As Winter Storm Fern barreled across the United States from January 20 to 27, 2026, blanketing much of the nation in ice, snow, and sub-zero temperatures, the electric grid faced one of its toughest tests in years. Stretching over 2,300 miles, the storm triggered record-breaking power demand, widespread outages, and skyrocketing electricity prices. In the midst of this chaos, it wasn’t the much-touted wind turbines or solar panels that kept the lights on and homes heated—it was the reliable workhorses of the energy world: coal, oil, natural gas, and even trash-burning facilities. As former Rep. Jason Isaac highlighted in a viral X post, coal stepped up to rescue grids in the Midwest, Northeast, and Texas, while a Wall Street Journal op-ed pointed out the ironic reality in New England: more power came from burning wood and trash than from wind.

This week’s events underscore a critical lesson for America’s energy future: when extreme weather strikes, intermittent renewables often falter, leaving fossil fuels and waste-to-energy plants to pick up the slack. Let’s break down the energy mix, the reports from New England, and what this all means for everyday consumers and the broader debate on grid reliability.

The Energy Mix During the Storm: Fossils Dominate, Renewables Take a Back Seat

Data from grid operators like PJM Interconnection (the nation’s largest, serving 67 million people from the Midwest to the Mid-Atlantic), ISO New England, and ERCOT in Texas paint a clear picture of how the U.S. grid powered through the storm. Peak demand shattered records, with PJM forecasting over 147 gigawatts (GW) on January 27—surpassing the previous winter high of 143.7 GW set in 2025.

This “winter streak” of extreme demand lasted seven consecutive days, a first for PJM.

Natural gas led the charge nationally, fueling about 40% of U.S. electricity generation, up from just 12% in 1990.

In PJM’s footprint, gas supplied over 39% of the load, nuclear 26%, and coal nearly 23%, while wind contributed a mere 5% during key periods.

Coal’s role was even more pronounced in the Midwest’s MISO grid, where it hit 40% of generation early Sunday morning.

Texas’s ERCOT grid also leaned heavily on gas and coal to meet a projected record demand of 86 GW on January 26, avoiding widespread blackouts despite the freeze.

Challenges abounded: Freezing temperatures caused generation outages totaling 21 GW in PJM (16% of demand), with fuel constraints and mechanical issues sidelining plants.

Wind output dropped due to icing, and solar provided negligible contributions amid short, cloudy days.

Overall, the storm exposed vulnerabilities, with over 548,000 customers losing power at its peak, though quick interventions—like federal waivers allowing dirtier fuels—prevented a total collapse.

New England’s Stark Reality: Oil and Trash Outshine Wind and Solar

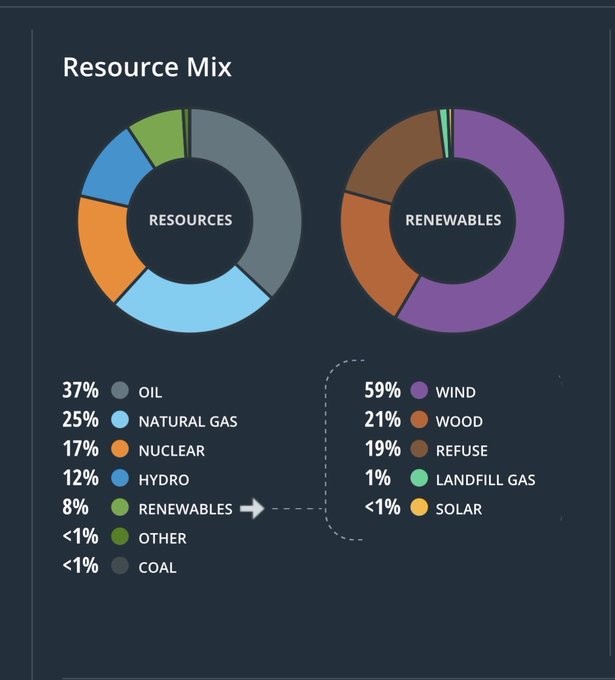

Nowhere was the reliance on non-renewables more evident than in New England, where the grid’s fuel mix flipped dramatically. With natural gas pipelines constrained—thanks in part to regional policies limiting expansions—power plants turned to oil, which surged to 40-43% of generation during peak demand.

