Jerry James, President of Artex Oil Company and an Executive Committee Member of Shale Crescent USA, stops by the Energy News Beat Podcast to share insights on the reindustrialization of the United States. With new electricity demands from AI, Data Centers, and the reindustrial movement from the Trump Adminstration, backed by huge investments from other countries, the United States is where companies and governments are looking to invest.

The trend that Jerry brings up that is so critical is the need for manufacturing to be placed near the power source, and Natural Gas is crucial for manufacturing. Jerry is also spot on, as he points out that you “Can Not Break the Grid” when adding massive amounts of energy sources. It has to be done correctly. As Stu Turley has pointed out, the Grid has to obey the laws of physics and fiscal responsibility.

Key Topics include:

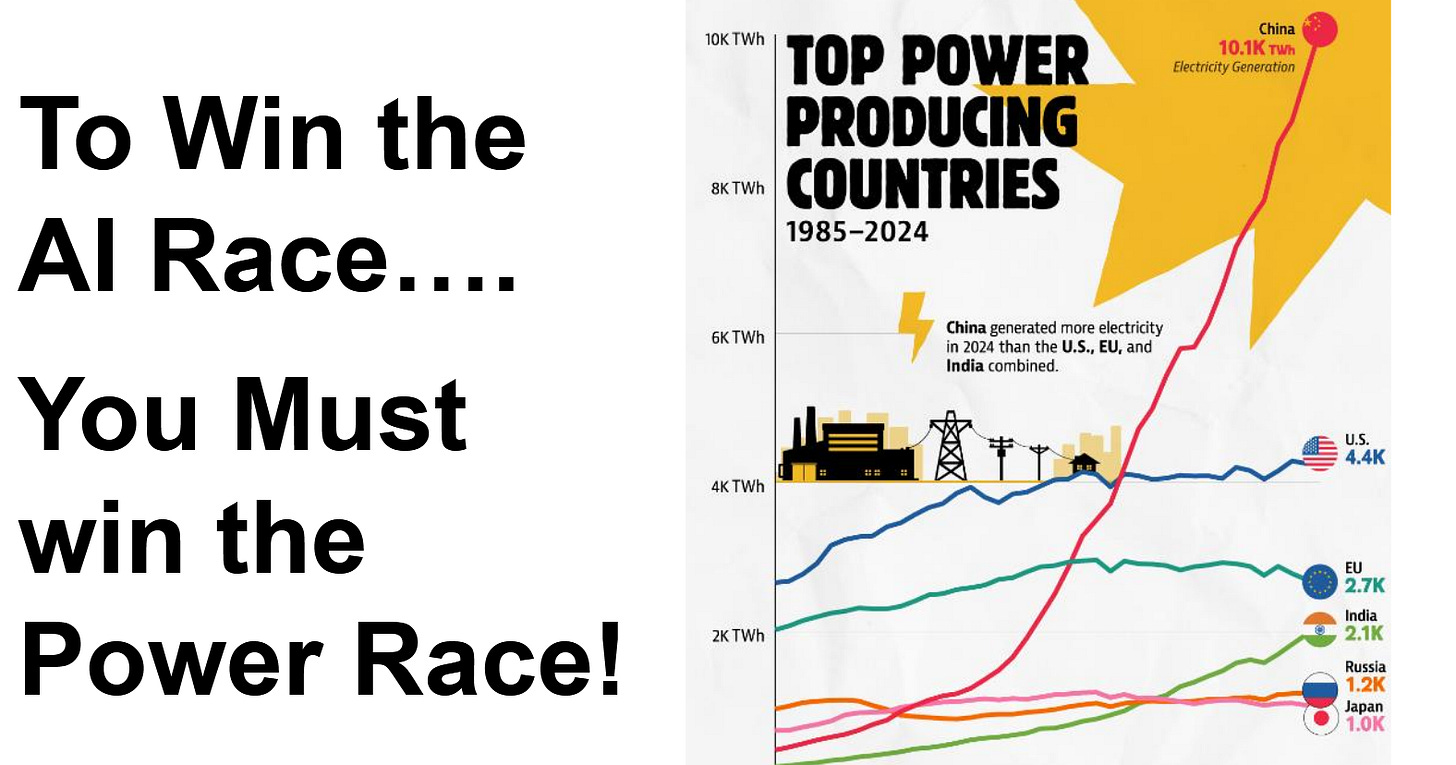

The growth of China’s electricity production and its implications for the US in terms of national security and the AI race. The transcript discusses how China has surpassed the US in electricity production and how this is a national security concern.

The reliability and affordability of the US electricity grid. The transcript discusses a Department of Energy study that projects a hundredfold increase in blackouts by 2030 if the current grid is not improved. It also discusses the impact of the 2022 Texas blackouts.

The history of energy shortages in the US, particularly the natural gas shortages in the 1970s, and the lessons that can be applied to the current situation.

The connection between US manufacturing jobs and energy production. They discuss how US manufacturing jobs have declined in parallel with declines in US oil and gas production.

The growth in demand for natural gas and electricity, particularly from industrial and AI-related sources, and the challenges in meeting this growing demand.

The challenges in expanding the US energy infrastructure include the time and investment required to build new pipelines and power plants, as well as the regulatory and market structure issues that have hindered this expansion.

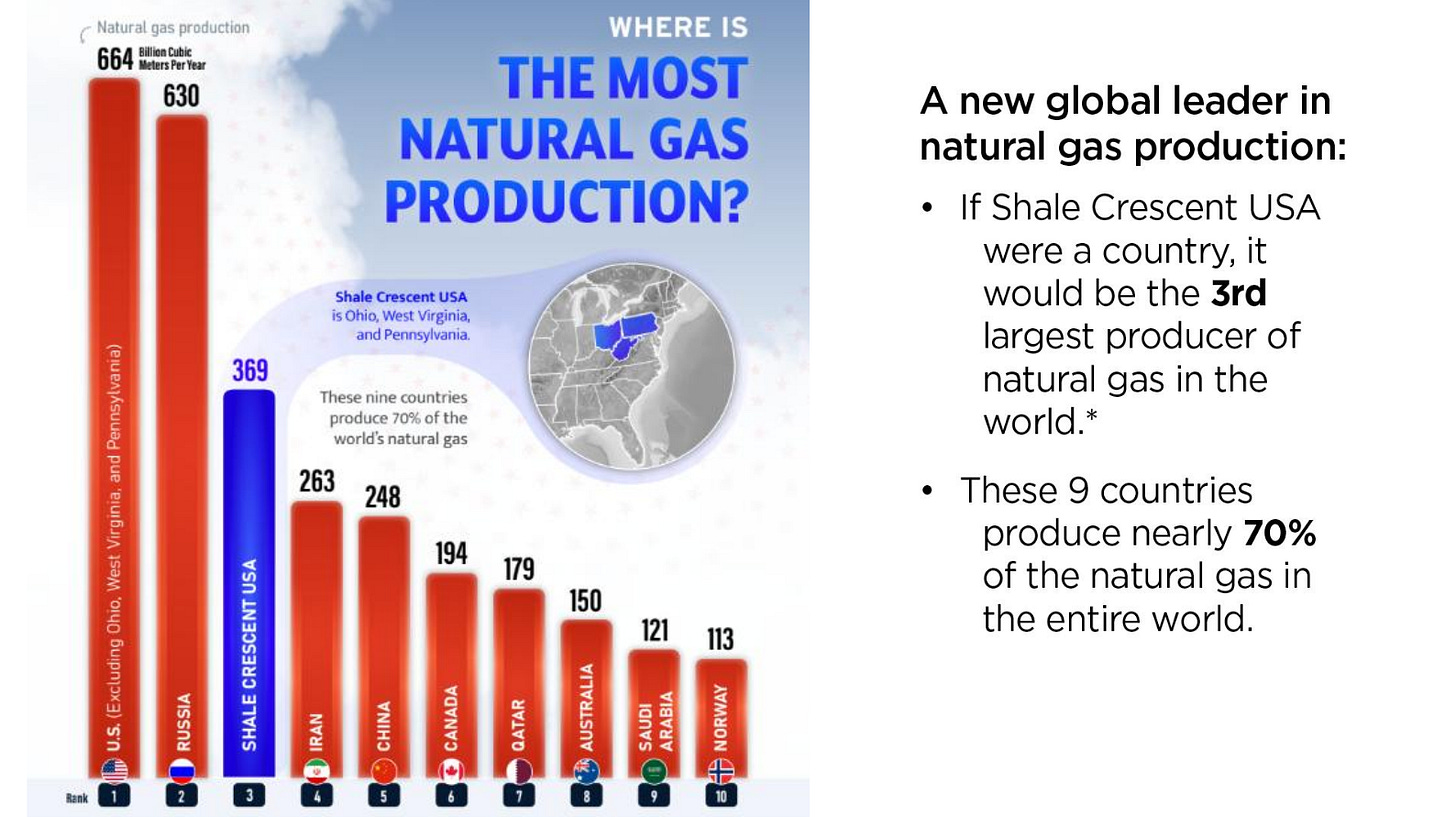

The energy advantages of the Appalachian region (Ohio, West Virginia, Pennsylvania) in natural gas production present opportunities for industrial growth and reindustrialization.

01:27 Introduction and Background

02:17 China surpasses the United States in electricity production

05:27 Don’t break the grid when updating

09:00 If you want speed to market, cut the cost of manufacturing

14:54 Interest rates and recessions

20:04 California was a major energy producer, but is now in a crisis

33:36 Spent billions on grid updates with huge increases to consumers.

49:58 Billion cubic feet of natural gas in the three states

51:54 Long-term contracts

To win the AI race, you have to wind the Power Race.

One critical part for the Trump Adminstration in the growth of Natural Gas.

We need a 3 billion cubic feet per day increase in the next five years. That is huge, and nobody is investing or talking with the oil companies.

To revitalize manufacturing, you have to look to low-cost energy.

Check out all the great work at the Shale Crescent USA https://shalecrescentusa.com/

Thank you for stopping by the podcast, Jerry! Your insights are critical to our United States industrial resurgence. – Stu

This is the first podcast from the Energy News Beat team in 2026, and it will help set the course for a great year. We ended 2025 with fantastic numbers, and FeedSpot ranked the Energy News Beat Podcast #3 globally in the top 70 Energy Podcasts to listen to. We want to thank all of our great guests, listeners, subscribers, and patrons.

We have a full lineup of CEOs in the Energy Space. Let us know if you need to get your story in front of our massive audience.

Full Transcript:

Stu Turley, Energy News Beat Podcast Host [00:00:06] Hello everybody, welcome to the Energy Newsbeat Podcast. My name’s Stu Turley, Presidency of the Sandstone Group. I got Jerry James here and we are absolutely ready for a wonderful discussion on US industrial expansion, national security and grid reliability. And we’ve had a heck of a talk getting in here. How are you today?

Jerry James, President, Artex Oil Company [00:00:27] Good, appreciate you inviting us today.

Stu Turley, Energy News Beat Podcast Host [00:00:29] I’ll tell you what, we just released out on the day we’re recording this. We released out a young man. You happen to know Nathan Lord. I’ll take what that was a heck of a podcast.

Jerry James, President, Artex Oil Company [00:00:40] Nathan does a wonderful job explaining the advantages of building industrial facilities in Ohio, West Virginia, and Pennsylvania.

Stu Turley, Energy News Beat Podcast Host [00:00:47] I’ll tell you, I’m going to brag on myself for half a second. You know, since my wife, we’ve been married 40 years. I have to brag because she won’t brag on me. Um, we released it this morning and he already got a big call.

Jerry James, President, Artex Oil Company [00:01:03] You get somebody wanting him to solve their problems. I’m not sure he may have to point to somebody else to solve her problems, but you got immediate response.

Stu Turley, Energy News Beat Podcast Host [00:01:11] Isn’t that fantastic? I absolutely love it. But well, tell us a little bit about what you do, Jerry, as we get rolling and getting ready to solve these problems. Cause we have got a huge list of international security issues to talk about.

Jerry James, President, Artex Oil Company [00:01:27] So I’m a petroleum engineer. I got into business 50 years ago. So I’ve been doing this just a little bit, but not even being a petroleum engineering, but I’m kind of a student of history and a little of energy history. Not an expert, but enough to realize that when you look at things, you can learn a lot by looking at the past. And because of that, and I’ve fortunate, did fairly well on my business side. I’ve volunteered for some groups or like energy education things or research like with Shale Press at USA, because I’m based here now in Marriott, Ohio. Even though I’ve worked offshore Louisiana, I’ve worked in. Texas and I worked out west Wyoming and stuff like that. So I’ve worked a few places and kind of try to bring all that experience and just see what we can help people understand on the energy side.

Stu Turley, Energy News Beat Podcast Host [00:02:07] Well, let’s go ahead and get rolling into some of your material here. And that is that you’ve, um, you were talking about China before we got rolling in here and what are you talking about on this one?

Jerry James, President, Artex Oil Company [00:02:17] Well, you know, when you look at this slide, and I got to give credit to a group that put this together, I think it makes a great point. You know, when you look back through history, most people don’t realize, but we really invented the modern energy business, whether it’s oil and gas or electricity. And so for the first 100 and over 100 homes, 150 years, we led an electricity production. But if you look at this slide and you follow the red line, that’s China. Well, 10 years ago, China passed us an electricity production. And now they produce two and a half times more electricity than we do. Well, why are we discussing electricity? We’ll get into the connection between it and natural gas in a little bit, but you hear quite a bit right now, but we’ve got to expand AI. Well, before you can win the AI race, you first have to win the electricity race and what most people miss is if you’re going to electricity race, you first got to win fuel supply race, which for the next decade is going to be natural gas. So we’ve gotta catch up with China. When you talk to people in D.C. They view this as a national security issue. They view AI as the next big opportunity, both militarily and industrial. And you can see how far we’re behind China on electricity generation. I should say one of the reasons we’re, behind is we’ve taken our eye off the reliability and affordability ball. China now burns half of the coal in the world is burnt in China. So they’ve grown their grip, it’s nuts. And while we focused merely on tripping in the last four years, you know we focused on merely on co2 reduction but if you look at co2 and in fact really is what concerns you all the co2 all the growth in co2 in the world now is coming from Asia. Asia’s two-thirds of the co 2 production in the world and the United States we’re only 12% of the CO2.

Stu Turley, Energy News Beat Podcast Host [00:04:04] You know, Jerry, the Great Wall of China does not keep smog and pollution in China.

Jerry James, President, Artex Oil Company [00:04:13] We’ve got to get, if we’re going to win the re-industrialization, if we’re gonna win the AI race, we’ve got a first focus on the energy solutions.

Stu Turley, Energy News Beat Podcast Host [00:04:22] Your next slide here talks about what the DOE says.

Jerry James, President, Artex Oil Company [00:04:25] Right. So we’ve got China over there with two and a half times more energy production, electricity production than we do. But a DOE just came out with a study a couple of months ago that said that if we don’t do anything on our current path, we’d be looking at a hundredfold increase in blackouts by 2030. And your viewers in Texas know how that was because of 2022. The blackout down there was severe. I think it was like $200 billion in damage. Right. And over 200 people were. So these blackouts are real serious things on the grid. If you notice, if we can keep our low growth on, in other words, most of that’s coal, we can our existing coal running, stuff like that. We can cut that down to 34-fold. That’s still a huge increase. Look at the current administration taking a lot of criticism, maybe, for keeping the existing grid facilities on. That’s why they’re trying to get the coal to the nerves.

Stu Turley, Energy News Beat Podcast Host [00:05:20] Oh, what’s wrong with keeping the lights on?

Jerry James, President, Artex Oil Company [00:05:21] I know.

Stu Turley, Energy News Beat Podcast Host [00:05:23] And so we’re going to roll to the next one here and go roll here.

Jerry James, President, Artex Oil Company [00:05:27] Let’s go right to here. Let’s just stop right here because one of the things we’re going to talk about is you’ll hear from me is, don’t break the grid. Whatever you do, don’t break the grid. And Texas ran that experiment for us and it was a very, very difficult experiment. $200 billion, we could pretty well fix most of the problems on the grid with most $200 billion. And think about that, it was just for not having electricity for one week. So what I’m looking at here, this goes back to my history though, And this is the 1970s, which is why I became a petroleum engineer. It was the only thing in the 70s you could get a job was in petroleum engineering. Otherwise there was no work at all. So most people remember the top picture and that shows the gasoline shortage and you could only buy 10 gallons of gas at a time for customer. And a lot of times that was only every other day or every third day. And I remember I turned 16 when the gasoline shortage hits. And I had a 1967 Firebird convertible, got 10 or 12 miles a gallon. I had girlfriend who’s my wife now, but lived 10 or 12 miles away. So you do the math on how difficult that was for me to get gasoline, to get out to see her. That was a trouble for a 16 year old young boy. But what most people miss is the bottom headline from an Ohio newspaper. And this is the winter of 1977, which was extremely difficult. I mean, it was a long winter. And what it says on the natural gas side… Large users lose 85% of Columbia Gas, that’s the utility up there, supply starting February 1st. So that means large industrial users like Ford Motor Company, General Electric, General Motors, Libby Owens Ford, Glassmaker, Owens Corning, all these people, they lost their gas supply. Well these things were caused by two totally different problems and they happened at the same time so a lot of people get confused. The first one, the gas shortage was caused because US oil and gas production peaks in the early 1970s. Because we supported Israel in a war in the Mideast, there’s always wars in the Mideasts, that the Arabs cut the oil supply off to us in 1973. What caused the gas, natural gas shortage, was again US production peaks in the early 70s and started to decline. But that was caused by government regulations. States like Texas and Louisiana have plenty of natural gas. Us up here in the upper Midwest, where I grew up in Ohio, we got supply cut off. This is what starts what’s called the rust belt was this issue of having gas cut off and the reason I bring this up to everybody is A, I don’t want this to ever happen again but what happens 50 years ago as we go through the talk here, you’re gonna see reverberate down to what’s going on today because dramatically the demand for electricity starts to decline at this point, the demand for natural gas starts to decline at this point. For industrial gas. And you’ll see that played out and what probably is going to put pressure on our grid today if we don’t fix it quick enough. But if we fix it quickly enough, we can have these problems. And I think a lot of people miss that.

Stu Turley, Energy News Beat Podcast Host [00:08:32] You know, and energy security starts at home and Nathan brought up a great point on his podcast the other day that that would release today. Wow. What a time warp I’m in, uh, energy, economic, uh energy growth and economics comes from exporting finished goods. And I, I think that that is an important point you’re now talking about where to build the factories is next to the power source.

Jerry James, President, Artex Oil Company [00:09:00] That’s right. If you want to, if you want speed to market, if you want a cut to cost of manufacturing, it’s interesting, Nathan, and this is a great one here of jobs. And Nathan to follow Nathan’s point, we’ll go to this one is what you learn is cost of building a plant is pretty much the same everywhere. Cost of operating a plant’s pretty much same everywhere, what really drives particularly energy intensive manufacturing, which will also drive AI, because that’s energy intensive manufacturing. Right is the the cost that you pay. It’s cost you pay for your fuel and your fuel is largely driven by what’s your transportation cost to get it in the front door. And, and so this, so I think is something to learn. What you see here though, Nathan, during the middle of COVID, you know, he stayed out of pool halls and he actually worked on this little chart. If you look at the blue bar, that’s combined us oil and gas production. If he looked at the gray bars in the back, that’s U.S. Manufacturing jobs. So what you see is we start in post-World War II because most things are relevant in post World War II Right what you’re seeing when people talk about the great times in America’s in 50s and 60s and in the early 70s What you see as US oil and gas production increased at the same time You see the blue bar going up there on the left Wow what you also see if you look behind it You see two gray bars going up. Those are US manufacturing jobs And you got to realize that the United States and the industrial revolution are the exact same age. We all start in the late 1700s. So from the late 17 hundreds until the mid 1970s, US manufacturing jobs went up and down, but more or less the trend was up. And the reason is, is you’re gonna run manufacturing, you need energy. You need energy to run the plant. There are 6,000 products made from oil and gas. And so you need it for molecules. You see what happens when US oil and gas production peaks and starts to decline there in the mid 1970s. You see that first drop. What you see is right behind it is US manufacturing jobs peak and start to decline. I mentioned earlier, this is what makes my area become the Rust Belt. Wow. And you see that it continues, US manufacturing drops continue to decline and you see what happened in 2000 when Bill Clinton lets China into World Trade Organization. And there’s another trade representative for the first Trump administration. And he’s also from Ohio. And he calls that some kind of stupid when you let the world trade organization. And if you look at manufacturing jobs, look at they drop and drop by a third. Yep. Five million manufacturing jobs right after that. Now, what’s fascinating, the end of shale boom comes along around 2008, 2009, 2010. First, you see US oil and gas production going back up. And it really, if you look at the increase, it’s even greater than the post-World War II during the great economic times. That’s why Nathan and a group formed in three states, Shale Crescent, that tried to bring US manufacturing jobs back because we knew that there could be great things for America behind that US oil gas boom. And if you looked, you’d see US manufacturing jobs starting to recover. We’re even going to see more of it recover right now because the current administration has a focus on re-industrializing America. And the reason that it is, and people work in the oil field kind of know this anyhow, is it’s the place where the average worker can make a really nice living for himself and support a family and everything else. Well, U.S. Manufacturing is the same thing. The average U. S. Manufacturing job pays about $75,000 a year plus benefits and it supports about four or five other jobs. So, this is why you want to keep it. This is why we’re excited as you see the U.S. Manufacturing jobs coming back. But there’s something on this chart that I’m going to point out, I alluded to it earlier. Okay. Two points on this chart and this will play out on our electric and natural gas grids. There’s the peak in the mid-19, late-1970s and decline starts. And there’s the peek when we let China and the World Trade Organization. Because of this, when we quit growing heavy industry, We quit growing a substantial part of our grids. And this is what worries me going forward now that we’re re-industrializing and we’ve created a new industry called AI. And the best way to think of an AI as a new industry, I had a guy explain to me, Mark Mills, who’s just fantastic. I think you’ve interviewed Mark in the past.

Stu Turley, Energy News Beat Podcast Host [00:13:17] I’ve interviewed Mark and he is one cool cat, too tiny.

Jerry James, President, Artex Oil Company [00:13:21] He’s great. And I love Mark’s quote. And he said, if you spend a billion dollars building an AI center and a billion dollar building an aluminum smelter, the AI center in the next 10 years will consume $300 million worth of electricity, and the aluminum smelt are 400 million. So in my simple mind, I think of these AI centers, like aluminum smellers, and I’ve lived around those, they are huge energy users. Right. So that’s why I think AI is another industrial load. As far as we on the energy supply business have to think about it.

Stu Turley, Energy News Beat Podcast Host [00:13:55] You’re I’ve got a crayon. I got to get my big chief tablet out here and some crayons because in Texas we are looking at we have 180 name capacity nameplate on the grid right now, but we are look at adding almost 270 of new demand gigawatt and I’m just sitting here, the math is just exploding on how much demand is coming around the corner.

Jerry James, President, Artex Oil Company [00:14:24] Oh it is. And that’s why I get a little concerned and I think we’re going to touch in a minute of where we are historically on the grid and can we build fast enough? Okay. Because what you’re going see and I want everybody to remember, remember the late 70s, 1980, remember around 2000 because you’re gonna see subtleties on our natural gas and electric grid that because we quit growing industrial load, you’ll see what it did to our grids if we go on and maybe we can go on to that slide. If you want to touch on this, I mentioned this and you liked it.

Speaker 3 [00:14:54] I love it!

Jerry James, President, Artex Oil Company [00:14:54] Hopefully, the public can see this on their screens, and I apologize, the light gray bars in the back are recessions, and the blue line in front is the crude oil adjusted price for inflation. And the red circles I just put on to draw the major recessions was the mid 1970s, which was major, the late 1980s, 70s, early 1980s. The Great Recession, they call it, in 2008, and you see two minor recessions in between. But what you notice, if everybody looks closely at that, if you can see it, I apologize for the gray bars being light, is what you see is when you have an increase in the price of oil, you have a recession at the exact same point, at the exactly same point. Now, I know everybody’s been told it. Everything’s ran by interest rates. But I’ll give you my simple-minded engineering mind thinking about this. My dad was a milkman. All my uncles were milkmen. So was my grandpa. We were a blue collar. Middle-class, hard-working, blue-collar family. But we were like most families, we live pretty much paycheck to paycheck. So if you start to think about that, and two thirds of Americans only have a few hundred dollars in the bank, if all of a sudden you jack their price of energy up, they don’t have any other solution other than to quit spending money on anything else, and voila, you got a recession.

Speaker 3 [00:16:15] Mm-hmm

Jerry James, President, Artex Oil Company [00:16:16] The reason I point this out to people is whatever you do, don’t break the grid. Don’t make it too expensive and don’t make an unreliable, because you will break the entire economy. So energy, in my opinion, the economy really runs on affordable energy, is really what runs it. And I’ll tell you who believes that too. Scott Bessett, who they appointed treasury secretary, he has three goals and he lists three 3% goals. The The first two are. Debt and deficit 3% goals. The third one, I’ve never seen a major official in the government ever say that. His third goal in us in the oil and gas industry should have listened this closely because he apparently believes this too, is he wanted to increase energy production by three million barrels a day equivalent, which means it could be oil or it could a combination of natural gas. Right. But the reason is, I always tell people that are in clinical office, if you can only do one thing, increase the supply of affordable energy. Because the economy runs great when the energy is affordable, because if you look at those long times when the blue lines decreasing, there’s no recessions and economies booming, right? Right. Wow. And so if you think about that, if you only do one thing, and the reason is that affects the average working person and, you know, it goes into all the products they make and all the food they consume and everything else.

Stu Turley, Energy News Beat Podcast Host [00:17:38] This really explains President Trump’s drill baby drill.

Jerry James, President, Artex Oil Company [00:17:42] Absolutely

Stu Turley, Energy News Beat Podcast Host [00:17:43] I mean, it really, this articulates drill, baby drill, but the one problem is, um, all my oil man friends, uh, get richer selling more oil under Democrat rule because the oil prices are always higher under Democrat.

Jerry James, President, Artex Oil Company [00:18:00] But they always vote Republican. It’s their logical mind gets in the way, doesn’t it?

Stu Turley, Energy News Beat Podcast Host [00:18:05] It does. But this one’s a follow along to that. I love this slide.

Jerry James, President, Artex Oil Company [00:18:12] This is the same thing, again, I apologize for the gray bars being kind of light in the background. Those are the recessions. What this now is the rate of change of energy prices. So what you see when the blue greenish bar spikes up, that’s a fast rate of change. And what you see is virtually every recession is preceded by a spike in energy prices.

Speaker 3 [00:18:33] Wow.

Jerry James, President, Artex Oil Company [00:18:34] And the one that a lot of your younger viewers will probably remember is the 08 recession. And everybody says, well, the 0 8 recession was caused by the bankers, right? Lending money they shouldn’t have lent on things they shouldn’t let money on. But I always remind people, what really started that was when oil went to $145 a barrel and gasoline went to 550 a gallon. The bankers got blamed for it. I tell my bankers buddies, I’m glad you all got blamed for that one rather than us. Warren Buffett says what happened to the bankers is the recession started because of high energy prices. And if Warren Buffet says the bank got caught swimming naked when the tide went out. And so that’s what happened. So that gives one back in current times that maybe more people are familiar with.

Stu Turley, Energy News Beat Podcast Host [00:19:23] We are about to see an update to this slide. And I’ll tell you why, because California is our largest economy in the United States, fourth in the world, and they’ve got their own self-imposed crisis, energy crisis going on with Gavin Newsom, destroying and eviscerating the oil. Uh, they’re importing 70% of their oil in California. And they have eviscerated everybody. They’re gonna start about $10 gasoline here real soon. And I’m wondering if he hadn’t pushed the oil production too far.

Jerry James, President, Artex Oil Company [00:20:04] Yeah, you know, and most people don’t realize it because, you know, if you’re younger, you don’t think California was ever a major energy producer. But it was always one of the top energy producing states in the top five, probably since beginning the oil and gas industry. I mean, they date back to the 1800s. You know, Chevron was a real name was standard oil of California. And so I forgot that I agree 100% with you. The only thing that kind of saves California is they did two things. Let’s see where I live. One, they de-industrialized, there used to be 1.6 million cars manufactured in California. It’s another Mark Mills quote. Wow. A few years ago, all they had left was a Tesla factory. And I’m not sure it’s there anymore, either. Right. So they deindustrialize. At the same time, they don’t have to deal with severe cold weather like we do in the north. So that’s why that’s why their move away from affordable energy kind of gets hidden. Because, you know, they just basically got rid of their manufacturing base.

Stu Turley, Energy News Beat Podcast Host [00:21:06] Here’s a little tidbit for you, Jerry. And that is the coal consumption went up, even though they’ve killed all of the coal plant usage, because they’re still producing a lot of cement in the area. And so all of a sudden I was, I was trying to figure out why California’s coal usage went. And that crayon broke when I was just laughing. I was like, come on guys, you, you’re bragging about not doing using coal. Have you got cement going anywhere?

Jerry James, President, Artex Oil Company [00:21:43] There you go. I will tell everybody too, if you think the slide doesn’t kind of go with what Stu and I are talking about, that’s because we pulled these from a recent presentation I did. Really want to talk about the grid fragility. So there’s some things going on here and there’s seven changes on the grid that are just dramatic. So you go back to, well, how did I get started in the oil and gas industry? Remember I said, I became a petroleum engineer during the energy shortage of the 70s, particularly the natural gas shortage. There really wasn’t a shortage of natural gas then. It was that we could not deliver natural gas where we needed and the quantities we needed it. And that’s what started to break the grid. Well, so let’s look at what’s going on the grid now. If you remember earlier, I talked about, there’s two times I wanted you to think about. One time was 50 years ago, roughly. And that was when we had the first energy shortage and manufacturing jobs started down. The other was about 25 years ago when we let China and the World Trade Organization and we lost a lot of our manufacturing jobs. So now all of a sudden we’re back to the grid’s gotta grow. We gotta grow and it’s gotta grown dramatically. People are talking about the next decade, we’ve got to increase natural gas production to meet all the new demands of AI, reindustrialization, don’t forget exports. We’re talking about 30 to 40% more natural gas next five to 10 years. Ohio’s got a study out there right now that says they’re gonna need 50% more electricity. And we’re like the fifth or sixth largest economy in the United States, starting in five years. So this is dramatic growth that we’ve not seen because we’ve de-industrialized for 50 years, right? So this the first time in 25 years we’re seeing demand grow on electricity grid. We’ll go into these details. It’s the first in 50 years we’ve seen industrial demand for natural gas growing. It’s a first time ever we’ve got a new technology called artificial intelligence. It’s the first time ever we’ve got a transition from coal to natural gas on the grid. It’s first time, ever putting large quantities of intermittent generation on the grip. Now, the reason I put that down is that’s a new source of demand at certain times natural gas has to meet. And when you can’t meet it, Texas understands exactly what happens in 2022, in February, 2022 when you can’t beat that demand, right? Oh yeah. And it’s first-time ever, ever we’re exporting large volumes of natural gas. What’s really important, this is the first time we need substantial grid expansion, but who’s going to make the required investment? Because what we did when the grid quit growing in the 1980s, we decided, well, we just need to deregulate everything. You can bid on power, you can bid on natural gas. Enron loved this thing. In fact, it was 24 years yesterday, but Enron but bankrupt and they loved all these kind of things. They promoted them. But where we’re at now, though, is we need to regrow the grid. And people always said, well, how did you used to grow the grid? Well, it used to be a regulated utility model, but the rate payers, you know, they went to the public utility commission of your state and they got approval to build it, they got to do that. Well, in a lot of states, including Ohio, we don’t really quite have that system anymore. So, because why? Because we weren’t really growing much. We were living off the legacy that our parents built.

Speaker 3 [00:24:56] Right.

Jerry James, President, Artex Oil Company [00:24:57] And now we’re kind of in. So we’ll go through some of these individually just so everybody realizes this isn’t Jerry James’s opinion. I’ll show them the data. This is all from the Department of Energy mainly.

Stu Turley, Energy News Beat Podcast Host [00:25:07] We, uh, I was, oh, sorry. Let me back up. Uh, the, one of the things I was in, I interviewed, uh Meredith, uh Anglin who authored shorting, shorting the grid, loved Meredith. Her sub stack is the, um, electric grandma. And I absolutely love that lady. She is a common sense. She is. A national treasure. And when you sit back and what you just said resonates so much to, to me because of her book. The grid balancing authorities have a real problem adding the wind and solar in because of the AC versus DC direct current wind and solar and then they have to be transformed into AC asynchronous in order to get onto the grid and they don’t match.

Jerry James, President, Artex Oil Company [00:25:58] That’s exactly right. And then the other thing that everybody misses, and this is a good time to address that because I don’t really talk about it, but you’ve raised up another thing. The other thing is it’s like they build a huge brand new power plant just north of my office here. It’s just state-of-the-art. It’s one of the biggest in the country, natural gas fired. I think it’s 1,800 megawatts. It is a dandy. And I was talking to the guy that ran it one day and he said, you know what? This was a couple years ago and this was the of the S.G. Movement. He said, the real problem is he says, I don’t know who builds the next one of these because people don’t think about it as, you know, it used to be under, I’m old enough to remember Ronald Reagan and Ronald Reagan, you always quoted Milton Friedman. Milton Friedmann always said, the government is horrible about picking winners and losers, right? Well, people don’t understand. When we went down this road to subsidizing a mandating wind and solar and there was places that makes perfect sense to me that it worked. I live in the Ohio Valley. It wouldn’t work here. It’s going to cloud these places in the United States. But the point about it is my grandson’s working on solar array right here today. I speak. So I say this and this shows you what he’s doing. What happens is, is the reliable power gets squeezed to the back of the line because nobody’s mandating or subsidizing it. And so it’s not only the ACDC problem. It’s also who stands up to build a for-profit power plant when, you know, and we’re looking right here and you can see the problem why this guy made the statement. And at the same time, you knows, somebody else is going to be put first in line. So if you look at this, this is total electricity demand. And the only thing I want to show people is a couple of things on here. The first thing, if you look at 2025 or 2012, 2000, you see electricity demand. Well, you got to look at it. The other two, the green and the brown bars are commercial and residential. You know, they’re just like that. But if you look at industrial, remember I said, look 25 years ago, when we let China in the world trade organization, it starts to flatten in 1980. You can see that dip in 1980, then you see it really flatten. So really the reason top line electricity hasn’t grown, if you looked at the chart and you look all the way back to 1950, It was growing until we de-industrialized. And we deindustrialize two times. The first time when we created Rust Belt, second time we let China in the World Trade Organization. That flattened electricity, man. Everybody’s been told if you read the newspapers, they’ll tell you, well, it’s because we all put more efficient light bulbs in. Well, you can see, but that’s not true, because residential and commercial have continued to grow. Maybe not as fast, but they grew. The reason we went flat, and this gets back to why the guy said, who’s gonna build the next power plant? If you’re into a flat electricity market… And somebody’s subsidizing somebody else to get part of that market, do you really want to go make a multi-billion dollar investment in a flat market? It could be hard to make money. Well, now the electricity market’s growing, but the point we try to make here is it’s growing because the industrial processes are growing and we’re still going to have room for the residential commercial. So we’re looking at something that really most people haven’t experienced in a working career. They’ve never seen where we’ve had industrial load grow on the grid. Now our parents would have thought, or at least your and I’s parents, some of the younger viewers would be their grandparents, they were used to this. And this will play out a lot. And why we haven’t had as many problems in the grid as we should have, because our parents were wonderful builders. They came in post-World War II and post- World War II, they came home from World War Two and they were great. They built this grid eight, ten fold, both gas and electric. They actually overbuilt it. They had an incentive to overbuild it because they look in the future and they can see growth. Right. We live, we have lived off of what they built and it’s that that is coming to an end.

Stu Turley, Energy News Beat Podcast Host [00:29:50] We’ve lived off of what we built. Now I’m old enough that my dad at 91, um, uh, he didn’t have a indoor plumbing until he was 16 and he left for college at 17. He then went to World War II. I mean, he, didn’t go to World war II. We went to… Vietnam right out of college. And he’s the only one that made his way back home. All of his friends were shot down. The F4 brought him home now. So you go from being my granddad came to Oklahoma in a covered wagon. My dad didn’t have indoor plumbing and barely had electricity. To now he’s 91 and a day trader and having an app. So that generation has seen a lot.

Jerry James, President, Artex Oil Company [00:30:47] He’s seen a lot. And I think we’re going to see a lot now too. The change is coming. If you think about this, where I said earlier, Ohio recently did a study, a very thorough study with some of the biggest companies in Ohio. And combined with McKinsey helped them on the study. And they’re predicting the next five to ten years, Ohio’s electricity demand is going to grow 50 percent. When we haven’t seen much growth in a generation.

Stu Turley, Energy News Beat Podcast Host [00:31:14] I’ll tell you, I love Chris Wright. I just flat out, he has got his work cut out for him. What you, Jerry, what you just said is the amount of growth right now. I mentioned that, I believe I mentioned this with Nathan on his podcast. And that was Bloomberg had written 230% increase in some of the areas near data centers back East. Because they’re government data centers and they’re, you’re having to pay for the transmission lines to be brought in. That’s getting dinged to the, uh, consumers. So people are not going to be real thrilled with these things. Even in Tulsa, Oklahoma, they’ve had a hundred percent increase in their electricity prices. And now this is a big Democrat thing going affordability. Well, if we’d been growing the grid under the Biden, Obama, Bill Clinton, all of these other regimes of building the grid and stability and having a decent path forward, we wouldn’t be where we are today.

Jerry James, President, Artex Oil Company [00:32:29] You’re absolutely right. And I’ll go back to Ohio again, because Ohio’s most people think of as coal producing state, we are mainly a natural gas producing state today, I will say, but if you look at Ohio, one time at our peak, we had 23 or 24 coal plants, we’re down to four. Wow. So that, that gives you a real world example. You, you still, you nailed it. We have had a misallocation of funds. And so how did we do this? You got to remember and don’t get the politics. These are just reality. We deal with the energy business, it doesn’t care about politics, it talks about reality. And I showed you don’t don’t break the grid because you can really mess things up.

Stu Turley, Energy News Beat Podcast Host [00:33:06] Jerry, we got, don’t break the grid. I hate to do a Sean Hannity and interrupt you, but we got don’t break the grip, but, we also have, I’ve always said the grid says physics and fiscal responsibility matters. So we’ve got a new tagline. Thanks to Jerry James.

Speaker 3 [00:33:25] Well, I appreciate that.

Stu Turley, Energy News Beat Podcast Host [00:33:26] Break the grid. And then the other one is still physics and fiscal responsibility matter to the grid, it could care less about anything else.

Jerry James, President, Artex Oil Company [00:33:36] That’s right. And so what we’ve done is we spent hundreds of billions of dollars just where you went, Stu. If we had spent that money on reliable and affordable electricity, we wouldn’t have the affordability problem. You know, there was a guy named Henry Grappi. Did you ever know Henry out of Houston, Texas? Henry passed away last year, two years ago. Henry Grappy was great. He worked well into his 90s. And he starts in post-World War II. He was in Saudi Arabia in post World That shows you how long Henry Grapi. He eventually became an expert on pricing and consulting. And Henry Grapp, he taught me this on oil prices. For every 1% you move supply and demand, you will move the price of oil 10%. For every one percent, you will moved the price 10%. So it goes to your affordability things. All changes in balancing the grid will have huge changes in prices. And so that’s the thing of it is, if we would have spent that money overbuilding the grid, we might’ve reduced the price because the more energy you provide, it’s a commodity, less expensive it gets. It’s counterintuitive to what most people think. So, well, you can see right here, this is what concerns me. We got now Grovis Grid a bunch and most people in their career have never done it. I wanna go into the natural gas grid now. So the natural grid is a little easier to see. You see that happens in late 70s, remember? That was the time that we got into Energy production in this country peaked and started to decline. We started to lose in manufacturing jobs. We lose them again in 2000. Again, I want to go back to industrial loads. So if you follow the brown now, and I apologize for the colors sometimes changing, if I could talk to DEI, I’d say for love of God, keep your colors all the same. But anyhow, they produce good data though.

Stu Turley, Energy News Beat Podcast Host [00:35:22] Let me get, let me get Chris on the phone here.

Jerry James, President, Artex Oil Company [00:35:24] Yeah, I’d say if he can ask him to do that for us. And so what you see is you see that drop in industrial demand both times. So if you look at industrial demand, we really haven’t changed much industrial demand on the natural gas grid in 50 years. And if you because of efficiencies on the furnaces and everything like that in slaving houses, really residential commercial haven’t change much at all. So now all of a sudden we’re re-industrializing. And the estimate is coming out of the Department of Energy in the next decade, we could add eight BCF a day of natural gas demand on the grid for industrial load because we’re re-industrializing. And at the same time, what you see there is you see that the biggest chunk of growth on the natural gas grid was from electricity. Right. So, and again, what you’ll see is our parents again, did a wonderful job of overbuilding the grid. They even overbuilt it because they were looking always to the future. There just came out a report from the National Association of Utility Regulators, NAVROC or something like that. And they have a beautiful statement. Report just came a week ago. And they talk about problems on the electric grid after the Texas event, after the event we had up here in 2022 in the Northeast on Christmas Eve where we just about ran out of power too. So they got together for the last two years and they’ve had the utilities, they’ve the pipelines people, they’ve electric generating people. They’ve had the regulators all working together and they just issued a report, it’s a wonderful report. And basically what they make a statement at the very beginning of that says, the natural gas grid has done a wonderful job of backing up the electric grid, but it wasn’t designed to back up the electrical grid. And I told one of the guys that worked on the report, don’t give us too much credit. The reason that it is, is because we deindustrialized. So that’s why we had extra capacity on the grid. But I said, all that’s coming to an end, and this is what starts to make me a little concerned with all these changes on the grid. Now we’ve got the electric grid growing, we’ve got the natural electric grid needing more natural gas. At the same time, we’re reindustrializing and there’s a lot of places, you know, we are like in Ohio here. We have one of the oldest utilities in the world is in Ohio because, you know, the oil and gas industry, most of it starts in Ohio. And so And, you know, our natural gas utilities date back to 18, late 1800s. Right. One of the major utilities told me something in January of this year, which was cold, but not, I’ve seen a lot colder. They moved the most gas across their system they had ever in the history of the system. I think that’s true.

Stu Turley, Energy News Beat Podcast Host [00:38:06] I, I, man, this is some huge news and also natural gas. Seem net gas seems to be a cyclical, um, process. I think cyclical is going away because of LNG, then the long, the faster demand. Uh, we’re at four 50 now on that gas. I think that we are facing some. Great things for the oil and gas industry because of demand. I think that we’re going to see that. And the rig counts in the United States have remained flat to growing in rig counts for Nat gas.

Jerry James, President, Artex Oil Company [00:38:46] I agree with you. I think it looks a lot better than the last 15 years has looked, for sure, because you can see right here, the top line, we’re growing natural gas. And let’s go ahead. You talked about exports, too. I can’t refer to our next slide, or I’ll get to it eventually. So this is the other thing. I talked about AI, and this gives you an idea. This is the electricity consumption that they’re projecting out of AI, and that’s the blue line. So you see it swooping up there?

Stu Turley, Energy News Beat Podcast Host [00:39:13] Yeah, oh yeah.

Jerry James, President, Artex Oil Company [00:39:14] So this is the first time ever. And so they’re showing 350 billion. Try and get my right, that’s probably a billion kilowatts. So, but the way I always do this, I can’t do electricity, I’m a petroleum engineer, it’s just hard for me. What I always is when somebody gives me a number in like megawatts or gigawatts, we divide it by seven. So if there’s gonna be a 300 growth, we divided by seven, that’s about 20 BCF a day.

Speaker 3 [00:39:44] Wow.

Jerry James, President, Artex Oil Company [00:39:45] So you start to see that these estimates come true, these are huge growth numbers and it goes back to your point. So we’ve got all this other stuff going with gas, industrial loads growing, as you said, exports is growing, but this is going to grow too. If you go to the next slide, we may get to exports. We’re going to get there eventually. This is coal. I just want to show everybody this because this is explaining to you why the gas grid is growing. And if you’re from an area of stock coal generating, this may be a little confusing to you. Coal is gray on this graph. Natural gas is red. You can kind of ignore the rest of them. They aren’t really players. But what you see is coal has shrunk dramatically in the last 20, 30 years, and natural gas has expanded dramatically.

Stu Turley, Energy News Beat Podcast Host [00:40:29] For our podcast listeners, we’re looking at a slide from the US Industrial Expansion and National Security Grid Reliability slide deck, US electric generation by source, but also Jerry, look at the top two solar and wind as it comes in just a few years, you know, a couple of days, let’s say two decades, uh, 20 years, we’ve spent trillions of dollars globally on wind and solar. Look at amount that it has added in energy. Not that much.

Jerry James, President, Artex Oil Company [00:41:02] Well, and this is on the electric grid, and that’s where a lot of people I know get confused, and I don’t blame them, and I kind of blame the people who are right about this subject. They will talk about how much wind and solar progress they made on the electrical grid. But remember, the real key is you don’t want to break the grid, so you don’t want to run out. And so, on a peak day, on the peak day of a natural gas grid delivers four times more energy than the electric on a peaked day. Right. So when you look at the electric grid… It’s only a small fraction, and that doesn’t include the petroleum grid. So it’s only small fraction of the whole thing. So that’s the other thing to think about. This idea that we could replace the entire energy grid with wind and solar, it was just, it was never going to work.

Stu Turley, Energy News Beat Podcast Host [00:41:52] No, it was downstream marketing that failed.

Jerry James, President, Artex Oil Company [00:41:56] Yep. And it’s like you said, it’s physics. So here’s where we are. We’re finally on the, on the exports. So let’s first start with something that if you’ve not followed the natural gas grid historically, let’s go all the way back. We’ve originally supplied all of our natural gas from the United States. And then I said in the early 1970s, U.S. Production peaks and starts to decline. But everybody notices where no one got cut off their gas. So how did we get the We imported it mainly from Canada. And so for the next 30, 40 years, we imported from Canada. Well, something happened about five years ago, we first time in history, we become a next exporter of natural gas. We had never substantially exported natural gas in 150 year history of this industry. And you see it, you started right here in 15, LNG exports are zero. I heard last month, they almost got to 20 BCF a day. And if you look going out, to 2030, that’s not that far away. And each one of these facilities are named facilities that are under construction or permitted. And you look at it, this number could go to 30 to 35. And this goes to exactly where you went. So let’s go back and start kind of doing some math here, unless I did it in a slide. If this is going up 15 BCF a day. We may need 15 BCF a day for the electric grid, and we may need eight BCF a day for the natural gas industrial fuel. All of a sudden we’re looking at 30, 40, maybe 50 BCF a day in 100, 105 BCF a day market.

Speaker 3 [00:43:32] Wow

Jerry James, President, Artex Oil Company [00:43:33] And so, and remember, small shortages cause big problems, and big problems on price and big problems on reliability. This total change is the thing that concerns me, having started my career in a very, very bad time in the energy industry, and it was a good time for me, but it was bad for the country, is that I’m worried that we’re starting to go here because we have not been building to this future. And you start looking at the time frame. These are not long time frames. These are time frames by the end of the decade, just stuff’s going to start happening. And just to give your listeners a little bit of an idea, let’s take the Mountain Valley pipeline they got, you know, which was the pipeline only going from West Virginia into Virginia is where it got stopped by litigation. That pipeline eventually took seven years to build. Okay, I asked the guy that built the electric generating plan up here how permit, from idea to permit to build. He was almost six or seven years. So you start looking at some of these timeframes. I tell everybody, the grid you want in the next decade, you have to order today. And we’re not making the orders. We are not making orders.

Stu Turley, Energy News Beat Podcast Host [00:44:44] Oh, and it’s, it’s even worse than that. When you take a look at the turbine, uh, wait, you gotta have cash in hand and nuclear is not going to get here. I love nuclear. Believe me, I’m a nuclear fan.

Speaker 3 [00:45:00] Yay, nuclear!

Stu Turley, Energy News Beat Podcast Host [00:45:02] But it is not here yet and it’s always been the

Jerry James, President, Artex Oil Company [00:45:04] And it’s always been the fuel of the future.

Stu Turley, Energy News Beat Podcast Host [00:45:06] A fuel of the future. I absolutely love it. Now, I want to give Nano Nuclear a shout out because I’m working on, I’ve got a commitment from JU, the founder of Nano Nuclear. They’ve got two reactors approved that they are now moving forward on. They’re building their plants so they can mass produce the micro reactors at the same time. That to me is brilliant because nuclear does not have the long-term cash flow… They seem to have that fixed and they’re bringing it in years instead of decades.

Jerry James, President, Artex Oil Company [00:45:42] So that’s the problem. Can you bring it in? What I tell everybody though, the opportunity, because remember it’s an opportunity for growing the grid here too. I don’t want everybody to just think this is all negative. This is what I’ve been waiting on for my whole career, to re-industrialize so the average working person can make a living, right? That’s a great thing. We’ve created a new industry called AI. That’ll create more jobs for blue collar workers and stuff like that. Not as much as industrialization, but you know, the time you supply the fuel, you generate electricity. You man the AI centers and stuff like that. But the point of it is, is all these opportunities are gonna come before we can deploy nuclear at scale.

Stu Turley, Energy News Beat Podcast Host [00:46:21] Jerry, let me ask this. I think Elon Musk put out just a little while ago. He’s not calling me yet, but he just put out a little a while ago that AI is going to cost a lot of people jobs, and when it happens, it’s going to happen quick. In an oil and gas space, the Advances that are happening to AI in the oil and gas space is very impressive. And I think that we are losing a lot of office workers, but we still need guys on the rigs, we still needs pipelineers. We need those badly. And in California, Oh, speaking of California. They’ve lost all of the talent. So even if they did try to put out 2000 permits or slow walk down, they don’t have enough people.

Jerry James, President, Artex Oil Company [00:47:18] Yeah, I know. Well, Nathan, you talked to Nathan last week. Nathan’s brother is a petroleum engineer, started his career of Chevron in California. Right. And this is probably about five, seven years ago. They called a company-wide meeting in California of the operations people, you know, the engineers and the field workers, that type of stuff, people that actually do stuff. And there’s like 250 in the room, and they asked them to raise their hands and ask them how many they their jobs would be there in five, ten years. And there was only a handful people raised their hands. And now he works back East now. So your comment on an anecdotal basis, your comment’s spot on.

Stu Turley, Energy News Beat Podcast Host [00:47:59] And if you can’t figure it now, the other comment is, and I think that if you don’t understand how to utilize AI, you will be replaced.

Jerry James, President, Artex Oil Company [00:48:09] Yep.

Stu Turley, Energy News Beat Podcast Host [00:48:10] Um, anyway, that, that was fantastic.

Jerry James, President, Artex Oil Company [00:48:13] Well, and so, so this is really we can skip through this. This was the Ohio study, but I was talking about how much Ohio’s on the grid is going to grow. Wow. So, and this gets into your CVET, starting in 2025, you show it going up to how much Ohio needs to grow in five years. What I want to show you is where you end up on the grass grid. If you kind of go through each slide, we won’t drag everybody through the electric. Apologize. Let’s go back just a little bit. Let’s keep going. And I want to show everybody where this ends up. I’m trying to remember my study. It’s been a few right here. Okay. This slide, this chart right here, so this is Ohio. I’m using Ohio as a bellwether state. Now they also showed PJM, which is the grid we’re in in the Eastern United States, which runs from the East coast through Pennsylvania, through Ohio, a little bit of Illinois and a little bit a Michigan that thing it’s largest grid in the United States. It’s got dramatic growth projections in this study too. So it says Ohio produces five and a half BCF a day. Know, we’re like the fifth or sixth largest producer in the United States of natural gas. Luckily, we’ve got our two neighbors of West Virginia and Pennsylvania. That’s really helpful. Our consumption after 150 years of industrialization and people, we’ve got 11 million people, is three and a half BCF a day. We net exports too. Not too bad. If you look at where we’re going based on the study that the Ohio Business Roundtable conducted of their members, now these are industrial people, where we need to have an three BCF a day to meet the new demand and replace retirements on our poll system and stuff like that.

Stu Turley, Energy News Beat Podcast Host [00:49:51] For our podcast listeners, BCF is. Billion cubic

Jerry James, President, Artex Oil Company [00:49:58] Billion cubic feet, billion cubic feet. So I always tell people, remember I said earlier, we’re one of the oldest producing places in the United States, right? And when we have the oldest utilities probably in the world, it took us 150 years to get to three and a half. But you’re telling me in the next five to 10 years, I’ve got to nearly double that. And what I told them is, and they’re taking this seriously, that’s why they had us come up there, and we spoke for just a couple hours on this one subject, which is why we’re kind of skipping over some slides to the public, we don’t want to bore them to death. But it just makes the idea how big this challenge is. The trouble is, nobody’s specifically telling the natural gas industry that you’ve got to grow that much. You know, the market signal is not being sent. That you need to grow that much. Because I tell everybody this, the wells I drilled today, they were a thought in somebody’s mind three to five years ago. It’s not something, you know, It’s not three to five days.

Speaker 3 [00:51:02] No, no.

Jerry James, President, Artex Oil Company [00:51:02] The time you develop the prospect, you test it geologically, you acquire the acreage, you get the permits, you get to drilling contractors signed up. It’s a three to five year process. So if you got to do this, the industry needs to know now, and this is really where a breakdown is occurring nationwide. And this is what really starts to worry me before about problems on the grid is this, LNG guys are doing a great job of sending market signals. They’re signing long-term contracts. Heck, Japan just popped two producers in Hainesville. The country of Japan now owns two producers in Hainsville.

Stu Turley, Energy News Beat Podcast Host [00:51:41] And Saudi Arabia and Qatar are doing the same thing.

Jerry James, President, Artex Oil Company [00:51:45] And so they’re signing long-term contracts or even buying the gas. They’re laying the pipelines. They’re building the facilities. Okay. The electric industry, which is the next biggest demand chunk of the gas grid. And I’m not blaming the electric industry. This is part of the unintended consequences of deregulation that I mentioned that started back in the eighties when we have the independent electric companies, like the one I described, it’s just north of me. They’ve got to bid every 15 minutes to get on the electric grid. That’s how they get on. Every 15 minutes, they got to put a new bid in. Well, you don’t want to go and sign a long-term contract with the natural gas fuel supply because like right now it’s really cold out. If you sign a contract and the price drops because it turns warm, all of a sudden you won’t win the bid because your gas price is too high. That’s I’m not blaming them, but this is the reality of the market. We set up in a deregulated market. They can’t make a long-term commitment for the fuel supply, or they can make a long- term commitment for pipelines, or for natural gas storage to back all this up. I did not know that. They own a short-term price sprite. I talked to one electric guy, and he says, well, we’ve got contracts that run out two years. And I said, well, that’s great. And then I went back to showing the slide on the exports. I said here’s your competitors. They’re getting ready to double in five years and they’re signing long-term contracts of 10 years or more or they’re buying the fuel itself. What are you going to do when that doubles? And I’m here to tell you major electric generator. He did not have an answer for that question.

Stu Turley, Energy News Beat Podcast Host [00:53:23] To your point, Jerry, what happened in Germany is absolutely parallel to what we’re talking about now. They had no contracts on that gas. They said, oh, there’s plenty of gas. I can’t, I can barely do a Putin imitation, let alone a German. Oh, lots of gas anyway. There’s lots of guests and that’s what happened. Oh, one, uh, missing Nord stream pipeline later and one more. And they have gone falling off the deindustrialization bench totally.

Jerry James, President, Artex Oil Company [00:53:58] Nathan was in Germany. Again, Nathan was who Stu interviewed last week and he goes around representing our region trying to bring industrial manufacturing to Ohio, West Virginia, Pennsylvania. He was in German and he was explaining to the head of one of our industrial councils how much our energy advantage was. And just so if everybody didn’t catch Nathan’s talk, if Ohio, West Virginia, Pennsylvania formed a country. We would be the third largest natural gas producer in the world, only behind. Russia and the rest of the United States total. Wow. Now I like what the DOE, the DOe I told Nathan right before we got on and as the DO just came out of study a couple weeks ago in which they divided the Appalachian Basin which is quartered to Ohio, West Virginia, Pennsylvania and they then died of the Permian Basin, which is West Texas, New Mexico and then they separated the Haynesville which are the three major gas fields. Those three fields produce about 75 percent of all the natural gas in the United States come from three major basins. Anyhow, when the DOE did that, we moved up from third to second behind Russia because the rest of the United State got divided in half.

Stu Turley, Energy News Beat Podcast Host [00:55:09] Wow.

Jerry James, President, Artex Oil Company [00:55:11] So when Nathan explained that to him and he explained how low of it our price was here, the guy just said, I knew we had a bad. He said, and he had to do an accident, I can’t do it here. He goes, we’re screwed.

Stu Turley, Energy News Beat Podcast Host [00:55:23] R-Retro

Jerry James, President, Artex Oil Company [00:55:25] Because not only did they go the wrong direction, they focused on CO2 reduction, while the competitors in Asia were focused on energy growth, then now they’ve got a problem with the United States.

Stu Turley, Energy News Beat Podcast Host [00:55:42] Unbelievable. This is, this is an amazing, and I absolutely love Nathan’s comment. He says, God bless Texas. Cause they tell the, when the rest of the world looks at the United States, they think Texas produces all of the energy for the United states that we tell everybody that. And that’s what, you know, shame on us, but you know people need to know how prevalent the Marcellus and that is up in your area up there.

Jerry James, President, Artex Oil Company [00:56:10] It is 35% of the natural gas today going to 50%. By in 10 years of U.S. Natural gas is what the DOE says, Department of Energy. This right here, I just want to explain to the listeners the problem we touched on this just a little bit a minute ago, Stu, is this is an example of LNG. So this is a new proposed pipeline to come into Ohio, pick up two billion cubic feet per day. Remember, we produce five and a half billion and take it on down to Louisiana. Now they’re saying they might not take it that far. They may take it down into Tennessee and support data centers there. But what you see is this is an example of the LNG people making commitments, making commitments.

Stu Turley, Energy News Beat Podcast Host [00:57:02] You know, it would make so much more sense to also carry these pipelines through New York and then off to the east coast to export LNG to Atlantic. And you would cut a lot of shipping down.

Jerry James, President, Artex Oil Company [00:57:17] Well, the other thing is, if you did that, you keep the lights from going out in New York. I may have a slide in here. What happens in New York doesn’t have enough gas. Yeah, this is this is just our grid PJM, because I was doing this presentation for Ohioans. Yep. You can see here the states it covers. It’s the largest grid. It has the largest industrial base in the United States. And we also have cold temperatures on top of that. For the people who live in Texas in 2022, they understand what happens when you mix. All these things and it gets cold, the grid can break, right? Oh yeah. So what I always tell people, you’ve got to fix it on PJM because it’s 65 million people and it’s got everything else mixed in. If we can’t fix it PJM, we can fix it anywhere. So that’s why we went a deep dive in PJM. I don’t think your readers want to take that deep of a dive. So we’ll just kind of gloss over these slides.

Stu Turley, Energy News Beat Podcast Host [00:58:12] Do you want to keep going on those?

Jerry James, President, Artex Oil Company [00:58:14] No, the only point I was going to make is if you had the one chart, if we get to there, you mentioned what Ohio stacks up, if you keep going, okay, if I keep going. Here we go. For anybody that missed this and Nathan’s presentation, this was interesting. Nathan just released a study in which he said, in one of the first research we did almost 10 years ago, and I mentioned earlier, if Ohio, West Virginia, and Pennsylvania formed a country. If anybody knows anything about the three states, you know, Pennsylvania, we consider giving Philadelphia to New Jersey. We might talk with the rest of Pennsylvania about that. We could even put up with Steelers fans, but if we did three states. We would be the third largest producer of natural gas in the world. And what’s interesting is you hear Donald Trump and he always says bombastic things. He’s, he’s Donald Trump, right? But every talks about Canada. Well, Canada is I think number four on the list. Yeah. You know, right. We produce, in Ohio, West Virginia, and Pennsylvania, we produce twice as much natural gas as the entire country of Canada. Wow. We produce 50% more natural gas than.

Stu Turley, Energy News Beat Podcast Host [00:59:27] And you know, what’s sad is Canada could produce so much more. I mean, Canada could add Canada. I love Canada. Absolutely love Canada and especially Alberta, the, uh, uh Quebec in that area, let it go to Europe. I just let it, go away. We’ll take Alberta, bring them in as a 51st state and Greenland. I’m all in.

Jerry James, President, Artex Oil Company [00:59:53] Let’s do that. Yeah, yeah, that’s right. So, you know, it just goes to state, I will say one thing politically on this one, if you look at the last country on that list of the top 10 countries in the world, and that’s 70% of all the natural gas in the world, then you’ve got to understand natural gas is the industrial fuel. It’s what keeps the lights on. It’s the big part of making the 6,000 products. A lot of things you wear, the carpet you stand on probably starts to light the natural gas molecule. The last one on there, I believe, is it Norway still? Is that number the last one? I can’t quite read it there.

Stu Turley, Energy News Beat Podcast Host [01:00:26] I believe so. Yeah. Yeah. And they’re, they’re growing and Norway three or four years, four years ago, when we started, we started a podcast, I believe five years ago. Four years ago Norway said we’re getting out of all fossil fuels. Now they’re putting in $3.5 billion expansion into the North sea to do more drilling.

Jerry James, President, Artex Oil Company [01:00:50] And it’s where everybody understands Norway kind of owns the, unlike the United States, they kind of own the, the country kind of owned some of the producers over there or has an interest in the field. You bet. But the other reason I tell everybody is why we shouldn’t listen to Western Europeans on their energy policy is when you’re last on the list and you’re only two or three percent of the world’s natural gas supply. Right. I’m just not questioning their motives, but maybe the reason they really wanted the United states to get rid of all its oil and gas production is. How are they going to compete?

Stu Turley, Energy News Beat Podcast Host [01:01:24] Um, that’s a good point.

Jerry James, President, Artex Oil Company [01:01:26] We shouldn’t listen to people who don’t have anything right? It’s easy to say you’re going to do away with something if you don’t have it.

Stu Turley, Energy News Beat Podcast Host [01:01:32] Um, like politicians they they i’m not a politician fan anymore. I’ll tell you I think

Jerry James, President, Artex Oil Company [01:01:39] Well, I’ve got some good friends that are politicians and I always add an all seriously to them. They have a very difficult job because

Stu Turley, Energy News Beat Podcast Host [01:01:46] Can I ask a personal question? Yeah. If you have politicians that are good people, they’re probably not originally politicians.

Jerry James, President, Artex Oil Company [01:01:56] That’s true, a lot of them work.

Stu Turley, Energy News Beat Podcast Host [01:01:59] Uh, Donald Trump was not a politician to begin with. And so I think that the politician and even take JD Vance, he is not a politician originally, he was a Marine. I consider that a thing. Even Vivek Ramaswamy. He was actually a huge businessman.

Jerry James, President, Artex Oil Company [01:02:21] And so was J.D. Before he got into it, too. He was into investment banking, stuff like that, too, he was just elected. I mean, I think he just turned 40 and he was elected two years ago for the first time. So his first day to 38 years of life, he learned that he had a normal life, let’s say.

Stu Turley, Energy News Beat Podcast Host [01:02:38] Oh, I’ll tell you what, I think JD Vance is a hoot and I love the fact that JD Vans has embraced the meme ology. And, um, when, uh, our Congress, the Democrats did the Schumer shutdown. I absolutely love president Trump’s, uh sombreros and everything else. If you can’t have a little bit of fun and they didn’t think that was real funny. I, I I’m sorry. I thought it was kind of funny. I’m…

Jerry James, President, Artex Oil Company [01:03:08] Stu, you’re as a broadcaster, you are in good company because one of the big political writers a generation ago was George Will. Remember George Will? He would do a lot of columns on all the talk show. George Will said what made Ronald Reagan a different president was he had an adult life before he was in politics.

Stu Turley, Energy News Beat Podcast Host [01:03:26] I love that in adult life.

Jerry James, President, Artex Oil Company [01:03:27] That’s the same thing you just said, right?

Stu Turley, Energy News Beat Podcast Host [01:03:29] Yeah, but but again, I’m mentally 12. So yeah, you know, I just like oops. But anyway, well, tell us, Jerry, how people can find you. You’re Jerry James. And how to

Jerry James, President, Artex Oil Company [01:03:40] I have a day job. I do all of this. We do have a project we’re working on. That’s why my team’s researched a lot of this, but a day job, I’m president of Artex Oil Company in Marietta, Ohio, is where I’m out of. And so they can text me or email me. It’s jjames at ArteX, that’s A-R-T-E-X, oil.com. So we do this. I do this mainly as volunteer work. Because my dad, I mentioned earlier, my dad was a milkman. All my uncles were milkmen. My grandpa was a Milkman. These are guys that got up three o’clock in the morning and went to work my whole life. And so, but then when they got home at three or four o’ clock in the evening after he worked 12 hours, and now that I’m old, I don’t know how they did this, you would see them down at the ball diamonds, working on the Little Lake ball diamonds or helping build a Little Lake football field and stuff like that. And so when I got to the point in life where I could give back, I thought, well, how can I give back? And I thought, well, really a lot of this is trying to inform people on the, on the energy business. Cause the last thing we want, I go back to where we started. I never want to see the 1970s repeat themselves. We had something we called the misery index back there and everybody knows how miserable it was. Stu’s laughing, he remembers it. He can talk about inflation now and they talk about interest rates now, and they talked about unemployment. These are all in the low single digits. We had, we had in late seventies, we had double digit unemployment, double digit interest rates, and double digit inflation all at the same time. The first house I bought in Ohio had a 15 and a half percent mortgage with a 20 and a Half percent cap. Cause it was variable. So I bought a house on credit card interest rates and the only reason I got a job, I was lucky because I became a petroleum engineer, but you just couldn’t hardly keep up. I’m really worried about this country where it’s at today. We can not go back to, we have a system where we fail. And with all the energy we produce, we shouldn’t fail. But it’s not how much energy you produce. It’s really boils down to where I ended that talk. Is it readily available? And this gets into nuclear versus gas. Gas is gonna be here first. Is it scalable? Luckily it’s scalable. Is it affordable? It’s the cheapest hydrocarbon molecule in the world is natural gas in the United States. Right. And is it reliable? And it is. And so we’ve got all this opportunity. The question is, is whether we’ve got the political will to get the infrastructure built where we need it, when we need it, because that’s really how energy matters.

Stu Turley, Energy News Beat Podcast Host [01:06:13] It’s going to take an internal fortitude of Jerry Nadler stature in order to get this done. Um, and I’m being a, uh, making a joke there, but we are going to need incredible fortitude, uh of internal, uh systems to get those pipelines done. We need pipelines badly. We need manufacturing badly.

Jerry James, President, Artex Oil Company [01:06:40] I will give you one thought that we have as we turn that on the head, because I worry about whether we can build enough pipelines fast enough, because the opportunity is going to be here really quick. It is, and I might have mentioned to this one time, is there’s the old adage, if you can’t move the mountain to Muhammad, you got to move Muhammad to the mountain. There’s a mountain of energy in Ohio, West Virginia, Pennsylvania, and in Texas, and in Louisiana. Thank you. Good night. That’s about 75% or 80% of the natural gas we produce in this country. Right. So if you look at that, and this is already starting to happen, it wasn’t happening a year or two ago when we used to preach this, it’s happening more today is if we build the demand on top of the fuel supply would dramatically cut the time that it takes to get this done, would dramatically cut to cost and will dramatically cut, the, um, friction we create with the public because nobody wants a major pipeline or major electric line laid through his property. So we can dramatically cut all of that. But I think it’s gonna take, it’s interesting the Texans are doing a much better job. They’re doing a job in Louisiana. But even in Ohio, we’ve got a lot of data centers. We’re like on the top of the list on data centers, but interesting most of the gas is from Eastern Ohio. Matter of fact, if you look over Ohio, West Virginia, Pennsylvania, run together, 20, 25% within a 50 mile radius of all the gas produced in the United States is where those three states meet. But there’s very little data centers been built in that region at all, and it should be where they build it.

Stu Turley, Energy News Beat Podcast Host [01:08:12] Uh, let’s go build a data center. That is so cool. I will thank you so much here. I hope this is the first of multiple, uh, conversations, uh. Cause I really am, I’m floored by how well you articulated a lot of these problems out there, Jerry. You did great.

Jerry James, President, Artex Oil Company [01:08:33] Well, as long as I didn’t depress anybody, my goal is not to depress them. Always remember, your goal at the end of the line is the jobs. If you always keep that as the mind of how to really help you, my dad used to tell me the best way to help me is to help him get a good job.

Stu Turley, Energy News Beat Podcast Host [01:08:47] Absolutely. And I think when my first interview with Nathan and my first exposure to the, uh, crescent shale, uh, USA organization is critical. And I want to do what I can to help get that story out there.

Jerry James, President, Artex Oil Company [01:09:01] Out there. We appreciate that.

Stu Turley, Energy News Beat Podcast Host [01:09:03] Uh, this is a huge deal. Cause if we don’t industrialize, we will end up like the UK, EU and Canada. And I firmly believe that we’re approaching new trading blocks and those new trading walks are going to be everybody that has the all above energy policies, not tied to net zero. Those are going be the new trading. India, Saudi Arabia cutter. Russia, the United States are all going to be in these new trading blocks coming around the corner. Cause the war is going to end. I’m very positive that it’s going to it. So anyway, but with that again, Jerry, thank you very much for stopping by.

Jerry James, President, Artex Oil Company [01:09:45] Thank you and thank the listeners for taking the time to listen.

Stu Turley, Energy News Beat Podcast Host [01:09:49] And we’ll have all your contact information in the show notes.

Jerry James, President, Artex Oil Company [01:09:52] Okay, thank you.