As winter grips the United States with unprecedented intensity in January 2026, natural gas prices have skyrocketed, reflecting a sharp surge in heating demand amid freezing temperatures and looming storms. This volatility underscores the energy market’s sensitivity to weather patterns, with implications rippling through consumer budgets and investment portfolios alike. In this article, we’ll examine the recent price escalation, the forecast for upcoming storms in the lower United States, and the potential effects on everyday consumers and savvy investors.

The Sharp Rise in Natural Gas Prices

Natural gas futures have experienced one of their most dramatic rallies in recent memory, driven primarily by an Arctic cold snap that has blanketed much of the U.S. As of January 21, 2026, Henry Hub natural gas futures settled at $4.728 per million British thermal units (MMBtu), marking a staggering 21.01% increase in a single day.

Over the past week, prices have surged more than 50%, with intraday highs approaching $5 per MMBtu in some sessions.

This follows a relatively stable period earlier in the month, where the Henry Hub spot price hovered around $3.12/MMBtu as of January 14.

The catalyst? A combination of frigid weather boosting residential and commercial heating needs, coupled with production disruptions from “freeze-offs” in key basins like the Permian and Haynesville.

U.S. natural gas production dipped to around 110.5 billion cubic feet per day (Bcf/d), down from over 112 Bcf/d earlier in the week, exacerbating supply tightness.

Meanwhile, storage levels remain above the five-year average at 3,185 Bcf, but net withdrawals of 71 Bcf for the week ending January 14 were lower than expected, signaling that the current cold wave could erode surpluses quickly.

Analysts attribute part of the rally to short covering by traders caught off-guard by revised weather models flipping to colder forecasts.

This has created a feedback loop, amplifying price gains and highlighting the market’s vulnerability to meteorological shifts.

Upcoming Storms Across the Lower United States

The price spike is only the beginning, as meteorologists warn of a massive winter storm set to unfold starting January 23, 2026. Dubbed Winter Storm Fern by The Weather Channel, this system is projected to impact over 180 million people—more than half the U.S. population—stretching from the Southwest through the Plains, South, and into the Northeast.

The storm will span a 2,000-mile swath, bringing heavy snow, sleet, and potentially damaging freezing rain from New Mexico and Texas eastward to the Carolinas and Mid-Atlantic by the weekend.

In the lower United States, particularly the Deep South, the forecast calls for a mix of precipitation types. Northern areas like Oklahoma, Arkansas, Tennessee, and northern parts of Mississippi, Alabama, and Georgia could see 6-12 inches of snow, while southern regions face risks of ice accumulations up to 0.75 inches, leading to hazardous travel, downed power lines, and widespread outages.

Winter storm watches are already in effect from central Texas through Tennessee and into the Appalachians, with temperatures plummeting 8°F below normal in the Midwest, Mid-Atlantic, and parts of New England.

Subfreezing conditions may extend deep into Texas and the Gulf Coast, accompanied by ice storms and heavy snow in higher elevations.This event is described as one of the most extreme winter storms in years, with the potential for “life-threatening” wind chills, frostbite, and hypothermia risks.

The National Weather Service emphasizes uncertainty in the storm’s exact track, but confidence is high in significant impacts, including power disruptions that could further strain natural gas demand for electricity generation.

Impacts on Consumers: Higher Bills and Potential Hardships

For consumers, the confluence of spiking prices and severe weather spells trouble. Natural gas is the primary heating fuel for about half of U.S. households, and the current rally could translate to “very expensive natural gas bills arriving in February.”

Residential heating costs may rise 200-400% during peak cold periods, disproportionately affecting lower-income families who lack buffers for sudden increases.

In a moderate price doubling scenario, average annual energy costs could climb by $300-800 per household.

Beyond bills, the storms pose risks of power outages from ice-laden lines, forcing reliance on alternative heating or emergency shelters amid frigid temperatures.

Utilities may pass on fuel surcharges, compounding inflation pressures already felt in the power sector.

While U.S. Energy Information Administration (EIA) forecasts suggest Henry Hub prices may dip slightly to under $3.50/MMBtu annually in 2026 due to supply growth keeping pace with demand, the short-term spike could erode these buffers if cold persists.

Consumers in affected regions should prepare by stocking up on essentials, insulating homes, and monitoring utility alerts to mitigate risks.

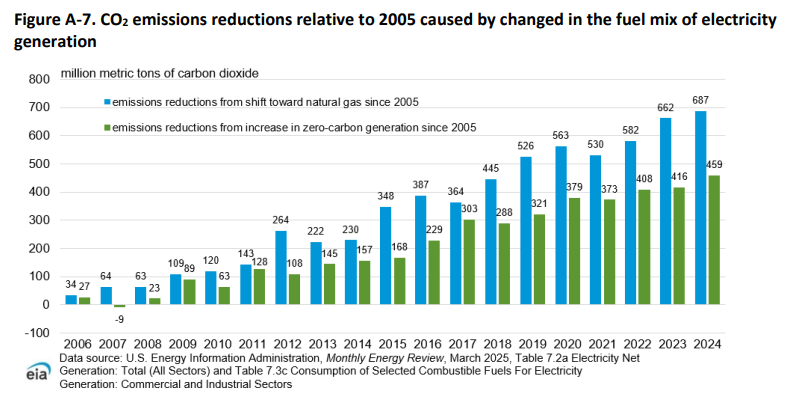

Emission Reductions from Natural Gas

One part of the natural gas story not covered by the mainstream media is that the reduction in CO2 emissions is greater by using natural gas rather than zero-carbon wind and solar. So the question is: “Is Natural Gas no longer a bridge fuel?”

Opportunities for Investors: Navigating Volatility for Gains

Investors, however, may find silver linings in this turbulence. The price surge has benefited natural gas producers and exporters, with futures contracts like February 2026 (NGG26) up over 20%.

Exchange-traded funds (ETFs) tied to natural gas have seen sharp moves: the United States Natural Gas Fund (UNG) rose 9.30%, while the leveraged Ultra Bloomberg Natural Gas (BOIL) jumped 18.54%.

Bearish plays, such as the UltraShort Bloomberg Natural Gas (KOLD), have plummeted accordingly.

To capitalize, investors could consider long positions in natural gas futures or options if weather models continue signaling prolonged cold, potentially pushing prices toward $5/MMBtu or higher amid freeze-offs and demand peaks.

Stocks in major producers like those in the Permian Basin may rally, as reduced output tightens supply. For diversification, look to liquefied natural gas (LNG) exporters, as global demand remains robust—U.S. LNG exports are absorbing surplus production, and analysts predict Asian spot prices around $9.50-9.90/MMBtu in 2026, down from 2025 but still supportive.

That said, volatility cuts both ways. The EIA anticipates demand growth outpacing supply only in 2027, suggesting a potential price pullback later in 2026 if inventories rebuild.

Short squeezes, as seen this week, can lead to rapid reversals, so risk management via stops or hedged positions is crucial. Investors should monitor EIA storage reports and weather updates closely to time entries.

In summary, the ongoing cold snap and impending storms are reshaping the natural gas landscape, challenging consumers with higher costs while offering investors tactical opportunities in a dynamic market. As always in energy, weather remains king—stay tuned for developments that could shift the balance.

Sources: eia.gov, barchart.com

Be the first to comment