In an era when energy independence is paramount to national security, California’s aggressive push to phase out fossil fuels under Governor Gavin Newsom has created a precarious situation. Refineries are shuttering, fuel shortages loom, and the Golden State is increasingly reliant on imports—including jet fuel from India, much of which is refined from Russian crude. This dependency not only undermines U.S. energy resilience but also indirectly bolsters adversaries amid global tensions. Enter Phillips 66’s proposed Western Gateway Pipeline: a bold initiative to reroute refined products from Texas and the Midwest directly to the West Coast, turning a crisis into an opportunity for domestic supply chains. With strong bipartisan support and a target completion date of 2029, this pipeline isn’t just infrastructure—it’s a lifeline that needs to be fast-tracked yesterday.

The Fallout from California’s “War on Oil”Governor Newsom’s environmental policies have been hailed by some as progressive, but they’ve decimated California’s refining capacity. The state, once a powerhouse in oil production, has seen major closures: Phillips 66’s Los Angeles refinery (139,000 barrels per day) shut down in late 2024, and Valero’s Benicia facility (145,000 bpd) is slated to end operations by April 2026.

These moves represent a 17-20% drop in regional capacity, forcing California to look abroad for essentials like jet fuel.

The irony is stark: California, which banned new oil and gas leases and imposed strict emissions rules, now imports jet fuel from India—cargo that often originates from Russian oil. In November 2025, India exported its first-ever jet fuel shipment to the U.S. West Coast for Chevron, filling gaps left by a fire at Chevron’s El Segundo refinery and broader closures.

India sources about 35% of its crude from Russia, meaning Californians are unwittingly fueling Moscow’s economy while decrying fossil fuels at home.

This isn’t just hypocritical; it’s a national security risk. Dependence on foreign supply chains, especially from geopolitically volatile regions, exposes the U.S. to disruptions that could cripple aviation, military operations, and everyday transport.

The ripple effects extend beyond California. Oregon Governor Tina Kotek has sounded the alarm on potential fuel shortages and price spikes in Portland, where the state relies on imports for its 100,000 bpd demand.

Oregon has no in-state refineries and limited storage (just 10-15 days’ worth), making it vulnerable to any hiccup—like the September 2025 Olympic Pipeline shutdown that already drove prices up. Washington State, which supplies 90% of Oregon’s gasoline via its five refineries, faces similar threats from its own net-zero mandates by 2050, potentially halving output and leading to massive job losses.

Kotek’s panic underscores a regional crisis: without action, families could see gas prices triple to $8-$10 per gallon, adding $2,000-$3,000 annually to household costs.

The Western Gateway Pipeline: A Domestic Solution

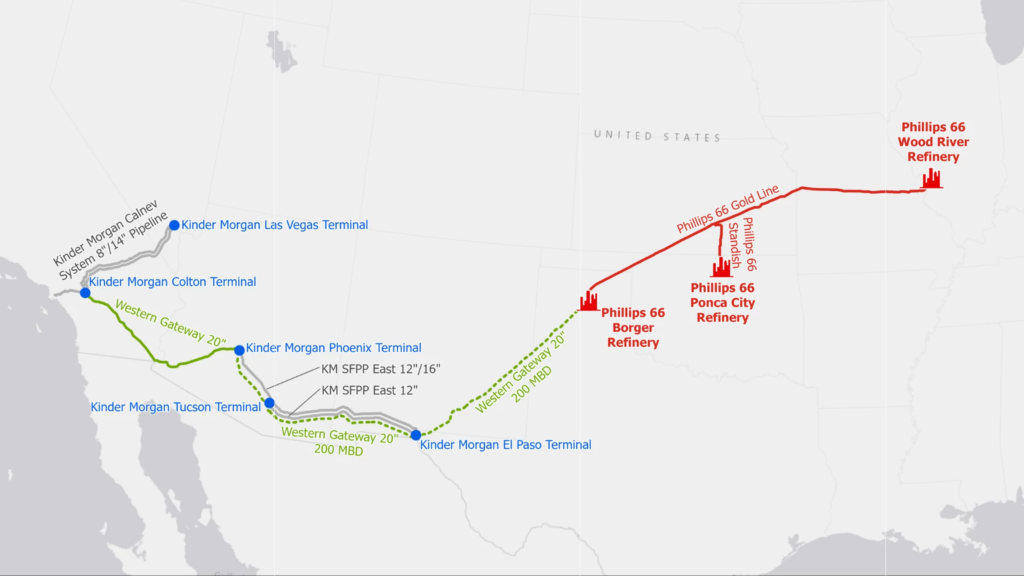

Phillips 66, in partnership with Kinder Morgan, is stepping up with the Western Gateway Pipeline—a 1,300-mile system designed to transport gasoline, diesel, and jet fuel from Midwest refineries to Arizona and California.

The project involves building a new pipeline from Borger, Texas, to Phoenix, Arizona, reversing Kinder Morgan’s existing Santa Fe Pacific Products West Line for east-to-west flows into California, and flipping Phillips 66’s Gold Pipeline to feed the system at Borger.

If realized, it could become the world’s largest refined products pipeline, easing high fuel costs in the West by bolstering supply from domestic sources.

Support is robust: The Trump Administration, state officials in surrounding regions, and local communities—including the Mescalero Apache in New Mexico—have backed the initiative.

The binding open season, which ended on December 19, 2025, progressed well, with Phillips 66 committing as a major shipper.

This enthusiasm reflects the pipeline’s potential to stabilize prices and reduce reliance on costly Asian imports, which come with month-long shipping delays and $40 per barrel premiums.

Timeline and Economic Boost for Texas

Construction could take 3-4 years, with Phillips 66 eyeing a 2029 in-service date—assuming regulatory hurdles are cleared swiftly.

In a world of permitting delays, this timeline is ambitious but feasible with federal support, especially given the national security stakes. Delays aren’t an option; as Kotek’s concerns highlight, military fuel supplies could be jeopardized without reliable domestic flows.

For Texas refineries, the revenue upside is significant. The pipeline opens West Coast markets—where prices are premium due to scarcity—to Texas producers. Phillips 66, with origins in Borger, stands to gain by shipping substantial volumes, potentially boosting midstream EBITDA through expanded NGL and pipeline projects.

While exact figures aren’t public, the project’s scale suggests billions in annual revenues: Texas refineries could see increased utilization, exporting 200,000 bpd or more to high-margin areas like California.

This not only revives U.S. refining but also creates jobs and economic growth in the heartland.

Why This Pipeline Must Be Built Now

The Western Gateway isn’t a luxury—it’s essential. Newsom’s policies have succeeded in curbing domestic production, but at the cost of energy security. Importing Russian-sourced fuel via India while refineries idle is untenable in a multipolar world. By connecting Texas’s abundance to the West Coast’s needs, this pipeline restores balance, safeguards against shortages, and bolsters national defense. Policymakers must prioritize approvals; the alternative is more panic, higher prices, and weakened sovereignty. The time to act was yesterday—let’s build it today.

We will be tracking this, and the companies involved as investors are looking to invest in energy security projects in the United States.

Energy Security starts at home, and we do not need to buy jet fuel, gasoline, or diesel from India that was sourced from Russia, Iraq, or Venezuela. Just saying.

Sources: energynewsbeat.co, rbnenergy.com, oilprice.com, californiaenergyforall.com

Want to get your story in front of our massive audience? Get a media Kit Here. Please help us help you grow your business in Energy.