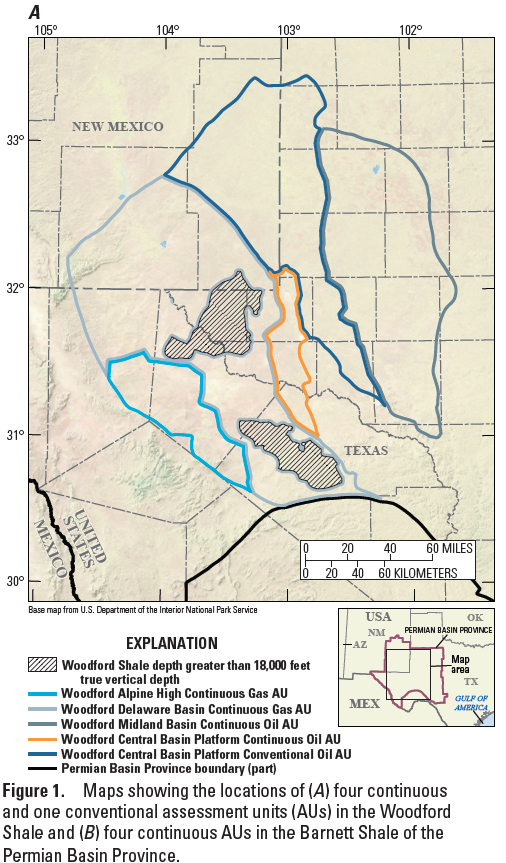

The USGS’s geology-based assessment focuses on the Woodford and Barnett shales, organic-rich formations located up to 20,000 feet below the surface in the Permian Basin Province, spanning West Texas and southeastern New Mexico. These shales, deeper than many other Permian resources, were once considered challenging to access. However, advancements in hydraulic fracturing and horizontal drilling have transformed them into viable targets for production.

Key highlights from the report include:

Oil Resources: An estimated mean of 1.6 billion barrels of undiscovered, technically recoverable oil—enough to supply the United States for approximately 10 weeks at current consumption rates.

Natural Gas Resources: A staggering 28.3 trillion cubic feet of gas, which could meet national demand for about 10 months.

Natural Gas Liquids: An additional 813 million barrels, adding further value to these resources.

Production from these shales began in the late 1990s, yielding about 26 million barrels of oil to date—equivalent to just one day’s U.S. consumption. The USGS emphasizes that these estimates represent “undiscovered” resources, meaning they haven’t yet been proven through drilling but are deemed recoverable with current technology.

This assessment builds on the Permian’s legacy as one of the world’s most prolific oil-producing regions, where operators are increasingly targeting deeper “benches” like the Barnett and Woodford for new inventory.

As USGS Director Ned Mamula stated, “The U.S. economy and our way of life depend on energy, and USGS oil and gas assessments point to resources that industry hasn’t discovered yet. In this case, we have assessed that there are significant undiscovered resources in the Woodford and Barnett shales in the Permian Basin.”

Geologist Christopher Schenk added, “The shift to horizontal drilling with fracking has revolutionized oil production, and we’ve changed with it.”

Basins and Formations Involved

The Permian Basin, often dubbed the “crown jewel” of U.S. shale, is the focal point here. Spanning roughly 75,000 square miles across West Texas and New Mexico, it’s already the nation’s top oil-producing area. The Woodford and Barnett shales are key formations within this province:

Woodford Shale: A Devonian-age formation known for its organic-rich content, it’s been a target in other basins like Oklahoma’s Anadarko but is now gaining traction in the Permian’s deeper sections. Production is concentrated along the margins of the Delaware and Midland sub-basins and on structural highs like the Central Basin Platform.

Barnett Shale: Famous for kickstarting the shale boom in North Texas’ Fort Worth Basin, its Permian extension is deeper and more oil-prone in areas like Andrews and Ector counties. Recent drilling has yielded promising results, with operators refining techniques to achieve economic viability.

These formations add layers—literally—to the Permian’s stacked pay zones, extending the basin’s lifespan amid maturing Wolfcamp and Spraberry plays.

Companies Poised to Capitalize

This assessment has sparked renewed interest in deeper Permian targets, with several operators already exploring or developing the Woodford and Barnett. Here’s a look at key players well-positioned to benefit, based on their acreage, recent activity, and strategic focus:

|

Company

|

Key Advantages

|

Recent Activity

|

|---|---|---|

|

ExxonMobil (including Pioneer Natural Resources)

|

Massive Permian footprint; acquired Pioneer in 2024, which had identified thousands of potential locations in these shales.

|

Pioneer tested the formations in 2023; Exxon is integrating deep shale into its inventory for long-term growth.

|

|

Diamondback Energy

|

Strong Midland Basin presence; early delineation of Barnett and Woodford with encouraging results.

|

Actively drilling laterals; views these as potential “Tier 1” resources; shifting to development mode.

|

|

Occidental Petroleum

|

Extensive holdings across the basin; targeting deeper zones amid portfolio optimization.

|

Reported activity in Barnett and Woodford; leveraging tech for high-pressure, deep drilling.

|

|

SM Energy

|

20,000 net acres prospective for deeper oil; promising well results.

|

Drilled two new wells in Barnett and Woodford; planning significant development.

|

|

Continental Resources

|

Acquired Midland Basin acreage specifically for Barnett exploration.

|

Permitted Woodford tests; joining peers in assessing economic potential.

|

|

Elevation Resources

|

Focused on Barnett in Andrews County; refining drilling for gas-prone areas.

|

Completed 34 wells in 2023; case studies show improved viability.

|

|

Other Notables (e.g., Marathon Oil, EOG Resources)

|

Broad Permian operations with shale expertise.

|

Exploring extensions; EOG has historical Barnett experience adaptable to Permian.

|

These companies are at the forefront, with many shifting from exploration to full development. Challenges like high depths and pressures remain, but as Toti Larson from the University of Texas’ Bureau of Economic Geology noted, operators are “looking beyond traditional landing zones” to unlock this value.

Broader Implications for Energy and the Economy

This USGS report arrives at a pivotal time, with global energy demand rising and geopolitical tensions underscoring the need for domestic production. The Permian Basin already accounts for over 40% of U.S. oil output, and these new resources could extend its dominance for decades. For Texas, it means more jobs, royalties, and economic activity in communities like Midland and Odessa.

However, realizing these reserves will require continued innovation in drilling tech and responsible development to address environmental concerns. As the energy transition evolves, natural gas from these shales could play a key role in bridging to renewables, given its lower carbon footprint compared to coal.

On the Energy News Beat podcast, we’ll be discussing this with industry experts soon—stay tuned! In the meantime, this assessment reaffirms why the Permian remains a global energy powerhouse. For more details, check out the full USGS report and fact sheet.

What are your thoughts on this discovery? Drop a comment below or hit me up on X @STUARTTURLEY16, or on the Energy News Beat Substack. We will post the Energy News Beat Stand-up at both locations.

.

How Did President Trump Change the Oil Markets?

Be the first to comment