In a landmark move to sever its remaining energy ties with Moscow, the European Union has agreed on a phased ban on Russian natural gas imports, effectively aiming to end all such supplies by the end of 2027. This decision comes amid ongoing geopolitical tensions stemming from Russia’s invasion of Ukraine in 2022, which prompted the EU to accelerate its diversification away from Russian energy under the REPowerEU plan. While the bloc has already drastically reduced its reliance on Russian gas—from over 40% of imports in 2021 to around 18% in 2024—the new regulation targets the complete elimination of the remaining flows, including both pipeline gas and liquefied natural gas (LNG).

Breaking Down the EU’s Announcements

The EU Council’s agreement, finalized on October 20, 2025, outlines a legally binding, stepwise prohibition on Russian gas imports. Key provisions include:

Immediate Ban with Transition Periods: Imports of Russian gas will be prohibited starting January 1, 2026, but with allowances for existing contracts. Short-term contracts signed before June 17, 2025, can continue until June 17, 2026, while long-term contracts may run until January 1, 2028. This transition is designed to give member states, particularly landlocked ones like Hungary and Slovakia that still depend on Russian supplies, time to adjust without abrupt disruptions.

Full Ban by 2028: A complete prohibition on all Russian natural gas imports—pipeline and LNG—takes effect from January 1, 2028. Amendments to contracts are strictly limited to operational needs and cannot increase volumes, ensuring no loopholes for expanded supplies.

Customs and Authorization Mechanisms: To enforce the ban, the regulation introduces rigorous customs procedures. Importers must provide proof that gas is non-Russian at least five days before entry into EU territory, with stricter requirements for any transitional Russian supplies (submitted one month in advance). Mixed LNG cargoes must document the shares of Russian and non-Russian gas, allowing only the latter into the EU. The European Commission will compile a list of exempt countries within five days of the regulation’s entry into force.

National Diversification Plans: All EU member states must submit plans detailing how they will diversify gas supplies and address potential challenges. Exemptions apply to countries already free of Russian imports. Similar plans are required for oil imports, with a goal to end those by January 1, 2028.

Monitoring and Review: Enhanced information sharing among national authorities, the EU Agency for the Cooperation of Energy Regulators (ACER), and the Commission will track compliance. The Commission must review the regulation’s effectiveness within two years, and a suspension clause allows temporary lifts in case of severe supply disruptions.

This framework builds on earlier efforts, such as the end of Russian gas transit through Ukraine on January 1, 2025, which further curtailed pipeline flows. EU energy ministers emphasized that the move not only bolsters energy security but also prevents Russia from using gas as a geopolitical tool to manipulate prices and supplies.

Financial Impact on the EU: The High Cost of Switching to LNG

The EU’s decision to phase out Russian gas comes at a significant financial price, as the bloc shifts toward more expensive alternatives like LNG from suppliers such as the United States, Norway, and Qatar. Pre-crisis, Russian pipeline gas was a bargain for Europe, often priced at around €200-€300 per thousand cubic meters (tcm) under long-term contracts. In contrast, LNG imports—now comprising a record share of EU gas supplies—have been trading at double those levels or more, with the European benchmark Title Transfer Facility (TTF) price hovering around €60 per megawatt-hour (equivalent to about €600/tcm) in late 2025, roughly twice pre-2022 averages.

EU gas imports from Russia have already plummeted from 150 billion cubic meters (bcm) in 2021 to about 54 bcm in 2024, but the remaining volumes still represent a cost-saving for some member states compared to global LNG spot prices.

Replacing these with LNG could add billions to the EU’s energy bill. For instance:In the first seven months of 2025, the EU paid €5.1 billion for Russian LNG alone, up from €4 billion in the same period of 2024, despite overall import volumes being lower.

Total Russian gas imports (pipeline and LNG) cost the EU around €10 billion annually in 2025, based on monthly figures averaging €800 million.

Economic analyses suggest that a full embargo on Russian gas could double the welfare costs for the EU, exacerbating price volatility and requiring substantial infrastructure investments in LNG terminals and regasification capacity.

The shift has already driven up household and industrial energy costs, with gas prices expected to rise further in late 2025 due to tight supplies and competition from Asia.

Overall, the EU’s diversification strategy has succeeded in reducing dependency, but at the expense of affordability. By 2028, when the ban is fully enforced, the bloc could face an additional €20-30 billion in annual energy costs if LNG prices remain elevated, though renewables and efficiency measures may mitigate some of this burden in the long term.

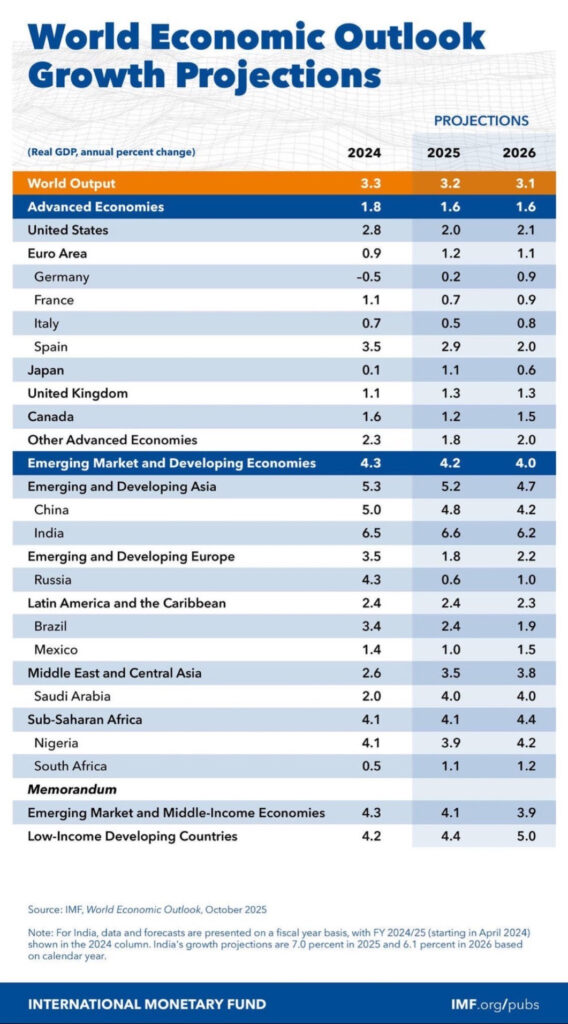

Below is the World Economic Outlook Growth in GDP projections.

Russia’s Response: Can the Power of Siberia 2 Pipeline Offset Revenue Losses?

For Russia, the EU ban represents a further blow to its gas export revenues, which have already declined sharply. In 2024-2025, Russia’s natural gas sales to Europe generated around €10-12 billion annually, down from over €50 billion pre-2022.

With volumes at about 28 bcm in the first nine months of 2025, the full phase-out by 2028 could erase this revenue stream entirely.

To pivot eastward, Russia is banking on the Power of Siberia 2 (PoS-2) pipeline, a proposed 2,600-kilometer link from Western Siberia’s Yamal region through Mongolia to northern China. Designed to carry up to 50 bcm annually, PoS-2 could potentially generate $10-15 billion in yearly revenue for Russia, assuming prices around $200-250/tcm—lower than historical EU rates but sufficient to partially offset losses.

Combined with the existing Power of Siberia 1 (delivering 38 bcm in 2025 and expanding to 56 bcm), total exports to China could exceed 100 bcm by the 2030s, rivaling pre-war EU volumes.

However, PoS-2’s rollout is far from swift. A legally binding memorandum was signed during President Putin’s visit to China in September 2025, but critical terms like pricing, investment, and timelines remain unresolved after years of talks.

If finalized by the end of 2026, construction could take five years, with initial deliveries starting in late 2030 or 2031. Reaching half capacity (25 bcm) might not occur until 2034-2035, with full ramp-up taking another few years.

This timeline means PoS-2 won’t immediately cushion the EU ban’s impact, leaving Russia with a revenue gap through the late 2020s. Challenges include Mongolia’s surveys (ongoing in 2024-2025), China’s leverage in negotiations for lower prices, and potential geopolitical hurdles.

While PoS-2 represents Russia’s strategic pivot to Asia, its delayed payoff underscores the long-term economic strain from losing the European market. So with one customer moving away, it appears that there will be others that Russia does business with to make up for the lost revenue stream.

In summary, the EU’s gas ban marks a decisive step toward energy independence, but at a steep financial cost amid higher LNG prices. Energy Secuity starts at home and the EU, may want to look at restarting Germany’s nuclear Reactors to buy less LNG. For Russia, PoS-2 offers a lifeline, yet its slow progress— with deliveries unlikely before 2031—means the revenue offset will come too late to fully mitigate the immediate losses. As global energy dynamics shift, both sides face uncertain transitions in the years ahead.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack