The American Petroleum Institute (API) reported a surprise build this week for crude oil of 2.156 million barrels, while analysts predicted a draw of 400,000 barrels.

The build comes as the Department of Energy released 5.3 million barrels from the Strategic Petroleum Reserves in week ending August 5, to 464.6 million barrels.

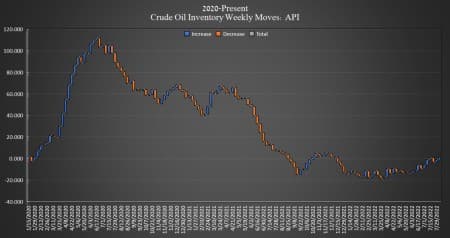

U.S. crude inventories have shed some 61 million barrels since the start of 2021, with a 2 million barrel gain since the start of 2020, according to API data.

In the week prior, the API reported a surprise build in crude oil inventories of 2.165 million barrels after analysts had predicted a draw of 467,000 barrels.

WTI was trading down on Tuesday even as Russia suspended oil exports through the Druzhba pipeline via Ukraine. WTI was trading down 0.91% on the day at 12:23 p.m. ET in the runup to the release at $89.93 per barrel—down roughly $5 per barrel on the week. Brent crude was trading down 0.42% on the day at $96.24—also a $5 drop on the week.

U.S. crude oil production data for the week ending July 29 held steady at 12.1 million bpd, according to the latest EIA data.

The API also reported a draw in gasoline inventories this week of 627,000 barrels for the week ending Aug 5, compared to the previous week’s 204,000-barrel draw.

Distillate stocks saw a build of 1.376 million barrels for the week, compared to last week’s 351,000-barrel decrease.

Cushing inventories rose by 910,000 barrels this week. Last week, the API saw a build of 653,000 barrels. Official EIA Cushing inventories for week ending July 29 was 24.466 million, up from 23.540 in the prior week.

At 4:50pm, ET, WTI was trading down at $90.58 (-0.20%), with Brent trading down at $96.45 (-0.21%).

Source: Oilprice.com