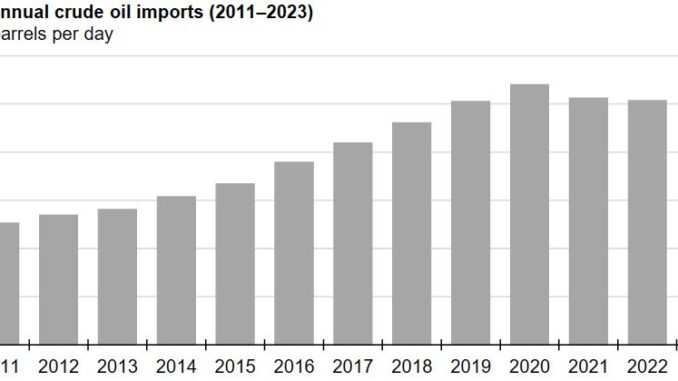

China, the world’s largest importer of crude oil, imported 11.3 million barrels per day (b/d) of crude oil in 2023, 10% more than in 2022, according to China customs data. Refiners in China imported record volumes of crude oil in 2023 to supply the country’s increasing refining capacity in order to support the country’s transportation fuel needs and produce feedstocks for its growing petrochemical industry.

Russia, Saudi Arabia, and Iraq were China’s main sources of crude oil imports in 2023. Compared with 2022, China’s 2023 crude oil imports increased the most from Russia, Iran, Brazil, and the United States. China’s largest volumetric increase in crude oil imports in 2023 was from Russia. From 2019 to 2021, China obtained 15% of its crude oil imports from Russia, second only to Saudi Arabia. In 2023, Russia became China’s top source of crude oil imports, supplying 19% of China’s crude oil imports (2.1 million b/d). This increase was the result of discounts related to sanctions and price caps on crude oil from Russia following its full-scale invasion of Ukraine in 2022.

Note: Many imports attributed to Malaysia, the United Arab Emirates (UAE), and Oman originated in Iran and were relabeled to avoid detection. Top trading partners are all countries from which China imported more than 150,000 barrels per day of crude oil from 2020 to 2023. Congo=Congo-Brazzaville

The next largest increases in China’s crude oil imports came from Iran, Brazil, and the United States. Customs data indicate that China imported 54% more crude oil (1.1 million b/d) from Malaysia in 2023 than in 2022. However, crude oil imports from Malaysia exceeded Malaysia’s total crude oil production. Industry analysts believe that much of the oil shipped from Iran to China was relabeled as originating from countries such as Malaysia, the United Arab Emirates, and Oman to avoid U.S. sanctions against countries engaging in petroleum transactions with Iran. In 2023, China increased crude oil imports from Brazil by 52%, from 498,000 b/d to 755,000 b/d, and from the United States by 81%, from 158,000 b/d to 286,000 b/d.

Although China’s overall crude oil imports increased, crude oil imports from a few of its largest sources decreased. Notably, after crude oil from Russia became available at a discount when sanctions were imposed, China decreased its crude oil imports from Western Europe, where crude oil prices were relatively high. China’s crude oil imports from Norway decreased 100,000 b/d from 2022 to 2023, and China continued to import much smaller volumes of crude oil from the United Kingdom than before crude oil from Russia was discounted.