The prospect of decreased crude oil supplies from Mexico, the top international supplier to the U.S. Gulf Coast (USGC), is creating uncertainty among heavy crude-focused refineries. Mexico’s state-owned energy company, Petróleos Mexicanos (Pemex), instructed its trading unit to cancel up to 436 Mb/d of crude exports for April to supposedly focus on processing domestic oil at its new 340-Mb/d Dos Bocas refinery and/or its existing plants. While the refinery’s startup is likely not nearly as imminent as Pemex says, the cancellation of Mexican crude imports could be problematic for U.S. refiners with plants built to run heavy crude, a necessary ingredient to optimize operations and yields. Adding to the complexity of the situation is the upcoming startup of the Trans Mountain Pipeline expansion (TMX) and the recent reinstatement of U.S. sanctions on Venezuelan crude. In today’s RBN blog, we’ll examine the potential fallout resulting from Pemex’s decision at a time when heavy crudes elsewhere are also becoming less available.

Mexico’s energy ministry has stated that Dos Bocas will process about 179 Mb/d of crude oil this year, with plans to reach full capacity at 340 Mb/d; however, RBN’s downstream consulting practice, Refined Fuels Analytics (RFA), sees the future of Dos Bocas much differently. Previous announcements of its imminent startup have yet to result in any notable operations and we don’t see the facility reaching consistent levels of meaningful fuel output until 2026, with full ramp-up stretching to 2028. Assuming Dos Bocas does make it there (which certainly isn’t a given), our expectations are that utilization will only average about 60%. (See Here I Go Again for a detailed examination of Dos Bocas’ prospects.) There continue to be mixed signals as Pemex reversed at least 330 Mb/d of the planned cut for May, according to news reports, due to lower demand from domestic refineries.

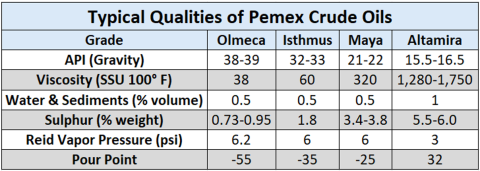

Overall, Pemex has projected domestic crude oil processing will increase from 713 Mb/d in 2023 to an average of 1.04 MMb/d in 2024, with local refineries, including Dos Bocas, aiming for 1.7 MMb/d by year-end (a prospect we think is unachievable). Let’s take a step back and delve into the various grades of Mexican crude oil. Mexico produces and exports four distinct quality grades, ranging from light to heavy:

- Olmeca, the lightest among them, boasts an API gravity of 38-39 and a sulfur content of 0.73% to 0.95% by weight, making it a valuable feedstock for lubricants and petrochemicals. Although Olmeca shares some similar product yields as Eagle Ford crude, the latter has lower sulfur content, particularly important for the naphtha cut used in gasoline production.

- Isthmus falls into the medium-heavy category, with a typical API gravity of 32-33 degrees and sulfur content of 1.8%. Isthmus yields commendable amounts of gasoline and intermediate distillates such as diesel and jet fuel.

- Maya, considered a heavy, high-sulfur grade, boasts an API gravity of 21-22 degrees and 3.4% to 3.8% sulfur. Maya produces lower yields of gasoline and diesel in simple refineries when compared to lighter crudes, necessitating high-conversion units for optimal processing.

- Altamira, the heaviest and most sour, has an API gravity of 15.5-16.5 and a sulfur content of 5.5% to 6%. Similar to Maya, Altamira yields lower gasoline and diesel in simple refining setups compared to lighter crude oils, making it suitable for asphalt production due to its physical properties.

See Figure 1 below for more details around quality for these types of crude grades. (As we noted in The Weight, crude with a higher API gravity is lighter, or less dense, while oil with a lower API gravity is heavier, or denser.)

Figure 1. Typical Qualities of Pemex Crude Oils. Source: Pemex

Mexico’s export cancellations are expected to predominantly impact volumes of it’s flagship grade, Maya, while shipments of other grades like Isthmus and Olmeca may also see reductions; however, uncertainties persist regarding Pemex’s ability to enact these export cuts. In fact, Pemex is now offering more crude cargoes to customers after fires recently struck two of its refineries (the Salina Cruz refinery and the Minatitlan refinery), disrupting the country’s plan to reduce exports and boost domestic fuel production. Maya dominates the Mexican export market, and it averaged 612 Mb/d in 2023. To further exasperate the issue, the availability of Maya crude has been dwindling for some time (See Maya Mia!). These developments have repercussions on imports not only in the U.S., but also in Europe and Asia, where lesser volumes of Maya are shipped.

The Mexican export reduction comes at a time when OPEC and its allies are already curbing production, potentially further escalating oil prices, which are currently near a six-month peak. This tightening of physical supplies, particularly a heavier, sour grade like Maya, exacerbates the strain. Further, Venezuelan exports are expected to decline following the reinstatement of U.S. sanctions on its oil industry. Venezuela’s oil exports rose to the highest levels since early 2020 in March, ahead of the April 18 expiration of a six-month general license that allowed the country to freely sell its crude. The U.S. Department of Treasury issued a new license April 17 requiring companies doing oil and gas business in Venezuela, including international oil producers, to wind down those operations by May 31. New business or investments that would have been authorized under the expired license will not be allowed.

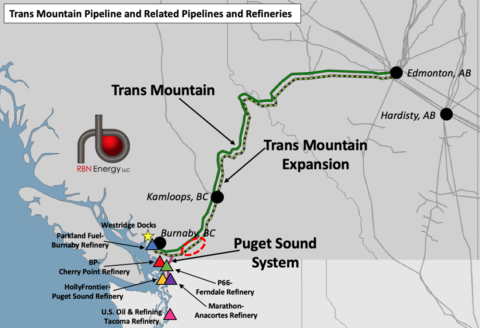

The most apparent alternative for Maya crude would be Canadian heavy crudes, although the impending TMX startup adds complexity, potentially reducing for a time the availability of Canadian crude in the USGC via the Keystone Pipeline. TMX, which is expected to commence commercial operations on May 1, recently completed construction in southern British Columbia, concluding a decade-long project marked by delays and cost overruns. (Additional delays remain a distinct possibility, and shippers have expressed concerns that the pipeline will not be fully operational by May 1.) The pipeline is set to provide service for contracted volumes after finishing a drilling project on the final remaining segment in the Fraser Valley (red dashed oval in Figure 2 map below).

Figure 2. Trans Mountain Pipeline and Related Pipelines and Refineries. Source: RBN

With a capacity of 590 Mb/d and a US$25 billion investment, the expansion (dashed black-and-green line) parallels the original pipeline (solid green line), connecting Edmonton, AB, to Canada’s west coast at Westridge and Burnaby, BC, while also integrating with refineries in the Pacific Northwest via the Puget Sound pipeline system. This infrastructure serves as a crucial conduit for exporting larger volumes of Western Canadian crude oil to both overseas markets and the U.S. West Coast. While TMX is expected to decrease total heavy crude available to the USGC in the immediate future, it could increase total heavy crude availability by incentivizing more Canadian production. Even in the short term, increased Canadian crude flows to Asia and the U.S. West Coast via TMX would displace heavy crude from Latin America that currently feeds those refineries, making those flows available to the USGC.

Amid ongoing OPEC+ production cuts of 2.2 MMb/d that are expected to continue through Q2, the combined effects of these trends may compel USGC refineries to rely more heavily on domestic crude, potentially tightening U.S. exports moving forward. However, transitioning feed slates is easier said than done, particularly for deep-conversion refineries built to run heavy crude, which cannot readily adjust their crude distillation unit (CDU) configurations from one day to the other. A shortage of Maya crude directly impacts refineries with coking setups, prompting them to seek alternatives to maintain utilization rates. Failure to secure suitable replacements may result in decreased refinery utilization rates.

The extent to which an individual refinery can lighten up its crude slate varies by site. Switching to lighter crudes would increase costs given that light crude is more expensive than heavy crude. However, the light/heavy crude differential continues to narrow and may narrow further on the USGC as measured by the West Texas Intermediate (WTI)-Western Canadian Select (WCS) spread in Houston. Narrower heavy/light differentials are expected to incentivize some USGC refineries to shift toward lighter crude slates. Further, we expect minimal impact to overall crude runs and some increases in Latin American imports to the USGC, excluding Venezuela.

In closing let us note two other events that will/could play important roles in the heavy crude market. First, Mexican elections are scheduled to take place in early June. While it looks like Mexico’s current President Andres Manuel Lopez Obrador (also known by his initials AMLO) will be succeeded by his party mate, Claudia Sheinbaum, she has very different (and less friendly) views toward the oil industry, and it is certainly possible that she could divert investment away from completing Dos Bocas (and upgrading/maintaining existing refineries). This would result in lower domestic runs and more Maya available for export — assuming production isn’t also negatively impacted by her policies.

One other thing to mention: The very fact of the impending election might be a reason that Pemex is announcing the crude export cuts to support the optimistic outlook for Dos Bocas. Once victory is assured for the incumbent party, we might hear more realistic assessments of the project’s prospects and a return to normal levels of exports. While the impacts of the election are very uncertain, another event, the planned shutdown of LyondellBasell’s 268-Mb/d Houston refinery in Q1 2025, seems like a done deal. Upon closure, it will remove more than 200 Mb/d of heavy crude demand from the USGC market, making that amount available to other refiners.

“When Worlds Collide” was written by Powerman 5000 and appears as the third song on Powerman 5000’s second major-label studio album, Tonight the Stars Revolt! The lyrics in the song address social class problems in the world. The title comes from the 1933 novel of the same name written by Edwin Blamer and Philip Wylie and the 1951 science fiction film directed by Rudolph Mate that was based on the novel. Initially released as a single in July 1999, it went to #16 on the Billboard Mainstream Rock Tracks Singles chart. It has been used in video games — including Tony Hawk’s Pro Skater 1+2 and WWE Smackdown vs. Raw — and was featured in the film Little Nicky. In 2020, Powerman 5000 re-recorded the song and released it as a digital single. Personnel on the record were: Spider One (Michael Cummings) (vocals), Adam 12, M.33 (guitars), Dorian 27 (bass), and Al 3 (drums).

Tonight the Stars Revolt! was recorded in 1998-99 at Sunset Sound Studios, The Chop Shop Studios, Music Grinder Studios in Los Angeles, and Sound City Studios in Van Nuys. Produced by Sylvia Massey and Ulrich Wild, the album was released in July 1999 and went to #29 on the Billboard 200 Albums chart. It has been certified Platinum by the Recording Industry Association of America. Three singles were released from the LP.

Powerman 5000 is an American rock band formed in Boston in 1991 by Spider One, along with drummer Al Pahanish Jr. (Al3), bassist Dorian Heartsong (Dorian 27) and guitarist Adam 12. Their music is a combination of industrial rock and nu-metal. Spider One is the younger brother of Rob Zombie. They have released 11 studio albums, one compilation album, three EPs, and 24 singles. Their music has been featured in several video games, television shows and film soundtracks. Twenty-seven members have passed through the band since its formation, with Spider One being the only original member in the current lineup. They continue to record and tour and will release their 12th studio album, Abandon Ship, in May. They will begin a U.S. tour in late April.