That is a great question that I get asked a lot in media interviews and from our stakeholders. It is always fun in the first few weeks of January for the industry energy thought leaders all go through their forecasting exercises for energy and oil prices. So far on the 10th of January, the prognosticators … Continue reading “Where would the price of energy and oil be if we did not have the scare of two pandemics and the “Greener” movement?”

The post Where would the price of energy and oil be if we did not have the scare of two pandemics and the “Greener” movement? appeared first on King Operating Corporaton.

January 10, 2022

That is a great question that I get asked a lot in media interviews and from our stakeholders. It is always fun in the first few weeks of January for the industry energy thought leaders all go through their forecasting exercises for energy and oil prices.

So far on the 10th of January, the prognosticators are literally over the map. We are seeing reports of $60 to $200, and so taking a stab in the middle is easy right? Let’s back up a little to see how we got here. Oil and gas are some of the most important commodities around the world. Not only do they impact every consumer for energy price, but they also impact almost all other commodities on manufacturing through delivery.

The pricing matrices used in commodity fundamentals are heavily weighted towards supply and demand. Energy is different in that wars are fought over oil and gas between those with and without. So naturally, with the energy crisis in Europe, we are seeing this play out in real-time. Russia amassing over 100,000 troops to prove their energy dominance in order to get the Nord Stream 2 pipeline approved. It took over 25 years of bad energy policies to get here.

George Friedman’s Geopolitical Futures released this morning an interesting update to the EU’s energy crisis, “Europe’s Green Deal Trades One Dependence for Another”.

Europe’s energy security hinges on external actors. Largely devoid of energy resources of its own, the EU imports 87 percent of the oil and 74 percent of the natural gas that it consumes. But this also means that any shift by Europe away from fossil fuels will be felt beyond its borders, particularly in Russia. Of Moscow’s fossil fuels exports, close to half were destined for the EU. At the same time, the EU imports 48 percent of its natural gas needs from Russia. It’s safe to say, in other words, that EU energy security depends on Russia.

But the Green Deal will not eliminate Europe’s energy security risks. On the contrary, it will just alter the foreign powers on which the EU depends. European carbon neutrality can be achieved only through the widespread adoption of green technologies like lithium-ion batteries, fuel cells, wind turbine generators, traction motors and photovoltaics. Traction motors and lithium-ion batteries, for example, are crucial for manufacturing electric vehicles. Fuel cells are used to convert hydrogen to electricity without combustion. And photovoltaics convert solar energy into electricity and, along with wind energy, will be a critical part of achieving carbon neutrality.

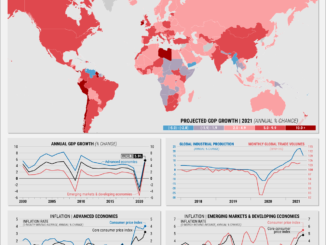

Below is a graphic that represents the critical components of almost all commodities (except food). Note that we will have other research topics with data around the facts surrounding the “Greener” we go, the more fossil fuels and resources we use.

Critical Raw Materials – Geopolitical Futures

The pandemic had a dramatic impact on bringing the world’s energy crisis to a boiling point. The demand side of the oil and gas pricing crashed, and the other commodities markets claimed as consumers stayed at home and bought TVs, refrigerators, and other consumables. Then along comes the commodities shortage. This totally wiped out the world’s just-in-time inventory and delivery system. The supply line break will be felt for years as the solutions are not going to be fixed anytime soon.

Below is a chart from the King Operating website. We are at 530 rigs, and one year ago we were at 311. The pandemic-induced reduction in demand really impacted the ability of the U.S. E&P companies to bring supply to the market. The “Greener” movement as I call it, impacted the financial side of the drilling equation by guaranteeing the supply side cannot be brought back to levels required to keep prices low for years.

King Operating Weekly Rig Count *Drill down by basin information available.

The Bottom Line

The question of “Where would the price of energy and oil be if we did not have the scare of two pandemics and the “Greener” movement?” is a two-part answer.

First: The energy crisis would have happened eventually. One cannot print money and not cause inflation. One also cannot transition to 100% renewable energy. Our research indicates that the “Greener” we go, the more fossil fuels and rare earth minerals we will use.

Second: The two pandemics brought the entire global crisis together under one roof. This may have been the straw that killed the camel and not broke its back. It might have been several years before all of the parts and pieces of this global multi-faceted crisis came together.

But the one thing the pandemics did provide is the catalyst to bring the awareness of the world about the bad energy policies and that moving to “Greener” will never happen without fossil fuels. This is validated by the COP26, the EU consortium, and the Biden administration all admitting that natural gas is a “renewable” source that is required. It is however too little too late. The Russian bear is now in control of Europe, and Saudi Arabia is in control of the world’s oil pricing.

Commodities crashes are accompanied by high inflation. This will impact the average investor, and they will need to visit with their CPA about protecting their portfolios and reducing their tax burdens.

Take our short survey to see if this may apply to you.

Please reach out to our team at any time.

Jay R. Young, CEO, King Operating

Click Here and Take our short survey and tell us your thoughts.

And visit the King Operating Website for more market information and insights.