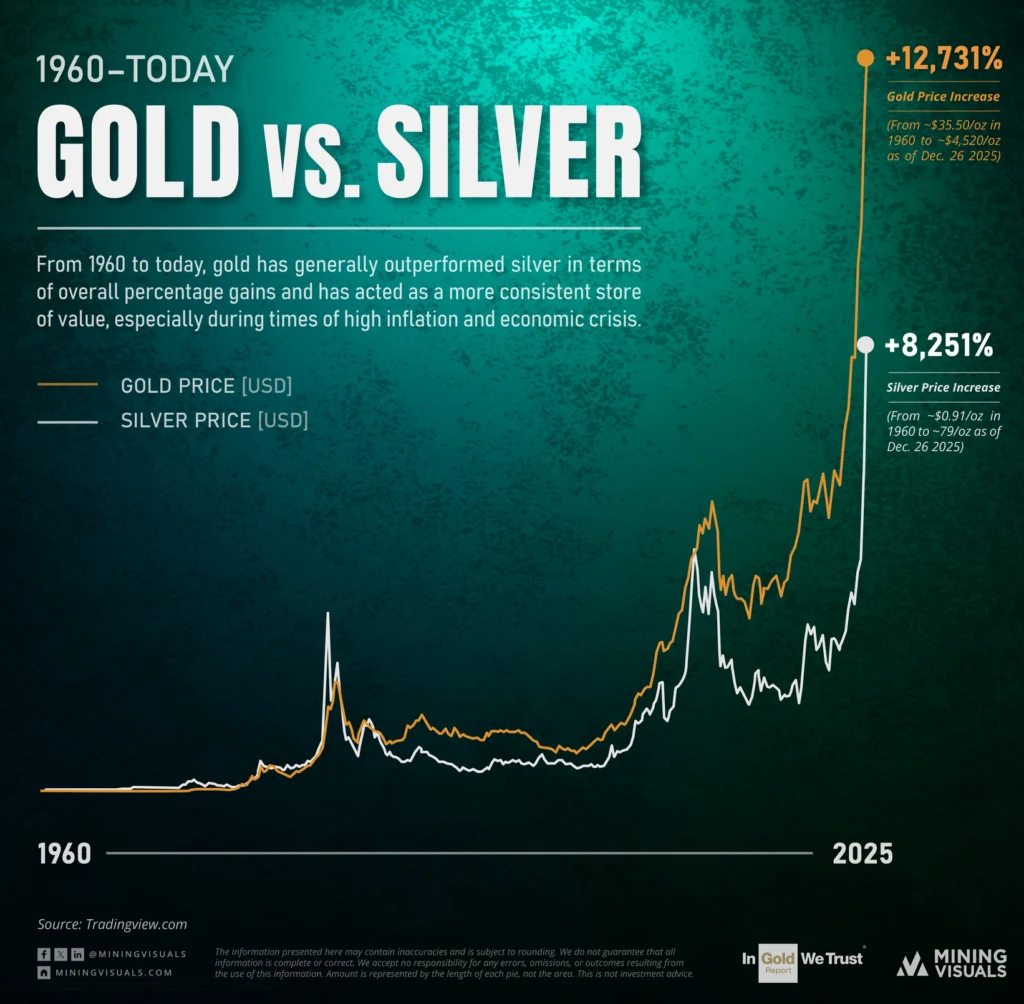

As we close out 2025, the commodities markets are buzzing with volatility, driven by a mix of geopolitical tensions, supply deficits, and economic uncertainties. Gold and silver have seen explosive gains this year, with silver emerging as one of the hottest trades amid fears of debt crises and industrial shortages. Oil, meanwhile, remains subdued but teeters on the edge of potential spikes due to ongoing Middle East conflicts. This article breaks down the current state of these key commodities, explores the so-called “silver crisis,” examines historical correlations, and assesses the broader implications for investors and consumers.

Gold and Silver Markets: Record Highs and Surging Demand

Gold prices have softened slightly today, December 29, 2025, trading below $4,500 per troy ounce after opening at a record $4,568 earlier in the session.

The spot price stands at approximately $4,473.12 per ounce, reflecting a 1.56% daily drop but a staggering 71.13% rise over the past year.

This surge is fueled by global debt concerns and a shift away from the U.S. dollar, with analysts predicting further gains into 2026 as part of a broader precious metals rally.

Silver, often called the “poor man’s gold,” has outperformed its counterpart dramatically, gaining over 170% in 2025 and hitting a record high of $83.62 per ounce on December 28.

Today’s spot price hovers around $75.64 to $76.11 per ounce, down about 4.39% on the day but up 161.40% year-over-year.

Mining Visuals writes:

Why is the chart going vertical now? Three specific market drivers are fueling this latest leg up:

The Geopolitical Premium: With conflicts escalating in Eastern Europe and the Middle East, the “Fear Trade” is back. Capital is fleeing risk assets and moving into physical metals, creating a price floor that didn’t exist a decade ago.

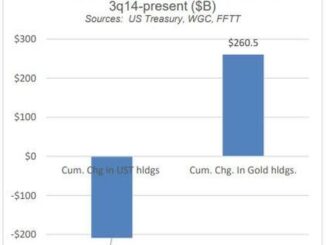

The Central Bank “Whales”: This is the biggest change in the market. Since 2022, global central banks (led by China, Poland, and Singapore) have been buying gold at record paces. They are not price-sensitive; they are buying to diversify away from the dollar, creating immense sustained demand.

The Rate Cut Narrative: As markets anticipate the end of the high-interest-rate cycle, speculators are front-running the Fed. Lower rates typically weaken the dollar, acting as rocket fuel for precious metals prices.

The Bottom LineThe chart shows a clear breakout. Gold has decoupled from traditional correlations and is carving a new path upward, driven by sovereign buying and geopolitical stress. Silver remains the wild card, lagging behind, but with the historical potential to outperform rapidly if the “catch-up” trade ignites.

Throw in some bank failure rumors, AI demand for Silver, and you will see some real confusion in the market.

Bloomberg posted this morning:

Silver, meanwhile, gyrated after smashing through $80 an ounce in a rally that’s been powered by speculative trades and fears about a supply shortage. Gold was down more than 1%. Copper surged to within touching distance of $13,000 a ton.

Precious metals have emerged as a hot corner of financial markets in recent months, boosted by elevated central-bank purchases and inflows to exchange-traded funds. Lower borrowing costs are also acting as a tailwind for non-yielding commodities.

Stocks Lag Behind Gold, Silver Since Start of Bull Run

Data is normalized with factor 100 as of October 12, 2022.

The initial momentum for metals on Monday came after a weekend comment by Elon Musk highlighted the growing bullishness around them. Musk replied to a tweet on Chinese export restrictions by saying on X: “This is not good. Silver is needed in many industrial processes.”

Frictions in Venezuela and strikes by Washington on Islamic State targets in Nigeria have also added to the haven appeal of metals. With silver inventories near their lowest on record, there’s a risk of supply shortages that could impact multiple sectors.

What Bloomberg strategists say…

“While there was no clear driver for the silver pullback, the low levels of liquidity and silver’s parabolic rise means that it is vulnerable to a snap back. Macro drivers and liquidity remain light, meaning that such erratic price action in the metals space could be a feature of trade for what is left of 2025.”

— Adam Linton, macro strategist. For full analysis, click here.

In geopolitical news, President Donald Trump said he made “a lot of progress” in talks with Ukrainian President Volodymyr Zelenskiy over a possible peace deal, but that it might take a few weeks to get it done.

Sources: finance.yahoo.com, jmbullion.com, pv-magazine.com, forbes.com, Bloomberg