As the UK hurtles toward its self-imposed Net Zero targets under the misguided leadership of Energy Secretary Ed Miliband, the nation stands on the brink of economic catastrophe. The policies championed by Miliband—ruthlessly prioritizing intermittent renewables like wind and solar while demonizing reliable natural gas and oil—are not just failing; they are actively dismantling Britain’s industrial backbone. We’re sleepwalking into a deindustrialized future, burdened by skyrocketing energy prices that outpace our European neighbors and even the United States. Prime Minister Keir Starmer must act decisively: sack Miliband now before irreversible damage is done. The path forward lies in pragmatic energy security—nuclear power and domestic gas—not in virtue-signaling fantasies that leave us dependent on foreign whims.

The Deindustrialization Onslaught: Net Zero’s War on British Manufacturing

Are you Paying High Taxes in New Jersey, New York, or California?

Net Zero policies are not a green dream; they are a blueprint for deindustrialization. By mandating the phase-out of fossil fuels and forcing industries to pivot to unproven, expensive electrification, the government is pricing British manufacturing out of existence. Take the steel sector, a cornerstone of the UK’s economy that contributes £2.3 billion in gross value added annually.

The transition to “green steel” through hydrogen or electric arc furnaces sounds noble, but the reality is brutal. Techno-economic modeling reveals massive policy and pricing barriers: electricity costs for steelmakers must plummet by at least 50% to make low-carbon production viable, yet under Net Zero, prices are soaring.

Without subsidies that balloon consumer bills, further deindustrialization looms, shrinking the sector’s relative importance and exporting emissions—and jobs—to dirtier foreign competitors.

This isn’t isolated. The government’s Clean Power 2030 Action Plan doubles down, lifting the onshore wind ban and pushing for tripled solar capacity, all while sidelining gas.

Manufacturers face “demand-side response” mandates, where factories must curtail operations during peak times to balance the grid’s intermittency—effectively turning industrial output into a sacrificial lamb for wind droughts.

A University of Warwick study highlights these barriers, warning that without urgent policy shifts, Net Zero will accelerate the exodus of energy-intensive industries like chemicals and cement.

The Climate Change Committee demands a 95% emissions cut in steel by 2050, but at what cost? Jobs lost, communities hollowed out, and a nation reduced to importing the very products it once forged.Miliband’s obsession with eliminating natural gas and oil exacerbates this. New North Sea drilling licenses are banned, shale exploration stifled, and even a £112 billion gas field under Lincolnshire is eyed warily.

Instead, we’re funneled into a renewables-only straitjacket, where wind and solar—unreliable and weather-dependent—dominate. The result? A grid that can’t support baseload industry, forcing blackouts or imports that undermine sovereignty.

Skyrocketing Energy Prices: The UK’s Burden Compared to the World

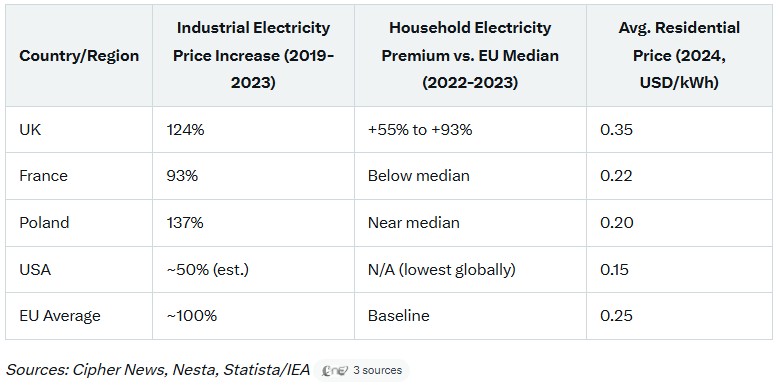

The human cost of this folly is etched in Britain’s energy bills, which have surged far beyond global norms over the past decade. From 2019 to 2023 alone, UK industrial electricity prices jumped 124%, outstripping Hungary’s 171% and Poland’s 137%, but dwarfing France’s more modest 93% rise—thanks to France’s nuclear backbone.

Household prices tell a starker tale: in 2022, UK electricity costs soared 55% above the EU-UK median in the first half and 93% above in the second, a gap that persisted into 2023 despite some relief.

By 2024, UK industry paid 60% more per unit than any other European nation, a premium driven by Net Zero levies rather than fuel costs.

Compare this to the US, where abundant shale gas and pragmatic policies keep residential electricity among the cheapest globally—often half the UK’s rate.

Over the last 10 years, UK industrial prices have hovered 17% to 49% above the International Energy Agency median, fueled by green subsidies now exceeding £17 billion annually and projected to hit £20 billion by 2029-30.

Miliband’s “polluter pays” rhetoric masks the truth: these aren’t gas-driven hikes but renewables’ hidden costs—balancing, curtailment, and backups—that pad bills without delivering reliability.

In Europe, countries like Germany grapple with similar pains, but the UK’s aggressive timeline amplifies the disparity, pushing fuel poverty to crisis levels.

Betting on Foreign Interconnectors: A Recipe for Vulnerability

Worse still, Miliband’s vision leaves Britain beholden to foreign powers. With gas phased out and renewables intermittent, the UK imported 33,000 GWh of electricity in 2023 via interconnectors—net imports dwarfing exports at 9,000 GWh.

Plans to quadruple offshore wind and triple solar by 2030 sound ambitious, but they ignore the grid’s fragility.

When winds falter, we turn to cables from France, Norway, and beyond—exposing us to geopolitical risks, as seen in the energy crisis post-Ukraine invasion.

Renewables have cut some gas imports, but electrification demands more power, not less, making interconnectors our lifeline.

This isn’t independence; it’s subservience, with blackouts looming if neighbors prioritize their own needs.

The Solution: Sack Miliband and Pivot to Nuclear and Gas

Ed Miliband’s Net Zero crusade—promising £300 bill cuts by 2030 while experts forecast the opposite—is a dangerous delusion.

Offshore wind auctions flop due to unaffordability, system costs soar, and industrial flight accelerates.

Starmer must intervene: dismiss Miliband, scrap the renewables obsession, and invest in nuclear for baseload power. Small modular reactors could deliver clean, reliable energy without the intermittency. Meanwhile, unleash domestic gas to bridge the gap, ensuring affordability and security. Britain can lead in clean energy, but not through Miliband’s masochism. Wake up before it’s too late—sack him now, or watch the lights go out on our industrial heritage. Kathryn Porter is an independent energy consultant, and I have enjoyed my conversations with her on the Energy Realities podcast.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack