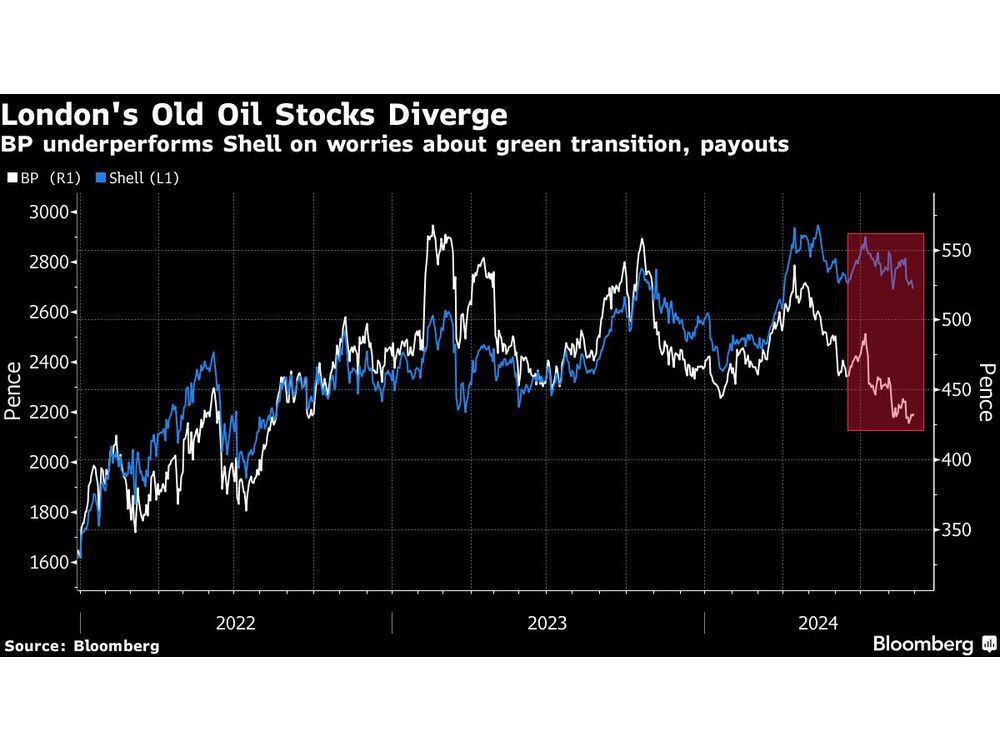

London’s old-school oil stocks are no longer moving in tandem, as BP Plc underperforms Shell Plc due to concerns over the former’s green-energy transition and the outlook for earnings and shareholder payouts.

August is set to mark the fifth-straight month that BP shares have trailed those of its larger rival, following a trio of analyst downgrades, underwhelming earnings and an impairment linked to a refinery in Germany. BP shares have slumped 12 per cent since the end of March, while Shell has risen 3.4 per cent.

BP still depends overwhelmingly on oil and gas for the profits that fund its dividend and share buybacks. Yet the company has been shifting toward low-carbon businesses such as offshore wind at a time when those operations aren’t providing the kind of returns that investors want. Shell, by contrast, has scaled back on its plans to cut CO2 emissions and invest in renewable power generation.

“The differences in these strategies is driving a preference for Shell over BP,” said Allen Good, an analyst at Morningstar Investment Services who cut his rating on BP to hold from buy this month. The company’s approach to the sustainable-energy transition means earnings and capital returns are uncertain, he said.

BP declined to comment on the stock performance.

Another factor in the relative stock moves is BP’s earnings growth and its ability to reduce its indebtedness, said Biraj Borkhataria, head of European energy research at RBC Europe Ltd.

“BP’s underperformance versus Shell is primarily related to weaker earnings momentum,” he said. “BP has had a number of operational issues and has de-leveraged much more slowly than Shell over the last year.”

Borkhataria cut his rating on BP to sector perform from outperform this month, saying the company’s balance sheet needed work.

Investors punish BP with a lower valuation, pricing the stock at 7.2 times estimated earnings for the next 12 months versus Shell’s 7.8 times, in part out of concern that the company may not be able to afford the share repurchases that investors expect.

BP also trades at a discount by other measures, such as cash flow and dividend yield, according to HSBC Holdings Plc, which also downgraded BP this month.

“This is for a good reason in our view, namely the unfunded nature of BP’s buyback, downside risks to its Ebitda guidance and expected decline in oil and gas output beyond 2025,” said HSBC analyst Kim Fustier.

“Unless this changes, we do not expect BP’s discount to peers to narrow,” Fustier added.

With assistance from William Mathis