Ok, so that push-back in the statement was unexpected.

By Wolf Richter for WOLF STREET.

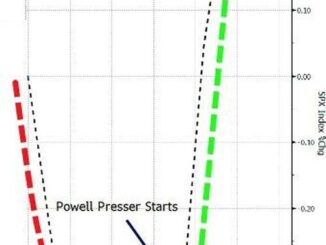

The FOMC statement released today by the Fed after its two-day meeting pushed back aggressively against the market’s massive rate cut expectations this year – what we’ve come to call “rate-cut mania” – and it pushed back against the expectations of an early end of QT.

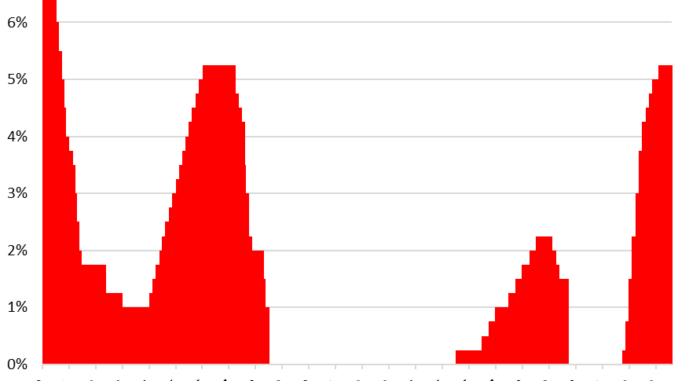

The FOMC voted unanimously today to maintain its five policy rates, with the top of its policy rates at 5.50%, as had been broadly telegraphed in recent weeks in speeches, interviews, and panel discussions by Fed governors in their efforts to push back against the rate-cut mania that had broken out in early November last year. The last rate hike occurred at its meeting in July.

Now the Statement pushed back against rate-cut mania and end-of-QT mania:

The Fed added entirely new language to its statement, explicitly pushing back against the markets’ rate-cut mania and end-of-QT mania. I don’t think I have ever seen anything like this in an FOMC statement. It said:

Rate cuts: “In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

QT: “In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.”

So QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion per month as per plan. The Fed has already shed nearly $1.3 trillion in assets since it started QT in July 2022.

Financial and credit conditions: The Fed removed the paragraph about “tighter financial and credit conditions for households and businesses” due to the banking crisis weighing “on economic activity, hiring, and inflation.” It likely removed it because financial and credit conditions have loosened recently, and the banking crisis is no longer on the front-burner.

Policy rates:

Today, the Fed kept its policy rates at:

Federal funds rate target range between 5.25% and 5.5%.

Interest it pays the banks on reserves: 5.4%.

Interest it pays on overnight Reverse Repos (RRPs): 5.3%.

Interest it charges on overnight Repos: 5.5%.

Primary credit rate: 5.5% (banks’ costs to borrow at the “Discount Window”).

Note the plateaus after the rate hikes. The one from June 28, 2006 through September 14, 2007 lasted nearly 15 months:

A no-dot-plot meeting. Today’s meeting was one of the four meetings a year when the Fed does not release a “Summary of Economic Projections” (SEP), which includes the “dot plot” which shows how each FOMC member sees the development of future policy rates. SEP releases occur quarterly at meetings that are near the end of the quarter. The next SEP will be released at the March 19-20 meeting.

At the last meeting in December, the median projection in the “dot plot” indicated three rate cuts in 2024.

I will publish my analysis of Powell’s preconference in a little while. Stay tuned.

Here is the whole statement:

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack