Federal Reserve Chair Jerome Powell’s annual address at the Jackson Hole Economic Symposium is always a pivotal moment for global markets, and his 2025 speech, delivered on August 22, was no exception. Titled “Monetary Policy and the Fed’s Framework Review,” Powell signaled a potential shift toward easing monetary policy amid cooling inflation and a softening labor market. This has ripple effects across sectors, but for the oil and gas industry—already navigating geopolitical tensions, supply constraints, and shifting demand—the implications are particularly profound. In this article, we’ll break down the key elements of Powell’s remarks, analyze immediate market reactions, explore their specific impact on energy markets, and discuss opportunities for private investors, including enduring tax incentives in the U.S. oil and gas space.

Key Takeaways from Powell’s Speech

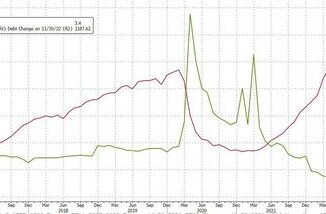

Powell’s address emphasized a data-dependent approach to policy, highlighting the Fed’s updated framework for balancing inflation and employment goals. Inflation has eased but remains above the 2% target, with the Personal Consumption Expenditures (PCE) index at 2.6% and core PCE at 2.9%.

Are you Paying High Taxes in New Jersey, New York, or California?

He noted upside risks from tariffs, which could cause one-time price hikes without necessarily sparking broader inflation if expectations remain anchored.

On the labor front, job growth has slowed to about 35,000 per month, with unemployment steady at 4.2%—a historically low level but indicative of cooling demand and restricted labor supply due to factors like immigration policies.

Economic growth has decelerated to around 1.2% in 2025, down from the previous year’s pace. Powell reiterated that monetary policy is still restrictive but suggested adjustments could be warranted to address downside risks to employment, while avoiding a resurgence in inflation.

A notable update was the revision to the Fed’s longer-run goals, moving away from the 2020 “average inflation targeting” toward a more flexible approach. This commits the Fed to decisive action when goals conflict, prioritizing price stability without pre-committing to a specific path.

Markets interpreted this as paving the way for a 25 basis-point rate cut in September, with Powell’s tone tilting toward easing to support growth.

Immediate Market Reactions

The speech ignited a broad rally across financial markets, reflecting investor relief over the prospect of lower rates. U.S. stocks surged, with the Dow Jones Industrial Average gaining over 1.5%, and major indexes like the S&P 500 and Nasdaq following suit.

Bond yields fell as the market rallied, with the 10-year Treasury note dropping, signaling expectations of reduced borrowing costs.

In energy markets, oil prices were poised to end the week higher despite earlier volatility from geopolitical uncertainties, such as Russia-Ukraine developments.

Brent crude stabilized around $80–$85 per barrel post-speech, buoyed by a weaker U.S. dollar and optimism for demand recovery under easier monetary conditions. Natural gas futures also saw modest gains, as lower rates could stimulate industrial activity and energy consumption. However, some caution persists: while the speech reduced fears of stagflation, analysts warn that persistent inflation risks from tariffs could cap upside in commodities.

Overall, the reaction underscores a market consensus that Powell “walked a fine line,” balancing inflation concerns with labor market vulnerabilities, without committing to aggressive cuts that might reignite price pressures.

Implications for Oil and Gas Markets

Powell’s pivot toward potential rate cuts has indirect but significant effects on oil and gas dynamics, primarily through currency strength, demand expectations, and supply responses. A weaker dollar from easing policy makes oil more affordable for non-U.S. buyers, potentially boosting global demand and supporting prices in the $80–$90 range for Brent if a September cut materializes.

For OPEC+, lower rates could ease the pressure to maintain deep supply cuts, allowing a gradual return of barrels to the market without crashing prices. U.S. shale producers might benefit from cheaper financing, accelerating drilling and adding supply, which could complicate OPEC+’s balancing efforts.

Sanctioned producers like Russia and Iran may ramp up shadow-market exports if prices firm, further influencing global balances.On the demand side, emerging markets such as India and Southeast Asia could absorb higher prices more easily with reduced global financing costs, while importers might build stockpiles, tightening short-term supplies.

However, if the Fed delays cuts, downside risks emerge, with OPEC+ possibly defending a $75 floor amid hesitant U.S. shale expansion.In the longer term, easier money risks overstimulating supply from both shale and sanctioned sources, heightening volatility—especially if Middle East disruptions occur. For gas markets, lower rates could spur LNG demand in energy-intensive industries, but domestic oversupply in the U.S. might keep prices muted.

Opportunities for Private Investors in the U.S. Oil and Gas Sector

For private investors eyeing the oil and gas space, Powell’s signals of easing could enhance attractiveness by lowering capital costs and supporting asset values. The private sector—encompassing independent producers, drilling partnerships, and direct investments—remains a fertile ground, bolstered by robust tax incentives that persist into 2025 despite broader fiscal changes. This is where the United States has an advantage over state-owned oil companies: as money is freed up and the cost of capital is lowered, independent producers can borrow more money, and investors look for higher returns.

Key tax advantages include:

Intangible Drilling Costs (IDC) Deductions: Investors can deduct 70–100% of IDCs (e.g., labor, fuel, and site preparation) in the first year, potentially reducing taxable income by tens of thousands per investment. For a $250,000 stake, this could yield up to $175,000 in immediate deductions.

Percentage Depletion Allowance (Small Producers Exemption): This allows a 15% deduction on gross production income, tax-free over the well’s life, ideal for smaller operations.

Tangible Drilling Costs: Deductible over seven years via depreciation, providing ongoing relief.

Recent federal policies under the 2025 budget bill maintain high marginal rates (37% for ordinary income) but preserve these incentives, while prioritizing domestic fossil fuel production to reignite private equity interest.

Accredited investors can leverage structures like limited partnerships to maximize these benefits, offsetting other income and enhancing after-tax returns in a potentially lower-rate environment.

However, risks remain: Volatility from policy shifts or global events could erode gains, so diversification and due diligence are key. When we look at oil and gas deals at Sandstone Group, we evaluate the entire deal and lifecycle of the well and field.

The Bottom Line

Powell’s Jackson Hole remarks signal a Fed increasingly attuned to employment risks, setting the stage for rate cuts that could bolster oil and gas markets by supporting demand and easing financing. While short-term price stability seems likely, medium-term supply pressures loom. For investors, this environment amplifies the appeal of private U.S. oil and gas opportunities, where tax incentives provide a powerful edge. As always, stay vigilant—energy markets thrive on data, just like the Fed. For more insights, tune into Energy News Beat for ongoing coverage.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack