As investors demand higher returns, Shell took another step toward giving them what they want. After slashing its dividend last year, the company went ahead with a planned 4% increase to the payout. It also managed to pay off $4.1 billion of net debt, moving closer to the level of borrowing that will allow it return extra cash to shareholders.

Reason to Cheer Royal Dutch Shell’s gearing, a key measure of debt, fell below 30% in 1Q

Source: Royal Dutch Shell

“Shell has made a strong start to 2021,” Chief Executive Officer Ben van Beurden said in a statement on Thursday. “We have reduced net debt by more than $4 billion this quarter, progressing towards the $65 billion milestone to increase shareholder distributions.”

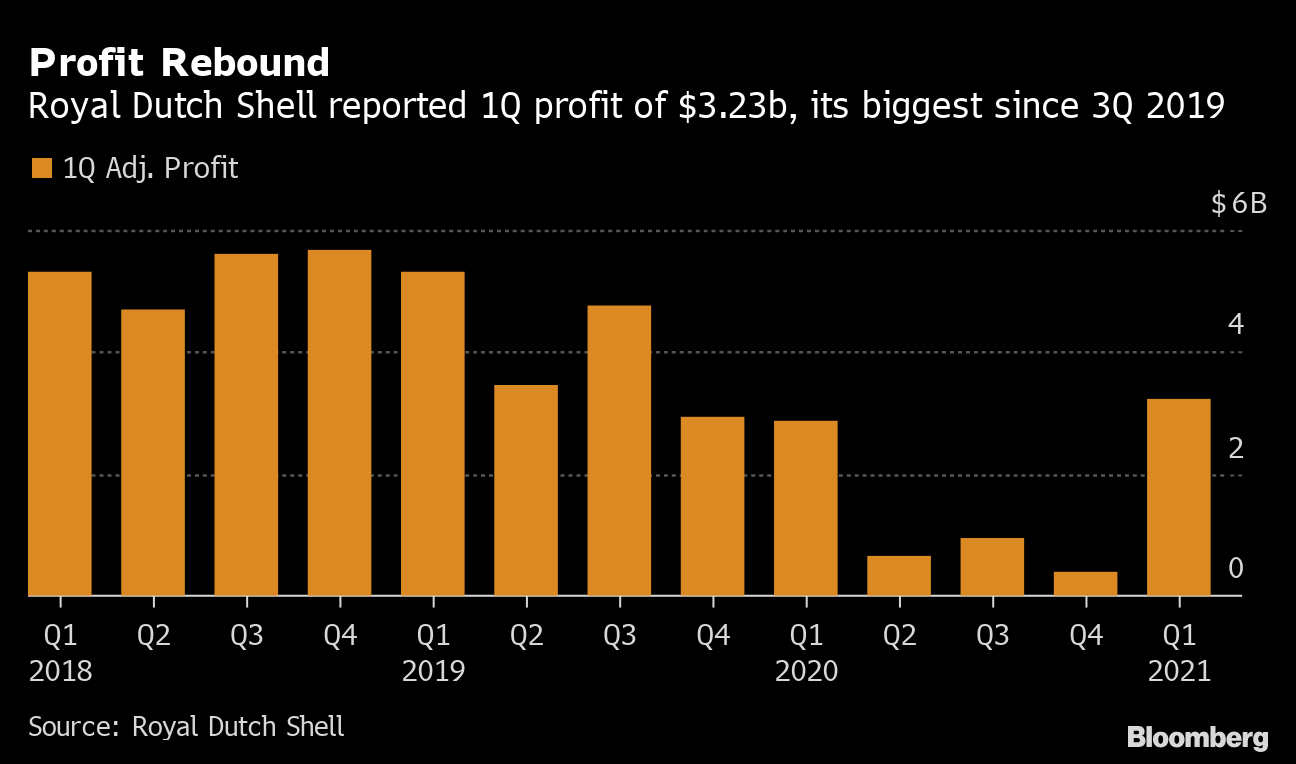

First-quarter adjusted net income was $3.23 billion, up from $2.86 billion a year earlier, Shell said. That compares to an average analyst estimate of $3.06 billion. It was the highest profit since the third quarter of 2019, joining Total SE, BP Plc and Equinor ASA in restoring earnings to pre-pandemic levels.

Profit Rebound

Royal Dutch Shell reported 1Q profit of $3.23b, its biggest since 3Q 2019

Source: Royal Dutch Shell

The results come two days after BP posted a much higher profit than expected and started share buybacks, thanks in large part to “exceptional” earnings from natural gas trading related to the big freeze in Texas.

Shell said its gas trading results were lower in the first quarter, but the company’s chemicals business really shone. The unit delivered $730 million in adjusted net income, almost double the amount of a year earlier and about a quarter of the company’s total first-quarter earnings.

Chemicals is an area that Shell — and its U.S. peer Exxon Mobil Corp. which reports earnings on Friday — really excels. Prices for the products are rising strongly around the world with the rebound in the manufacturing industry.

— With assistance by Javier Blas, and Christopher Sell