In this episode of Energy Newsbeat – Conversations in Energy, host Stu Turley sits down with Nathan Lord, President of Shale Crescent USA, to unpack why Ohio, West Virginia, and Pennsylvania may be the world’s most overlooked manufacturing and energy powerhouse. Nathan explains how the region’s abundant, low-cost natural gas creates a world-class advantage for petrochemicals, power generation, and reshoring manufacturing from Europe and China—while also cutting emissions by building near the fuel source. They dive into Europe’s deindustrialization, the risks of net-zero policies that export industry (and emissions) to China, the coming surge in gas demand from LNG and AI data centers, and why winning the “fuel race” is the key to U.S. energy security, grid reliability, and long-term prosperity for American workers.

We wrote an introduction to this interview for the Energy News Beat Substack, and it included data compiled by Nathan and the Shale Crescent team. America’s Strategic Energy Asset: Why the Ohio, West Virginia, Pennsylvania Region Must Be Prioritized for Power, Prosperity, and National Security

I look forward to more podcasts and interviews with CEOs from Ohio, West Virginia, and Pennsylvania to discuss this significant, strategic reindustrialization effort for the United States.

Listen Here:

Highlights of the Podcast

00:00 – Intro

01:01 – What Is Shale Crescent USA?

02:53 – Marcellus Gas Volumes & Global Ranking

04:20 – Where Global Manufacturers Go Next

05:35 – Trump, the Saudi Crown Prince & LNG Dreams

06:02 – Maximizing the Molecule: From Gas to Booster Seats

07:16 – Germany’s Net-Zero Deindustrialization

09:06 – Europe’s Energy Insecurity vs. U.S. Shale Advantage

11:15 – Energy Security at Home, Energy Dominance Abroad

12:12 – How Shale Crescent Lands Global Projects

13:07 – Stu’s Two-Track World & China’s Manufacturing Pull

14:54 – Can the U.S. Beat China on Manufacturing Costs?

17:51 – Onshoring, ESG & Emissions Reality

20:26 – Is ESG Fading? Cleanest Molecule Wins

21:51 – Rare Earths vs. “Rare Natural Gas” Advantage

23:08 – 50 Bcf of New Gas Demand: AI, LNG & Manufacturing

24:11 – Who’s Locking Up Molecules (and Who Isn’t)

26:02 – 1970s Lessons: Grandma First & Behind-the-Meter Power

28:30 – Avoiding Blackouts & Winning the AI Fuel Race

32:06 – Build on the Fuel Source: Speed to Power

35:53 – Gulf Coast + Shale Crescent: 80% of U.S. Gas & Storage Gaps

37:39 – Man-Made Energy Problems & Leadership

38:18 – How to Find Nathan & Shale Crescent USA

39:08 – Closing: From Rust Belt to Prosperity

I had an absolute blast visiting with Nathan Lord, and I am interviewing Jerry James, President of Artex Oil Company, who is also on the Board of Shale Crescent USA, today, to be released in a week or so.

It’s not work if you love what you do, and Nathan really loves trying to help rebuild the United States manufacturing machine. And, I also get to talk with great energy leaders like Nathan and Jerry, who do not look at what we do as work. It is way too much fun.

Buckle up, and let me know if you have any topics you want our team to research.

On Friday, I have a Live podcast with

and Katy Grimes, the Editor in Chief of the California Globe on her article “Has California’s Oil and Gas Industry Hit the Point of No Return?.

Here is the live link on Friday at 1:00 Central and 11:00 Pacific. https://www.youtube.com/live/9iQIhfX0ydM?si=Znq7qqLAusx0-xuS

If you would like to advertise on Energy News Beat, we offer ad programs starting at $500 per month, and we use a program that gets around ad blockers. When you go to Energynewsbeat.co on your phone, or even on Brave, our ads are still seen. The traffic ranges from 50K to 210K daily visitors, and 5 to 7K or more pull the RSS feeds daily.

https://energynewsbeat.co/request-media-kit/

Full Transcript:

Stuart Turley – ENB Podcast Host [00:00:07] Hello, everybody. Welcome to the Energy Newsbeat Podcast. My name’s Stu Turley, President of C of the Sandstone Group. We’ve got a fantastic discussion. Buckle up if you wanted to find out something about natural gas, but more importantly, how we are going to re-energize manufacturing. I happen to know a guy. And that guy is Nathan Lord. He’s the president at Shale Crescent USA. Welcome to the podcast.

Nathan Lord – President at Shale Crescent USA [00:00:33] Yes, how are you? So I’m doing great. Thanks for having me. I’m looking forward to this.

Stuart Turley – ENB Podcast Host [00:00:37] I tell you what, we were just chit-chatting before the show, and it is amazing who you run into for dinner, and then you have a wonderful conversation, but yet on our conversation right now, you’ve got a two-pronged approach. You’ve got one for something that you tell the rest of the world, and then you’ve got one for you tell local folks. What do you do for Shale Crescent USA?

Nathan Lord – President at Shale Crescent USA [00:01:01] Thank you. And I’ll set this up real quick. Shale Cress and USA is a nonprofit economic and development organization. We represent Ohio, West Virginia, and Pennsylvania. Those three states have a huge supply of natural gas and energy. Well, what does that mean? For manufacturers, it means there’s this incredible economic opportunity. So we go tell the world what that opportunity is. I’ve been in Mumbai and Netherlands and Belgium and France and Germany presenting this message. Hey, there’s a lot of energy in the US, but do you know where it all is? And let me tell you where they think most of it is Texas. They always think it’s Texas. And that’s true. Texas has a ton of energy.

Stuart Turley – ENB Podcast Host [00:01:40] Right.

Nathan Lord – President at Shale Crescent USA [00:01:40] But but to be fair to them, I don’t I don’t know all the energy producing regions or the industrial regions in Europe and Asia, but they always seem to know this is the way I’d say it Texas, California, New York, and Disney World. But outside of that, they don’t have a good understanding of the rest of the US. So that’s a that’s a message that we carry to the rest of the world. We’re manufacturing opportunity.

Stuart Turley – ENB Podcast Host [00:02:01] Isn’t that great? Now I’ll tell you the Marcellus and up where you are, Nick over there at CNX, a CEO over there. I’ve loved my interview with him. He is a cool cat. Most people don’t realize that how much of natural gas is available and where we’re going with our grid. We kind of chit chatted about the grid and we need natural gas. In order to be energy dominant or energy security starts at home, we need coal, we need natural gas, we need nuclear, we need the wind and solar when it when it works, but we really need the ones that work all the time for industry. And when you sit back and take a look, the Marcellus, you’ve got 35 BCF a day up in the Marcellus, the rest of the US is six, and then Texas 16. But we let the world think that we’re the energy powerhouse.

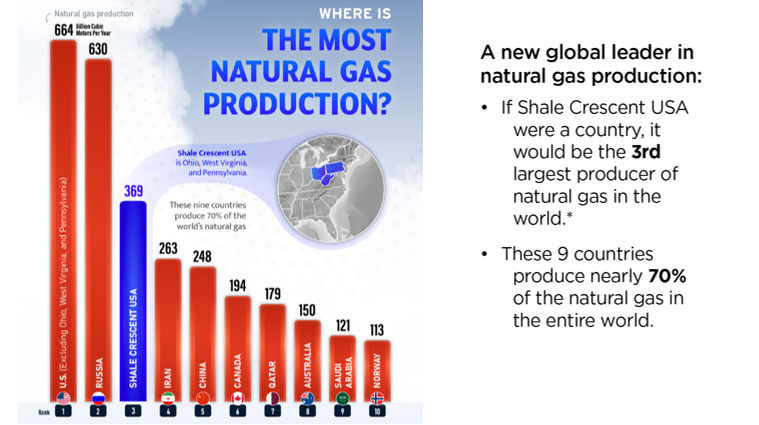

Nathan Lord – President at Shale Crescent USA [00:02:53] That’s true. And I was born in Dallas. Love the Dallas Cowboys. Hopefully people are still watching after I just made that comment. And shout out to shout out to Nick at CNX. He’s on our board and yes, tremendous expert and leader in the field. So to elaborate on what you just made, the statements about how much natural gas we have, we have a line. If the three states, Ohio, West Virginia, and Pennsylvania were a country, we’d be the third largest natural gas producing country in the world. So it’s a huge volume of gas. It didn’t used to be that way. In 2008, we were producing 3% of the nation’s natural gas. Now we’re producing 35% of the nation’s natural gas. And the DOE just came out with a projection last month, states that this will be the only region projected to grow. And they say we’ll be at 50% of US natural gas production by 2050. So it’s just it’s this huge supply. Now now I made that statement. If we were a country, we’d be the third largest natural gas producing country. The r other countries on this list that are in front of us, the rest of the US, Russia, us, and then countries like China, Canada, Qatar, Saudi Arabia, Norway, there’s a very short list of countries that produce a majority of all the natural gas in the world. Actually, 70% of all the gas in the world comes from just 10 countries. So if you’re a manufacturer and you’re in Europe, you’re in Asia and you consume a large amount of energy.

Stuart Turley – ENB Podcast Host [00:04:20] Right.

Nathan Lord – President at Shale Crescent USA [00:04:20] And you’re gonna make a billion dollar investment because you want to expand, or you need to get out of maybe Europe because you’re having struggles struggles there. Where are you gonna go? Well, it’s a short list of countries that’s even shorter when you look at some of the other ones on there, the Russia’s, the Chinas, the Iran, some of those, some of those countries that would make it very difficult. Cause these guys are building facilities that they expect to operate for the next 40 to 50 years. Oh, yeah. So we communicate to them, come to the US. Within the US, there’s there’s really two regions where you’re gonna end up. It’s either gonna be the Gulf Coast or it’s gonna be the Shale Crescent USA region right here.

Stuart Turley – ENB Podcast Host [00:04:53] How cool is that? Now, yesterday, the day we were recording this podcast, that President Trump welcomed the Saudi Crown Prince. Holy smokes, Batman, what a show. And now this Crown Prince is sitting there going, Oh, yeah, what’s a few trillion between friends? And he he ups his ante and they’re investing a trillion dollars. There’s 33 billion dollars in LNG and natural gas projects. I’ll tell you what I would love to see. Wouldn’t it be cool if we could get a LNG export facility on that side of it there? That would be huge to be able to take our great Marcellus gas and throw it on a tanker up there in Boston and ship it across the Atlantic.

Nathan Lord – President at Shale Crescent USA [00:05:36] I I like the way you’re thinking. We we want to see the investment. And actually, one of my meetings that was scheduled yesterday was held up. And the reason it was held up was, hey, I got called in, the Saudi Prince is here, and I have to so my meeting got postponed. And I said, okay, I’ve never had that one before, but I’ll take it. Well, Stu, what we look to to do is we want to maximize the value of the molecule that comes out of the ground.

Stuart Turley – ENB Podcast Host [00:06:02] Right.

Nathan Lord – President at Shale Crescent USA [00:06:02] Whatever use of energy doesn’t have an equal value. And let me explain that for a second. If we extract the natural gas out of the ground and we export it, the value added to our economy, and I’m thinking in the lens of Ohio, West Virginia, Pennsylvania, but this is this is anywhere, the value added to your economy is one. Okay. If you extract it and export out, you you’ve got the value, you’ve sold the molecule. The next best thing to do is if you can take that natural gas and turn it into an electron, power generation, data centers, powering heavy industry. That’s the next best thing you can do. But the the ultimate value that you can do to bring to your economy is get that molecule out of the ground and turn that valuable resource into a commodity petrochemical and then into a derivative product, all the way down into a child’s booster seat. And if you’re able to take that molecule and turn it over and turn it over and turn it over, you’ve created an incredible amount of economic gain and jobs, high-wage manufacturing jobs. So when I see the president working to attract investment, yes, I want to see all types of investment, but really I want to see the downstream activity here. And if the crown prince is listening, we have a few ideas on some projects that would that would work great here. Glad to share them.

Stuart Turley – ENB Podcast Host [00:07:16] How cool is that? I’ll tell you, and now Germany, you mentioned Germany just a minute ago, Nathan. And when you sit back and take a look, net zero energy policies equals deindustrialization. They were the poster child of what not to do. They used to be the poster child of you know, wind, solar, and then Vlukenvlocken or whatever the wind thing that doesn’t blow showed up. And all of a sudden they blew up their last nuclear cooling towers, believe three weeks ago, a couple of weeks ago. And then you have them now, they are now importing more LNG. So they went from the poster child to holy smokes, we are now in a deindustrialization. The UK is is really in some serious deep stuff, and it’s not good. And so when you sit back and look, where do you go? I see New York in that same deindustrialization mindset. And who would have guessed that the back east, I believe it’s New Jersey, has got nuclear and natural gas, and they still have high energy prices because of their policies. So it is energy policies that make the manufacturing area attractive. Is that a fair statement?

Nathan Lord – President at Shale Crescent USA [00:08:33] Is that a fair stage? You’re you are spot on. And and let me touch on the the Germany piece there for a little bit. So last year we were in Dusseldorf, and Dusseldorf is their version of Houston, petrochemical industry all over the place. They bring in major shows, the largest plastic show in the world’s held there. It’s incredible. Their infrastructure, it’s incredible. And I had the chance to meet with the head of the plastics association there and went through our presentation of hey, here’s what we’ve got going on. Love to work with your companies in a way that’s a win-win for both.

Stuart Turley – ENB Podcast Host [00:09:06] Right.

Nathan Lord – President at Shale Crescent USA [00:09:06] And he sat back in his chair, and this guy was kind of like an absent minded professor type of guy. His hair was everywhere. And he he made the statement, he said, Yeah, we knew we had it bad. He literally said, We’re screwed. We we cannot compete with what the US is doing right now. We can’t compete with US energy. They would say US shale gas. We can’t compete with it. And the reason that is, so right now, if we were in Europe, today we would be paying about $12 per BTU for the natural gas. In the US, we’re at about, I think we’re at about $4.50 today, somewhere around there. Yep. Right here where I’m sitting, we’re at about $3.75. So the lowest cost natural gas in the industrialized world, the industrialized world, the lowest cost is right here. Now let’s get in the mind of a manufacturer. If if you’re, let’s say a cracker plant that consumes 100,000 barrels a day of ethane to make polyethylene plastic pellets, and you consume a tremendous amount of energy, not just in the form of power or or heat for steam or whatever it might be, but you’re actually consuming the molecules as an ingredient, as a feedstock. And you’re in Europe and you’re paying four to five, sometimes up to 10 times more for the same amount of energy as what we’re paying here, and you’re producing a commodity. How do you compete? The answer is you don’t compete. And so they’re deindustrializing, they’re heavily deindustrializing. And you can click on the internet and make a Google search, and you’d see any CEO making statements like this we are concerned first. That we can’t get the molecules to operate. They are they’re concerned they don’t have the supply. Second, if we can get the molecules, can we even afford to pay for them? And so they’ve got a term that they’ve developed. We wouldn’t know it here because we don’t experience it, but it’s called energy insecurity. They are energy insecure. In the US, we have such an abundant supply, and especially in regions like the Gulf Coast and the Shale Crest in USA, we are energy secure. So as we work daily with these energy intensive manufacturers, they’re looking to make a secure investment. And our whole organization, we work on saying if you locate here, this part of the world or this part of the world, here’s what the economic return is going to be. Here’s why it’s secure.

Stuart Turley – ENB Podcast Host [00:11:15] This is cool. I’ll tell you, when you sit back and think, take a look, energy security starts at home, but energy dominance begins when you export.