This is a throwback for a region that has largely phased out oil under normal conditions, but it highlights ongoing issues during cold snaps.The Wall Street Journal captured the irony perfectly: “Get this—the region generated more power from burning wood and trash than from wind power.”

Reports from ISO New England confirm that “renewables” in the mix were dominated by biomass, wood, and refuse (trash-to-energy facilities), which accounted for roughly half of the category’s output.

Wind and solar? Less than 2% combined at times, with solar barely registering and wind hampered by the weather.

Trash-burning, classified as “renewable” in some contexts, proved a literal lifesaver, providing steady baseload power when imports from Canada and neighbors weren’t enough.

This isn’t new for New England—similar patterns emerged in past storms, like the 2022 Christmas freeze—but the 2026 event amplified the trend, with oil imports (once from places like Venezuela) filling the gap amid tight gas supplies.

A real question remains: why are blue states like Hawaii and New England still burning oil?

What This Means for Consumers: Higher Bills, but Dodged Bullets

For everyday Americans, the storm translated to immediate pain: Wholesale electricity prices spiked wildly, hitting $3,000 per megawatt-hour in PJM (up from $200) and over $1,800 in data-center-heavy Virginia.

In Texas, prices jumped to $1,500-$1,600 in some areas.

These surges will likely filter down to higher utility bills, especially in regions like the Northeast where heating demands compete with power generation.Outages affected hundreds of thousands, with ice-downed lines and frozen equipment delaying restorations.

Yet, consumers should thank the fossil fuel backbone for averting worse scenarios—think rolling blackouts or prolonged darkness. Without coal’s 40% in MISO or oil’s surge in New England, demand could have overwhelmed the system, leading to mandatory cuts.

The Trump administration’s quick waivers to bypass pollution rules for full-tilt operation of all sources was a game-changer.

Long-term, this means vulnerability to price volatility and weather risks, particularly as data centers and electrification drive up baseload needs. NERC’s pre-storm warnings of “elevated risk” due to rising demand outpacing capacity additions (mostly batteries and solar, which underperformed) ring true.

The Path Forward: Rethinking Reliability and Pricing in US Grid Discussions

In the interview on the Energy News Beat podcast with Stu Turley and Bret Bennet, “Ensuring a Reliable and Affordable Texas Grid: An Interview with Dr. Brent Bennett of the Texas Public Policy Foundation”,Dr. Bennet brings up some great points. After spending $150 Billion on wind, solar, and storage on the Texas ERCOT grid, they could spend 25% less on wind, solar, and storage and deploy that funding to grid-resilient power plants like gas or clean coal, making it more economical. That brings up the next article: the damage caused to the Grid by spinning-up and spinning-down turbines. They do not like to be maintained that way, and there is evidence showing the gas turbines are wearing out faster due to the cycles forced on them by the addition of wind and solar intermittency.

This all goes back to putting DC wind and solar on an AC grid, and the second-order effects of the forced energy pattern.

This storm should spark honest conversations about reliable power. Key things to watch:Baseload vs. Intermittency: Dispatchable sources like coal, gas, nuclear, and even trash-burning provide power on demand, unlike wind and solar, which dipped below expectations due to weather.

We need policies that value “always-on” capacity, not just cheap intermittents that fail during extremes.

Infrastructure Gaps: Pipeline constraints in New England forced oil reliance—addressing this could stabilize supplies without ditching fossils entirely.

Resilience Investments: Grid operators activated emergency measures; future discussions should prioritize hardening infrastructure against cold snaps, including better fuel storage.

On restructuring pricing: Absolutely, we should account for wind and solar’s intermittency by paying for resilience. Current markets often subsidize renewables with low marginal costs, pushing reliable plants offline.

Shift to capacity markets or performance-based payments that reward plants for availability during peaks. This could mean higher upfront costs but fewer spikes and outages—ultimately saving consumers money and headaches.In the end, Winter Storm Fern was a wake-up call. Thank heaven for coal, oil, natural gas, and yes, even trash—they kept America powered when it mattered most. As we push toward a cleaner grid, let’s not forget the reliability that fossils provide. The alternative? A dark, cold future we can’t afford.

Sources: theenergynewsbeat.substack.com,

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment