In a decisive move to prioritize grid reliability, the Trump administration’s Department of Energy (DOE) has issued a second emergency order extending the operation of the J.H. Campbell coal-fired power plant in West Olive, Michigan, until November 19, 2025. This extension, announced on August 21, 2025, comes just as the plant was set to retire, underscoring the administration’s push to maintain fossil fuel capacity in the face of surging electricity demands and regional shortages.

The 1,420 MW facility, owned primarily by Consumers Energy and operated within the Midcontinent Independent System Operator (MISO) grid, was originally slated for closure in May 2025 as part of Michigan’s broader shift away from coal. However, the DOE’s initial order in May kept it running through August 21 to handle peak summer loads. Energy Secretary Chris Wright justified the latest 90-day extension by pointing to persistent “energy emergency” conditions, stating, “The United States continues to face an energy emergency, with some regions experiencing more capacity constraints than others. With electricity demand increasing, we must put an end to the dangerous energy subtraction policies embraced by politicians for too long.” Wright emphasized the plant’s role in providing “affordable, reliable, and secure baseload power” independent of weather-dependent renewables.

Since the first extension, Consumers Energy has incurred $29 million in costs over the initial 38 days to keep the plant operational, equating to nearly $1 million per day. The Federal Energy Regulatory Commission (FERC) approved recovery of these expenses last week, allowing the utility to pass them on to ratepayers.

This decision aligns with the Trump administration’s broader agenda to support fossil fuels, countering rising demands from data centers, AI, and electrification, even as electricity prices have risen 5.5% in the past year, according to the Bureau of Labor Statistics.

Michigan’s Energy Mix: A Snapshot in TransitionMichigan’s electricity generation is undergoing a significant transformation, with natural gas and renewables gaining ground while coal’s share declines. According to the latest data from 2024, the state’s total utility-scale electricity generation reached approximately 125,696 GWh, with a diverse fuel mix reflecting efforts to balance reliability, cost, and environmental goals.

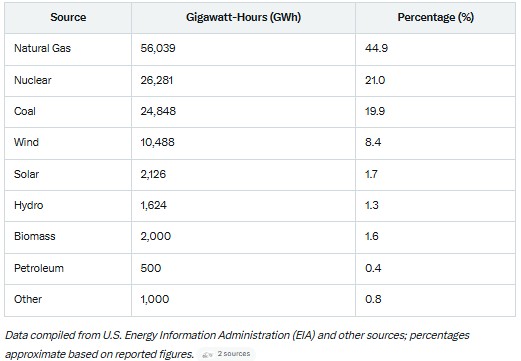

Here’s a breakdown of Michigan’s electricity generation by source for 2024:

Data compiled from U.S. Energy Information Administration (EIA) and other sources; percentages approximate based on reported figures.

Natural gas has surged from 12% in 2013 to 46% in 2023, continuing its dominance into 2024, while coal has fallen from higher historical shares.

Renewables, particularly wind and solar, have grown 2.5 times over the past decade, with distributed generation capacity reaching 189 MW in 2023—a 14 MW increase from the prior year.

Consumers Energy had planned to phase out coal entirely by 2025, making the J.H. Campbell extension a notable deviation.

Looking ahead to 2025, projections from the Michigan Public Service Commission’s Summer Energy Appraisal indicate continued growth in renewables and natural gas to meet rising demand, though emergency measures like this extension could temporarily bolster coal’s role.

Nationally, renewables overtook coal in U.S. generation for the first time in 2024, but Michigan’s mix remains more reliant on traditional sources due to regional grid dynamics.

Implications for Michigan Consumers: Reliability vs. Rising Costs

While the DOE’s order aims to enhance grid stability during high-demand periods, it raises concerns about affordability and environmental impacts for Michigan’s 4.5 million electricity consumers. The average retail price of electricity in Michigan stood at 14.57 cents per kWh as of May 2025, already above the national average, and extensions like this could exacerbate price pressures.

Proponents argue that keeping the plant online prevents blackouts and ensures baseload power, potentially stabilizing prices in the long term amid growing demands. However, critics, including environmental groups like the Sierra Club and NRDC, contend that the costs far outweigh the benefits. The initial extension alone has already added $29 million to the tab, with projections suggesting that delaying the plant’s closure could cost ratepayers up to $600 million in savings foregone by 2040.

An independent report estimates that propping up similar aging coal plants nationwide could hike consumer bills by $3 to $6 billion annually.

Environmental advocates also highlight increased pollution: The half-century-old plant will emit more sulfur dioxide, nitrogen oxides, and carbon, potentially worsening air quality and health outcomes in surrounding communities.

Groups like Michigan League of Conservation Voters warn of “guaranteed rate hikes,” arguing that the administration’s focus on fossil fuels ignores cheaper, cleaner alternatives like renewables, which have seen rapid growth.

For consumers, this could mean higher monthly bills in the short term—potentially adding cents per kWh—as utilities recover costs through FERC-approved mechanisms. On the flip side, if the extension averts energy shortages, it might prevent even steeper spikes from supply disruptions. As Michigan pushes toward its clean energy goals, including 100% carbon-free electricity by 2040 under state law, this federal intervention highlights the tension between immediate reliability needs and long-term sustainability.

Stay tuned to Energy News Beat Channel for the latest on U.S. energy policy, grid challenges, and consumer impacts. What do you think—does extending coal plants make sense for Michigan’s future? Share your views in the comments!

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack