In a bold escalation of its campaign against Russian energy assets, Ukraine’s military claimed responsibility for a drone strike on Rosneft’s Ryazan oil refinery, one of Russia’s largest facilities, on November 15, 2025. This attack is part of Kyiv’s strategy to disrupt Moscow’s oil revenues, which fund the ongoing war. The Ryazan refinery, located southeast of Moscow and processing around 340,000 barrels per day, was hit overnight, triggering multiple explosions and a significant fire in at least one processing unit. Local authorities attributed the blaze to “falling debris” from intercepted drones, but Ukrainian sources confirmed the operation as a success in degrading Russian fuel production capabilities.

Damage Reports

Reports indicate the strike caused a fire in a key facility at the refinery, leading to visible smoke and flames. While the full extent of structural damage remains unclear—Russian officials downplayed it as minimal—the incident forced a temporary suspension of operations at affected units. Satellite imagery and eyewitness accounts suggest damage to storage tanks and processing equipment, consistent with previous Ukrainian drone attacks that have targeted distillation columns and fuel depots. No casualties were reported, but emergency services were deployed to contain the blaze.

Impact on Refinery Output

The Ryazan refinery, Rosneft’s fourth-largest, has seen its output disrupted, with estimates suggesting a short-term reduction of up to 20-30% in processing capacity while repairs are underway. Russia has mitigated broader impacts by tapping into spare refining capacity elsewhere, but repeated strikes like this have cumulatively knocked out around 38-40% of Russia’s total oil refining capacity as of October 2025. This particular attack could reduce daily output by tens of thousands of barrels, exacerbating seasonal fuel shortages as winter approaches.

Potential Impact on Consumers

Russian consumers are bearing the brunt of these disruptions, with fuel shortages leading to long queues at gas stations and price increases of about 10% for gasoline and diesel in affected regions. The Ryazan facility supplies much of central Russia’s petroleum products, so delays could ripple into higher heating costs during the cold season. Globally, while Russia’s oil exports remain robust, such strikes contribute to market volatility, potentially pushing Brent crude prices higher if supply fears intensify. However, Russia’s ability to reroute exports has limited immediate worldwide effects, though prolonged campaigns could tighten diesel and gasoline supplies in Europe and Asia.

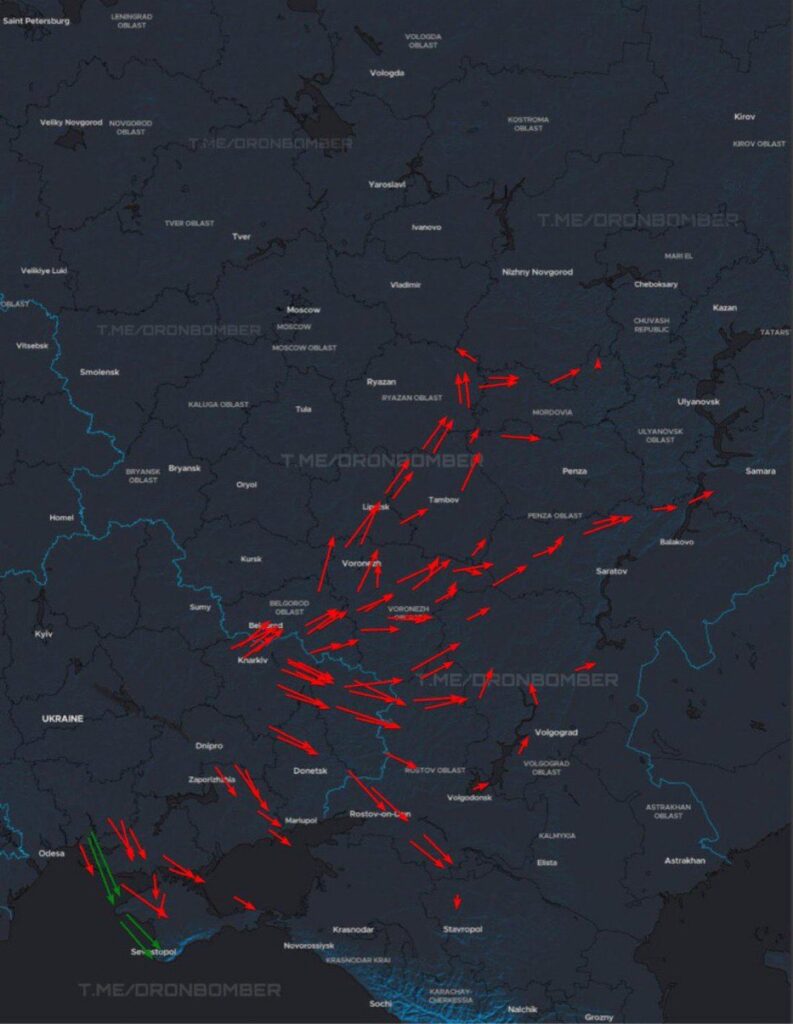

As both sides intensify attacks on energy infrastructure, the tit-for-tat strategy risks deeper economic fallout. Below, we outline key strikes in 2025, focusing on damage, local impacts, and global market repercussions. Note that no confirmed Ukrainian strikes on Russian energy infrastructure in foreign countries (e.g., Belarus or other allies) were reported in 2025, with all incidents occurring within Russian territory.

Ukraine Strikes on Russian Energy Infrastructure in 2025

Ukraine has conducted dozens of drone attacks on Russian refineries and depots, aiming to curb Moscow’s war funding. Here’s a selection of notable incidents:

January 24: Ryazan Refinery – Fire damaged processing units; output reduced temporarily. Contributed to early-year fuel price spikes in Russia; minimal global impact but signaled escalating campaign.

January 29: Nizhny Novgorod Oil Facility – Fire reported; minor disruptions to local supply. Part of broader efforts to reduce Russian refined product exports by up to 20% year-over-year.

February 3: Astrakhan Gas Plant – Fire caused an operational halt; affected gas processing. Tightened regional energy supplies, with indirect pressure on global LNG markets.

February 19: Syzran Refinery – Fire damaged infrastructure; output down 15-20%. Led to local shortages; global diesel prices edged up amid supply concerns.

March 14: Tuapse Refinery (Krasnodar Region) – Flames and thick smoke from two strikes; significant repairs needed, reducing capacity by 25%. Contributed to Russia’s refining throughput falling below 5 million bpd, tightening Asian markets.

July (Multiple): Ryazan, Kirishi, Nizhny Novgorod, Volgograd, Saratov Refineries – Repeated hits caused fires and shutdowns; collective output loss of ~600,000 bpd compared to prior year. Gasoline down 25%, diesel 20%; global effects included tighter supplies in Europe.

August 13-14: Volgograd Refinery – Multiple drones caused damage, but were fully repaired; temporary halt. Part of 58+ attacks since August, knocking out 38% of capacity overall.

September (Multiple): Ryazan, Kirishi, Nizhny Novgorod, Volgograd, Saratov Refineries – Fires and smoke; diesel deficits risked for winter. Global: Potential shortages in Asia’s heating season.

November 3 & 11: Saratov Refinery – Strikes led to a full operational stoppage; major output loss. Fuel queues and 10% price hikes in Russia; minor global volatility.

November 14: Novorossiysk Oil Depot – Damaged berths and tanker; halted exports equivalent to 2% of global oil supply. Oil prices rallied >2%; disrupted Black Sea shipments.

November 15: Ryazan Refinery – Fire and suspension; reduced capacity. Ongoing shortages contribute to market uncertainty.

Overall, these strikes have forced 38-40% of Russian refining offline, leading to domestic fuel crises and global price fluctuations of 2-5% during peaks.

Russian Strikes on Ukrainian Energy Infrastructure in 2025

Russia has ramped up assaults on Ukraine’s power grid, gas facilities, and nuclear-related sites, aiming to cripple the economy ahead of winter. Key incidents include:Early 2025 (January-March): Gas Production Facilities – Targeted eastern sites; 40% of capacity damaged. Led to 6-10% drop in output; blackouts affected millions, with global concerns over European gas transit disruptions.

March-April: Thermal Power Plants and Grids – Strikes on TPPs like Burshtyn and Ladyzhyn; over 4 GW lost. Widespread outages; economic losses in billions, nuclear safety risks highlighted globally.

July 3-4: Nationwide Airstrikes – Record drone launches targeting power grids; damage in Kyiv and beyond. Power shortages, civilian casualties, and amplifying humanitarian concerns.

October 23: Massive Drone/Missile Barrage – 405 drones and 28 missiles hit energy sites; substations damaged. Millions without power; global oil/gas prices stable but nuclear oversight increased.

October 30: Nuclear Power Substations – Hits on Khmelnytskyi and Mykolaiv NPP feeders; temporary disconnections. Risked meltdowns; international alarms over radiation threats.

October 31: Large-Scale Combined Strike – Targeted energy infrastructure; civilian facilities damaged, 11 energy workers killed/injured in 2025. Deepened blackouts; the UN noted civilian hardship, potential refugee flows affecting Europe.

November 8: Missile/Drone Assault – Hit key facilities including nuclear substations in Kyiv, Poltava, Kharkiv; thousands without power/water, 7 killed. Generating capacity near zero in some areas; global markets monitored for energy ripple effects.

November 10: Wave of Attacks – Energy sites struck; scheduled outages nationwide. Millions in dark/cold; economic strain, with indirect pressure on EU energy security.

November 14: Kyiv Region Strike – Damaged critical infrastructure; at least 1 injured, 6 killed overall. Further blackouts; heightened global nuclear concerns.

Cumulatively, Russia has destroyed or damaged 80% of Ukraine’s thermal capacity and halved power generation, causing rolling blackouts for 8+ million people and $14.6 billion in losses. Global impacts include heightened nuclear risks and potential disruptions to residual gas flows to Europe, though self-sufficiency measures have mitigated broader effects.

It will be a great day when the war is over and the killing can stop.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack