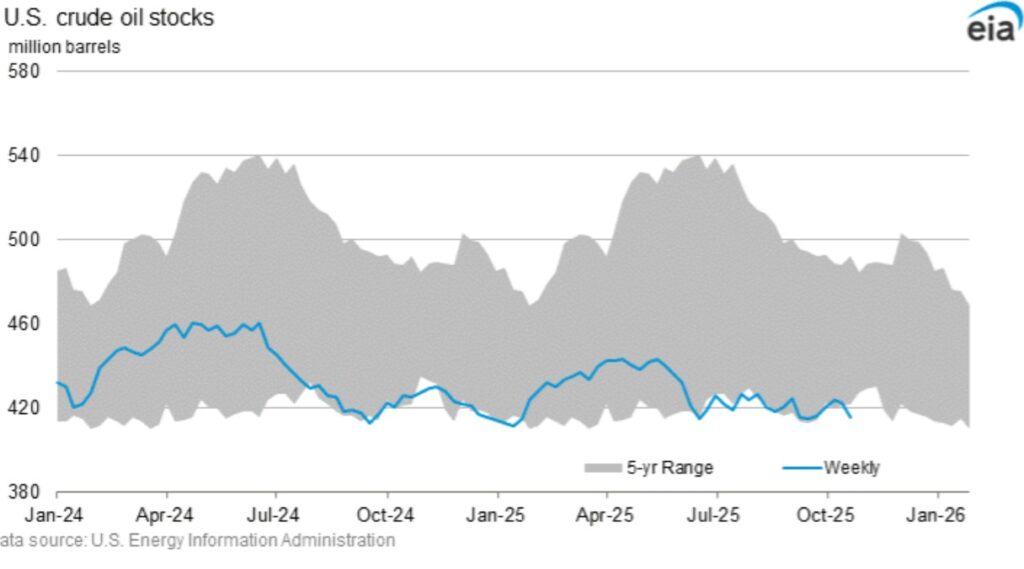

In the latest Weekly Petroleum Status Report from the U.S. Energy Information Administration (EIA) for the week ending January 9, 2026, U.S. commercial crude oil inventories (excluding the Strategic Petroleum Reserve) saw a notable increase of 3.4 million barrels, reaching a total of 422.4 million barrels. This build defied market expectations of a drawdown and marks a reversal from the previous week’s decline of 3.8 million barrels. At current levels, inventories sit about 3% below the five-year average for this time of year, reflecting ongoing dynamics in supply, demand, and refining activity. This uptick comes amid broader market concerns over global oversupply, even as domestic production remains robust but shows signs of slight softening.

Strategic Petroleum Reserve Levels

The Strategic Petroleum Reserve (SPR) continues its gradual rebuild following significant drawdowns in prior years. For the week ending January 9, 2026, SPR crude oil stocks stood at 413.7 million barrels, up modestly by 0.2 million barrels from the prior week. This level represents a 5% increase compared to the same period in 2025, when stocks were at 393.8 million barrels. The Department of Energy has been actively refilling the reserve, with recent awards for additional purchases signaling a commitment to bolstering emergency stockpiles. As of early January 2026, the SPR provides approximately 413 million barrels of import protection, though it remains well below its authorized capacity of 714 million barrels.

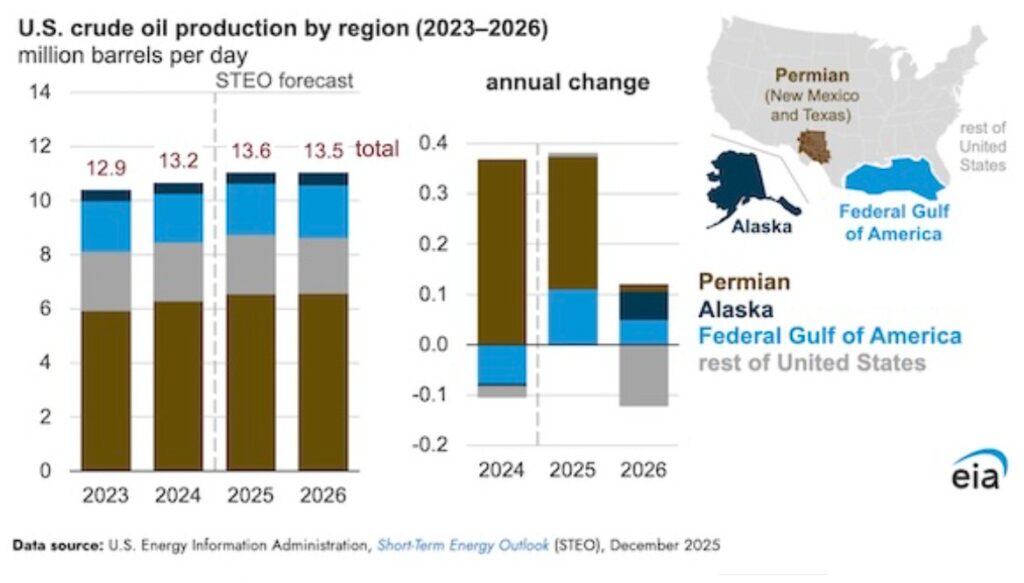

U.S. Crude Oil Production Trends

U.S. crude oil production averaged 13.753 million barrels per day (b/d) for the week ending January 9, 2026, down 0.4% from the previous week’s 13.811 million b/d. This marks a slight pullback but keeps output near record highs achieved in 2025. Looking ahead, the EIA’s January 2026 Short-Term Energy Outlook forecasts annual production to hold relatively flat at around 13.6 million b/d in 2026 before declining by about 2% to 13.3 million b/d in 2027. This projected slowdown is attributed to sustained lower oil prices, which could curb drilling activity, despite ongoing efficiency gains in key regions like the Permian Basin. The Permian is expected to average 6.6 million b/d in 2026, with modest growth in the Gulf of Mexico and Alaska offsetting declines elsewhere.

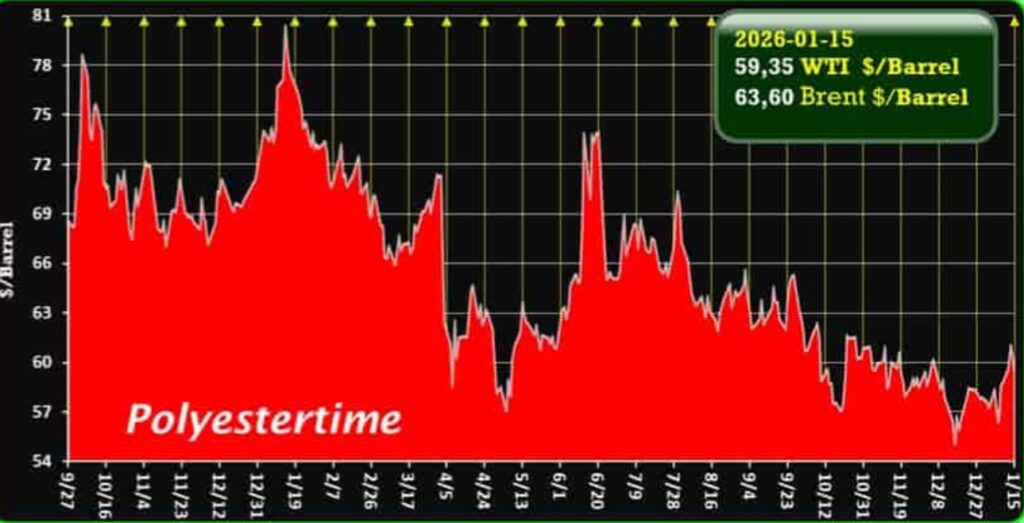

Crude Oil Prices: WTI and Brent

As of January 22, 2026, West Texas Intermediate (WTI) crude oil prices hovered around $59.88 per barrel, down approximately 1.2% from the previous day amid oversupply fears and easing geopolitical tensions. Brent crude, the global benchmark, traded at about $64.04 per barrel, reflecting a similar daily decline of 1.8%.

Over the past month, WTI has risen modestly by around 2%, but it remains down more than 20% year-over-year. Brent has followed a comparable pattern, up 2.8% monthly but down 18% from January 2025 levels. These prices are influenced by expectations of global inventory builds outpacing demand growth, with the International Energy Agency projecting a surplus of 3.7 million b/d in 2026. The EIA forecasts Brent to average $56 per barrel in 2026, down 19% from 2025.

Gasoline Inventories and Market Dynamics

Gasoline stocks surged by 9 million barrels in the week ending January 9, 2026, reaching 251 million barrels—well above market forecasts of a 3.6 million-barrel build. This increase follows a 7.7 million-barrel rise the prior week and pushes inventories to 3% above the five-year average. Production averaged 9.0 million b/d, while demand ticked up slightly to 8.3 million b/d. Retail gasoline prices have nudged higher to a national average of $2.84 per gallon as of mid-January, though they remain below last year’s $3.08.

The EIA anticipates prices to fall to $2.92 per gallon in 2026, down 6% from 2025, driven by lower crude costs but partially offset by tightening refinery margins due to West Coast capacity reductions.

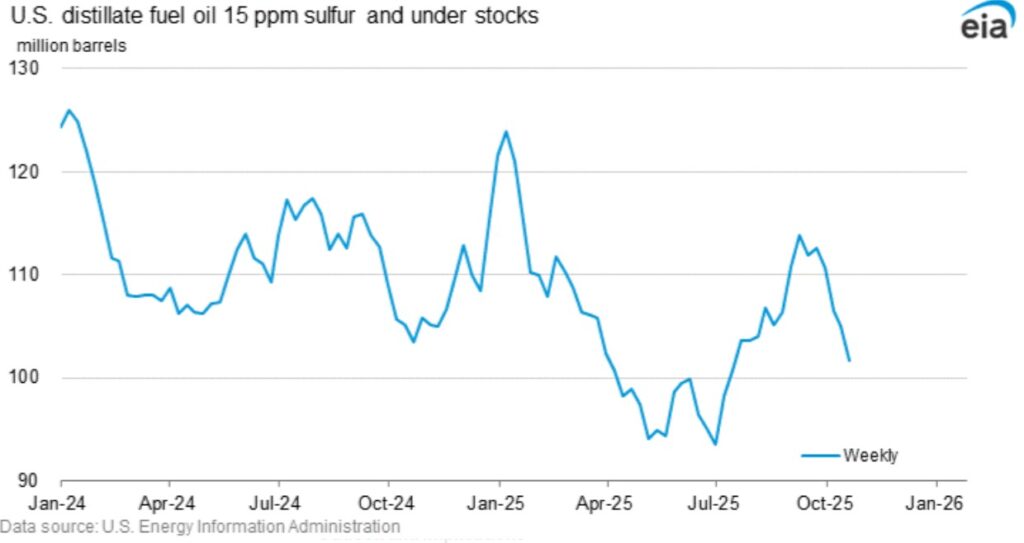

Diesel (Distillate) Inventories

Distillate fuel inventories, which include diesel and heating oil, remained nearly unchanged at 129.2 million barrels for the week ending January 9, 2026, dipping by just 29,000 barrels against expectations of a slight rise. This level is about 4% below the five-year average, highlighting tighter conditions in the distillate market. Production held steady at around 5.3 million b/d, with demand averaging 3.6 million b/d over the past four weeks—down 4.3% year-over-year. The stability in distillate stocks comes amid seasonal heating demands and robust exports, but ongoing builds in overall petroleum products could pressure prices downward.

Outlook and Implications

The recent crude inventory build underscores a market grappling with ample supply amid moderate demand growth. With global production expected to outstrip consumption, prices may face downward pressure in the near term. However, geopolitical developments—such as tensions in Iran or disruptions in Kazakhstan—could introduce volatility. For the U.S. energy sector, steady production near records supports economic activity, but investors should monitor upcoming EIA releases, including today’s delayed report for the week ending January 16, for further insights. As always, these trends highlight the interconnected nature of inventories, production, and prices in shaping the energy landscape.

Saudi Arabia’s Energy Transition and the Evolving Global Oil Landscape

Be the first to comment