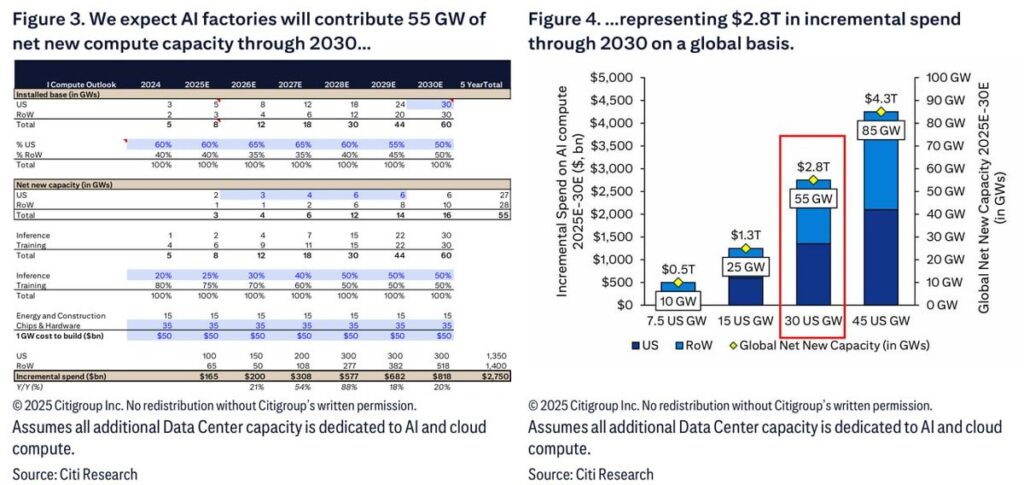

The rapid expansion of artificial intelligence (AI) is reshaping global energy landscapes, with data centers at the epicenter of this transformation. According to recent estimates from Citi, the surge in AI computing demand will necessitate an additional 55 gigawatts (GW) of power capacity worldwide by 2030.

This projection aligns with broader industry analyses, such as those from Goldman Sachs, which forecast a 165% increase in data center power demand by the end of the decade, building on current global consumption of around 55 GW.

As AI workloads intensify—driven by advancements in machine learning, cloud computing, and generative technologies—the strain on power infrastructure is becoming a critical bottleneck. This article explores the implications of this demand, including potential expenditures, investment opportunities in energy sectors, and viable power generation options amid supply chain hurdles.

Linking Power Demand to Massive AI Infrastructure Investments

The question arises: Will this 55 GW addition fuel a $1.5 trillion wave of AI computing expenditure in the United States alone? The short answer is that while the U.S. will see substantial investments, the $1.5 trillion figure more closely reflects global AI spending trends rather than U.S.-specific computing capex tied directly to this power increment. Citi’s analysis ties the 55 GW global power need to approximately $1.4 trillion in worldwide AI computing capital expenditures (capex) by 2030, encompassing data center builds, hardware, and supporting infrastructure.

However, broader forecasts paint an even larger picture. Gartner’s projections indicate that global AI spending could reach nearly $1.5 trillion as early as 2025, driven by cloud infrastructure, software, and data center expansions.

This includes not just computing hardware but also the energy systems required to support it. McKinsey estimates that worldwide data center investments to meet compute demands could total $6.7 trillion by 2030, with a significant portion allocated to AI-ready facilities.

In the U.S., where data centers are projected to consume up to 9% of electricity by 2030 (up from 3-4% today), AI-driven capex is expected to contribute heavily to this total.

Another report suggests global AI data center spending alone could exceed $1.4 trillion by 2027, with the U.S. capturing a lion’s share due to its dominance in tech giants like Google, Meta, and OpenAI.

While not exclusively pegged to the 55 GW figure, this power demand is a key driver of the investment surge. The U.S., as a hub for AI innovation, could see expenditures approaching or exceeding $1.5 trillion in cumulative AI-related infrastructure by 2030 when factoring in domestic data center builds, grid upgrades, and energy procurement. This represents a compounding effect: more power capacity enables more AI compute, which in turn demands further investment. However, exact U.S.-only figures for “AI computing expenditure” remain estimates, with global totals often serving as proxies.

Companies Poised for Investment in the AI Power Wave

The intersection of AI demand and energy infrastructure presents lucrative opportunities for investors. Companies involved in grid modernization, power generation, and transmission are particularly well-positioned, as utilities and tech firms race to scale capacity. Here are some standout players, based on their exposure to data center electrification and related trends:Quanta Services (PWR): As a leading provider of infrastructure solutions, Quanta specializes in power grid upgrades and transmission line installations. With AI data centers requiring robust, high-voltage connections, the company is deeply embedded in projects addressing surging demand. Analysts highlight its role in modernizing aging grids to handle intermittent loads.

GE Vernova (GEV): Spun off from General Electric, GE Vernova focuses on power generation equipment, including gas turbines and renewable technologies. Despite supply chain bottlenecks in turbines, its diversified portfolio—including wind and grid solutions—positions it to benefit from both fossil fuel and clean energy transitions fueled by AI needs.

Southern Company (SO): This utility giant operates in states like Georgia, a hotspot for data center growth. Southern is investing heavily in nuclear and natural gas expansions to meet rising electricity demands, with dividends appealing to income-focused investors.

Williams Companies (WMB): A major natural gas pipeline operator, Williams stands to gain from increased gas transport to power plants serving data centers. As AI drives gas-fired generation, its infrastructure network supports reliable fuel delivery.

Fluence Energy (FLNC): Specializing in energy storage systems, Fluence addresses the intermittency of renewables, crucial for AI’s 24/7 power requirements. Its battery solutions enable grid stability amid fluctuating data center loads.

Eaton Corporation (ETN): Eaton provides electrical components for power management, including transformers and switchgear essential for transmission upgrades. Its focus on efficient energy distribution aligns with the need for resilient grids.

Other notables include Entergy (ETR) for its Southern U.S. utility operations and EQT Corporation (EQT) as a natural gas producer supplying fuel for generation.

Investors should consider diversified ETFs like those tracking data center REITs (e.g., Equinix, Digital Realty) or infrastructure funds for broader exposure.

|

Company

|

Sector Focus

|

Key AI Power Advantage

|

Recent Performance Note

|

|---|---|---|---|

|

Quanta Services (PWR)

|

Grid/Transmission

|

Infrastructure builds for data centers

|

Strong backlog from utility contracts

|

|

GE Vernova (GEV)

|

Power Generation

|

Turbines and renewables

|

Benefiting from gas boom despite delays

|

|

Southern Company (SO)

|

Utilities

|

Nuclear/gas expansions in data center hubs

|

Reliable dividends amid demand growth

|

|

Williams Companies (WMB)

|

Pipelines

|

Gas transport to plants

|

Positioned for fuel supply chain

|

|

Fluence Energy (FLNC)

|

Energy Storage

|

Battery solutions for grid stability

|

Tackles renewable intermittency

|

|

Eaton Corporation (ETN)

|

Electrical Components

|

Transmission equipment

|

Essential for efficient power delivery

|

These firms are not without risks—regulatory shifts, commodity prices, and competition could impact returns—but their alignment with AI’s energy needs makes them compelling for long-term portfolios.

Power Plants That Can Scale Quickly Amid Natural Gas Turbine Constraints

Bringing new power capacity online swiftly is essential to match AI’s timeline, but supply chain issues for natural gas turbines pose significant challenges. Major manufacturers like GE Vernova, Siemens, and Mitsubishi are facing backlogs, with wait times for advanced turbines stretching 1-7 years and costs rising sharply.

This “turbine crunch” stems from surging demand for gas-fired plants, which could limit near-term growth despite their efficiency for baseload power.

Battery Energy Storage Systems (BESS): Not plants per se, but standalone or hybrid BESS can be deployed in 6-12 months, enhancing grid capacity without new generation. Ideal for peaking and stabilizing AI loads.

Reciprocating Engine Plants (Gas-Fired): Using smaller engines instead of turbines, these can be built in 1-2 years with potentially shorter lead times. They offer flexibility for quick starts and are less affected by large-turbine bottlenecks.

Small Modular Reactors (SMRs): Emerging nuclear options promise 2-4 year builds once regulatory hurdles clear, but current prototypes face delays.

Traditional combined-cycle gas plants, while efficient, may take 3-5 years under normal conditions, and are extended further by shortages.

The 55 GW power addition underscores AI’s profound impact on energy systems. While driving trillions in global investments—with the U.S. poised for a significant slice—strategic plays in infrastructure companies and rapid-build power options will be key to sustaining this growth. As the Energy News Beat Channel continues to track these developments, the fusion of tech and energy promises both challenges and opportunities for a sustainable future.

The challenges and delays in the SMR and nuclear markets will be addressed in a separate article. We do not have a frontrunner for mass production of SMRs, and whoever wins that race will be king of the energy growth segment. Natural Gas companies like Williams seem to be on the top of the list. A well-managed natural gas midstream company should be at the top of your list for solid investments.

We seem to be heading towards a bubble in the nuclear markets, as billions are rolling in. If there is no revenue associated with a reasonable timeframe, it may become dicey.