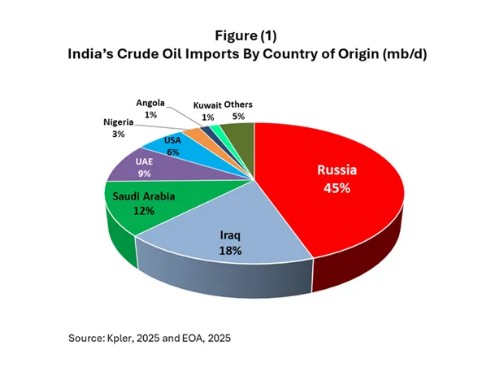

India’s reliance on Russian oil—now accounting for about 40% of its seaborne crude imports—raises a critical question: Can India realistically replace these supplies without major economic fallout?

Is Oil & Gas Right for Your Portfolio?

India’s Growing Dependence on Russian Oil.

This shift has been driven by economics: Russian oil is cheaper due to Western sanctions diverting flows away from Europe. However, Trump’s proposed secondary sanctions—tariffs on third-party nations dealing with Russia—could change this dynamic overnight.

Indian officials, including Petroleum and Natural Gas Minister Hardeep Singh Puri, have expressed confidence in the country’s ability to adapt. “India expanded the number of suppliers from 27 to 40. Currently, 35% of the oil comes from Russia, but India can quickly return to the previous scheme (2%),” Puri stated in comments to Reuters.

Alternatives include increased imports from traditional suppliers like Saudi Arabia, Iraq, and the UAE, as well as emerging sources such as the US, Guyana, and Brazil.

India’s largest state-owned refiner, Indian Oil Corporation, has already begun rebalancing its crude purchases in anticipation of tighter US sanctions.

Yet, experts warn that the replacement won’t be seamless. Russian oil’s discounts—often $10-20 per barrel below global benchmarks—have kept India’s energy costs low. Switching to pricier alternatives could drive up domestic fuel prices, exacerbating inflation and straining the economy.

A Bloomberg analysis estimates that enforcing such sanctions could disrupt 1.5-2 million barrels per day of Russian supply, pushing Brent crude prices to $90-100 per barrel by mid-2025.

For India, this means higher import bills and potential supply chain hiccups, though officials downplay long-term risks, citing sufficient global oil availability.

Geopolitical Pushback and Diplomatic Maneuvering

NATO Secretary-General Mark Rutte echoed Trump’s threats, warning India, China, and Brazil of 100% secondary sanctions if they don’t curb Russian trade.

However, Indian leaders remain unfazed, with Minister Puri asserting there’s “no pressure” and ample options to ensure uninterrupted flows.

This stance reflects India’s strategic autonomy, balancing ties with Russia (a key defense supplier) and the US (a major trade partner). Past experiences, like halting Iranian oil imports in 2019 under Trump’s first-term sanctions, show India can pivot—but at a cost.

Ukraine’s presidential aide Andriy Yermak has urged such measures, arguing they could force China and India to push for peace to avoid a trade war.

Analyzing Second-Order Effects on Diesel, Gasoline, and Petroleum Products Exports

Supply Chain Disruptions and Price Volatility

A shortfall could spike European fuel prices, contributing to inflation and higher transportation costs across industries like logistics and agriculture.

In the UK, similar bans have shifted reliance to non-Russian sources, but reduced Indian exports might force sourcing from farther afield (e.g., the US or Middle East), increasing shipping costs and emissions. Globally, this could lead to a “reshuffling” of trade flows, with Russia redirecting crude to other Asian buyers via shadow fleets, but enforcement challenges persist.

Economic Ripple Effects

- Inflation and Consumer Impact: Higher refining costs in India would raise domestic fuel prices, indirectly affecting food and goods transport. In the EU and UK, elevated diesel prices could add 5-10% to household energy bills, slowing economic recovery.

- Refining Margins and Industry Shifts: Indian refiners like Reliance and Nayara (part-Russian owned) profit from cheap Russian feedstocks. Sanctions could erode margins, prompting investments in alternative crudes but delaying transitions due to infrastructure mismatches.

- Geopolitical and Environmental Consequences: Reduced Russian revenues (estimated at $10-20 billion loss) weaken its war funding, but workarounds like price cap evasions could prolong the conflict.

Environmentally, longer shipping routes increase carbon footprints, countering global green energy goals. Some analysts suggest this could accelerate renewables adoption, though short-term fossil fuel dependence remains.

|

Second-Order Effect

|

Impact on EU/UK

|

Impact on Other Markets (e.g., India, Global)

|

|---|---|---|

|

Price Increases |

Diesel/gasoline up 10-20% due to supply squeeze |

Global Brent spikes to $90-100/bbl, inflating costs everywhere |

|

Trade Shifts |

More imports from US/Middle East, higher logistics costs |

India exports less, seeks new buyers in Asia/Africa |

|

Economic Strain |

Industrial slowdown, higher inflation |

India’s import bill rises $5-10B annually; Russia loses revenue |

|

Environmental |

Increased emissions from rerouted tankers |

Potential push for renewables, but delayed by energy security needs |