As the world grapples with the dual challenges of energy security and climate change, nuclear power is experiencing a renaissance. With net-zero goals looming large, countries are ramping up investments in clean, reliable baseload energy. According to the latest data, approximately 70 nuclear reactors are under construction globally, representing a total gross capacity of around 78 gigawatts electric (GWe).

This surge marks one of the highest levels of activity since the 1990s, driven largely by ambitious projects in emerging markets. But amid this global push, one region stands out: Asia. Home to the majority of these developments, Asia is not just participating in the nuclear revival—it’s leading it.

Global Nuclear Construction: A Snapshot

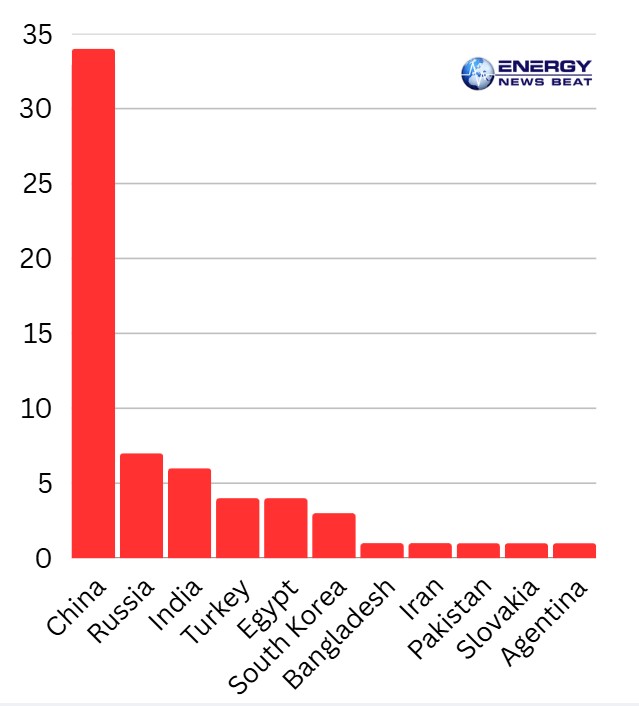

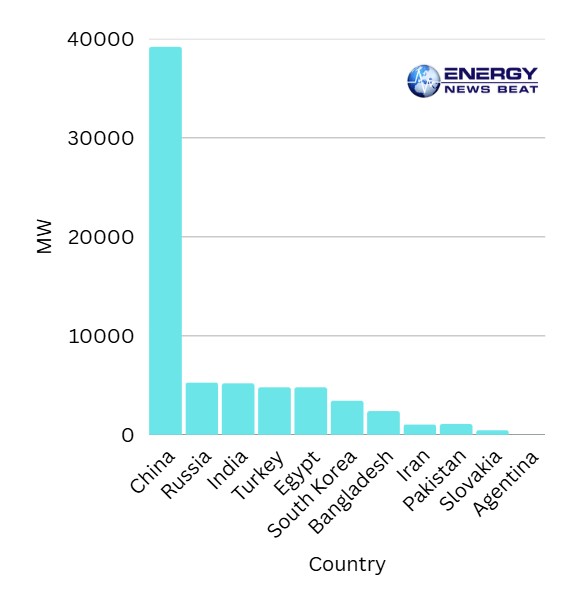

The current wave of nuclear construction is a testament to the technology’s enduring appeal. These projects span 15 countries, with timelines varying from a few years for advanced modular designs to over a decade for large-scale reactors. The focus is on Generation III+ reactors, which emphasize enhanced safety, efficiency, and waste reduction. While Europe and North America are seeing selective restarts and extensions of existing plants, new builds are predominantly elsewhere.To illustrate the distribution, here’s a breakdown of reactors under construction by country, based on the most recent figures:

Total Capacity MWe

Asia’s dominance is unmistakable. China alone accounts for nearly half of all reactors under construction, with India, South Korea, Bangladesh, Pakistan, and Iran adding significant numbers. If we include Turkey (often categorized in Asia for energy discussions), the region boasts over 70% of global projects.

This isn’t just about quantity; it’s about scale and speed. China’s state-backed programs allow for rapid deployment, often completing reactors in under five years. India’s focus on indigenous pressurized heavy water reactors (PHWR) supports energy independence, while South Korea’s APR1400 design is gaining export traction.In contrast, Western projects like the UK’s Hinkley Point C face delays and cost overruns, highlighting Asia’s edge in execution. Geopolitical factors play a role too—Russia’s Rosatom is exporting its VVER technology to several Asian and Middle Eastern nations, further cementing the region’s lead.Key Companies Driving the BoomThe nuclear construction landscape is shaped by a handful of powerhouse companies specializing in design, engineering, and equipment installation. These firms handle everything from reactor vessels and steam generators to turbines and control systems. Here’s a look at the major players, with a focus on their roles in ongoing projects:China National Nuclear Corporation (CNNC) and China General Nuclear Power Group (CGN): These state-owned giants are at the heart of China’s 34 reactors. CNNC leads on Hualong One designs, while CGN collaborates on CAP1400 units. They’re also exporting, as seen in Pakistan’s Chashma 5 project.

As non-public entities, direct earnings aren’t available, but their government support ensures steady funding.

Rosatom (Russia): A global exporter, Rosatom is involved in 7 domestic reactors and international projects in Turkey (Akkuyu), Egypt (El Dabaa), Bangladesh (Rooppur), Iran (Bushehr), and India’s Kudankulam.

As a state corporation, it doesn’t report traditional earnings, but its backlog exceeds $140 billion, signaling robust growth.

Korea Hydro & Nuclear Power (KHNP): A subsidiary of Korea Electric Power Corporation (KEPCO), KHNP is building South Korea’s three APR1400 reactors and eyeing exports.

It’s known for cost-effective, on-time delivery.

Électricité de France (EDF): Leading the UK’s Hinkley Point C with EPR reactors, EDF provides engineering and equipment for large-scale projects.

On the equipment side, specialized vendors include:

GE Vernova: Supplies steam turbines, generators, and nuclear services. Involved in various global projects through partnerships. See the Chart Below.

Doosan Enerbility: A Korean firm manufacturing heavy components like reactor vessels and turbines for APR1400 and other designs.

BWX Technologies (BWXT): US-based, focuses on nuclear components, fuel, and naval reactors, with growing commercial involvement. This stock is currently overvalued and has a current value price of $93.29, and has a current price of $175.13.

Earnings Insights: What Investors Should Watch

For investors eyeing nuclear growth, public companies offer entry points. Focus on revenue from nuclear segments, order backlogs, and margins amid rising demand. Here’s a rundown of recent earnings for key players, highlighting investor signals:EDF: In H1 2025, EDF reported an EBITDA improvement despite falling market prices, with positive cash flow of €5.3 billion from reduced receivables.

Investors should monitor nuclear output and regulatory support in France and the UK—strong backlog in new builds could boost long-term revenue, but debt levels (net financial debt at €54.2 billion) warrant caution.

KEPCO (Parent of KHNP): Q3 2025 showed a consolidated operating profit of KRW 11.5 trillion and net profit of KRW 7.3 trillion, driven by stable power sales.

Look for export wins; KEPCO’s EPS for 2025 (TTM) is $4.34.

Rising Asian demand could enhance its nuclear arm’s contribution, but energy price volatility is a risk.

GE Vernova: For 2025, guidance points to $36-37 billion in revenue (trending high) and 8-9% adjusted EBITDA margin.

Q4 EPS is expected at $2.99, up 72.8% year-over-year.

Investors: Watch nuclear services growth amid small modular reactor (SMR) hype; diversification into renewables adds resilience.

Doosan Enerbility: Q3 2025 EBIT was KRW 783 billion (6.7% margin), with net income at KRW 455 billion.

2025 TTM earnings: $0.26 billion.

Key metric: Backlog covers 92% of FY25 sales plan.

Nuclear orders from Korea and potential exports signal upside.

BWX Technologies: Q3 2025 revenue hit $866.3 million, with net income of $82.2 million and adjusted EBITDA of $150 million.

Double-digit organic growth; consensus 2025 EPS: $3.80.

Investors: Naval contracts provide stability, but commercial nuclear expansion (e.g., microreactors) could drive premiums.

As of December 29, 2025, there are no large-scale commercial nuclear power reactors under construction in the United States.

The last new commercial reactors were Vogtle Units 3 and 4 in Georgia (both Westinghouse AP1000 designs), which completed construction and entered commercial operation in 2023 and 2024, respectively.

However, some advanced small modular or non-commercial demonstration reactors have begun limited construction activities:

Kairos Power’s Hermes (a low-power fluoride salt-cooled test reactor) at Oak Ridge, Tennessee — the only SMR explicitly described as under construction in recent reports, with a construction permit issued and work ongoing, aimed for operation around 2030.

Early non-nuclear site preparation has started for projects like TerraPower’s Natrium demonstration in Wyoming.

Large-scale new builds remain in planning, permitting, or announcement stages, with goals set for starting construction by 2030 under recent policy initiatives. Globally, this contrasts sharply with Asia’s dozens of ongoing projects. The U.S. focus is shifting toward advanced reactors, but no full-scale commercial units are currently being built.

Looking Ahead: Opportunities and Challenges

Asia’s nuclear surge positions it as the epicenter of clean energy growth, potentially adding terawatts of carbon-free power by 2040. For investors, the sector offers diversification beyond renewables, with stable dividends from utilities and growth from equipment makers. However, watch for supply chain bottlenecks, regulatory hurdles, and geopolitical tensions—especially with Rosatom’s dominance.

In summary, as nuclear power rebounds, Asia’s lead underscores a shift in global energy dynamics. Whether through direct investments in companies like GE Vernova or KEPCO, or broader ETFs, the nuclear narrative is one of resilience and potential.

Investment from the U.S. Federal Government is required at this point, and should come through low-cost loans to help kickstart the U.S. Energy Dominance in the Nuclear sector.

Stay tuned to Energy News Beat for more updates on this evolving story.

Sources: world-nuclear.org, nasdaq.com, investors.bwxt.com, doosanenerbility.com, marketscreener.com, finance.yahoo.com