ENB Pub Note: Doug Sheridan writes on LinkedIn the following, and he is spot on. And as the subtitle suggests, “Turley’s Law” has been proven accurate in the past, and we will have to look at modifications as the world needs more oil and gas. The overall premise was that the more money spent on “renewable wind, solar, and hydrogen,” the more oil, natural gas, and coal would be used. We have been discussing the trillions of dollars needed to meet standard decline curves, and we are now seeing a significant shift back to investing in oil and gas. As investors seek returns, they are beginning to realize that oil and gas, when managed properly, is not as bad as they initially thought. Returns are not happening in the “renewable” space, as we see in the headlines this week from Orsted.

The FT writes, the world’s leading oil companies are stepping up their hunt for new oil and gas reserves, as a slower than expected transition to clean energy sets the stage for stronger fossil fuel demand for decades to come. Execs from bp, Chevron, ExxonMobil, Shell and TotalEnergies all used recent earnings calls to highlight how they have begun refocusing on securing new reserves after years of prioritising renewables.

in

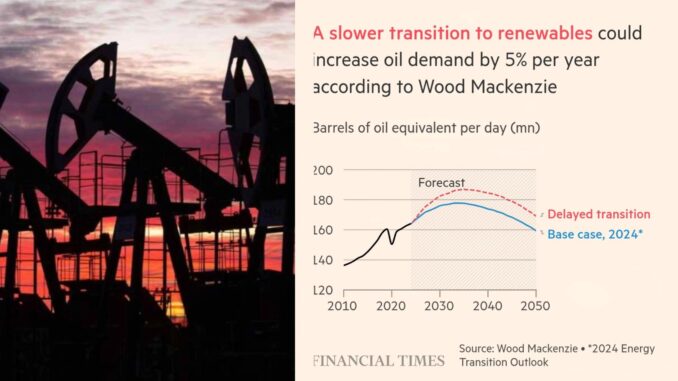

Geopolitical instability has led gov’ts to prioritise energy security over decarbonisation. Trump has directed oil and gas producers to “drill, baby, drill.” And Wood Mackenzie estimates a slower transition could leave the world needing about 5% more oil per year than previously forecast from the mid-2030s. It forecasts the world will require more than 100bn extra barrels of oil and gas from exploration by 2050 to help fill this gap.

Our Take 1: Remember when the group thinkers were insisting oil companies face a massive stranded assets issue? We do. In reality, it turns out oil companies might need to come up with an extra 100 billion barrels of oil equivalent by 2050. Assuming an average price of $70 per barrel, that’s a minimum of $7 triilion worth additional hydrocarbons. Gulp.

The expectations of greater demand is raising concerns that years of under-investment have left the industry unprepared. Jessica Ciosek, head of Americas exploration research at Wood Mackenzie, said there was a “huge need” for more oil and gas. “There is a very big supply gap that M&A cannot solve for in the long run. Companies are refilling a pipeline, not just in drill-ready prospects, but in access to the areas where they would consider drilling.”

Ciosek noted the industry was playing catch-up after neglecting exploration earlier in the decade, choosing instead to focus on slashing costs and gearing up for a quick shift to clean energy. Last year, a total of 5bn barrels of oil were discovered, according to Rystad, equivalent to just 19% of the world’s annual production.

Our Take 2: There’s no other way to put it—this is bombshell stuff and a stunning reversal in conventional wisdom within and toward the oil and gas industry… and just the latest nail in the coffin of the wishfully thinking “Big Oil is dead” narrative. Not only is Big Oil not dead, we’re now seeing the outlines of a resurgence in growth rates and profitability for the industry. Wow.

“There’s an industry-wide sentiment now that while the energy transition is happening, it is not nearly as rapid as we thought it would be,” said Palzor Shenga, senior upstream analyst at Rystad Energy.

Our Take 3: We disagree with any assertions that the energy transition—defined as the march toward Net Zero by 2050—is “happening.” Anyone paying attention can see what’s been accomplished so far is almost inconsequential toward that goal, and now even those efforts are stalling. It’s time to stop sugarcoating the facts, folks. Seriously.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack