In the rapidly evolving energy landscape of 2025, a critical shortage of gas turbines is raising eyebrows across the industry. These turbines, essential for natural gas-fired power plants, are in short supply due to limited manufacturing capacity and surging demand from sectors like AI-driven data centers. But could this bottleneck inadvertently benefit the planet by curbing fossil fuel expansion, or might it backfire by prolonging dirtier alternatives like coal? This article dives into the global natural gas and LNG demand dynamics, the split between shipping and electricity uses, the role of gas in displacing coal, and insights from a recent Bloomberg analysis to explore both sides.

Understanding the Gas Turbine Shortage

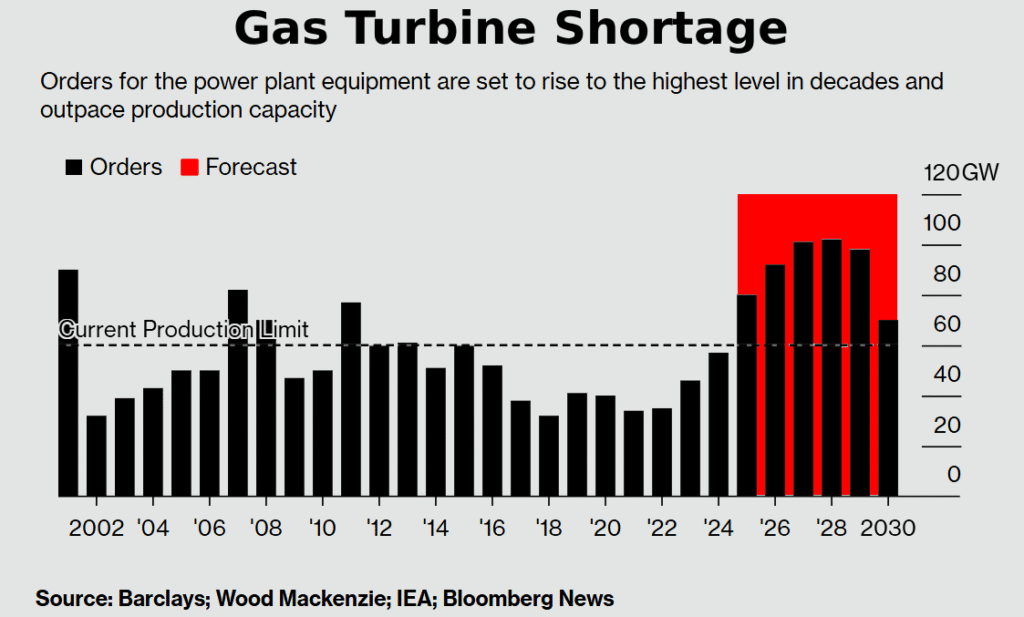

Gas turbines are the workhorses of modern natural gas power plants, converting fuel into electricity efficiently. However, the global market is dominated by just three major players controlling 70% of supply, and they’re wary of overinvesting amid uncertain long-term demand.

This hesitation has stretched order wait times from two years to five or more, inflating U.S. construction costs from $800 per kilowatt in 2021 to as high as $2,800 today.

The crunch puts $400 billion in planned gas-fired projects through 2030 at risk, potentially delaying or scrapping them.

Proponents argue this could be environmentally positive by slowing the build-out of new fossil infrastructure, forcing a faster pivot to renewables. Yet, as Bloomberg’s newsletter highlights, the shortage might actually exacerbate climate issues.

In developed regions like the UK, Texas, and Australia, where gas has helped integrate renewables and cut grid pollution, delays could mean pricier battery storage solutions. In developing nations such as China, India, and Vietnam, it risks locking in more coal dependency, widening the global emissions gap.

Bloomberg posts:

A gas bottleneck

Worth of planned gas-fired power plants through 2030 are in jeopardy of delay or cancellation because of the lack of capacity to meet future turbine orders

Why so slow?

“It’s not so easy to ramp up. The whole supply chain is struggling to also keep pace.”Joern SchmueckerSiemens Energy’s senior vice president of gas serviceGas turbine makers aren’t able — or willing — to increase production capacity fast enough to meet rapid demand.

Global Natural Gas and LNG Demand in 2025

Global natural gas demand is on an upward trajectory, though growth is moderating. According to the International Energy Agency (IEA), demand rose 2.8% in 2024 but is projected to slow to about 1.3% in 2025, driven largely by Asia-Pacific markets.

This equates to total consumption potentially exceeding 4,100 billion cubic meters (bcm), with LNG playing a pivotal role in trade. Shell’s LNG Outlook 2025 forecasts a 60% rise in global LNG demand by 2040, fueled by economic expansion in emerging economies.

In the U.S., marketed production is expected to average 117.1 billion cubic feet per day (Bcf/d) in 2025, remaining relatively flat into 2026 amid balanced supply and demand.

Prices reflect this stability, with Henry Hub futures averaging around $4.02 per million British thermal units (MMBtu) for 2025.

These figures underscore natural gas’s entrenched role as a “bridge fuel,” but the turbine shortage could disrupt this growth, potentially reducing emissions if alternatives fill the void—or increasing them if not.

Got A Tax Burden in 2025?

Natural Gas Allocation: Shipping vs. Electrical Generation

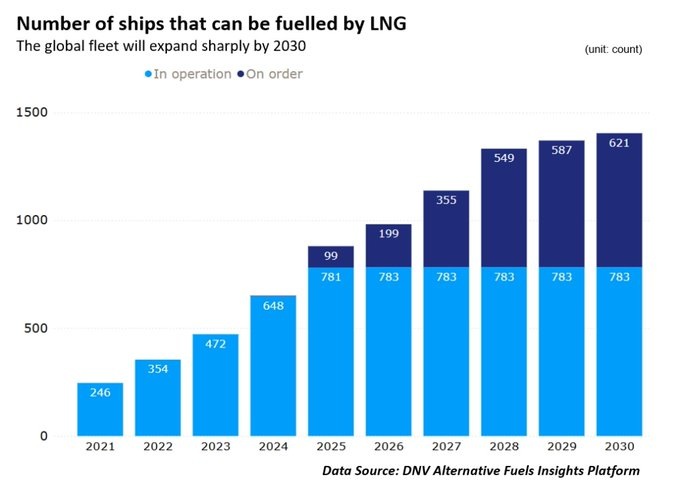

While power generation remains the dominant consumer of natural gas, its use in shipping—primarily as LNG bunker fuel—is growing but still niche.In 2025, global LNG bunkering volumes are set to exceed 4 million tons, potentially doubling by 2030 as shipping decarbonizes under IMO regulations.

The LNG bunkering market is valued at about $2.9 billion this year, projected to skyrocket to $46.5 billion by 2034 at a 35.9% CAGR, driven by new LNG-fueled vessels.

However, this represents a small slice: maritime LNG use accounts for roughly 1-2% of total global LNG demand, with port power (including shore-based) at about 7% of the shipping industry’s energy needs.

In contrast, electrical generation gobbles up around 40% of global natural gas supply, per IEA data, making it the largest sector.

In 2024, gas-fired electricity hit a 23% share globally, up 2.5% year-over-year.

The turbine shortage hits here hardest, as delays in new plants could shift reliance elsewhere. Shipping’s LNG demand, while rising, is less affected since it doesn’t rely on turbines for propulsion but on direct fuel use.

Natural Gas Replacing Coal: Progress and Setbacks

One of gas’s strongest environmental credentials is its role in phasing out coal, which emits roughly twice the CO2 per unit of energy. Globally, coal-to-gas switching has been a key emissions reducer, especially in the U.S., where it could immediately supplant two-thirds of coal generation.

In 2024, U.S. gas generation rose 3.3%, meeting demand growth alongside renewables rather than directly replacing coal.

Worldwide, however, the picture is mixed. Coal capacity climbed to 2,175 GW in 2024, up 259 GW since the 2015 Paris Agreement, mostly in China.

That year saw 44 GW of new coal plants added, versus 52 GW of gas-fired capacity.

The IEA notes final investment decisions for new gas plants outpacing coal in recent years, but the turbine shortage threatens this momentum.

In developing Asia, where coal dominates, gas is positioned as a cleaner bridge, but shortages could extend coal’s lifespan, boosting emissions.

Resources for the Future’s Global Energy Outlook 2025 projects flat or growing gas electricity under evolving policies, highlighting its transitional importance.

Weighing the Environmental Impact

So, is the gas turbine shortage good for the environment? It’s a double-edged sword. On one hand, it could accelerate renewables by making gas less viable, as seen in NextEra Energy’s push for batteries as a “critical bridge.”And batteries have their own problems, and have yet to have a good recycling plan for the end of life of the batteries that only last a couple of years. That in itself creates a huge ecological problem that nobody is talking about.

Methane leaks are controlled, and gas cuts pollution compared to coal. On the other hand, in coal-heavy regions, it might entrench dirtier power, undermining climate goals. As global demand for natural gas steadies and LNG expands, the shortage spotlights the need for diversified energy strategies. Policymakers must incentivize renewables and efficiency to ensure this hiccup doesn’t become a climate setback. For now, the jury’s out— but watching developing markets will be key.

The complex problem we face is that we need more power at a lower cost for consumers while minimizing the environmental impact. The balancing act between climate activists relying on inaccurate science and market-driven supply chain issues will drive the solution. We have seen the world responding to President Trump’s “Shark Week” type presentation at the UN, denouncing climate change and warning the globalist leaders to stop putting their faith in “renewable wind and solar”. And the markets responded to this public call out of the climate fear mongering and are accelerating a shift on Wall Street and global investments away from wind, solar, and hydrogen. As the money dries up for climate alarmism support, we will see good old market forces start to drive solutions. The fallout will be a tough few years as it gets sorted out.

The survivors in the financial markets will be those investing in companies with good management and have a plan to navigate regulations, consumer demand, and the supply chain changes. Like the company Liberty Energy, headed up by Ron Gusek, CEO, on the Energy News Beat podcast with Stu Turley, covered how a company starting as an oil and gas oilfield service company can shift to power generation and data center, while maintaining its focus. Look for great leaders in companies that will help with your investment dollars.

Got A Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Be the first to comment