In a series of escalating attacks that underscore the fragile security in Iraq’s oil-rich regions, drone strikes have targeted multiple oilfields in the semi-autonomous Kurdistan area, leading to the shutdown of up to 200,000 barrels per day (bpd) of crude production. These incidents, attributed to Iran-aligned militias, come amid longstanding disputes over oil revenue sharing and export controls between the Kurdistan Regional Government (KRG) and Iraq’s federal government in Baghdad. As global energy markets remain sensitive to Middle Eastern disruptions, this halt—though relatively small in scale—could contribute to upward pressure on oil prices if tensions persist.

The Attacks: A Timeline of Disruption

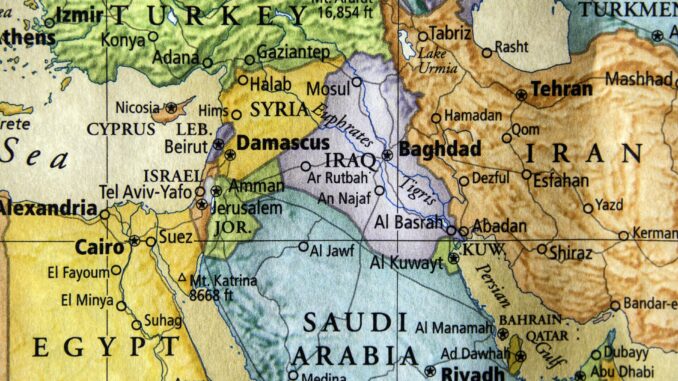

The drone strikes began earlier this week and intensified over three days, marking a concerning uptick in targeted assaults on critical energy infrastructure. On Monday and early Tuesday, drones hit the Tawke and Peshkabir oilfields, operated by Norwegian firm DNO ASA. These fields, located in northern Iraq’s Dohuk province, were followed by an attack on the Sarsang field, managed by HKN Energy, which ignited a fire and forced immediate shutdowns.

The latest strike occurred late Wednesday at around 7:10 p.m. local time (1610 GMT), targeting another site in Dohuk connected to U.S. operator Hunt Oil. According to preliminary intelligence, the attacks originated from southern Iraq and are linked to pro-Iranian militias, though no group has claimed responsibility.

The Kurdistan government has labeled these as “acts of terrorism” aimed at national infrastructure, while U.S. officials have warned that such actions threaten Iraq’s economic stability and regional security.

In response, the Association of the Petroleum Industry of Kurdistan (APIKUR)—representing international oil companies in the region—announced that more than 200,000 bpd of output has been suspended. This includes an initial 150,000 bpd from the directly affected fields, plus preemptive halts at unaffected sites to ensure safety.

Companies like Gulf Keystone Petroleum have also paused operations for assessments, further compounding the downtime.

These strikes are not isolated; they occur against the backdrop of the Iraq-Turkey Pipeline (ITP) being offline since a 2023 international arbitration ruling favored Baghdad’s control over exports from Kurdistan. The pipeline’s paralysis has already limited Kurdistan’s ability to export its roughly 400,000-450,000 bpd of typical production, forcing reliance on trucking or local refining.

This ongoing impasse has deepened frictions, with Erbil accusing Baghdad of withholding budget shares, potentially motivating proxy attacks to pressure negotiations.

Iraq’s Oil Exports: Steady but Strained

Iraq, OPEC’s second-largest producer after Saudi Arabia, has maintained robust export levels despite internal challenges. According to the latest data, the country’s average daily crude oil exports stood at approximately 3.506 million bpd in early 2025, based on figures through the first few months of the year.

This marks a slight uptick from 2024’s average of 3.367 million bpd.

- March 2025: 3.441 million bpd

- April 2025: 3.365 million bpd

- Planned for May-June 2025: Around 3.2 million bpd, as part of Iraq’s voluntary cuts under OPEC+ agreements to stabilize global prices.

These exports are mostly from southern fields like Basra, with Kurdistan’s contributions minimal due to the pipeline shutdown. In fact, much of Kurdistan’s output has been sold domestically or via alternative routes, meaning the current 200,000 bpd halt primarily affects local supply rather than immediate international flows. However, if repairs and security reinforcements drag on, it could indirectly strain Iraq’s overall production capacity, which hovers around 4.5-4.6 million bpd total.

Potential Impacts on Global Markets

While 200,000 bpd represents just a fraction—about 0.2%—of global daily oil supply (estimated at 100 million bpd), the shutdowns could ripple through markets by heightening geopolitical risks in the Middle East. Oil prices, already influenced by factors like OPEC+ production policies and demand from Asia, often spike on news of regional instability.<g>Analysts note that these attacks could exacerbate existing vulnerabilities. For instance, if the strikes signal a new pattern of militia aggression, they might deter foreign investment in Kurdistan’s fields, prolonging the export stalemate and adding to supply-side uncertainties.

Brent crude futures, which serve as a global benchmark, have seen modest gains in recent trading sessions, potentially attributable to these events amid broader concerns over Red Sea shipping disruptions and U.S.-Iran tensions.In the short term, the impact may be muted given ample global inventories and Iraq’s compliance with OPEC+ quotas. However, escalation could lead to broader disruptions: U.S. involvement (given Hunt Oil’s stake) might draw diplomatic responses, while prolonged halts could force Iraq to compensate by ramping up southern exports, testing OPEC+ unity.

Traders are watching closely, as similar past incidents in the region have led to price premiums of $1-3 per barrel.

Market reactions on social platforms like X (formerly Twitter) reflect growing alarm, with users highlighting the potential for wider energy crises if the attacks continue.

(post) As one observer put it, “200,000 barrels shut in… the region’s oil future is on shaky ground.”

Looking to Resolution

The KRG has called for federal support to secure oil infrastructure, while international operators demand accountability. As investigations proceed, the focus will be on restarting operations safely and addressing the root causes—namely, the pipeline dispute and militia activities.For energy stakeholders, this serves as a reminder of the Middle East’s pivotal role in global supply chains. While Iraq’s exports remain resilient for now, sustained disruptions in Kurdistan could tip the scales in an already volatile market. Stay tuned to Energy News Beat for updates on this developing story.