Too little too late? Japan had trade deficits for years; a crushed yen is not good. Needed now: Big QT & rate hikes to bail out the yen.

By Wolf Richter for WOLF STREET:

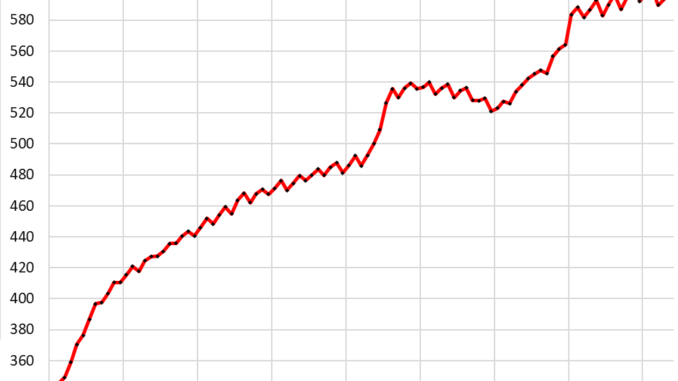

The Bank of Japan’s holdings of Japanese government securities – so Japanese Government Bonds (JGBs) and short-term bills – have been roughly flat since August, with a downward bias in recent months.

Its JGB holdings run on a three-month cycle: Every third month, a large batch of long-term bonds mature and come off the balance sheet, and its bond holdings fall that month, but then it purchases replacement bonds over the next two months, and its holdings rise again. So down big one month, up two months in a row, over and over again.

Its holdings of government securities at the end of May rose to ¥596.7 trillion ($3.8 trillion), the second month of increases, to be followed by a decrease in June, according to the BoJ’s balance sheet released today. That ¥596.7 trillion in May was:

Down from the ¥600.8 trillion three months earlier (in February);

Down from the ¥600.1 trillion three months before that (in November);

Up a hair from the ¥596.4 in August. So QE has effectively ended in August:

Equity ETFs and Japanese REITs: The BoJ stopped buying equity ETFs and J-REITs in 2022, when they’d reached ¥38 trillion ($244 billion). It carries those instruments at cost, not at market value:

Commercial paper and corporate bonds: It stopped buying commercial paper and corporate bonds two years ago, and they have started to mature and run off the balance sheet since then. It carries corporate bonds at amortized cost. They’re now down to ¥8.0 trillion ($51 billion), from ¥11.6 trillion two years ago:

Loans: As part of the pandemic stimulus programs, the BoJ lent money directly to banks and other entities. The total amount of loans outstanding more than tripled from ¥48.8 trillion in February 2020 to ¥151.5 trillion at the peak in March 2022.

At the end of May, the amount of loans outstanding was unchanged from April, at ¥106.3 trillion, and down a tad from March, but down by about 30% from the peak in March 2022:

Total assets – which include the assets above plus gold, cash, and foreign currency assets – have been roughly flat at peak levels for the past four months, at ¥761.1 trillion ($4.89 trillion):

The yen paid the price.

The BoJ is under heavy pressure to do something functional about the yen, which has plunged 43% against the dollar since September 2022, when the Fed started talking about hiking rates, ending QE, and pivoting to QT.

The yen has plunged despite repeated interventions by the Ministry of Finance, including the record interventions between April 26 and May 29 when it sold $62 billion in USD in the foreign exchange market to buy ¥9.79 trillion in yen, to prevent the yen from crashing through the 160 mark.

Inflation is surging for Japanese companies.

The producer price index for services that Japanese businesses buy jumped by 0.82% in April from March, after a similar jump in March from February, according to data from the Bank of Japan. On an annualized basis, both those jumps amounted to over 10%.

In the data that exclude the consumption tax hikes in the past, the April spike boosted the year-over-year increase to 2.9%, the worst jump going back to 1991, with prices in some categories jumping by 5% to over 7% year-over-year, such as Civil engineering and architectural services (+7.5%), other technical services (+ 5.9%), training and development services (+6.7%), machinery repair and maintenance (+5.5%), or waste and industrial-waste disposal (+5.1%):

Due to trade deficits, a crushed yen is not good for Japan.

Japan has run annual trade deficits every year since 2010 except in 2016 and 2017, thereby importing more than exporting. And since 2022, the crushed yen has made these imports much more expensive and has widened the trade deficit.

Crude oil, coal, and natural gas (in form of LNG) are imported. So the plunge in the yen caused energy prices in Japan to spike since 2022, on top of the global price spikes. The government has had to step in to subsidize energy costs at the wholesale level.

In addition, all major Japanese manufacturers have offshored a portion of their production. For example, most of the Japanese vehicles Americans can buy are made in North America, and a weak yen doesn’t lower their costs and doesn’t make them more competitive. Even Japanese production gets hit by the crushed yen because supply chains of Japanese manufacturers run through China and other countries, and the crushed yen makes these imported materials and components more expensive and raises their input costs.

The Bank of Japan is responding, but at a ridiculous snail’s pace.

The BoJ can do something functional about the yen: it can hike interest rates in a big way and start large-scale QT.

It already hiked, but only once, and by a ridiculously minuscule 10 basis points from the negative to 0% in March. And it already ended QE last year. And it announced that it is backing away from Yield Curve Control by reducing its purchases of JGBs.

These moves were not enough, leading to the plunge of the yen, and the record intervention by the Ministry of Finance in April and May to slow the bleeding.

What is now required to prop up the yen is actual and substantial QT and substantial rate hikes, not another 10 basis points, which would be ludicrous, and markets would see it as such.

The BoJ seems to have gotten tangled up with the US tightening deniers in 2022 and 2023, believing perhaps that the Fed could never hike as much as it did. And starting in late last year, maybe it got caught up in the Rate-Cut Mania and was apparently expecting that the Fed would cut multiple times in a big way in 2024 to bring US rates down and toward the BoJ’s rate, so that the BoJ wouldn’t have to hike rates much or at all. But instead, higher-for-longer continues to be the strategy in the US, and the Fed is in wait-and-see mode as inflation remains stubbornly high, and the BoJ got caught with its pants down, and the yen paid the price.