Nathan Lord – President at Shale Crescent USA [00:11:24] Oh yeah, you’re you’re right on. And and we’re all for the exports. I’m not gonna say one one way or the other. And I know they become powerful trade tools.

Stuart Turley – ENB Podcast Host [00:11:33] You bet.

Nathan Lord – President at Shale Crescent USA [00:11:34] And our mission and our mindset of what we’re thinking is how can we maximize value here now? And we s we see it as both. You you have to have both.

Stuart Turley – ENB Podcast Host [00:11:42] What are the CEO’s comments from around the world? Because I love talking to energy leaders around the world. And what are they saying to you? And saying how do they get you on your speed dial? Because they say, Hey, wait a minute, this is kind of cool. So when they say Nathan, who do I talk to? And you go, Hey, I know people, right? Do you do break out in your best Tony? What’s the Soprano? Hey, I know people. Okay. You break into your soprano and say, This is how you get to business in the US. Is that a fair statement?

Nathan Lord – President at Shale Crescent USA [00:12:12] It’s how we’re set up as an organization actually. The way we develop it. So it’s why Nick is on our board with CNX. And it’s why we’ve got utilities on our board and railroads on our board and other producers on our board. Because when I go to Germany or I go to Mumbai, India, and I meet with the petrochemical company or the large steel manufacturer. Yeah, I want to share with them what I know and make them aware and give them the economic out analysis. But I’m not the person they’re going to be doing business with. I want to connect them with the folks that they’re going to be doing business with here. And so we’re very quickly engaging them with a network of folks that want to see them develop here. It it’s a pretty m easy message to communicate because the things that we’re talking about are growth, investment. And who doesn’t want that? Well, we know some people don’t want that, but for the most part, it’s a win win win message. And so a lot of people get on board pretty quickly.

Stuart Turley – ENB Podcast Host [00:13:07] Let me let me ask this. I have a theory that we are going to see the world bifurcate into two different markets. And I believe that the countries following net zero are going to follow the Germany deindustrialization, which is a lot of the EU, the UK and Canada, and they are going to have their manufacturing stolen by China. And China is gonna just keep there. It’s gonna re China’s new manufacturing for the EU and UK and Canada are going to be absorbing what they used to make for the United States. And so then you’re gonna see the United States. I think that we’re gonna see an end to the Russian war. We’re gonna be trading with Russia, we’re gonna be trading with India, Asia, and all of the others. And you’re gonna see the bifurcation of net zero energy policies trading with net zero energy policy at non net zero. And then you’re gonna see the net zero folks trading with China as the majority of it works out. And this is gonna be fiscal greatness and grandeur, which is the Middle East, as we saw yesterday as we recorded this with President Trump and the trillions of investment. But this almost sounds like your target market for bringing joint manufacturing to eliminate tariffs, would be those those countries over here or possibly Germany. To get out of the tariff area. Did I articulate that correctly or was I that my

Nathan Lord – President at Shale Crescent USA [00:14:43] You made a you made a great point and you said it in a way that I hadn’t thought of before. You you’re you’re saying you see net zero type of countries being forced to do business with China.

Stuart Turley – ENB Podcast Host [00:14:54] Yep.

Nathan Lord – President at Shale Crescent USA [00:14:54] So, how does that make sense? If you really care about global emissions, is sending manufacturing to China the most environmentally friendly thing to do? I don’t see how it makes sense. But let me let me throw something at you that that might adjust your thinking on some of this. Cool. So the very first thing we did when we realized we had all this natural gas in the Shale Crescent region, Ohio, West Virginia, Pennsylvania, was we said, okay, how do our prices compare to the rest of the world? Well, we’d gotten to the point where we produced so much that we became a negative basis differential. So we’re we’re routinely about a dollar, maybe a little less than that, less than NIMEX prices, and we’re significantly less than Europe and Asia prices. And then we did a study, we said, well, what if you built a large petrochemical facility here compared to Europe or the Gulf Coast of Texas? How do we come out? Came out very advantaged. We took that farther down. What about derivative products? Then we got all the way to the point, well, okay, if we can make all these ingredient raw material type products, what if we tried to make a child’s booster seat here or a tackle box or a toothbrush? Things that are primarily made in China. Right. Can we compete with the manufacturing giant of China? So we did a head to head comparison. We looked at all the cost, all the cost drivers of making those finished consumer good products, plastic base.

Stuart Turley – ENB Podcast Host [00:16:11] Here.

Nathan Lord – President at Shale Crescent USA [00:16:12] Making them here versus making them in China. And you know what came out? We are significantly financially advanced to make them here. And it comes down to a pretty simple reason. We don’t have to pay for transportation of our feedstock in, and we don’t have to pay for transportation of the finished product out. You have both of them right here. Wow. The thing that we found that rose to the top is labor’s not as big of a component, it’s not as big of an advantage anymore in China like it used to be. They don’t work for a dollar a day anymore. Actually, their labor rates increase about 20% each year. So they’re doubling about every four to five years. So they’re they’re not at the low labor rates they used to. And with automation, labor’s not as large of an input. So if I were to show you a cost bar stack of building it here in the shalecres in USA versus building in China, we come out on top, better priced. And I’ll give you just a simple example. We produce an abundance of ethane here. Our ethane is piped to the Gulf Coast. The Gulf Coast turns it into polyethylene, which is a plastic pellet resin, sends that plastic pellet to China, China turns it into the toothbrush and sends it back to us. How is that economic? It’s not, it’s not anymore. Now that the US has energy, it’s not the manufacturing model that works anymore. That’s the old manufacturing model. The new manufacturing model, nice the US is incredibly blessed to be able to do this, is built on top of the feedstock supply and in the center of customers. Avoid the transportation cost in and avoid the transportation cost of the finished product out. It it’s so simple. I I have a a stack of reports that are that are this tall, they put all of us to sleep in about two minutes, but that’s what they all come down to. They say that point right there.

Stuart Turley – ENB Podcast Host [00:17:51] It this is amazing. I’ll tell you, this is, but you know what it validates though, Nathan, is the fact that it validates we will be doing business with other countries that are not following the net zero deindustrialization model. I can see the Saudi Arabia folks investing in plants. I can see India investing in plants here that they would need. I mean, I can see the investment flowing and then the manufacturing done here. That’s the critical part. I’m all this, but we’re still going to be doing business with those bifurcated groups. I mean, I I think this your information is phenomenal.

Nathan Lord – President at Shale Crescent USA [00:18:32] Well let me tell you one that we throw at them. So I think your audience would probably understand this well. Most every time when you hear something, is it ESG friendly? You might as well just say that’s gonna cost more. If if someone’s telling me it needs to be ESG friendly, just double the price of it. So we kind of tried to turn we turn this up on side of its head and we said, Well, you know, our focus is how can we be more economic? But if you’re not long haul transporting feedstock in and long haul transporting finished product out, you eliminated the transportation. Therefore, you eliminated the transportation emissions that went with it. So it is a more economic and more environmentally friendly solution to do it here as well. So win win.

Stuart Turley – ENB Podcast Host [00:19:10] It is. And when you Larry Fink, I believe about four or five months ago, head of BlackRock said we don’t want to talk about ESG anymore. It finally realizes ESG is a fake thing that’s put out there to take advantage of. And I think we’re going to see the end of the carbon taxes and all of those others, because we had Bill Gates now flop. And when you sit back and take a look at Bill Gates flopping that way on the climate change, well, climate change, we’re not going to die from climate change. It’s not the biggest thing in the world. ESG for the Nick, for the US, I believe that ESG did a good thing to the oil and gas producers that it allowed for better governance in oil and gas, and they are fiscally responsible by constantly giving money back to investors. Investors are getting the best returns because of the ESG, the environmental we produce in the United States, especially up where Nick does. Nick is, like we said, a cool cat. We provide the cleanest molecule to the market better than anybody else in the in the entire world. It’s because our people live ESG every day.

Nathan Lord – President at Shale Crescent USA [00:20:26] And that’s exactly right.

Stuart Turley – ENB Podcast Host [00:20:27] And I I I I loved your statement, by the way. I I think it is great. And I think the ESG is gonna go away because when BlackRock says we don’t need to bother about it anymore, I think it is gonna go away.

Nathan Lord – President at Shale Crescent USA [00:20:40] We agree. And to your point, if it’s not made here, it’s gonna be made in China. And so where would you rather have something produced? Where do you think it’s gonna be done the the most clean, the most friendly?

Stuart Turley – ENB Podcast Host [00:20:51] Exactly. Now, Lee Zeldin’s got his work cut out for him. Holy smokes, Batman. I I love Lee Zeldon. I think he’s a cool cat, but it we have got to get our regulatory issues fixed for manufacturers to be built here quicker. Because right now we’re at we’re at 20 years to get a mine built in the United States. And and poor old Chris Wright, who is a rock star, is doing the best he can with Lee to get that done. So that one is a really big topic to say, hey, we need manufacturing in the United States. I love President Trump’s comment. Lee, you’ve got to get rid of 10 regulations for every one you put in. I thought that was kind of cool.

Nathan Lord – President at Shale Crescent USA [00:21:34] That would be great. And yes, a more regulatory friendly environment is what we need. You you brought up mining and the topic a month ago was rare earths. How are we going to have the rare earths? How are we going to have the rare earths? And we all know that we have those assets here in the US. It’s taken advantage of advantage of them. But where I think the US needs to focus its messaging, and especially our region, what we’re looking to do is I would say yes, we have rare earths and they need to be extracted, but what we really need to be promoting is a rare natural gas advantage. It’s so unique what we have here in the US to have so much energy to be a net exporter of natural gas, even to the point where it’s densely located in what we would call the shale crescent in the center of 50% of the US population. That’s an incredibly rare asset. And where we think it is, it’s an opportunity for the rest of the world. Ideally, we would like to see the Department of Energy, we’d like to see other energy leaders within the country start pointing their finger of blessing on the Gulf Coast, the Shale Crescent USA, because Stu, I think you and I know with the incoming demand that we have, whether in the form of power generation, onshore and industrial LNG, it’s it’s only going to be done with natural gas. These these new energy needs that are coming, they can only be answered by the energy form of natural gas today. And where’s all this natural gas? It’s in Texas and it’s it’s right here. If if you’d like, I can talk. Briefly on what I think is a dinner table conversation we need to have here.

Stuart Turley – ENB Podcast Host [00:23:07] Absolutely.

Nathan Lord – President at Shale Crescent USA [00:23:08] Okay. So the the first thing that I was kind of walking around and discussing was we have a world class manufacturing advantage. That’s what we go tell the rest of the world.

Stuart Turley – ENB Podcast Host [00:23:17] Yeah.

Nathan Lord – President at Shale Crescent USA [00:23:18] Comb your hair, you put a smile on.

Stuart Turley – ENB Podcast Host [00:23:20] Hey, hey, hey, our podcast listeners, he’s bringing up a sore subject. I used to have a full head of hair. Okay, sorry.

Nathan Lord – President at Shale Crescent USA [00:23:27] I apologize that when you put your best coat on and you go out there and you tell the world, hey, here’s an opportunity for you. Take advantage of it. Then you go back home and you realize, well, there’s a there’s a crack over there in the door. I need to mow the lawn. I need to do a few other things here. And there’s a dinner table conversation we need to have. There, there’s some first-time events happening in the US, like we haven’t seen in a long time. Well, we haven’t really ever seen in 50 years. And I’ll walk through a few of these. So Chris Wright comes out and he says, we’re gonna need anywhere from 50 to 150 gigawatts of new power, even by the end of this decade. And that number might even be more than that. We all continue to hear large numbers. We know they’re large. That in itself, right there, is about 20 BCF of new gas demand.

Stuart Turley – ENB Podcast Host [00:24:11] Right.

Nathan Lord – President at Shale Crescent USA [00:24:12] We also see the Department of Energy saying we’re going to attract a whole lot of onshore manufacturing here in the form of petrochemicals and heavy industry, another 10 BCF of natural gas. We can look at the charts and we can see that there’s new LNG coming online over the next five years, about another 15 to 20 BCF. I just listed 50 BCF of new gas coming online. We’ve never seen a growth in gas demand like that in a long time. So what are we going to do to meet that new demand that’s that’s coming online? Well, it’s going to be increased production in the Gulf Coast, or it’s going to be increased production here. But one of the one of the challenges that we see we have right now is how are we going to communicate to the electric grid, the power grid, that they need to secure their molecules today? And I’ll I’ll make a statement here. Market signals right now are being sent by LNG. LNG wants to, LNG could tell you on this quarter in 2029, this facility is going to be built and they’re going to need two a BCF of gas a day. Right. They’ve got that locked up and they’re going to have it locked up for the next 10 to 15 years on contracts. Okay, that gas is spoken for. Then you’ve got data centers coming in. They know exactly how much they need, and they have an incredible amount of money. They’re locking up their gas contracts right now. You know who’s not locking up their gas contracts? RTOs, ISOs, grid operators, the PJMs, the others of the world. Wow. And so one of the things that we’re trying to actively communicate with energy leaders is hey, we got to figure out a mechanism that secures the natural gas that we have right now to supply the current power demands, whether it’s small industrial, commercial, residential. There’s a there’s a game inside a game right now that’s really interesting. And I’d like to at some point bring on a guest who could talk more about that. I think you’d find it incredibly interesting if absolutely.

Stuart Turley – ENB Podcast Host [00:26:02] Absolutely. You just brought up about 19,000 things. And I can see that we’re going to need to have about three or four follow-up podcasts after this because I’m sitting here thinking about the the your comment, Nathan, is phenomenal. The the power companies not locking up the contracts. Let’s take the Abilene Stargate, for example. It it would power, you know, 800,000 homes to whatever the number is. I’d have to go look it up. I could throw a rock from my house there. But when you sit back and take a look, it’s behind the meter and you are spot on. They’ve got it locked up because in Texas, they just passed the law that said if you’re a data center and the grid’s in trouble, they could shut you off. Data centers don’t behave very well when they are shut off with no power. They don’t like that. That’s a bad thing. So this is huge. Your comment is like I’m over here going, I got about 19 articles I gotta write on this one right now. This is like holy smoke.

Nathan Lord – President at Shale Crescent USA [00:27:04] Well, very astute for you to make that statement. We’ve seen an industry cut off before. It was called the nineteen seventies. In Ohio, it was called a self-help program. You know, Ohio’s heavily industrialized. The three states, birthplace of oil and gas, birthplace of petrochemicals, birthplace of glass, rubber, steel. Right. We’ve we’ve always had an incredible amount of industry demand and the energy to go with it. But the 70s came along and we experienced an energy crisis. Right. And you know who got the gas supply first? Grandma. Grandma got the gas supply first. Everybody else was cut off because they had to curtail the amount of natural gas being sent to industry so grandma could heat her home. Right. There’s a world where that could happen again if we’re not smart about how we approach this problem. And that’s why there was companies like Ford or Owens Corning. They went out and drilled their own wells to get their own gas supply. We’re starting to see that be done in a different way. It’s with the data centers. It’s why they’re going, building behind the meter in the form of behind the power grid, and they’re working to lock up long term contracts of gas supply. LNG doing the same thing. But what if the ISOs and the RTOs, what if they’re not communicating far enough in advance? Where does that leave us right now? And so these are all hard things. It’s it’s not easy. They’re all new. And the reason it’s it’s a challenge right now is we haven’t seen the grid grow like this in a long, long time.

Stuart Turley – ENB Podcast Host [00:28:30] Yep. Very long time. It and the exponential growth, we’ve never seen this. In fact, the Secretary Wright, his team put out a report several months ago that we dodged a bullet by the election. And the reason we dodged a bullet was the Biden administration, Jennifer Granholm’s policies were so horrific. We were approaching blackouts across the US like a third world country. I mean, people don’t realize how close we came to deindustrialization in the United States based off of the election and the policies that were about to be thrown in.

Nathan Lord – President at Shale Crescent USA [00:29:10] I totally believe it. And I would even venture to say we’re still at risk of seeing a lot of those blackouts. I I I know the president and his administration is doing everything it can, but there’s a machine that’s been rolling for a while. Right. It’s really put us behind the eight ball. You know, one of the things that the that the US wants to do is they want to win the AI race. Well, while we were doing things like reducing our power output, China was drastically increasing their power output. They produce since 2010, we were equal in the amount of power. Now they produce 2.5 times more electricity than we do. Well, if you want to win the AI race, you have to win the power race. And the only way you’re going to win the power race is if you win the fuel race. And that’s going to be done through natural gas.

Stuart Turley – ENB Podcast Host [00:29:54] I like your thought process, Nathan. Wow. I cause because I I don’t want to cut you off, but that was a brilliant statement. You have to win the fuel race. I mean, I’m I picked up on that because that is a brilliant comment. You not only have to have the raw materials, you have to have the steel. You can’t do what Europe did and try to produce green steel. Green steel does not work. You gotta have coking coal. I mean, it just does not make any sense. But you nailed it with that. China has ballpark, I believe they have 50 to 60 nuclear reactors. They have another 10 on that they’re building currently right now. We have currently about 95 reactors. Now I just interviewed JU last year. He is the founder of nano nuclear. They are they’ve got to, and then I also interviewed James Walker, their their CEO, and they have two plants and two reactors going, but they’ve got at the same time their manufacturing plants so they can start building modular nuclear reactors at the same time that they’ve got these two reactors being approved. They’re approving the the mult the plants to mass produce them. That’s how that’s the only way we’re going to get nuclear rolling out fast. Is by being able to build the assembly lines at the same time that you get them approved. And it’s the fuel. They also have their fuel line being approved at the same time. It’s brilliant. You nailed it. You nailed it based on the

Nathan Lord – President at Shale Crescent USA [00:31:36] You’ve got to focus on the fuel. And go to any conference. And what is the focus going to be? Power generation. It’s going to be focused on power generation. You can build power generation anywhere. I know there’s backlogs and supply chain issues, but really they’re machines. They’re very sophisticated machines that are built by man. Fuel cannot be sourced anywhere. It it’s where it’s located. And you better be planning on the fuel that you need coming out of the ground now if you want to expect to have it by the time these plants get up and running. And so what we’ve seen.

Stuart Turley – ENB Podcast Host [00:32:06] Nathan, you just brought up an oh sorry, you brought up another huge thing for you to put in your arsenal to for you when you’re talking to people and saying, hey, wait a minute, you gotta, hey, I know people. I mean, you gotta give me your best soprano when you say, Hey, I know people. Think of the cost that you save, because in Texas, they spent, I believe it was $8.9 billion to get the transmission lines from West Texas to Texas to Dallas and Houston to get the wind and solar here. That’s a lot of money. That’s a lot of transmission line. That’s a lot of rare earth minerals. That’s a lot of all these other things. If you’re building your manufacturing next to the shale crescent right there, you’re saving a lot of money by putting that plant right next to the source.

Nathan Lord – President at Shale Crescent USA [00:32:56] You must sit in our board meetings. That is exactly our talking point through and through. So the Department of Energy has an RFI that’s out right now. It’s called speed to power. It closes tomorrow. And their whole focus is how can we get more power online faster? What can we do to reduce risk, cost? Let’s bring it on so it’s ready. Do you want to know the easiest way to do that? You bring that power and you build it right on top of the fuel source. Don’t build it 200 miles to the left or 200 miles to the right. You build it right there. You eliminate the cost of transport lines, pipelines, transmission lines, and you eliminate a lot of the risk that goes with it. We’ve done all these studies, whether it’s for petrochemicals, power, metals, and it all comes back to this. If you can be on top of your fuel source, you have an incredible economic advantage. But in this case, it’s a speed to power issue. It is the fastest way to do it now. And if you were to listen to Chris Wright, they’ll tell anybody in the Department of Energy will tell you we need your ideas and solutions. Now we don’t need them two, three years from now. We need them here. And they would say to the point that this is the Manhattan Project of today. And so it’s a monumental effort, but we can do it. We just got to take some of these simple, proactive steps. And I think we’ll see it happen.

Stuart Turley – ENB Podcast Host [00:34:10] Well Nathan, you’ve added about sixteen different questions. I’m filling out my form to get the interview with Chris Wright again. I’ve interviewed him four times and I’m getting the my fifth one lined up. But I’ve got to f you’ve gotta fill out the form and you’ve gotta make sure everything’s all in there and I’ve got it on my desk and I’m I’ve got about nineteen other questions in the world.

Nathan Lord – President at Shale Crescent USA [00:34:29] Questions. He he must like you if he keeps coming back.

Stuart Turley – ENB Podcast Host [00:34:32] I think he’s a glutton for punishment, but he’s he is a very I’ll tell you what, he is definitely the right man for the right job. And I’m not making a pun. He is the right man for the job.

Nathan Lord – President at Shale Crescent USA [00:34:45] We’re we are so privileged to have him. I was at the West Virginia Governor’s Energy Summit last week, and I had a chance to meet with Energy Dominance Council, Blake Dealey, had the chance to meet with the deputy secretary Kyle Hosweit of the Office of Fossil Fuels. These are sharp guys. These are industry experts, and these are sharp guys. And we are so fortunate to have them in charge. And I’m I’m I can’t imagine where we would have been, but I’m thankful that they’re they’re there and in charge now. And one of the things that I tried to communicate with them just very briefly and in the time that you have at a conference is you know, some of the biggest challenges that the US has right now, grid reliability, onshore and critical energy intensive manufacturing, winning the AI race. All those things are going to be solved today at scale by natural gas. Everything else can’t be done at scale, can’t be done fast enough, not yet, and it’s not affordable. We’ve got to make sure we solve these problems and it’s affordable. If we raise energy prices, we’re going to collapse the economy. And so, where’s the solutions going to be found? 80%, excuse me, 80% of all the natural gas. I apologize. We’ll get this.

Stuart Turley – ENB Podcast Host [00:35:54] I’ll have the team yep. Okay.

Nathan Lord – President at Shale Crescent USA [00:35:56] Eighty percent of all the natural gas in the US is produced on the Gulf Coast and the Shale Crescent region.

Stuart Turley – ENB Podcast Host [00:36:01] Right.

Nathan Lord – President at Shale Crescent USA [00:36:02] Those two regions are going to be the solutions. They’ve got heavy infrastructure and pipelines and transmission lines. You’ve got to build on top of the fuel source. And so we’ve got these incredible opportunities. Some of the challenges that we see when you think about natural gas, natural gas was built to support traditional natural gas demands. Home heating industry wasn’t built, it wasn’t built to support power generation. So now it now it’s going and it’s being asked above and beyond what it’s ever been asked.

Stuart Turley – ENB Podcast Host [00:36:31] Right.

Nathan Lord – President at Shale Crescent USA [00:36:31] And I don’t know if we’re seeing some of the infrastructure move along with it. I’ll give you an example. We’ve nearly doubled natural gas demand in the past decade and a half. So much new natural gas production, so much new demand. Natural gas storage has barely even grown. Natural gas storage is what backs up our whole grid on peak demand days. 50% of 50% of the gas that flows on peak demand days comes from natural gas storage. And so there’s some things here, pieces where we’ve got to we’ve got to look in advance and start addressing some of these problems.

Stuart Turley – ENB Podcast Host [00:37:03] You bet. In fact, I just wrote out a article this morning, the pipelines where they’re going and everything else. Texas to Louisiana, we’ve got three point five BCF focusing on the Permian. We’ve got Louisiana one point eight BCF, Oklahoma, Mississippi, Alabama, North Carolina. And those were the main areas of the new build outs for natural gas build outs in the US right now.

Nathan Lord – President at Shale Crescent USA [00:37:29] Wow.

Stuart Turley – ENB Podcast Host [00:37:30] So that was an article I just put out.

Nathan Lord – President at Shale Crescent USA [00:37:32] Lar large new demand coming online. We’re in a position though where we can we can solve these problems.

Stuart Turley – ENB Podcast Host [00:37:39] Absolutely.

Nathan Lord – President at Shale Crescent USA [00:37:39] Absolutely. If we can’t, it’s because they’re man made problems. You know, we’ve had times before where the solutions that we had difficulty just because we didn’t have the fuel source or the energy. Well, now if we end up being short energy or finding extremely high energy prices, those are gonna be man made problems. And so these are all things that can be avoided. We j need the leaders to lead and grateful that we’ve got some good leaders right now.

Stuart Turley – ENB Podcast Host [00:38:03] Well N well Nathan, this this conversation felt like about five minutes, which tells me that either I was it really funny and I thought I was a just a really moving right along, or it was a good conversation and I’m gonna vote for B that it was a good conversation. But how do people find you, Nathan?

Nathan Lord – President at Shale Crescent USA [00:38:19] So thank you for bringing that up. Shale Crescent USA dot com. We give away all of our resources. We’ve done an incredible amount of research on where the most profitable locations in the world for manufacturing, what’s our energy opportunity in the US today? And we give that all away. You can also find me on LinkedIn, Nathan Lord, Shale Crescent USA. I’m glad to have a dialog with anyone.

Stuart Turley – ENB Podcast Host [00:38:42] Well, that is I’m gonna have that in the show notes and and have that in there. And I truly appreciate Nathan, you and your time and what you’re doing for the United States. You’re you’ve got a big job. And I I really truly appreciate it because for our kids to be able to have jobs, to be able to look, we’ve got to be manufacturing. And you’re at the core of what needs to happen.

Nathan Lord – President at Shale Crescent USA [00:39:08] Well, thank you. And and I will speak very positively of my board and and many others that that we work with. I I will say it this way everyone on our board is a senior level person. They’ve been in the industry for for some decades and they all see this as a giving back opportunity. They they they give their expertise, their time, their treasure because they want to see jobs created. They’ve they experience the rust belt. And that’s a term that we just want to totally get rid of and forget. And we want to see prosperity here and all throughout the US.

Stuart Turley – ENB Podcast Host [00:39:40] That is really, really cool. Well thank you for your leadership, your time, and look forward to more podcasts with you ’cause I I can tell right now I got a lot more questions that I think I’ve I’ve