Berkshire Hathaway (BRKA: BRKB) has expanded its stake in Occidental Petroleum (OXY) with a purchase of another 3.9 million shares this week, according to a Securities and Exchange Commission regulatory filing.

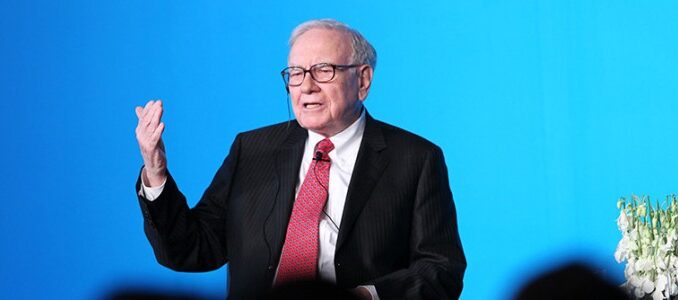

Source: Reuters

Warren Buffet’s holding company now owns 25.8% of the Houston-based oil company, for a value of more than $14 billion, after purchasing 1,686,368 shares at a weighted average price of $62.7969 on October 23, 1,195,400 shares on October 24 at $62.6863, and 1,040,067 on October 25 at $63.0483.

Buffet received approval to purchase up to 50% of Occidental, holding warrants for another 83.86 million shares at $59.624 each, the security filing showed. While Buffet doesn’t often comment on Berkshire’s purchases of OXY, he did previously say at Oxy’s annual meeting this summer that they are not going to take outright control of OXY.

In general, however, Buffet has described his stock strategy as one that buys stock in well-run companies with a time horizon measured in decades, weathering any typical market fluctuations. His strategy also involves adding stakes when share prices have fallen, and trimming his position during strong periods.

Buffet’s purchase breaks from his previous additions of Occidental shares, this time spending more than $60 per share. Up until now, Berkshire has increased its stake in Oxy only when the share price dipped below $60, with the last purchase in June.

This week’s share purchase of OXY began on the same day that Chevron announced it was buying Hess Corp for $53 billion. Berkshire is the largest shareholder in Chevron, holding more than 123 million Chevron shares.

Occidental was trading down on Thursday afternoon following the news, sinking 0.16% to $63.26 per share by 2:20 pm ET.

Occidental has been referred to by analysts as Buffet’s favorite energy stock.

By Julianne Geiger for Oilprice.com